Current Report Filing (8-k)

June 05 2020 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 5, 2020

THE ALKALINE WATER COMPANY INC.

Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-55096

|

|

EIN 99-0367049

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

14646 N. Kierland Blvd., Suite 255

Scottsdale, Arizona 85254

(Address of principal executive offices and Zip Code)

Registrant's telephone number, including area code: (480) 656-2423

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act

|

Title of Each Class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.001 per share

|

WTER

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 3.02 Unregistered Sales of Equity Securities.

Effective as of January 2, 2020, we issued 400,000 shares of our common stock upon conversion of 400,000 shares of our Series D Preferred Stock without the payment of any additional consideration. We issued these shares to one individual relying on the exemptions from registration under the Securities Act of 1933 provided by Section 4(a)(2) and/or Section 3(a)(9) of the Securities Act of 1933.

Effective as of May 20, 2020, we issued an aggregate of 287,666 shares of our common stock upon exercise of our common stock purchase warrants with an exercise price of $0.90 per share for aggregate gross proceeds of $258,899.40. We issued 121,000 of these shares to four non-U.S. persons (as that term is defined in Regulation S of the Securities Act of 1933) in an offshore transaction relying on Regulation S and/or Section 4(a)(2) of the Securities Act of 1933. We issued 166,666 of these shares to one U.S. person (as that term is defined in Regulation S of the Securities Act of 1933) relying on the exemptions from the registration requirements of the Securities Act of 1933 provided by Section 4(a)(2) of the Securities Act of 1933 and/or Rule 506 promulgated under the Securities Act of 1933.

Effective as of May 22, 2020, we issued 170,000 shares of our common stock in consideration for services to be rendered to our company. We issued these shares to one U.S. person (as that term is defined in Regulation S of the Securities Act of 1933) and in issuing these shares, we relied on the exemption from the registration requirements of the Securities Act of 1933 provided by Section 4(a)(2) of the Securities Act of 1933.

Item 8.01 Other Events.

Effective as of April 29, 2020, we issued an aggregate of 116,000 shares of our common stock upon exercise of stock options. 25,000 were exercised at a price of $1.29 per share for gross proceeds of $32,250 and 91,000 were exercised at a price of $0.53 per share for gross proceeds of $48,230.

On April 30, 2020, we granted one of our employees an award of 20,000 shares of our common stock as a "restricted award" under our 2020 Equity Incentive Plan, vesting as to one-third on each anniversary of the grant date. We amended the vesting provision of these shares so that they vested effective as of April 30, 2020.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

THE ALKALINE WATER COMPANY INC.

/s/ Richard A. Wright

Richard A. Wright

President, Chief Executive Officer and Director

June 5, 2020

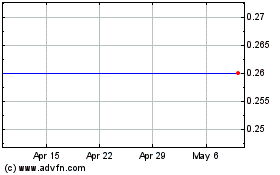

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Mar 2024 to Apr 2024

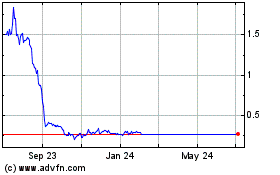

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Apr 2023 to Apr 2024