Akari Therapeutics Reports Second Quarter 2019 Financial Results And Highlights Recent Clinical Progress

August 29 2019 - 8:06AM

Akari Therapeutics, Plc (Nasdaq: AKTX), a biopharmaceutical company

focused on innovative therapeutics to treat orphan autoimmune and

inflammatory diseases where complement (C5) and/or leukotriene

(LTB4) systems are implicated, today announced financial results

for the second quarter ended June 30, 2019 and recent clinical

progress.

“We are pleased with the progress we have made advancing our BP,

HSCT-TMA and AKC programs and are encouraged by the initial data we

have received to date in these programs,” said Clive Richardson,

Chief Executive Officer of Akari Therapeutics. “Both AKC and BP

have further planned clinical readouts this year, providing a

potential opportunity for advancing both programs into pivotal

trials in 2020 and further supporting the novel therapeutic role of

combined C5 and LTB4 treatment. In addition, we are planning to

start a pivotal clinical trial for HSCT-TMA in the fourth quarter

of this year.”

Second Quarter 2019 and Recent Business

Highlights

- Pediatric HSCT-TMA

- The Company continues to progress towards a pivotal trial for

HSCT-TMA with nomacopan, which is expected to start in the fourth

quarter of 2019. This condition has an estimated 80% mortality rate

in children with this severe disease, with currently no approved

treatments. In a March 2019 meeting, a framework for the trial

design was agreed with the U.S. Food and Drug Administration (FDA).

In August 2019, the FDA granted Fast Track designation for

nomacopan for the treatment of HSCT-TMA in pediatric patients.

- Phase II clinical trial in patients with BP

- Initial results from the first three patients with

mild-to-moderate BP in the ongoing Phase II trial with nomacopan

demonstrated a rapid reduction in BP Disease Area Index (BPDAI)

score and blistering of 52% and 87%, respectively, by day 42. There

were no drug related serious adverse events. The Company

anticipates new safety and efficacy data in mild-to-moderate

patients from this study to be given as an oral presentation at the

the 28th European Academy of Dermatology and Venereology (EADV)

Congress, October 10, 2019.

- In early August, the Company announced new data demonstrating

synergistic benefits of nomacopan’s dual C5 and LTB4 inhibitory

activity in pemphigoid disease, generated by Dr. Christian Sadik’s

group at University of Lubeck, Germany, and published in the August

2019 edition of JCI Insight [link].

- Phase I/II clinical trial in patients with AKC

- Successfully completed Part A of TRACKER, a Phase I/II clinical

trial evaluating the safety and efficacy of topical nomacopan in

patients with moderate-to-severe AKC. Results showed a rapid

response and an overall improvement of 55% in the composite

clinical score, which was composed of an improvement in symptoms of

62% and signs of 52% by Day 56. Three patients were treated with

twice daily nomacopan eye drops in addition to standard of care for

up to 56 days, with one patient completing 14 days and then

withdrawing for reasons unrelated to the study. All patients had

been on maximal topical cyclosporine, the standard of care, for at

least three months prior to entry. The nomacopan eye drops were

found to be comfortable and well tolerated with no serious adverse

events. Enrollment in the Part B placebo-controlled efficacy arm in

16 patients continues to progress, with data read out planned for

the fourth quarter of 2019.

- Clive Richardson has been appointed permanent Chief Executive

Officer of Akari after having served as interim Chief Executive

Officer since May, 2018

Upcoming Events and Milestones

- HSCT-TMA pivotal clinical trial expected to start in the fourth

quarter of 2019.

- Mild-to-moderate BP trial data to be presented at EADV

Congress, October 10, 2019.

- Completion of Part B of AKC Phase I/II trial by the fourth

quarter of 2019.

Second Quarter 2019 Financial Results

- Research and development (R&D) expenses in the second

quarter of 2019 were $3.6 million, as compared to R&D expenses

of $5.1 million in the same quarter the prior year. This decrease

was primarily due to lower manufacturing expenses as the Company

had previously manufactured clinical trial material for supply

through 2019, which was slightly offset by higher clinical trial

costs and personnel expenses. R&D expenses for the six months

ended June 30, 2019 were $1.3 million reflecting the receipt of a

Q1 R&D tax credit of $4.9 million.

- General and administrative (G&A) expenses in the second

quarter of 2019 were $2.4 million, as compared to $2.9 million in

the same quarter last year. This decrease was primarily due to

lower expenses associated with professional services, personnel and

rent, partially offset by higher stock-based non-cash compensation

expenses.

- Total other income for the second quarter of 2019 was $1.9

million, as compared to total other expense of $43,000 in the same

period the prior year. This change was primarily due to $2.0

million of higher income related to the change in the fair value of

the stock option liabilities in 2019 compared to 2018, and to

higher foreign exchange gains of approximately $39,000 in 2019 as

compared to 2018.

- Net loss for the second quarter of 2019 was $4.1 million,

compared to a net loss of $8.0 million for the same period in 2018.

The decrease in net loss in the second quarter of 2019 was due

primarily to the change in the fair value of the stock option

liabilities and foreign exchange gains previously cited,

accompanied by lower operating expenses in the second quarter of

2019.

- As of June 30, 2019, the Company had cash of $2.7 million, as

compared to cash of $5.4 million as of December 31, 2018. On July

3, 2019, the Company sold to certain institutional investors,

accredited investors and an existing shareholder, RPC Pharma Ltd.,

an affiliated entity of Dr. Ray Prudo, Akari’s Chairman, an

aggregate 2,368,392 registered American Depository Shares (ADSs) of

Akari at a purchase price of $1.90 per ADS, resulting in gross

proceeds of approximately $4.5 million. Additionally, for each ADS

purchased by investors, the investors received an unregistered

warrant to purchase one-half ADS. The warrants have an exercise

price of $3.00 per ADS, were exercisable upon their issuance and

will expire five years from the issuance date.

- As of June 30, 2019, the Company has sold to Aspire Capital

Fund, LLC (Aspire Capital) a total of $2.0 million of ordinary

shares. Subsequent to June 30, 2019, the Company sold to Aspire

Capital a further $3.5 million of ordinary shares and approximately

$14.5 million remains available for draw down under the purchase

agreement entered into with Aspire Capital.

About Akari Therapeutics

Akari is a biopharmaceutical company focused on developing

inhibitors of acute and chronic inflammation, specifically for the

treatment of rare and orphan diseases, in particular those where

the complement (C5) or leukotriene (LTB4) systems, or both

complement and leukotrienes together, play a primary role in

disease progression. Akari's lead drug candidate, nomacopan

(formerly known as Coversin), is a C5 complement inhibitor that

also independently and specifically inhibits leukotriene B4 (LTB4)

activity. Nomacopan is currently being clinically evaluated in four

indications: bullous pemphigoid (BP), atopic keratoconjunctivitis

(AKC), thrombotic microangiopathy (TMA), and paroxysmal nocturnal

hemoglobinuria (PNH). Akari believes that the dual action of

nomacopan on both C5 and LTB4 may be beneficial in AKC and BP.

Akari is also developing other tick derived proteins, including

longer acting versions.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements in this press release constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, statements related to the offering, the expected gross

proceeds and the expected closing of the offering. These

forward-looking statements reflect our current views about our

plans, intentions, expectations, strategies and prospects, which

are based on the information currently available to us and on

assumptions we have made. Although we believe that our plans,

intentions, expectations, strategies and prospects as reflected in

or suggested by those forward-looking statements are reasonable, we

can give no assurance that the plans, intentions, expectations or

strategies will be attained or achieved. Furthermore, actual

results may differ materially from those described in the

forward-looking statements and will be affected by a variety of

risks and factors that are beyond our control. Such risks and

uncertainties for our company include, but are not limited to:

needs for additional capital to fund our operations, our ability to

continue as a going concern; uncertainties of cash flows and

inability to meet working capital needs; an inability or delay in

obtaining required regulatory approvals for nomacopan and any other

product candidates, which may result in unexpected cost

expenditures; our ability to obtain orphan drug designation in

additional indications; risks inherent in drug development in

general; uncertainties in obtaining successful clinical results for

nomacopan and any other product candidates and unexpected costs

that may result therefrom; difficulties enrolling patients in our

clinical trials; failure to realize any value of nomacopan and any

other product candidates developed and being developed in light of

inherent risks and difficulties involved in successfully bringing

product candidates to market; inability to develop new product

candidates and support existing product candidates; the approval by

the FDA and EMA and any other similar foreign regulatory

authorities of other competing or superior products brought to

market; risks resulting from unforeseen side effects; risk that the

market for nomacopan may not be as large as expected; risks

associated with the departure of our former Chief Executive

Officers and other executive officers; risks associated with the

SEC investigation; inability to obtain, maintain and enforce

patents and other intellectual property rights or the unexpected

costs associated with such enforcement or litigation; inability to

obtain and maintain commercial manufacturing arrangements with

third party manufacturers or establish commercial scale

manufacturing capabilities; the inability to timely source adequate

supply of our active pharmaceutical ingredients from third party

manufacturers on whom the company depends; unexpected cost

increases and pricing pressures and risks and other risk factors

detailed in our public filings with the U.S. Securities and

Exchange Commission, including our most recently filed Annual

Report on Form 20-F filed with the SEC. Except as otherwise noted,

these forward-looking statements speak only as of the date of this

press release and we undertake no obligation to update or revise

any of these statements to reflect events or circumstances

occurring after this press release. We caution investors not to

place considerable reliance on the forward-looking statements

contained in this press release.

|

|

|

|

|

AKARI THERAPEUTICS, PlcCONDENSED CONSOLIDATED BALANCE SHEETSAs of

June 30, 2019 and December 31, 2018 (in U.S. Dollars, except

share data) |

|

|

|

|

|

June 30, 2019 |

|

|

December 31, 2018 |

|

| |

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

|

|

Assets |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

2,736,663 |

|

|

$ |

5,446,138 |

|

|

Prepaid expenses and other current assets |

|

|

1,747,365 |

|

|

|

1,423,184 |

|

|

Deferred financing costs |

|

|

606,508 |

|

|

|

585,000 |

|

| Total Current Assets |

|

|

5,090,536 |

|

|

|

7,454,322 |

|

| |

|

|

|

|

|

|

|

|

| Restricted cash |

|

|

17,364 |

|

|

|

521,829 |

|

| Property and equipment,

net |

|

|

12,056 |

|

|

|

20,425 |

|

| Patent acquisition costs,

net |

|

|

31,065 |

|

|

|

32,978 |

|

| Total Assets |

|

$ |

5,151,021 |

|

|

$ |

8,029,554 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders' (Deficiency) Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,481,536 |

|

|

$ |

1,586,285 |

|

|

Accrued expenses |

|

|

2,671,393 |

|

|

|

1,489,558 |

|

|

Liabilities related to options |

|

|

2,370,507 |

|

|

|

1,842,424 |

|

| Total Liabilities |

|

|

6,523,436 |

|

|

|

4,918,267 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders' (Deficiency)

Equity: |

|

|

|

|

|

|

|

|

|

Share capital of £0.01 par value |

|

|

|

|

|

|

|

|

|

Authorized: 10,000,000,000 ordinary shares; issued and

outstanding: |

|

|

|

|

|

|

|

|

|

1,650,693,413 and 1,580,693,413 at June 30, 2019 and

December 31, 2018, respectively |

|

|

24,538,137 |

|

|

|

23,651,277 |

|

|

Additional paid-in capital |

|

|

107,960,836 |

|

|

|

106,616,083 |

|

|

Accumulated other comprehensive loss |

|

|

(405,374 |

) |

|

|

(352,426 |

) |

|

Accumulated deficit |

|

|

(133,466,014 |

) |

|

|

(126,803,647 |

) |

| Total Shareholders'

(Deficiency) Equity |

|

|

(1,372,415 |

) |

|

|

3,111,287 |

|

| Total Liabilities and

Shareholders' Equity |

|

$ |

5,151,021 |

|

|

$ |

8,029,554 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

AKARI THERAPEUTICS, PlcCONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE LOSS - UNAUDITEDFor the Three Months Ended June 30,

2019 and June 30, 2018(in U.S. Dollars) |

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, 2019 |

|

|

June 30, 2018 |

|

|

June 30, 2019 |

|

|

June 30, 2018 |

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

$ |

3,593,341 |

|

|

$ |

5,120,840 |

|

|

$ |

1,274,981 |

|

|

$ |

6,129,228 |

|

|

General and administrative expenses |

|

|

2,438,106 |

|

|

|

2,858,065 |

|

|

|

4,744,504 |

|

|

|

6,155,038 |

|

| Total Operating Expenses |

|

|

6,031,447 |

|

|

|

7,978,905 |

|

|

|

6,019,485 |

|

|

|

12,284,266 |

|

| Loss from Operations |

|

|

(6,031,447 |

) |

|

|

(7,978,905 |

) |

|

|

(6,019,485 |

) |

|

|

(12,284,266 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income (Expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

449 |

|

|

|

67,436 |

|

|

|

1,735 |

|

|

|

132,073 |

|

|

Changes in fair value of option liabilities – gain/(loss) |

|

|

1,830,689 |

|

|

|

(152,557 |

) |

|

|

(528,083 |

) |

|

|

2,792,974 |

|

|

Foreign currency exchange gains (losses) |

|

|

86,438 |

|

|

|

47,421 |

|

|

|

(109,198 |

) |

|

|

6,446 |

|

|

Other expenses |

|

|

(3,213 |

) |

|

|

(5,591 |

) |

|

|

(7,336 |

) |

|

|

(7,998 |

) |

| Total Other Income

(Expenses) |

|

|

1,914,363 |

|

|

|

(43,291 |

) |

|

|

(642,882 |

) |

|

|

2,923,495 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

|

(4,117,084 |

) |

|

|

(8,022,196 |

) |

|

|

(6,662,367 |

) |

|

|

(9,360,771 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Comprehensive (Loss) Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Currency Translation Adjustment |

|

|

(160,116 |

) |

|

|

(27,188 |

) |

|

|

(52,948 |

) |

|

|

5,611 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive Loss |

|

$ |

(4,277,200 |

) |

|

$ |

(8,049,384 |

) |

|

$ |

(6,715,315 |

) |

|

$ |

(9,355,160 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per ordinary share (basic

and diluted) |

|

$ |

(0.00 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average ordinary

shares (basic and diluted) |

|

|

1,607,121,984 |

|

|

|

1,525,693,393 |

|

|

|

1,594,063,579 |

|

|

|

1,525,693,393 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For more informationInvestor Contact:

Peter VozzoWestwicke Partners(443)

213-0505peter.vozzo@westwicke.com

Media Contact:

Sukaina Virji / Nicholas Brown / Lizzie SeeleyConsilium

Strategic Communications+44 (0)20 3709

5700Akari@consilium-comms.com

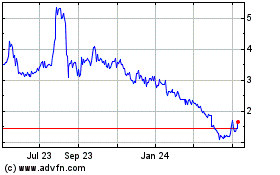

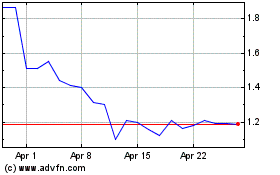

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024