UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

March 2020

Commission file number: 001-36288

Akari

Therapeutics, Plc

(Translation of registrant’s name

into English)

75/76 Wimpole Street

London W1G 9RT

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulations S-T Rule 101(b)(1):_____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulations S-T Rule 101(b)(7): _____

CONTENTS

On February 13, 2020, February 19, 2020,

February 20, 2020 and February 28, 2020, respectively, Akari Therapeutics, Plc (the “Company”) entered into definitive

securities purchase agreements (the “Purchase Agreements”) with certain accredited investors, the majority of whom

are existing investors of the Company, including Dr. Ray Prudo, the Company’s Chairman, providing for the issuance of an

aggregate of 5,620,296 American Depositary Shares (the “ADSs”) in a private placement at $1.70 per ADS for aggregate

gross proceeds of approximately $9.5 million. The offering initially closed on February 25, 2020 and a final closing was held on

March 3, 2020. Following the closing of the offering, as of March 3, 2020, the Company had 28,681,598 ADSs and 2,872,895,513 ordinary

shares outstanding.

In addition, under the Purchase Agreements,

the investors received unregistered warrants to purchase an aggregate of 2,810,136 ADSs. The warrants are immediately exercisable

and will expire five years from issuance at an exercise price of $2.20 per ADS, subject to adjustment as set forth therein. The

warrants may be exercised on a cashless basis if six months after issuance there is no effective registration statement registering

the ADSs underlying the warrants (the “Warrant ADSs”). Subject to certain conditions, the Company has the option to

“call” the exercise of the warrants from time to time after any 10-consecutive trading day period during which the

daily volume weighted average price of the ADSs exceeds $3.30.

Under the Purchase

Agreements, the Company agreed to file, as soon as reasonably practicable (and in any case by the earlier of (i) March 26, 2020,

and (ii) five trading days following the date of filing with the Securities and Exchange Commission (the “SEC”) of

the Company’s annual report on Form 20-F for the fiscal year ended December 31, 2019), a registration statement with the

SEC, registering the resale of (i) the ADSs and (ii) the Warrant ADSs and to use commercially reasonable efforts to cause such

registration statement to be declared following the closing date and to keep such registration statement effective at all times

until the earlier of: (a) the ADSs and Warrant ADSs are sold under such registration statement or pursuant to Rule 144 or other

exemption under the Securities Act of 1933, as amended (the “Securities Act”), (b) the ADSs and Warrant ADSs may be

sold without volume or manner-of-sale restrictions pursuant to Rule 144 under the Securities Act, and (c) the five year anniversary

of the date of the issuance of the warrants.

The Purchase Agreements

also contain representations, warranties, indemnification and other provisions customary for transactions of this nature.

The Company also entered into a letter agreement

(the “Placement Agent Agreement”) with Paulson Investment Company, LLC (the “Placement Agent”), pursuant

to which the Placement Agent agreed to serve as the placement agent for the Company in connection with the offering. Under the

Placement Agent Agreement, the Company agreed to pay the Placement Agent a cash placement fee equal to 8.0% of the aggregate purchase

price for the ADSs, an expense reimbursement not to exceed $50,000 and a non-accountable expense allowance of $10,000. The Placement

Agent also received compensation warrants on substantially the same terms as the investors in the offering in an amount equal to

8.0% of the number of ADSs sold in the offering, or 449,623 ADSs, at an exercise price of $2.55 per ADS and a term expiring on

February 21, 2025.

The ADSs, the warrants

and the Warrant ADSs are being offered and sold pursuant to an exemption from the registration requirements under Section 4(a)(2)

of the Securities Act and Rule 506 of Regulation D promulgated thereunder. Each investor has represented that they are an accredited

investor, as that term is defined in Regulation D, or a qualified institutional buyer as defined in Rule 144(A)(a), and has acquired

the ADSs, warrants and the Warrant ADSs as principal for their own account and have no arrangements or understandings for any distribution

thereof. The offer and sale of the foregoing securities is being made without any form of general solicitation or advertising.

The ADSs, the warrants and the Warrant ADSs underlying the warrants have not been registered under the Securities Act or applicable

state securities laws. Accordingly, the ADSs, the warrants and the Warrant ADSs may not be offered or sold in the United States

except pursuant to an effective registration statement or an applicable exemption from the registration requirements of the Securities

Act and such applicable state securities laws.

This Report shall not

constitute an offer to sell or the solicitation to buy nor shall there be any sale of the ADSs or warrants in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of

any such state or jurisdiction.

The foregoing summaries

of the terms of the Purchase Agreements and warrants are subject to, and qualified in their entirety by such documents attached

hereto as Exhibits 10.1 and 10.2 respectively, and are incorporated herein by reference. The Purchase Agreements contain representations

and warranties that the parties made to, and solely for the benefit of, the others, except as expressly set forth in the Purchase

Agreements, in the context of all of the terms and conditions of that agreement and in the context of the specific relationship

between the parties.

On March 4, 2020, the

Company issued a press release announcing it had closed its previously announced private placement. A copy of the press release

is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in

paragraph one of Exhibit 99.1 is hereby incorporated by reference into all effective registration statements filed by the Company

under the Securities Act of 1933.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements

in this press release constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. You should not place undue reliance upon the Company’s forward looking statements. Except as required

by law, the Company undertakes no obligation to revise or update any forward looking statements in order to reflect any event or

circumstance that may arise after the date of this Report. These forward-looking statements reflect our current views about our

plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on

assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in

or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations

or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking

statements and will be affected by a variety of risks and factors that are beyond our control. Such risks and uncertainties for

our company include, but are not limited to: needs for additional capital to fund our operations, our ability to continue as a

going concern; uncertainties of cash flows and inability to meet working capital needs; an inability or delay in obtaining required

regulatory approvals for nomacopan and any other product candidates, which may result in unexpected cost expenditures; our ability

to obtain orphan drug designation in additional indications; risks inherent in drug development in general; uncertainties in obtaining

successful clinical results for nomacopan and any other product candidates and unexpected costs that may result therefrom; difficulties

enrolling patients in our clinical trials; our ability to enter into collaborative, licensing, and other commercial relationships

and on terms commercially reasonable to us; failure to realize

any value of nomacopan and any other product candidates developed and being developed in light of inherent risks and difficulties

involved in successfully bringing product candidates to market; inability to develop new product candidates and support existing

product candidates; the approval by the FDA and EMA and any other similar foreign regulatory authorities of other competing or

superior products brought to market; risks resulting from unforeseen side effects; risk that the market for nomacopan may not be

as large as expected; risks associated with the departure of our former Chief Executive Officers and other executive officers;

risks associated with the SEC investigation; inability to obtain, maintain and enforce patents and other intellectual property

rights or the unexpected costs associated with such enforcement or litigation; inability to obtain and maintain commercial manufacturing

arrangements with third party manufacturers or establish commercial scale manufacturing capabilities; the inability to timely source

adequate supply of our active pharmaceutical ingredients from third party manufacturers on whom the company depends; unexpected

cost increases and pricing pressures and risks and other risk factors detailed in our public filings with the U.S. Securities and

Exchange Commission, including our most recently filed Annual Report on Form 20-F filed with the SEC. Except as otherwise noted,

these forward-looking statements speak only as of the date of this press release and we undertake no obligation to update or revise

any of these statements to reflect events or circumstances occurring after this press release. We caution investors not to place

considerable reliance on the forward-looking statements contained in this press release.

The information contained

in this Report is hereby incorporated by reference into all effective registration statements filed by the Company under the Securities

Act of 1933.

Exhibit No.

|

10.1

|

|

Form of Securities Purchase Agreement

|

|

|

|

|

|

10.2

|

|

Form of Warrant issued by Akari Therapeutics, Plc

|

|

|

|

|

|

99.1

|

|

Press Release dated March 4, 2020

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

Akari Therapeutics, Plc

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

By:

|

/s/ Clive Richardson

|

|

|

|

Name:

|

Clive Richardson

Chief Executive Officer and Chief Operating Officer

|

|

Date: March 4, 2020

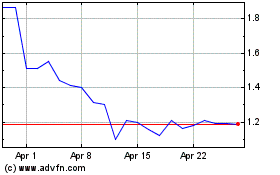

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

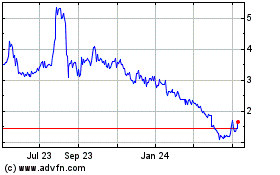

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024