Akoustis Technologies,

Inc. (NASDAQ: AKTS) (“Akoustis” or the “Company”), an

integrated device manufacturer (IDM) of patented bulk acoustic wave

(BAW) high-band RF filters for mobile and other wireless

applications, will host an investor call to provide a business

update and outlook, followed by a Q & A session this morning at

8:00 a.m. EST. The call-in numbers are 877-407-3982 (domestic) or

201-493-6780 (international). The conference call will be webcast

live on the Company’s website and will be available for playback at

the following URL: https://ir.akoustis.com/ir-calendar.

Jeff Shealy, founder and CEO of Akoustis,

commented, “The September quarter marked an important moment in our

history as a company as we successfully entered production in two

high volume commercial markets, namely, WiFi 6 and 5G small cell

network infrastructure." Mr. Shealy continued, “Despite the ongoing

COVID-19 pandemic, we achieved all of our strategic milestones for

the September quarter. We are actively delivering volume production

of our WiFi 6 tandem filter solution, ramping multiple 5G small

cell XBAW™ filter solutions and supporting numerous engagements

with our groundbreaking BAW-based WiFi 6E coexistence filters. With

our growing catalog of commercially available RF filter products

and technology aimed at large and growing markets including 5G

network infrastructure, high-band WiFi, 5G mobile devices and

advanced defense communications equipment, we expect continued

top-line growth moving forward.”

Recent Business Highlights

- Received first development order from new customer for XBAW™

filters for integration into mobile RF front end solutions

- Entered production for new tier-1 consumer focused tri-band

WiFi 6 product, which is expected to be available for purchase for

the holiday season

- Delivered multiple engineering samples to existing tier-1

enterprise WiFi 6E customer

- Announced the world’s first 6.5 GHz BAW filter for the emerging

WiFi 6E specification that covers the recently allotted

ultra-wideband 5.9 to 7.1 GHz unlicensed spectrum

- Achieved robust sampling of WiFi 6E filters to tier-1 and

tier-2 OEMs, ODMs and SoC customers

- Announced the first order for WiFi 6E 5.5 and 6.5 GHz tandem

catalog solution from enterprise-class customer

- Shipped volume order to tier-1 5G small cell network

infrastructure customer with band n77 filter solution

- Received first order from network infrastructure OEM for XBAW™

3.6 GHz CBRS filter solution

- Shipped fourth 5G small cell network infrastructure XBAW™

filter solution with tier-1 OEM with expected production ramp in

early calendar 2021

- Announced third 5G small cell network infrastructure design win

with tier-1 OEM customer

- Announced second 5G small cell network infrastructure customer

and design win expected to ramp in early calendar 2021

- Received DARPA direct to phase 2 (DP2) program to advance

design and manufacturing of XBAW™ technology

- Appointed J. Michael McGuire, former Grant Thornton CEO to the

board of directors

- Continued engagement with 5G mobile partner for evaluation in

future mobile RF products

- Further expanded Company’s product portfolio by adding 15th

design-locked RF filter solution to its product catalog

- Expanded XBAW™ patent portfolio to 33 issued and licensed

patents plus 73 patents pending as of October 19, 2020

First Fiscal Quarter Financial

Performance

For the 1st quarter ended September 30th, the

Company reported revenue of $636,000, which was an increase of 74%

as compared to the previous quarter and represented an 118%

increase in our core filter product revenue.

On a GAAP basis: Operating loss was ($10.3)

million for the September quarter, mainly driven by labor costs of

$6.3 million, depreciation of $1.0 million, and other operational

costs totaling $3.0 million. As a result, GAAP net loss per share

was ($0.31).

On a non-GAAP basis: Operating loss was ($8.3)

million, and non-GAAP net loss per share was ($0.23).

Capex spend for Q1 was $2.3 million compared to

$3.4 million in the prior quarter, mostly related to the targeted

500% capacity expansion in the Company’s NY fab. Cash used in

operating activities in Q1 was $7.9 million, compared to $4.9

million in the prior quarter. The increase of $3.0 million is

primarily due to certain fiscal year-end payments not expected to

repeat in the second quarter and increases in spend related to our

capacity expansion. The Company exited the September quarter

with $37.3 million of cash and cash equivalents, versus $44.4

million at the end of Q4.

Akoustis’ high frequency, high performance XBAW™

process and filters are experiencing growing interest as the

Company has entered production in multiple markets in calendar

2020, including 5G network infrastructure, high-band WiFi and

phased-array radar applications.

Akoustis has added 15 filters to its product

catalog including a 5.6 GHz WiFi filter, a 5.2 GHz WiFi filter, a

5.5 GHz WiFi-6E filter, a 6.5 GHz WiFi 6E filter, three small cell

5G network infrastructure filters including two Band n77 filters

and one Band n79 filter, a 3.8 GHz filter and five S-Band filters

for defense phased-array radar applications, a 3.6 GHz filter for

the CBRS 5G infrastructure market and a C-Band filter for the

unmanned aircraft systems (UAS) market. The Company is also

developing several new filters for the sub-7 GHz bands targeting 5G

mobile device, network infrastructure, WiFi CPE and defense

markets.

| |

|

|

|

|

|

|

|

Akoustis Technologies, Inc. |

|

|

Condensed Consolidated Statements of Operations |

|

|

(In thousands, except per share data) |

|

|

(Unaudited) |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

For the |

|

For the |

|

|

Three |

Three |

|

Months |

Months |

|

Ended |

Ended |

|

September 30, |

September 30, |

|

2020 |

2019 |

| |

|

|

|

|

|

Revenue |

$ |

636 |

|

$ |

543 |

|

| |

|

|

|

|

|

|

| Cost of

revenue |

|

1,649 |

|

|

336 |

|

| |

|

|

|

|

|

|

| Gross

profit |

|

(1,013 |

) |

|

207 |

|

| |

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

Research and development |

|

6,380 |

|

|

5,079 |

|

|

General and administrative expenses |

|

2,927 |

|

|

2,801 |

|

|

Total operating expenses |

|

9,307 |

|

|

7,880 |

|

| |

|

|

|

|

|

|

| Loss from

operations |

|

(10,320 |

) |

|

(7,673 |

) |

| |

|

|

|

|

|

|

| Other

(expense) income |

|

|

|

|

|

|

|

Interest (expense) |

|

(1,431 |

) |

|

(994 |

) |

|

Rental income |

|

— |

|

|

55 |

|

|

Other (expense) |

|

(1 |

) |

|

(1 |

) |

|

Change in fair value of contingent real estate liability |

|

— |

|

|

(18 |

) |

|

Change in fair value of derivative liabilities |

|

(198 |

) |

|

(344 |

) |

|

Total other (expense) income |

|

(1,630 |

) |

|

(1,302 |

) |

| Net

loss |

$ |

(11,950 |

) |

$ |

(8,975 |

) |

| |

|

|

|

|

|

|

| Net loss

per common share - basic and diluted |

$ |

(0.31 |

) |

$ |

(0.30 |

) |

| |

|

|

|

|

|

|

| Weighted

average common shares outstanding - basic and diluted |

|

38,176,702 |

|

|

30,325,185 |

|

| |

|

|

|

|

|

|

|

|

|

Akoustis Technologies, Inc. |

|

|

Condensed Consolidated Balance Sheets |

|

|

(In thousands, except share data) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, |

|

|

June 30, |

|

| |

|

2020 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

| Cash and cash

equivalents |

|

$ |

37,189 |

|

|

$ |

44,308 |

|

| Accounts

receivable, net |

|

|

346 |

|

|

|

351 |

|

| Inventory,

net |

|

|

236 |

|

|

|

136 |

|

| Other current

assets |

|

|

1,513 |

|

|

|

1,408 |

|

| Total

current assets |

|

|

39,284 |

|

|

|

46,203 |

|

| |

|

|

|

|

|

|

|

|

| Property and

equipment, net |

|

|

23,458 |

|

|

|

23,605 |

|

| |

|

|

|

|

|

|

|

|

| Intangibles,

net |

|

|

577 |

|

|

|

544 |

|

| |

|

|

|

|

|

|

|

|

| Operating

lease right-of-use asset, net |

|

|

645 |

|

|

|

699 |

|

| Restricted

cash |

|

|

100 |

|

|

|

100 |

|

| Other

assets |

|

|

282 |

|

|

|

282 |

|

| Total

Assets |

|

$ |

64,346 |

|

|

$ |

71,433 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

|

$ |

3,749 |

|

|

$ |

5,899 |

|

| Deferred

revenue |

|

|

190 |

|

|

|

— |

|

| Operating

lease liability - current |

|

|

241 |

|

|

|

231 |

|

| Total

current liabilities |

|

|

4,180 |

|

|

|

6,130 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

Liabilities: |

|

|

|

|

|

|

|

|

| Convertible

notes payable, net |

|

|

22,858 |

|

|

|

21,628 |

|

| Operating

lease liability - non-current |

|

|

408 |

|

|

|

472 |

|

| Loans

payable |

|

|

1,598 |

|

|

|

1,591 |

|

| Other

long-term liabilities |

|

|

117 |

|

|

|

117 |

|

| Total

long-term liabilities |

|

|

24,981 |

|

|

|

23,808 |

|

| |

|

|

|

|

|

|

|

|

| Total

Liabilities |

|

|

29,161 |

|

|

|

29,938 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Preferred stock, par value $0.001: 5,000,000 shares authorized;

none issued and outstanding |

|

|

— |

|

|

|

|

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized;

38,582,189 and 37,990,380 shares issued and outstanding at

September 30, 2020 and June 30, 2020, respectively |

|

|

39 |

|

|

|

38 |

|

| Additional

paid in capital |

|

|

150,711 |

|

|

|

145,072 |

|

| Accumulated

deficit |

|

|

(115,565 |

) |

|

|

(103,615 |

) |

| Total

Stockholders’ Equity |

|

|

35,185 |

|

|

|

41,495 |

|

| Total

Liabilities and Stockholders’ Equity |

|

$ |

64,346 |

|

|

$ |

71,433 |

|

Non-GAAP Measures

We regularly review a number of metrics,

including Non-GAAP Operating Loss and Non-GAAP Net Loss, which are

not financial measures calculated in accordance with generally

accepted accounting principles in the United States (“GAAP”).

Non-GAAP Operating Loss represents operating loss before common

stock issued for services. Non-GAAP Net Loss represents net

loss before change in fair value of contingent real estate

liability, change in fair value of derivative liabilities, debt

discount amortization and common stock issued for

services. The Company believes these non-GAAP measures provide

useful information to management, investors and financial analysts

regarding certain financial and business trends relating to the

Company’s financial condition and results of operations. We use

these non-GAAP measures to evaluate our business, measure our

performance, identify trends affecting our business, formulate

financial projections and make strategic decisions.

Non-GAAP measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with GAAP. These non-GAAP measures exclude significant

expenses that are required by GAAP to be recorded in the Company's

financial statements and are subject to inherent limitations.

Non-GAAP Operating Loss and Non-GAAP Net Loss

for the three months ending September 30, 2020 and 2019 were as

follows:

|

Akoustis Technologies, Inc. |

|

Unaudited Reconciliations of Non-GAAP Financial

Measures |

| |

|

|

| |

Three Months Ended |

| |

September 30, 2020 |

September 30, 2019 |

| (in thousands) |

| GAAP operating loss |

$

(10,320) |

$

(7,673) |

| Common stock issued for

services |

2,027 |

1,703 |

| Non-GAAP operating loss |

$

(8,293) |

$

(5,970) |

| |

|

|

| |

|

|

| |

Three Months Ended |

| |

September 30, 2020 |

September 30, 2019 |

| (in thousands) |

| GAAP net loss |

$

(11,950) |

$

(8,975) |

| Change in fair value of

contingent real estate liability |

- |

18 |

| Change in fair value of

derivative liabilities |

198 |

344 |

| Debt discount

amortization |

1,032 |

711 |

| Common stock issued for

services |

2,027 |

1,703 |

| Non-GAAP net loss |

$

(8,693) |

$

(6,199) |

| |

|

|

| Weighted

average common shares outstanding - basic and diluted |

38,176,702 |

30,325,185 |

| Non-GAAP net

loss per common share - basic and diluted |

$

(0.23) |

$

(0.20) |

About Akoustis Technologies,

Inc.

Akoustis® (http://www.akoustis.com/) is a

high-tech BAW RF filter solutions company that is pioneering

next-generation materials science and MEMS wafer manufacturing

to address the market requirements for improved RF filters -

targeting higher bandwidth, higher operating frequencies and higher

output power compared to incumbent polycrystalline BAW

technology deployed today. The Company utilizes its proprietary

XBAW™ manufacturing process to produce bulk acoustic wave RF

filters for mobile and other wireless markets, which

facilitate signal acquisition and accelerate band performance

between the antenna and digital back end. Superior performance is

driven by the significant advances of high-purity,

single-crystal and associated piezoelectric materials and the

resonator-filter process technology which drives electro-mechanical

coupling and translates to wide filter bandwidth.

Akoustis plans to service the fast growing

multi-billion-dollar RF filter market using its integrated

device manufacturer (IDM) business model. The Company owns and

operates a 120,000 sq. ft. ISO-9001:2015

certified commercial wafer-manufacturing facility located in

Canandaigua, NY, which includes a class 100 / class 1000 cleanroom

facility - tooled for 150-mm diameter wafers - for the

design, development, fabrication and packaging of RF filters, MEMS

and other semiconductor devices. Akoustis Technologies,

Inc. is headquartered in the Piedmont technology

corridor near Charlotte, North Carolina.

Forward-Looking Statements

This document includes “forward-looking

statements” within the meaning of Section 27A of the Securities

Act, and Section 21E of the Securities Exchange Act of 1934, as

amended, that are intended to be covered by the “safe harbor”

created by those sections. These forward-looking statements

include, but are not limited to, statements about our estimates,

expectations, beliefs, intentions, plans or strategies for the

future (including our possible future results of operations,

business strategies, competitive position, potential growth

opportunities, potential market opportunities and the effects of

competition), and the assumptions underlying such statements.

Forward-looking statements include all statements that are not

historical facts and typically are identified by use of terms such

as "may," “might,” “would,” "will," "should," "could," “project,”

"expect," "plan," “strategy,” "anticipate," “attempt,” “develop,”

“help,” "believe," "estimate," "predict," “intend,” “forecast,”

“seek,” "potential," "continue," “future,” and similar words

(including the negative of any of the foregoing), although some

forward-looking statements are expressed differently.

Forward-looking statements are neither historical facts nor

assurances of future results, performance, events or circumstances.

Instead, these forward-looking statements are based on

management’s current beliefs, expectations and assumptions and are

subject to risks and uncertainties. Factors that could cause

actual results to differ materially from those currently

anticipated include, without limitation, risks relating to our

ability to obtain adequate financing and sustain our status as a

going concern; our limited operating history; the results of our

research and development activities, including uncertainties

relating to semiconductor process manufacturing; the development of

our XBAWTM technology and products presently under development and

the anticipated timing of such development; our ability to protect

our intellectual property rights that are valuable to our business,

including patent and other intellectual property rights; our

reliance on third parties to complete certain processes in

connection with the manufacture of our products; product quality

and defects; existing or increased competition; our ability to

successfully manufacture, market and sell products based on our

technologies; the ability to achieve qualification of our products

for commercial manufacturing in a timely manner and the size and

growth of the potential markets for any products so qualified; our

ability to successfully scale our New York wafer fabrication

facility and related operations while maintaining quality control

and assurance and avoiding delays in output; the rate and degree of

market acceptance of any of our products; our ability to achieve

design wins from current and future customers; contracting with

customers and other parties with greater bargaining power and

agreeing to terms and conditions that may adversely affect our

business; risks related to doing business in foreign countries; any

security breaches or other disruptions compromising our proprietary

information and exposing us to liability; our ability to raise

funding to support operations and the continued development and

qualification of our products and the technologies underlying them;

our ability to service our outstanding indebtedness represented by

our $25.0 million principal amount of senior convertible notes due

in 2023; and the impact of a pandemic or epidemic or a natural

disaster, including the COVID-19 pandemic, on our operations,

financial condition and the worldwide economy, including its impact

on our ability to access the capital markets; our ability to

maintain effective internal control over financial reporting; and

our ability to obtain and maintain the Trusted Foundry

accreditation of our New York wafer fabrication facility. These and

other risks and uncertainties are described in more detail in the

Risk Factors and Management’s Discussion and Analysis of Financial

Condition and Results of Operations sections of the Company’s most

recent Annual Report on Form 10-K and in subsequently filed

Quarterly Reports on Form 10-Q. Considering these risks,

uncertainties and assumptions, the forward-looking statements

regarding future events and circumstances discussed in this

document may not occur, and actual results could differ materially

and adversely from those anticipated or implied in the

forward-looking statements. You should not rely upon

forward-looking statements as predictions of future events. The

forward-looking statements included in this document speak only as

of the date hereof and, except as required by law, we undertake no

obligation to update publicly or privately any forward-looking

statements, whether written or oral, for any reason after the date

of this document to conform these statements to new information,

actual results or to changes in our expectations.

Contact:

COMPANY:

Tom Sepenzis

Akoustis Technologies

VP of Corporate Development & IR

(980) 689-4961

tsepenzis@akoustis.com

The Del Mar Consulting Group, Inc.

Robert B. Prag, President

(858) 794-9500

bprag@delmarconsulting.com

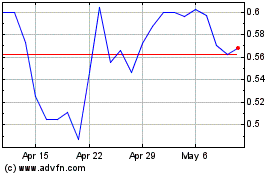

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

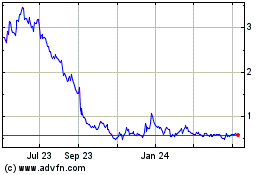

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From Apr 2023 to Apr 2024