Current Report Filing (8-k)

June 11 2019 - 9:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 10, 2019

AEROVIRONMENT, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-33261

|

|

95-2705790

|

|

(State or other jurisdiction of

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

|

|

|

900 Innovators Way

|

|

|

|

Simi Valley, California

|

|

93065

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(805) 581-2187

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

Common Stock, $0.0001 par value

|

|

AVAV

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 7.01 Regulation FD Disclosure.

On June 11, 2019, AeroVironment, Inc. (the “Company”) issued a press release announcing its acquisition of all of the issued and outstanding equity of Pulse Aerospace, LLC, a Delaware limited liability company (“Pulse Aerospace”) which transaction is described further under Item 8.01 below. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. Such information shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events

On June 10, 2019, the Company purchased 100% of the issued and outstanding units of Pulse Aerospace pursuant to the terms of a Unit Purchase Agreement (the “Purchase Agreement”) of the same date by and among the Company, each of the unit holders of Pulse Aerospace (collectively, the “Sellers”), and Shareholder Representative Services LLC, a Colorado limited liability company, as the representative of the Sellers. Pulse Aerospace develops, manufactures, markets and sells rotor-based unmanned aerial vehicles capable of vertical take-off and landing. Upon closing of the transactions contemplated by the Purchase Agreement, Pulse Aerospace became a wholly owned subsidiary of the Company.

Pursuant to the Purchase Agreement, at closing, the Company paid $20,650,000 in cash, less a $250,000 retention to cover any post-closing indemnification claims, and less a $1,250,000 holdback amount for breaches related to the sellers’ fundamental representations that exceed or are not covered by the obtained representation and warranty insurance policy or breaches of certain special indemnities under the Purchase Agreement, which such retention and holdback are to be released to Sellers, less any amounts paid or reserved, 18 months after the closing of the transactions contemplated by the Purchase Agreement in accordance with the terms of the Purchase Agreement. The closing cash consideration included the payoff of the outstanding indebtedness of Pulse Aerospace as of the closing date. In addition to the consideration paid at closing, the Sellers may receive up to a maximum of $5,000,000 in additional cash consideration, which amount has been placed into escrow, if specific research and development milestones are achieved by December 10, 2021. The purchase price paid by the Company is subject to certain pre- and post-closing adjustments as set forth in the Purchase Agreement.

The parties to the Purchase Agreement have made representations, warranties and covenants that are customary for a transaction of this type, including, among others, restrictions on the Sellers from engaging in certain competitive activities, as well as mutual indemnification obligations between the parties. To supplement certain indemnifications provided by the Sellers, the Company obtained a standard representation and warranty insurance policy.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

AEROVIRONMENT, INC.

|

|

|

|

|

|

|

|

Date: June 11, 2019

|

By:

|

/s/ Wahid Nawabi

|

|

|

|

Wahid Nawabi

|

|

|

|

President and Chief Executive Officer

|

3

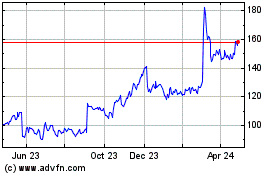

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Apr 2023 to Apr 2024