UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

[X] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under Rule 14a-12

|

THE ALKALINE WATER COMPANY INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

_____________________________________________________________________

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

THE ALKALINE WATER COMPANY INC.

14646 N. Kierland Blvd., Suite 255

Scottsdale, Arizona 85254

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON ♦ ♦, 2020

Dear Stockholder:

Our special meeting of stockholders will be held on ♦, ♦ ♦, 2020, at ♦, Arizona time, at the offices of Dickinson Wright PLLC, 1850 North Central Avenue, Suite 1400, Phoenix, Arizona 85004 for the following purposes:

|

1.

|

To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the private placement completed on April 17, 2020 and issuance of securities thereunder, including the issuance of 9,750,000 shares of our common stock upon the exercise of 9,750,000 warrants issued by our company on April 17, 2020;

|

|

2.

|

To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the private placement completed on May 11, 2020 and issuance of securities thereunder, including the issuance of 4,444,440 shares of our common stock on the conversion of 4,444,400 subscription receipts issued by our company on May 11, 2020 and the issuance of 4,444,440 shares of our common stock upon the exercise of 4,444,440 warrants underlying 4,444,440 subscription receipts issued by our company on May 11, 2020; and

|

|

3.

|

To transact such other business as may properly come before the special meeting or any adjournment thereof.

|

These items of business are more fully described in the proxy statement accompanying this notice.

Our board of directors has fixed the close of business on ♦ ♦, 2020 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the special meeting or any adjournment thereof. Only the stockholders of record on the record date are entitled to vote at the special meeting.

We are sensitive to the health and travel concerns our stockholders may have and the protocols that federal, state and local governments may impose. Due to the difficulties arising from the coronavirus known as COVID-19, the date, time, location or means of conducting the special meeting may change. In the event of such a change, we will announce alternative arrangements for the special meeting as promptly as practicable, which may include holding the special meeting by means of remote communication, among other steps, but we may not deliver additional soliciting materials to stockholders or otherwise amend the proxy materials. We plan to announce these changes, if any, at ♦ and encourage you to check this website prior to the special meeting if you plan to attend.

Whether or not you plan on attending the special meeting, we ask that you vote by proxy by following instructions provided in the enclosed proxy card as promptly as possible. If your shares are held of record by a broker, bank, or other nominee, please follow the voting instructions sent to you by your broker, bank, or other nominee in order to vote your shares.

Even if you have voted by proxy, you may still vote in person if you attend the special meeting. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the special meeting, you must obtain a valid proxy issued in your name from that record holder.

Sincerely,

By Order of the Board of Directors

___________________________________________

Richard A. Wright

President and Chief Executive Officer

♦ ♦, 2020

THE ALKALINE WATER COMPANY INC.

14646 N. Kierland Blvd., Suite 255

Scottsdale, Arizona 85254

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON ♦ ♦, 2020

Questions and Answers about the Special Meeting of Stockholders

Why am I receiving these materials?

The board of directors of The Alkaline Water Company Inc. ("we", "us" or "our") is soliciting proxies for use at the special meeting of stockholders to be held on ♦, ♦ ♦, 2020, at ♦, Arizona time, at the offices of Dickinson Wright PLLC, 1850 North Central Avenue, Suite 1400, Phoenix, Arizona 85004 or at any adjournment of the special meeting. These materials are expected to be first sent or given to our stockholders on or about ♦ ♦, 2020.

What is included in these materials?

These materials include:

-

the notice of the special meeting of stockholders;

-

this proxy statement for the special meeting of stockholders; and

-

the proxy card.

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to be Held on ♦ ♦, 2020

Above materials are also available at ♦.

What items will be voted at the special meeting?

Our stockholders will vote on:

-

the approval of the private placement completed on April 17, 2020 and issuance of securities thereunder, including the issuance of shares of our common stock upon the exercise of warrants; and

-

on the approval of the private placement completed on May 11, 2020 and issuance of securities thereunder, including the issuance of shares of our common stock upon the conversion of subscription receipts and the exercise of warrants underlying subscription receipts.

What do I need to do now?

We urge you to carefully read and consider the information contained in this proxy statement. We request that you cast your vote on each of the proposals described in this proxy statement. You are invited to attend the special meeting, but you do not need to attend the special meeting in person to vote your shares. Even if you do not plan to attend the special meeting, please vote by proxy by following instructions provided in the proxy card.

Who can vote at the special meeting?

Our board of directors has fixed the close of business on ♦ ♦, 2020 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the special meeting or any adjournment. If you were a stockholder of record of our common stock on the record date, you are entitled to vote at the special meeting.

As of the record date, ♦ shares of our common stock were issued and outstanding and, therefore, a total of ♦ votes are entitled to be cast at the special meeting.

How many votes do I have?

On each proposal to be voted upon, you have one vote for each share of our common stock that you owned on the record date. There is no cumulative voting.

How do I vote my shares?

If you are a stockholder of record, you may vote in person at the special meeting or by proxy.

-

To vote in person, come to the special meeting, and we will give you a ballot when you arrive.

-

If you do not wish to vote in person or if you will not be attending the special meeting, you may vote by proxy by mail, by fax, by email or via the Internet by following instructions provided in the proxy card.

If you hold your shares in "street name" and:

-

you wish to vote in person at the special meeting, you must obtain a valid proxy from your broker, bank, or other nominee that holds your shares giving you the right to vote the shares at the special meeting.

-

you do not wish to vote in person or you will not be attending the special meeting, you must vote your shares in the manner prescribed by your broker, bank or other nominee. Your broker, bank or other nominee should have enclosed or otherwise provided a voting instruction card for you to use in directing the broker, bank or nominee how to vote your shares.

What is the difference between a stockholder of record and a "street name" holder?

If your shares are registered directly in your name with our transfer agent, Transhare Corporation, then you are a stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, or other nominee, then the broker, bank, or other nominee is the stockholder of record with respect to those shares. However, you still are the beneficial owner of those shares, and your shares are said to be held in "street name." Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, or other nominee how to vote their shares. Street name holders are also invited to attend the special meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one name or in different accounts. To ensure that all of your shares are voted, please vote by proxy by following instructions provided in each proxy card. If some of your shares are held in "street name," you should have received voting instruction with these materials from your broker, bank or other nominee. Please follow the voting instruction provided to ensure that your vote is counted.

What vote is required for the approval of a proposal?

When a quorum is present or represented at the special meeting, the vote of the stockholders of a majority of our stock having voting power present in person or represented by proxy will be sufficient to decide any question brought before the special meeting.

This means, to be approved, a proposal must receive more "For" votes than the combined votes of "Against" votes and votes that are abstained.

How are votes counted?

At the special meeting, you may vote "For", "Against", or "Abstain" for a proposal. Votes that are abstained will have the same effect as "Against" votes. Broker non-votes will have no effect on the outcome of the vote on the proposal.

A "broker non-vote" occurs when a broker, bank, or other nominee holding shares for a beneficial owner in street name does not vote on a particular proposal because it does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner of those shares, despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions.

What happens if I do not make specific voting choices?

If you are a stockholder of record and you submit your proxy without specifying how you want to vote your shares, then the proxy holder will vote your shares in the manner recommended by our board of directors on a proposal.

If you hold your shares in the street name and you do not give instructions to your broker, bank or other nominee to vote your shares, under the rules that govern brokers, banks, and other nominees who are the stockholders of record of the shares held in street name, it generally has the discretion to vote uninstructed shares on routine matters but has no discretion to vote them on non-routine matters.

What is the quorum requirement?

A quorum of stockholders is necessary for the transaction of business at the special meeting. Stockholders holding at least 33⅓% of the stock issued and outstanding and entitled to vote at the special meeting, present in person or represented by proxy, constitute a quorum at the special meeting. Your shares will be counted towards the quorum requirement only if you or the registered holder of your shares, properly vote by proxy or present in person at the special meeting. Votes that are abstained and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the special meeting may be adjourned by the vote of a majority of the shares represented either in person or by proxy.

How does the board of directors recommend that I vote?

Our board of directors recommends that you vote your shares:

-

"For" the approval of the private placement completed on April 17, 2020 and the issuance of securities thereunder, including the issuance of shares of our common stock upon the exercise of warrants; and

-

"For" the approval of the private placement completed on May 11, 2020 and issuance of securities thereunder, including the issuance of shares of our common stock upon the conversion of subscription receipts and the exercise of warrants underlying subscription receipts.

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy and change your vote at any time before the final vote at the special meeting. If you are a stockholder of record, you may vote again on a later date via the Internet (only your latest Internet proxy submitted prior to the special meeting will be counted), by signing and returning a new proxy card with a later date by mail, by fax or by email, or by attending the special meeting and voting in person. Your attendance at the special meeting will not automatically revoke your proxy unless you vote again at the special meeting or specifically request in writing that your prior proxy be revoked. You may also request that your prior proxy be revoked by delivering us a written notice of revocation prior to the special meeting at The Alkaline Water Company Inc., 14646 N. Kierland Blvd., Suite 255, Scottsdale, Arizona 85254, Attn: Richard A. Wright.

If you hold your shares in the street name, you will need to follow the voting instruction provided by your broker, bank or other nominee regarding how to revoke or change your vote.

How can I attend the special meeting?

You may call us at 480-656-2423 if you want to obtain information or directions to be able to attend the special meeting and vote in person.

You may be asked to present valid picture identification, such as a driver's license or passport, before being admitted to the special meeting. If you hold your shares in street name, you also will need proof of ownership to be admitted to the special meeting. A recent brokerage statement or letter from your broker, bank or other nominee is an example of proof of ownership.

Will the special meeting be affected by the COVID-19 pandemic?

We are sensitive to the health and travel concerns our stockholders may have and the protocols that federal, state and local governments may impose. Due to the difficulties arising from the coronavirus known as COVID-19, the date, time, location or means of conducting the special meeting may change. In the event of such a change, we will announce alternative arrangements for the special meeting as promptly as practicable, which may include holding the special meeting by means of remote communication, among other steps, but we may not deliver additional soliciting materials to stockholders or otherwise amend the proxy materials. We plan to announce these changes, if any, at ♦ and encourage you to check this website prior to the special meeting if you plan to attend.

Who pays for the cost of proxy preparation and solicitation?

We pay for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokers, banks or other nominees for forwarding proxy materials to street name holders.

We are soliciting proxies primarily by mail. In addition, our directors, officers and regular employees may solicit proxies by telephone, facsimile, mail, other means of communication or personally. These individuals will receive no additional compensation for such services.

We will ask brokers, banks, and other nominees to forward the proxy materials to their principals and to obtain their authority to execute proxies and voting instructions. We will reimburse them for their reasonable expenses.

Forward-Looking Statements

This proxy statement contains forward-looking statements. These statements relate to future events. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our company's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Unless otherwise indicated, all reference to "dollars", "$", "USD" or "US$" are to United States dollars and all reference to "CDN$" are to Canadian dollars.

Voting Securities and Principal Holders Thereof

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of ♦ ♦, 2020, certain information with respect to the beneficial ownership of our common stock by each stockholder known by us to be the beneficial owner of more than 5% of any class of our voting securities and by each of our directors, director nominees and named executive officers (as defined in the "Executive Compensation" section below) and by our directors and executive officers as a group.

|

Name of Beneficial Owner

|

Title of Class

|

Amount and Nature of

Beneficial Ownership(1)

|

Percentage of

Class(2)

|

|

Richard A. Wright

|

Common Stock

|

3,825,000(3)

|

♦%

|

|

David A. Guarino

|

Common Stock

|

1,984,300(4)

|

♦%

|

|

Aaron Keay

|

Common Stock

|

475,000(5)

|

*

|

|

Bruce Leitch

|

Common Stock

|

125,000(6)

|

*

|

|

Brian Sudano

|

Common Stock

|

33,333(7)

|

*

|

|

All executive officers and directors as a group (5 persons)

|

Common Stock

|

6,442,633

|

♦%

|

* Less than 1%.

|

(1)

|

Except as otherwise indicated, we believe that the beneficial owners of the common stock listed above, based on information furnished by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Common stock subject to options or warrants currently exercisable or exercisable within 60 days, are deemed outstanding for purposes of computing the percentage ownership of the person holding such option or warrants, but are not deemed outstanding for purposes of computing the percentage ownership of any other person.

|

|

|

|

|

(2)

|

Percentage of common stock is based on ♦ shares of our common stock issued and outstanding as of ♦, 2020.

|

|

|

|

|

(3)

|

Includes 125,000 stock options that are exercisable within 60 days of the date of this proxy statement.

|

|

|

|

|

(4)

|

Includes 75,000 stock options that are exercisable within 60 days of the date of this proxy statement.

|

|

|

|

|

(5)

|

Consists of 475,000 stock options that are exercisable within 60 days of the date of this proxy statement.

|

|

|

|

|

(6)

|

Includes 100,000 stock options that are exercisable within 60 days of the date of this proxy statement.

|

|

|

|

|

(7)

|

Consists of 33,333 stock options that are exercisable within 60 days of the date of this proxy statement.

|

Changes in Control

We are unaware of any contract or other arrangement the operation of which may at a subsequent date result in a change in control of our company.

Proposal 1

Approval of April 17, 2020 Private Placement and Issuance of Securities Thereunder

At the special meeting, our stockholders will be asked to approve the private placement completed on April 17, 2020 and the issuance of securities thereunder, including the issuance of shares of our common stock upon the exercise of warrants as described below.

Pursuant to Nasdaq Listing Rule 5635(d), a company listed on Nasdaq is required to obtain stockholder approval prior to the issuance of common stock in connection with certain non-public offerings involving the sale, issuance or potential issuance by a listed company of common stock (and/or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock outstanding before the issuance at a price below the "Minimum Price" as defined in the Nasdaq Listing Rules.

Background

On April 17, 2020, we completed a private placement of 9,750,000 units of our securities at a price of $0.40 per unit for gross proceeds of $3,900,000. Each unit consisted of one share of our common stock and one share purchase warrant, with each share purchase warrant entitling the holder to acquire one additional share of our common stock at a price of $0.50 per share for a period of three years. In the event that the our common stock has a closing price on the TSX Venture Exchange (or such other exchange on which our common stock may be traded at such time) of $1.75 or greater per share for a period of twenty consecutive trading days at any time from the date of issuance, we may accelerate the expiry date of the warrants by giving notice to the holders thereof (by disseminating a news release advising of the acceleration of the expiry date of the warrants) and, in such case, the warrants will expire on the thirtieth day after the date of such notice.

Under the terms and conditions of the warrants, the warrants are not exercisable into shares of our common stock until such time as we have received an ordinary resolution of our stockholders approving the exercise of the warrants.

Of the 9,750,000 units we issued: (i) 1,250,000 units were issued pursuant to the exemption from registration under the Securities Act of 1933, as amended provided by Section 4(a)(2) and/or Rule 506 of Regulation D promulgated under the Securities Act of 1933, as amended to one investor who was an "accredited investor" within the respective meanings ascribed to that term in Regulation D promulgated under the Securities Act of 1933, as amended; and (ii) 8,500,000 units were issued to five non-U.S. persons (as that term is defined in Regulation S of the Securities Act of 1933, as amended) in an offshore transaction relying on Regulation S and/or Section 4(a)(2) of the Securities Act of 1933, as amended.

No broker fees or commissions were paid by us in connection with the private placement.

Reasons for the April 17, 2020 Private Placement

We undertook the private placements in order to improve our liquidity position in the 2020 fiscal year. Our board of directors determined that the private placement was in the best interests of our company and our stockholders because the financing provided funding for our continuing operations and potential future growth. The private placement resulted in aggregate gross proceeds to our company of $3,900,000 generated from the sale of units, before deducting offering expenses. The warrants issued in connection with the private placement for units, if exercised, would be a potential source of an additional $4,875,000 of cash.

While the private placement is potentially significantly dilutive, if we had not been able to complete the private placement or another similar transaction in the near term, we may not have had the funds necessary to continue as a going concern and to continue to execute on our business strategy.

Nasdaq Listing Rules

Because our common stock is traded on the Nasdaq Capital Market, we are subject to the Nasdaq Listing Rules, including Rule 5635(d). Pursuant to Listing Rule 5635(d), stockholder approval is required prior to the issuance of securities in connection with a transaction (or a series of related transactions) other than a public offering involving the sale, issuance or potential issuance of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the Minimum Price. "Minimum Price" means a price that is the lower of: (i) the Nasdaq official closing price immediately preceding the signing of the binding agreement; or (ii) the average Nasdaq official closing price of our common stock for the five trading days immediately preceding the signing of the binding agreement.

Effect of Issuance of Securities on Current Stockholders

If the proposal is adopted, it will result in the potential issuance of an aggregate of 9,750,000 shares of our common stock underlying the warrants issued pursuant to the private placement for units. This would result in significant dilution to our stockholders, and would afford our stockholders a smaller percentage interest in the voting power, liquidation value and aggregate book value of our company. The sale or any resale of our common stock issued could cause the market price of our common stock to decline.

Consequences if Stockholder Approval is Not Obtained

If we do not obtain approval of this proposal at the special meeting then, pursuant to the terms and conditions of the warrants, the subscribers for units will not be able to exercise the warrants into shares of our common stock for cash.

After extensive efforts to raise capital on more favorable terms, we believed that the private placement was the only viable financing alternative available to us at the time and we believe that the benefits of the approval of this proposal exceed the potential dilutive effects and related risks described above. If our stockholders do not approve this proposal, we will be unable to receive up to $4,875,000 on the exercise of warrants issued pursuant to the private placement for units.

Our board of directors recommends that you vote FOR the approval of the private placement and the issuance of securities thereunder, including the issuance of shares of our common stock upon the exercise of warrants.

Proposal 2

Approval of May 11, 2020 Private Placement and Issuance of Securities Thereunder

At the special meeting, our stockholders will be asked to approve the private placement completed on May 11, 2020 and issuance of securities thereunder, including the issuance of shares of our common stock upon the conversion of subscription receipts and the exercise of warrants underlying subscription receipts as described below.

Pursuant to Nasdaq Listing Rule 5635(d), a company listed on Nasdaq is required to obtain stockholder approval prior to the issuance of common stock in connection with certain non-public offerings involving the sale, issuance or potential issuance by a listed company of common stock (and/or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock outstanding before the issuance at a price below the "Minimum Price" as defined in the Nasdaq Listing Rules.

Background

On May 11, 2020, we completed a private placement of 4,444,440 subscription receipts at a price of $0.45 per subscription receipt for total gross proceeds of $1,999,998.

In the event of the occurrence of the escrow release condition (as defined below), each subscription receipt will automatically convert into one unit consisting of one share of our common stock and one transferable share purchase warrant, for no additional consideration. Each warrant will entitle the holder thereof to acquire one share of our common stock for a period of three years from the date of issuance thereof at a price of $0.55 per share. In the event that our common stock has a closing price on the TSX Venture Exchange (or such other exchange on which our common stock may be traded at such time) of $1.75 or greater per share for a period of 20 consecutive trading days at any time from the closing date of the private placement, we may accelerate the expiry date of the warrants by giving notice to the holders thereof (by disseminating a news release advising of the acceleration of the expiry date of the warrants) and, in such case, the warrants will expire on the thirtieth day after the date of such notice.

The subscription amounts will be held by an escrow agent until the escrow release condition occurs. The escrow release condition is the receipt by our company of an ordinary resolution of our stockholders approving the private placement and the issuance of the securities thereunder. In the event that the escrow release condition is satisfied prior to 5:00 p.m. (Vancouver time) on July 15, 2020, we will deliver a notice to the escrow agent confirming the escrow release condition has been satisfied. Upon receipt of the notice, the escrow agent will, as soon as practicable thereafter, release the subscription amounts to our company and each subscription receipt will automatically convert into one unit without payment of any additional consideration. If the escrow release condition is not satisfied by 5:00 p.m. (Vancouver time) on July 15, 2020 or if we deliver a written default notice to the escrow agent that the escrow release condition will not be satisfied by that time, the subscription receipts will expire and be of no further force and effect, effective as of the earlier of (i) 5:00 p.m. (Vancouver time) on July 15, 2020 and (ii) the date of the receipt of the default notice, and the subscribers will be entitled to receive from the escrow agent a refund of the subscription amounts held in escrow, without interest and less applicable expenses.

Of the 4,444,440 subscription receipts we issued: (i) 444,443 subscription receipts were issued pursuant to the exemption from registration under the Securities Act of 1933, as amended provided by Section 4(a)(2) and/or Rule 506 of Regulation D promulgated under the Securities Act of 1933, as amended to three investors, each of who was an "accredited investor" within the meaning ascribed to that term in Regulation D promulgated under the Securities Act of 1933, as amended; and (ii) 3,999,997 subscription receipts were issued to three non-U.S. persons (as that term is defined in Regulation S of the Securities Act of 1933, as amended) in an offshore transaction relying on Regulation S and/or Section 4(a)(2) of the Securities Act of 1933, as amended.

No broker fees or commissions were paid by us in connection with the private placement.

Reasons for the Private Placement

We undertook the private placement in order to improve our liquidity position in the 2020 fiscal year. Our board of directors determined that the private placement was in the best interests of our company and our stockholders because the financing provided funding for our continuing operations and potential future growth. The private placement resulted in aggregate gross proceeds to our company of $1,999,998 generated from the sale of subscription receipts, before deducting offering expenses. The proceeds of the private placement for subscription receipts are currently being held in escrow by an escrow agent, pending satisfaction of the escrow release condition. The warrants issued in connection with the private placement for subscription receipts, if exercised, would be a potential source of an additional $2,444,442 of cash.

While the private placement is potentially significantly dilutive, if we had not been able to complete the private placement or another similar transaction in the near term, we may not have had the funds necessary to continue as a going concern and to continue to execute on our business strategy.

Nasdaq Listing Rules

Because our common stock is traded on the Nasdaq Capital Market, we are subject to the Nasdaq Listing Rules, including Rule 5635(d). Pursuant to Listing Rule 5635(d), stockholder approval is required prior to the issuance of securities in connection with a transaction (or a series of related transactions) other than a public offering involving the sale, issuance or potential issuance of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the Minimum Price. "Minimum Price" means a price that is the lower of: (i) the Nasdaq official closing price immediately preceding the signing of the binding agreement; or (ii) the average Nasdaq official closing price of our common stock for the five trading days immediately preceding the signing of the binding agreement.

Effect of Issuance of Securities on Current Stockholders

If the proposal is adopted, it will result in the issuance of 4,444,440 shares of our common stock and the potential 4,444,440 shares of our common stock underlying the warrants that would be issued on conversion of the subscription receipts. This would result in an increase of up to an aggregate of 8,888,880 shares of common stock, and would result in significant dilution to our stockholders, and would afford our stockholders a smaller percentage interest in the voting power, liquidation value and aggregate book value of our company. The sale or any resale of our common stock issued could cause the market price of our common stock to decline.

Consequences if Stockholder Approval is Not Obtained

If we do not obtain approval of this proposal at the special meeting then, pursuant to the subscription agreements for the subscription receipts, the outstanding subscription receipts will not be automatically converted into units of our securities. Further, if the escrow release condition is not satisfied prior to the escrow deadline, the escrow agent will return the $1,999,998 in proceeds of the private placement for subscription receipts currently held in escrow to the subscribers.

After extensive efforts to raise capital on more favorable terms, we believed that the private placement was the only viable financing alternative available to us at the time and we believe that the benefits of the approval of this proposal exceed the potential dilutive effects and related risks described above. If our stockholders do not approve this proposal, we will be unable to receive $1,999,998 in proceeds from the private placement for subscription receipts currently being held in escrow, and we will be unable to receive $2,444,442 on the exercise of warrants issued on the conversion of the subscription receipts.

Our board of directors recommends that you vote FOR the approval of the private placement and issuance of securities thereunder, including the issuance of shares of our common stock upon the conversion of subscription receipts and the exercise of warrants underlying subscription receipts.

Interest of Certain Persons in Matters to be Acted Upon

No director or executive officer of our company and no associate of any of the foregoing persons has any substantial interest, direct or indirect, by security holding or otherwise, in any matter to be acted upon at the special meeting.

"Householding" of Proxy Materials

The Securities and Exchange Commission permits companies and intermediaries such as brokers to satisfy the delivery requirements for proxy statements or annual reports with respect to two or more stockholders sharing the same address by delivering a single copy of the proxy statement or annual report, as applicable, addressed to those stockholders. This process, which is commonly referred to as "householding", potentially provides extra convenience for stockholders and cost savings for companies.

Although we do not intend to household for our stockholders of record, some brokers household our proxy materials and annual reports, delivering a single copy of the proxy statement or annual report to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate copy of the proxy statement or annual report, or if you are receiving multiple copies of either document and wish to receive only one, please notify your broker. Stockholders who currently receive multiple copies of the proxy statement or annual report at their address from their brokers and would like to request "householding" of their communications should contact their brokers.

Stockholder Proposals

Stockholder proposals to be considered for inclusion in the proxy statement and form of proxy relating to our next annual meeting of stockholders must be received no later October 31, 2020. If we change the date of our next annual meeting of stockholders by more than 30 days from the date of this year's annual meeting of stockholders, then the deadline is a reasonable time before we begin to print and send our proxy materials. All such proposals must comply with the requirements of Rule 14a-8 of Regulation 14A of the Securities Exchange Act of 1934, which sets forth specific requirements and limitations applicable to nominations and proposals at annual meetings of stockholders.

All stockholder proposals, notices and requests should be made in writing and sent via registered, certified or express mail to The Alkaline Water Company Inc., 14646 N. Kierland Blvd., Suite 255, Scottsdale, AZ 85254, Attention: David A. Guarino.

Where You Can Find More Information

We file annual and other reports, proxy statements and other information with the United States Securities and Exchange Commission. The documents filed with the Securities and Exchange Commission are available to the public from the Securities and Exchange Commission's website at www.sec.gov.

Other Matters

Our board of directors does not intend to bring any other business before the special meeting, and so far as is known to our board of directors, no matters are to be brought before the special meeting except as specified in the notice of the special meeting. If any other matters are properly brought before the special meeting, it is the intention of the person named on the proxy to vote the shares represented by the proxy on such matters in accordance with his judgment.

By Order of the Board of Directors

___________________________________________

Richard A. Wright

President and Chief Executive Officer

♦, 2020

THE ALKALINE WATER COMPANY INC.

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON ♦, ♦

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

The undersigned stockholder of The Alkaline Water Company Inc. (the "Company") hereby appoints Richard A. Wright and David A. Guarino, and each of them, as attorneys and proxies, each with the power to appoint his substitute, and authorizes each of them to represent and vote all of the shares of common stock of the Company that the undersigned stockholder is entitled to vote at the special meeting of stockholders of the Company to be held on ♦, ♦, 2020 at ♦, Arizona time, at the offices of Dickinson Wright PLLC, 1850 North Central Avenue, Suite 1400, Phoenix, Arizona 85004 or any adjournment thereof, on the matters set forth below, and in his discretion on any other matters as may be properly brought before the meeting or any adjournment thereof, with all the powers which the undersigned stockholder would possess if personally present at the meeting or any adjournment thereof.

The Board of Directors recommends a vote "For" Proposals 1 and 2.

|

|

|

For

|

Against

|

Abstain

|

|

|

|

|

|

|

|

1.

|

To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the private placement completed on April 17, 2020 and issuance of securities thereunder, including the issuance of 9,750,000 shares of common stock of the Company upon the exercise of 9,750,000 warrants issued by the Company on April 17, 2020

|

☐

|

☐

|

☐

|

|

2.

|

To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the private placement completed on May 11, 2020 and issuance of securities thereunder, including the issuance of 4,444,440 shares of common stock of the Company on the conversion of 4,444,400 subscription receipts issued by the Company on May 11, 2020 and the issuance of 4,444,440 shares of common stock of the Company upon the exercise of 4,444,440 warrants underlying 4,444,440 subscription receipts issued by the Company on May 11, 2020

|

☐

|

☐

|

☐

|

The shares represented by this proxy, when this proxy is properly executed, will be voted as directed by the undersigned stockholder or, if no such directions are made, the shares represented by this proxy will be voted in accordance with recommendations of the Board of Directors, and as the proxies deem advisable on any other matters as may be properly brought before the meeting or any adjournment thereof.

This proxy is valid only when signed and dated.

Dated:___________________, 20____

__________________________________

Name

__________________________________

Signature

__________________________________

Signature if shares held jointly

Please date this proxy and sign your name as it appears on your stock certificate(s). When shares are held jointly, all owners should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title and authority. If a corporation, please sign in full corporate name by authorized officer and give full title of the authorized officer. If a partnership, please sign in full partnership name by authorized person and give full title of the authorized person.

PLEASE VOTE BY 11:59 P.M. (EASTERN TIME) ON ♦, 2020.

VOTE BY INTERNET

Use the Internet to transmit your voting instructions at www.transhare.com/alkaline. Click Vote My Proxy and then click on the Company's name and follow the on-screen instructions.

VOTE BY EMAIL

Mark, sign and date your proxy card and return it via email to bizsolaconsulting@gmail.com. Include your control ID in your email.

VOTE BY FAX

Mark, sign and date your proxy card and return it via fax to 1-727-269-5616.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Transhare Corporation, 2849 Executive Drive, Suite 200, Clearwater, Florida 33762.

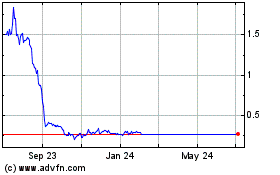

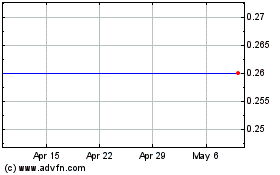

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Apr 2023 to Apr 2024