Alphatec Holdings, Inc. (“ATEC” or the “Company”) (Nasdaq: ATEC), a

provider of innovative spine surgery solutions dedicated to

revolutionizing the approach to spine surgery, today announced

financial results for the quarter ended June 30, 2019, and recent

corporate highlights.

Second Quarter 2019 Financial

Highlights

- Total net revenue of $27.3 million; U.S. revenue

of $26.1 million, up approximately 28% compared to the second

quarter of 2018;

- U.S. gross margin of 72.2%; and

- Cash and cash equivalents of $18.6 million as

of June 30, 2019.

Second Quarter-to-Date Commercial,

Product, and Organizational Highlights

- Enhanced clinical distinction of portfolio with four new

commercial releases: the IdentiTi™ TLIF system, the IdentiTi

ALIF system, the InVictus™ MIS Fixation System and the

InVictus Open Fixation System;

- Increased contribution from new products to 32% of Q2 2019 U.S.

revenue;

- Expanded percentage of revenue driven by strategic distribution

network to 88% of U.S. revenue in Q2 2019 compared to 80% in Q2

2018; and

- Increased U.S. revenue per distributor by more than 45% and

increased U.S. revenue per case by 15% in Q2 2019 compared to Q2

2018.

“Through the first half of 2019, execution

against our strategic commitments has been solid,” said Pat Miles,

Chairman and Chief Executive Officer. “That execution drove

the highest rate of quarterly U.S. revenue growth this company has

achieved in the past 10 years. Based upon our performance in

the first half of 2019 we are increasing full-year revenue

guidance, which speaks to the impact of spine’s new Organic

Innovation Machine. We are just getting started.”

Comparison of Selected GAAP and Non-GAAP

Financial Results for the Second Quarter 2019 to Second Quarter

2018

| |

Three Months Ended |

|

Change |

| |

June 30, 2019 |

|

June 30, 2018 |

|

$ |

|

% |

| |

(unaudited) |

|

(unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

Revenue from U.S. products |

$ |

26,093 |

|

|

$ |

20,409 |

|

|

$ |

5,684 |

|

|

28 |

% |

| Gross profit from U.S.

products |

|

18,841 |

|

|

|

15,462 |

|

|

|

3,379 |

|

|

22 |

% |

| Gross margin from U.S.

products |

|

72.2 |

% |

|

|

75.8 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

Research and development |

$ |

3,360 |

|

|

$ |

2,009 |

|

|

$ |

1,351 |

|

|

67 |

% |

|

Sales, general and administrative |

|

24,568 |

|

|

|

17,538 |

|

|

|

7,030 |

|

|

40 |

% |

|

Litigation-related expenses |

|

1,200 |

|

|

|

2,234 |

|

|

|

(1,034 |

) |

|

(46 |

%) |

|

Amortization of intangible assets |

|

172 |

|

|

|

187 |

|

|

|

(15 |

) |

|

(8 |

%) |

|

Transaction-related expenses |

|

- |

|

|

|

(62 |

) |

|

|

62 |

|

|

(100 |

%) |

|

Restructuring |

|

- |

|

|

|

193 |

|

|

|

(193 |

) |

|

(100 |

%) |

|

Total operating expenses |

$ |

29,300 |

|

|

$ |

22,099 |

|

|

$ |

7,201 |

|

|

33 |

% |

| |

|

|

|

|

|

|

|

| Operating loss |

$ |

(10,414 |

) |

|

$ |

(6,545 |

) |

|

$ |

(3,869 |

) |

|

59 |

% |

| |

|

|

|

|

|

|

|

| Non-GAAP operating loss |

$ |

(4,663 |

) |

|

$ |

(2,578 |

) |

|

$ |

(2,085 |

) |

|

81 |

% |

| |

|

|

|

|

|

|

|

| Non-GAAP adjusted EBITDA |

$ |

(3,018 |

) |

|

$ |

(989 |

) |

|

$ |

(2,029 |

) |

|

205 |

% |

Revenue from U.S. products for the second

quarter 2019 was $26.1 million, up 28% compared to $20.4 million in

the second quarter 2018. Revenue growth generated by new product

momentum and the strategic distribution channel is increasingly

outpacing the continued revenue impacts of transitioning or

discontinuing non-strategic distributor relationships.

Gross profit and gross margin from U.S. products

for the second quarter 2019 were $18.8 million and 72.2%,

respectively, compared to $15.5 million and 75.8%, respectively,

for the second quarter 2018. U.S. gross margin was impacted by

increased non-cash excess and obsolete write-offs related to legacy

products. On a non-GAAP basis, excluding non-cash excess and

obsolete charges, U.S. gross margin was 80.6% in the second quarter

of 2019, up from 77.5% in the second quarter of 2018.

Total operating expenses for the second quarter

2019 were $29.3 million compared to $22.1 million in the second

quarter 2018. On a non-GAAP basis, excluding restructuring

charges, stock-based compensation, transaction-related expenses,

litigation-related expenses, restructuring and fair value

adjustments, total operating expenses in the second quarter 2019

increased to $25.8 million from $18.5 million in 2018, reflecting

increased investments in organic product development to support new

product launches and increased selling costs from U.S. revenue

growth.

Non-GAAP operating loss which excludes

restructuring charges, stock-based compensation,

transaction-related expenses, litigation-related expenses,

restructuring, fair value adjustments and excess and obsolescence

charges, was $4.7 million for the second quarter 2019, compared to

a loss of $2.6 million for the second quarter 2018.

Non-GAAP adjusted EBITDA in the second quarter

was a loss of $3.0 million, compared to a loss of $1.0 million in

the second quarter 2018.

For more detailed information on non-GAAP

operating expenses, non-GAAP operating loss and non-GAAP adjusted

EBITDA, please refer to the table, “Alphatec Holdings, Inc.

Reconciliation of Non-GAAP Financial Measures,” that follows.

Current and long-term debt includes $45.0

million in term debt and $10.7 million outstanding under the

Company’s revolving credit facility at June 30, 2019, with cash and

cash equivalents of $18.6 million. In March 2019, the Company

closed its expanded credit facility with Squadron Medical Finance

Solutions, providing for up to $30 million in additional financing,

as needed. During the second quarter 2019, the Company drew $10

million against the credit facility.

Updated 2019 Financial

Outlook

|

Full Year 2019 |

Previous |

Updated |

|

|

Guidance ($M) |

YoY Growth |

Guidance ($M) |

YoY Growth |

|

U.S. Product Revenue |

$94 to $98 |

12% to 17% |

$100 to $104 |

20% to 24% |

|

International Supply Agreement |

$4 to $5 |

(38%) to (50%) |

No change |

No change |

|

Total Revenue |

$98 to $103 |

7% to 12% |

$104 to $109 |

13% to 19% |

Investor Conference Call

ATEC will present the results via a live webcast

today at 1:30 p.m. PT / 4:30 p.m. ET to discuss the results. At

that time, please click here to access the live webcast. An

audiocast of the presentation will be also be available

domestically at (877) 556-5251 and internationally at (720)

545-0036. The conference ID number is 6098197.

Non-GAAP Financial

Information

To supplement the Company’s financial statements

presented in accordance with U.S. generally accepted accounting

principles (GAAP), the Company reports certain non-GAAP financial

measures, including non-GAAP U.S. gross margin, non-GAAP operating

expenses, non-GAAP operating loss, and non-GAAP adjusted

EBITDA. The Company believes that these non-GAAP financial

measures provide investors with an additional tool for evaluating

the Company's core performance, which management uses in its own

evaluation of continuing operating performance, and a baseline for

assessing the future earnings potential of the Company. The

Company’s non-GAAP financial measures may not provide information

that is directly comparable to that provided by other companies in

the Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. Non-GAAP financial results

should be considered in addition to, and not as a substitute for,

or superior to, financial measures calculated in accordance with

GAAP. Included below are reconciliations of the non-GAAP financial

measures to the comparable GAAP financial measures.

About Alphatec Holdings,

Inc.

Alphatec Holdings, Inc., through its

wholly-owned subsidiaries, Alphatec Spine, Inc. and SafeOp

Surgical, Inc., is a provider of innovative spine surgery solutions

dedicated to revolutionizing the approach to spine surgery. ATEC

designs, develops and markets spinal fusion technology products and

solutions for the treatment of spinal disorders associated with

disease and degeneration, congenital deformities and trauma.

The Company markets its products in the U.S. via independent sales

agents and a direct sales force.

Additional information can be found at

www.atecspine.com.

Forward Looking Statements

This press release contains "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve risks and uncertainty. Such

statements are based on management's current expectations and are

subject to a number of risks and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. The Company cautions investors that

there can be no assurance that actual results or business

conditions will not differ materially from those projected or

suggested in such forward-looking statements as a result of various

factors. Forward-looking statements include the references to the

Company’s revenue and growth outlook, planned commercial launches

and product introductions, the Company’s strategy in significantly

repositioning the ATEC brand, turning the Company into a growth

organization and creating future market disruption, and the

Company’s future ability to finance its operations. The

important factors that could cause actual operating results to

differ significantly from those expressed or implied by such

forward-looking statements include, but are not limited to: the

uncertainty of success in developing new products or products

currently in the Company’s pipeline; the uncertainties in the

Company’s ability to execute upon its strategic operating plan; the

uncertainties regarding the ability to successfully license or

acquire new products, and the commercial success of such products;

failure to achieve acceptance of the Company’s products by the

surgeon community; failure to obtain FDA or other

regulatory clearance or approval for new products, or unexpected or

prolonged delays in the process; continuation of favorable third

party reimbursement for procedures performed using the Company’s

products; unanticipated expenses or liabilities or other adverse

events affecting cash flow or the Company’s ability to successfully

control its costs or achieve profitability; uncertainty of

additional funding; the Company’s ability to compete with other

products and with emerging new technologies; product liability

exposure; an unsuccessful outcome in any litigation in which the

Company is a defendant; patent infringement claims; claims related

to the Company’s intellectual property and the Company’s ability to

meet its financial obligations under its credit agreements and

the OrthoTec LLC settlement agreement. The words “believe,”

“will,” “should,” “expect,” “intend,” “estimate,” “look forward”

and “anticipate,” variations of such words and similar expressions

identify forward-looking statements, but their absence does not

mean that a statement is not a forward-looking statement. A

further list and description of these and other factors, risks and

uncertainties can be found in the Company's most recent annual

report, and any subsequent quarterly and current reports, filed

with the Securities and Exchange Commission. ATEC disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise, unless required by law.

Investor/Media Contact:

Tina JacobsenInvestor Relations(760)

494-6790ir@atecspine.com

Company Contact:

Jeff Black Chief Financial Officer ir@atecspine.com

|

ALPHATEC HOLDINGS, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(in thousands, except per share amounts -

unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

June 30, |

|

June 30, |

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Revenues: |

|

|

|

|

|

|

|

|

| |

Revenue from U.S. products |

$ |

26,093 |

|

|

$ |

20,409 |

|

|

$ |

49,048 |

|

|

$ |

39,610 |

|

|

| |

Revenue from international supply agreement |

|

1,226 |

|

|

|

1,633 |

|

|

|

2,826 |

|

|

|

3,739 |

|

|

| |

Total revenues |

|

27,319 |

|

|

|

22,042 |

|

|

|

51,874 |

|

|

|

43,349 |

|

|

| |

Cost of revenues |

|

8,433 |

|

|

|

6,488 |

|

|

|

16,420 |

|

|

|

12,890 |

|

|

| |

Gross profit |

|

18,886 |

|

|

|

15,554 |

|

|

|

35,454 |

|

|

|

30,459 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Operating expenses: |

|

|

|

|

|

|

|

|

| |

Research and development |

|

3,360 |

|

|

|

2,009 |

|

|

|

6,829 |

|

|

|

3,795 |

|

|

| |

Sales, general and administrative |

|

24,568 |

|

|

|

17,538 |

|

|

|

45,568 |

|

|

|

34,795 |

|

|

| |

Litigation-related expenses |

|

1,200 |

|

|

|

2,234 |

|

|

|

3,823 |

|

|

|

2,814 |

|

|

| |

Amortization of intangible assets |

|

172 |

|

|

|

187 |

|

|

|

354 |

|

|

|

364 |

|

|

| |

Transaction-related expenses |

|

- |

|

|

|

(62 |

) |

|

|

- |

|

|

|

1,480 |

|

|

| |

Gain on settlement |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6,168 |

) |

|

| |

Restructuring expenses |

|

- |

|

|

|

193 |

|

|

|

60 |

|

|

|

591 |

|

|

| |

Total operating expenses |

|

29,300 |

|

|

|

22,099 |

|

|

|

56,634 |

|

|

|

37,671 |

|

|

| |

Operating loss |

|

(10,414 |

) |

|

|

(6,545 |

) |

|

|

(21,180 |

) |

|

|

(7,212 |

) |

|

| |

Total other expenses, net |

|

(1,921 |

) |

|

|

(1,784 |

) |

|

|

(4,040 |

) |

|

|

(3,429 |

) |

|

| |

Loss from continuing

operations before taxes |

|

(12,335 |

) |

|

|

(8,329 |

) |

|

|

(25,220 |

) |

|

|

(10,641 |

) |

|

| |

Income tax (benefit) provision |

|

71 |

|

|

|

(1,265 |

) |

|

|

102 |

|

|

|

(1,723 |

) |

|

| |

Loss from continuing

operations |

|

(12,406 |

) |

|

|

(7,064 |

) |

|

|

(25,322 |

) |

|

|

(8,918 |

) |

|

| |

Loss from discontinued operations |

|

(30 |

) |

|

|

(12 |

) |

|

|

(82 |

) |

|

|

(74 |

) |

|

| |

Net loss |

$ |

(12,436 |

) |

|

$ |

(7,076 |

) |

|

$ |

(25,404 |

) |

|

$ |

(8,992 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Net loss per share,

basic and diluted: |

|

|

|

|

|

|

|

|

| |

Continuing operations |

$ |

(0.26 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.55 |

) |

|

$ |

(0.32 |

) |

|

| |

Discontinued operations |

|

(0.00 |

) |

|

|

(0.00 |

) |

|

|

(0.00 |

) |

|

|

(0.00 |

) |

|

| |

Net loss per share, basic and

diluted |

$ |

(0.27 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.55 |

) |

|

$ |

(0.33 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

Shares used in calculating

basic and diluted net loss per share |

|

46,880 |

|

|

|

34,030 |

|

|

|

45,957 |

|

|

|

27,656 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Stock-based

compensation included in: |

|

|

|

|

|

|

|

|

| |

Cost of revenue |

$ |

28 |

|

|

$ |

11 |

|

|

$ |

56 |

|

|

$ |

33 |

|

|

| |

Research and development |

|

293 |

|

|

|

129 |

|

|

|

533 |

|

|

|

13 |

|

|

| |

Sales, general and

administrative |

|

2,030 |

|

|

|

1,008 |

|

|

|

3,374 |

|

|

|

1,721 |

|

|

| |

|

$ |

2,351 |

|

|

$ |

1,148 |

|

|

$ |

3,963 |

|

|

$ |

1,767 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

ALPHATEC HOLDINGS, INC. |

| |

CONDENSED CONSOLIDATED BALANCE SHEETS |

| |

(in thousands) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

June 30, |

|

December 31, |

| |

|

2019 |

|

2018 |

| |

|

(Unaudited) |

|

|

| |

ASSETS |

| |

Current assets: |

|

|

|

|

|

Cash |

$ |

18,570 |

|

$ |

29,054 |

| |

Accounts receivable, net |

|

13,642 |

|

|

15,095 |

| |

Inventories, net |

|

32,605 |

|

|

28,765 |

| |

Prepaid expenses and other current assets |

|

10,904 |

|

|

2,380 |

| |

Current assets of discontinued operations |

|

225 |

|

|

242 |

| |

Total current assets |

|

75,946 |

|

|

75,536 |

| |

|

|

|

|

| |

Property and equipment,

net |

|

15,090 |

|

|

13,235 |

| |

Right-of-use asset |

|

2,170 |

|

|

- |

| |

Goodwill |

|

13,897 |

|

|

13,897 |

| |

Intangibles, net |

|

26,054 |

|

|

26,408 |

| |

Other assets |

|

222 |

|

|

347 |

| |

Noncurrent assets of

discontinued operations |

|

53 |

|

|

54 |

| |

Total assets |

$ |

133,432 |

|

$ |

129,477 |

| |

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' EQUITY |

| |

Current liabilities: |

|

|

|

| |

Accounts payable |

$ |

8,178 |

|

$ |

4,399 |

| |

Accrued expenses |

|

20,831 |

|

|

22,316 |

| |

Current portion of long-term debt |

|

286 |

|

|

3,276 |

| |

Current portion of lease liability |

|

1,173 |

|

|

- |

| |

Current liabilities of discontinued operations |

|

538 |

|

|

621 |

| |

Total current liabilities |

|

31,006 |

|

|

30,612 |

| |

|

|

|

|

| |

Total long term liabilities |

|

64,662 |

|

|

57,688 |

| |

|

|

|

|

| |

Redeemable preferred stock |

|

23,603 |

|

|

23,603 |

| |

Stockholders' equity |

|

14,161 |

|

|

17,574 |

| |

Total liabilities and

stockholders' equity |

$ |

133,432 |

|

$ |

129,477 |

| |

|

|

|

|

|

ALPHATEC HOLDINGS, INC. |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

(in thousands - unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

|

June 30, |

|

June 30, |

|

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Operating expenses |

|

|

29,300 |

|

|

|

22,099 |

|

|

|

56,634 |

|

|

|

37,671 |

|

|

| |

Adjustments: |

|

|

|

|

|

|

|

|

|

| |

Stock-based compensation |

|

|

(2,323 |

) |

|

|

(1,137 |

) |

|

|

(3,907 |

) |

|

|

(1,734 |

) |

|

| |

Contingent consideration fair value adjustment |

|

|

- |

|

|

|

(100 |

) |

|

|

(289 |

) |

|

|

(100 |

) |

|

| |

Litigation-related expenses |

|

|

(1,200 |

) |

|

|

(2,234 |

) |

|

|

(3,823 |

) |

|

|

(2,814 |

) |

|

| |

Restructuring |

|

|

- |

|

|

|

(193 |

) |

|

|

(60 |

) |

|

|

(591 |

) |

|

| |

Transaction-related expenses |

|

|

- |

|

|

|

62 |

|

|

|

- |

|

|

|

(1,480 |

) |

|

| |

Gain on settlement |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6,168 |

|

|

| |

Non-GAAP operating

expenses |

|

$ |

25,777 |

|

|

$ |

18,497 |

|

|

$ |

48,555 |

|

|

$ |

37,120 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

|

June 30, |

|

June 30, |

|

| |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Operating loss, as

reported |

|

$ |

(10,414 |

) |

|

$ |

(6,545 |

) |

|

$ |

(21,180 |

) |

|

$ |

(7,212 |

) |

|

| |

Add back significant

items: |

|

|

|

|

|

|

|

|

|

| |

Stock-based compensation |

|

|

2,351 |

|

|

|

1,148 |

|

|

|

3,963 |

|

|

|

1,767 |

|

|

| |

Contingent consideration fair value adjustment |

|

|

- |

|

|

|

100 |

|

|

|

289 |

|

|

|

100 |

|

|

| |

Litigation-related expenses |

|

|

1,200 |

|

|

|

2,234 |

|

|

|

3,823 |

|

|

|

2,814 |

|

|

| |

Restructuring |

|

|

- |

|

|

|

193 |

|

|

|

60 |

|

|

|

591 |

|

|

| |

Transaction-related expenses |

|

|

- |

|

|

|

(62 |

) |

|

|

- |

|

|

|

1,480 |

|

|

| |

Excess & obsolete charges |

|

|

2,200 |

|

|

|

354 |

|

|

|

4,175 |

|

|

|

1,272 |

|

|

| |

Gain on settlement |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6,168 |

) |

|

| |

Non-GAAP operating loss |

|

|

(4,663 |

) |

|

|

(2,578 |

) |

|

|

(8,870 |

) |

|

|

(5,356 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Operating loss, as

reported |

|

$ |

(10,414 |

) |

|

$ |

(6,545 |

) |

|

$ |

(21,180 |

) |

|

$ |

(7,212 |

) |

|

| |

Depreciation |

|

|

1,473 |

|

|

|

1,457 |

|

|

|

3,076 |

|

|

|

3,049 |

|

|

| |

Amortization of intangible assets |

|

|

172 |

|

|

|

132 |

|

|

|

354 |

|

|

|

426 |

|

|

| |

EBITDA |

|

|

(8,769 |

) |

|

|

(4,956 |

) |

|

|

(17,750 |

) |

|

|

(3,737 |

) |

|

| |

Add back significant

items: |

|

|

|

|

|

|

|

|

|

| |

Stock-based compensation |

|

|

2,351 |

|

|

|

1,148 |

|

|

|

3,963 |

|

|

|

1,767 |

|

|

| |

Contingent consideration fair value adjustment |

|

|

- |

|

|

|

100 |

|

|

|

289 |

|

|

|

100 |

|

|

| |

Litigation-related expenses |

|

|

1,2a00 |

|

|

|

2,234 |

|

|

|

3,823 |

|

|

|

2,814 |

|

|

| |

Restructuring |

|

|

- |

|

|

|

193 |

|

|

|

60 |

|

|

|

591 |

|

|

| |

Transaction-related expenses |

|

|

- |

|

|

|

(62 |

) |

|

|

- |

|

|

|

1,480 |

|

|

| |

Excess & obsolete charges |

|

|

2,200 |

|

|

|

354 |

|

|

|

4,175 |

|

|

|

1,272 |

|

|

| |

Gain on settlement |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6,168 |

) |

|

| |

Non-GAAP adjusted EBITDA |

|

$ |

(3,018 |

) |

|

$ |

(989 |

) |

|

$ |

(5,440 |

) |

|

$ |

(1,881 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

ALPHATEC HOLDINGS, INC. |

|

|

RECONCILIATION OF GEOGRAPHIC SEGMENT REVENUES AND GROSS

PROFIT |

|

|

(in thousands, except percentages -

unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

June 30, |

|

June 30, |

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

| |

Revenues by source |

|

|

|

|

|

|

|

|

| |

Revenue from U.S.

products |

$ |

26,093 |

|

|

$ |

20,409 |

|

|

$ |

49,048 |

|

|

$ |

39,610 |

|

|

| |

Revenue from international

supply agreement |

|

1,226 |

|

|

|

1,633 |

|

|

|

2,826 |

|

|

|

3,739 |

|

|

| |

Total revenues |

$ |

27,319 |

|

|

$ |

22,042 |

|

|

$ |

51,874 |

|

|

$ |

43,349 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Gross profit by source |

|

|

|

|

|

|

|

|

| |

Revenue from U.S.

products |

$ |

18,841 |

|

|

$ |

15,462 |

|

|

$ |

35,235 |

|

|

$ |

30,229 |

|

|

| |

Revenue from international

supply agreement |

|

45 |

|

|

|

92 |

|

|

|

219 |

|

|

|

230 |

|

|

| |

Total gross profit |

$ |

18,886 |

|

|

$ |

15,554 |

|

|

$ |

35,454 |

|

|

$ |

30,459 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Gross profit margin by

source |

|

|

|

|

|

|

|

|

| |

Revenue from U.S.

products |

|

72.2% |

|

|

|

75.8% |

|

|

|

71.8% |

|

|

|

76.3% |

|

|

| |

Revenue from international

supply agreement |

|

3.7% |

|

|

|

5.6% |

|

|

|

7.7% |

|

|

|

6.2% |

|

|

| |

Total gross profit margin |

|

69.1% |

|

|

|

70.6% |

|

|

|

68.3% |

|

|

|

70.3% |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

RECONCILIATION OF GAAP TO NON-GAAP GROSS PROFIT AND GROSS

MARGIN FROM U.S. PRODUCTS |

|

(in thousands, except percentages -

unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

June 30, |

|

June 30, |

|

| |

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

GAAP-based gross profit from

U.S. products |

$ |

18,841 |

|

|

$ |

15,462 |

|

|

$ |

35,235 |

|

|

$ |

30,229 |

|

|

| |

Add: non-cash excess and

obsolete charges |

|

2,200 |

|

|

|

354 |

|

|

|

4,175 |

|

|

|

1,272 |

|

|

| |

Non-GAAP gross profit from

U.S. products |

$ |

21,041 |

|

|

$ |

15,816 |

|

|

$ |

39,410 |

|

|

$ |

31,501 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

GAAP-based gross margin from

U.S. products |

|

72.2% |

|

|

|

75.8% |

|

|

|

71.8% |

|

|

|

76.3% |

|

|

| |

Add: non-cash excess and

obsolete charges |

|

8.4% |

|

|

|

1.7% |

|

|

|

8.5% |

|

|

|

3.2% |

|

|

| |

Non-GAAP gross margin from

U.S. products |

|

80.6% |

|

|

|

77.5% |

|

|

|

80.3% |

|

|

|

79.5% |

|

|

| |

|

|

|

|

|

|

|

|

|

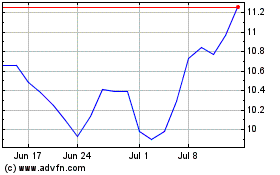

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

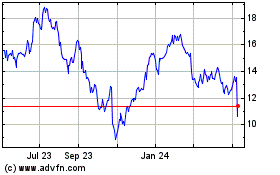

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Apr 2023 to Apr 2024