Microchip Slashes Guidance - Analyst Blog

October 14 2011 - 8:30AM

Zacks

Microchip Technology Incorporated (MCHP)

recently revised its guidance for the second quarter of fiscal

2012. The company now expects sales to decline by approximately

9.1% sequentially to $340.6 million. Microchip had earlier guided

sales to decline by about 1% to 6% sequentially to $352.0

million–$370.8 million.

Microchip stated that sales activity in the September quarter

did not progress as expected. The company had earlier expected that

business conditions would be impacted by weak, broad-based demand

conditions in the September quarter but should improve towards the

latter part of the quarter from the seasonal Christmas builds in

Asia.

However, Microchip saw no seasonal Christmas build-up in the

latter part of the quarter, which in turn adversely impacted all

the product lines and sales channels. Moreover, management stated

that the overall global outlook continues to be weak and the

company’s business will be impacted further.

Nevertheless, Microchip continues to be positive on design win

traction in microcontroller and analog product lines. Net sales

from the 32-bit microcontroller business were up 10.4% sequentially

and licensing business was up 6.4% sequentially. The company also

shipped its 10 billionth microcontroller during the quarter.

Meanwhile, management stated that the floods in Bangkok have not

affected the company’s two facilities there. Both the facilities

are located almost 50 miles east of Bangkok and are running

normally and meeting customer demand. The company has taken steps

to procure additional inventory to feed production and add

alternative suppliers to mitigate supply risk.

The downgrade in guidance led to a 2.01% decline in share price

in after-hours trading to close at $34.60. In regular trading, the

shares gained 2.47%.

The global slowdown has led many companies in the semiconductor

universe to revise their outlook for the third quarter of calendar

2011, namely Altera Corp (ALTR) and

Xilinx, Inc. (XLNX).

ALTERA CORP (ALTR): Free Stock Analysis Report

MICROCHIP TECH (MCHP): Free Stock Analysis Report

XILINX INC (XLNX): Free Stock Analysis Report

Zacks Investment Research

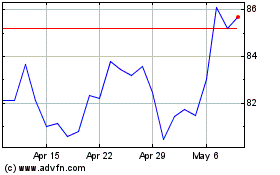

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Aug 2024 to Sep 2024

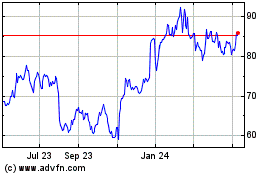

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Sep 2023 to Sep 2024