Google Parent Alphabet's Ad Sales Hit Record, but Costs Pile Up--4th Update

October 28 2019 - 8:03PM

Dow Jones News

By Rob Copeland

Quarterly results from Google showed the complexity of operating

its internet empire, as robust growth in online advertising sales

was overshadowed by rising costs and weak performances from some

long-held company investments.

Its parent, Alphabet Inc., on Monday reported third-quarter

revenue of $40.5 billion, a rise of 20% from the same period last

year. While that would be enviable growth for many companies, the

clip is modestly below Google's pace historically. Also, for Google

more than others, strong results raise concerns about its market

dominance. Its ad revenue rose 17% to $33.9 billion, contributing

to an overall profit of $7.1 billion.

Analysts and investors are encouraging the company to continue

its pursuit of new advertising opportunities for such units as its

YouTube video platform and the ubiquitous Google Maps app. Yet such

efforts to generate profit across the conglomerate could further

animate antitrust regulators.

The Trump administration and 50 attorneys general have already

opened wide probes into Google, including whether it has an unfair

advantage over smaller advertising rivals.

The Department of Justice's antitrust chief, Makan Delrahim,

said last week that a breakup of Silicon Valley's tech giants is

"perfectly on the table" as part of evaluations of whether

companies abuse their market power.

Alphabet's profit for the latest quarter was lower than Wall

Street's expectations and down 23% from a year earlier, when the

result was boosted by changes to the U.S. tax code. The company's

margin for the third quarter was also crimped as costs rose, a

long-term concern for investors.

Alphabet's stock fell 1% after hours. The shares are up roughly

25% this year, in line with the broader technology market.

Advertising is central to the Google narrative, constituting the

majority of the company's revenue, and also because the company is

scant with disclosures on other areas of its business. Alphabet has

resisted requests from analysts to detail the performance of

YouTube, for instance, and combines results from nascent units like

the Waymo self-driving car division, hardware and cloud computing

in a line item that Google simply calls "Other Bets."

Write to Rob Copeland at rob.copeland@wsj.com

(END) Dow Jones Newswires

October 28, 2019 19:48 ET (23:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

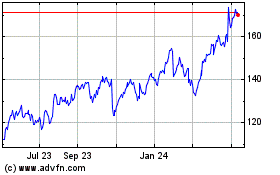

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

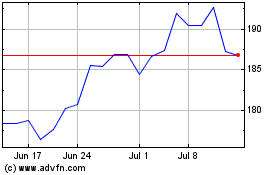

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Apr 2023 to Apr 2024