Current Report Filing (8-k)

June 04 2020 - 9:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 29, 2020

ALPHATEC HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

000-52024

|

|

20-2463898

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

5818 El Camino Real

Carlsbad, California 92008

(Address of Principal Executive Offices)

(760) 431-9286

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14.a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $.0001 per share

|

ATEC

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On May 29, 2020, Alphatec Holdings, Inc. (the “Company”), along with its wholly-owned subsidiaries Alphatec Spine, Inc. (“Alphatec Spine”) and SafeOp Surgical, Inc. (collectively, the “Borrowers”), entered into a Second Amendment to Credit, Security and Guaranty Agreement (the “Credit Agreement”) and Second Amended and Restated Term Note (the “Note”) with Squadron Medical Finance Solutions LLC (“Squadron”) to expand the secured term loan (the “Term Loan”) provided by Squadron under the Credit Agreement by $35,000,000 and to extend the term of the Term Loan by two additional years. The expanded Term Loan will mature on May 31, 2025 (the “Maturity Date”) and will bear interest at the one month London Interbank Offered Rate (“LIBOR”) + 8% per annum (subject to a 10% floor and 13% ceiling), the same rate as the other borrowing under the Term Loan. Interest-only payments are due monthly through November 2022, followed by $29 million in principal payments in equal monthly installments beginning December 2022 and a $71 million lump-sum payment payable at the Maturity Date.

In connection with the amendment of the Credit Agreement, the Company issued to each of Squadron and Tawani Holdings LLC (“Tawani”) a warrant (collectively, the “Warrants”) to purchase up to an aggregate of 537,910 shares of the Company’s common stock at a price of $4.88 per share. The Warrants are exercisable immediately and have a term of seven years. The Warrants are subject to price-based, weighted average anti-dilution adjustments in the event of certain issuances by the Company of equity or equity-linked securities at effective prices per share of less than $4.88; provided that the Company will not be required to issue any shares of common stock due to any such adjustment if the issuance (taken together with any prior issuance upon the exercise of a Warrant) would exceed the aggregate number of shares of common stock the Company may issue without breaching applicable Nasdaq rules. In connection with issuing the Warrants, the Company also entered into a registration rights agreement (the “Registration Rights Agreement”) with Squadron and Tawani whereby the Company agreed to register the resale of the shares of common stock issuable pursuant to the Warrants (the “Warrant Shares”) under the Securities Act of 1933, as amended, under certain circumstances upon demand of holders thereof or at their request to the extent the Company seeks to register other equity securities for sale.

Also in connection with the amendment of the Credit Agreement, the Company amended the expiration date of warrants previously issued to Squadron and Tawani to May 29, 2027, the same expiration date as the Warrants.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the Second Amendment to Credit, Security and Guaranty Agreement, the Note, the Form of Warrant, the Form of Amendment to Warrant, the Form of Second Amendment to Warrant and the Registration Rights Agreement, copies of which are attached hereto as Exhibits 10.1, 10.2, 4.1, 4.2, 4.3 and 4.4, respectively, and incorporated herein by this reference.

|

Item 1.02

|

Termination of a Material Definitive Agreement

|

On May 29, 2020, the Borrowers repaid in full all amounts outstanding and due under the Amended and Restated Credit, Security and Guaranty Agreement, dated as of August 30, 2013 (as the same has been further amended, extended, supplemented or otherwise modified through the date hereof, the “MidCap Credit Agreement”) by and among the Borrowers, the various financial institutions party thereto as “Lenders” and MidCap Funding IV Trust, in its capacity as agent for such Lenders. The Company made a final payment consisting of all outstanding principal, accrued interest and applicable fees. A description of the MidCap Credit Agreement is included in Item 1.01 of the Current Report on Form 8-K filed by the Company on September 6, 2013 and is incorporated into this Item 1.02 by reference.

On May 29, 2020, the Company also formally terminated that certain Commitment Letter, dated February 28, 2020 (the “Commitment Letter”), by Perceptive Credit Holdings III, LP (the “Lender”) to, and agreed and accepted by, the Company. A description of the Commitment Letter is included in Item 1.01 of the Current Report on Form 8-K filed by the Company on February 28, 2020 and is incorporated into this Item 1.02 by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 above is incorporated by reference into this Item 2.03.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The information set forth in Item 1.01 above is incorporated by reference into this Item 3.02. The Company relied on the exemption from registration contained in Section 4(2) of the Securities Act, and Rule 506 of Regulation D thereunder, for the issuance of the Warrants and the Warrant Shares. Each of Squadron and Tawani has represented that it is an “accredited investor” as defined in Regulation D of the Securities Act and that the Warrants and the Warrant Shares were being acquired solely for investment for its own account and not with a view to, or for resale in connection with, any distribution thereof in violation of the Securities Act.

|

Item 9.01

|

Financial Statements and Exhibits

|

(d)Exhibits.

|

4.1

|

|

Form of Warrant

|

|

4.2

|

|

Form of Amendment to Warrant

|

|

4.3

|

|

Form of Second Amendment to Warrant

|

|

4.4

|

|

Registration Rights Agreement between Alphatec Holdings Inc. and Squadron Medical Finance Solutions LLC and Tawani Holdings LLC, dated May 29, 2020

|

|

10.1

|

|

Second Amendment to Credit, Security and Guaranty Agreement among Alphatec Holdings, Inc., Alphatec Spine, Inc., SafeOp Surgical, Inc. and Squadron Medical Finance Solutions LLC `

|

|

10.2

|

|

Second Amended and Restated Term Note issued by Alphatec Holdings, Inc., Alphatec Spine, Inc., SafeOp Surgical, Inc. in favor of Squadron Medical Finance Solutions LLC

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: June 4, 2020

|

|

|

|

ALPHATEC HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

|

By: /s/ Jeffrey G. Black

|

|

|

|

|

|

|

Name: Jeffrey G. Black

|

|

|

|

|

|

Its: Chief Financial Officer

|

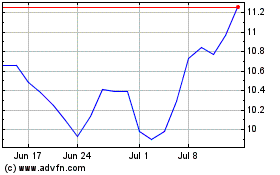

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

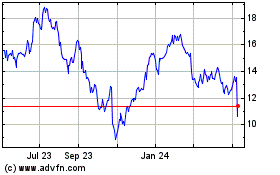

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Apr 2023 to Apr 2024