United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

______________________________________

|

|

|

|

|

|

|

|

|

|

|

|

Filed by the Registrant

|

|

x

|

|

Filed by a Party other than the Registrant

|

|

¨

|

|

Check the appropriate box:

|

|

|

|

|

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

x

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

|

Advanced Emissions Solutions, Inc.

(Name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Check the appropriate box:

|

|

|

|

|

|

x

|

No fee required

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

1) Title of each class of securities to which transaction applies:

|

|

|

2) Aggregate number of securities to which transaction applies:

|

|

|

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4) Proposed maximum aggregate value of transaction:

|

|

|

5) Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

1) Amount Previously Paid:

|

|

|

2) Form, Schedule or Registration Statement No.:

|

|

|

3) Filing Party:

|

|

|

4) Date Filed:

|

ADVANCED EMISSIONS SOLUTIONS, INC.

640 Plaza Drive, Suite 270

Highlands Ranch, Colorado

80129

Telephone: (888) 822-8617

AMENDED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

The Annual Meeting of Stockholders of Advanced Emissions Solutions, Inc. ("ADES" or the "Company"), a Delaware corporation, will be held at 9:00 a.m. (local time) on

June 18, 2019

at

the Denver Marriott Tech Center

located at

4900 S. Syracuse Street, Denver, Colorado 80237

, or at any postponement or adjournment thereof, for the following:

|

|

|

|

1.

|

To elect seven directors of the Company;

|

|

|

|

|

2.

|

To approve, in an advisory vote, our executive compensation;

|

|

|

|

|

3.

|

To ratify the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019;

|

|

|

|

|

4.

|

To approve the Second Amendment of the Company's Tax Asset Protection Plan;

|

|

|

|

|

5.

|

To conduct an advisory (non-binding) vote regarding the frequency of future votes regarding the compensation of our Named Executive Officers ("Say-On-Frequency"); and

|

|

|

|

|

6.

|

To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

|

Stockholders of record at the close of business on

April 22, 2019

are entitled to notice of and to vote at the Annual Meeting.

Our stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares by telephone or Internet, or by completing, signing and dating the available proxy card and returning it promptly to the Company.

Please call on our toll-free number (888-822-8617) if you require directions or have other questions concerning the meeting.

By Order of the Board of Directors,

Greg P. Marken

Chief Financial Officer, Treasurer and Secretary

April 29, 2019

The Proxy Statement made available to shareholders on or about April 29, 2019 provides information about the matters you will be asked to consider and vote on at the Meeting, except that additional information with respect to Proposal 5 listed above is set forth in the accompanying Supplement to Proxy Statement.

Important Notice

Regarding Internet Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on

June 18, 2019

The Company’s Proxy Statement and Annual Report to Stockholders are Available at:

www.proxyvote.com

SUPPLEMENT TO PROXY STATEMENT

This Supplement to Proxy Statement (the "Supplement") supplements and amends the original definitive proxy statement of Advanced Emissions Solutions, Inc., a Delaware corporation, ("ADES" or the "Company"), dated

April 29, 2019

(the "Proxy Statement") for the Company’s 2019 Annual Meeting of Stockholders (the "Annual Meeting") to, (i) add a new Proposal 5 to the Proxy Statement that provides for a non-binding, advisory vote of Company stockholders on the frequency with which the Company’s stockholders shall have the advisory say-on-pay vote on compensation paid to our named executive officers ("Proposal 5") and (ii) amend the Notice of the Annual Meeting to add the new Proposal 5 (the "Amended Notice"). This Supplement, along with the Amended Notice accompanying this Supplement, contains additional information about the Annual Meeting, including any adjournments or postponements thereof. The form of proxy card included with the originally filed definitive proxy statement is amended in its entirety to include all five proposals. The revised proxy card accompanies this mailing. The Annual Meeting is to be held at 9:00 AM on Tuesday,

June 18, 2019

, at

the Denver Marriott Tech Center

located at

4900 S. Syracuse Street, Denver, Colorado 80237

, and any postponements or adjournments thereof. Throughout this Supplement, the terms "we," "us" "our" and "our Company" refer to Advanced Emissions Solutions, Inc. and, unless the context indicates otherwise, our consolidated subsidiaries.

On

April 29, 2019

, we filed the Proxy Statement relating to the Annual Meeting with the Securities and Exchange Commission (the "SEC") and made available to our stockholders on the Internet. Subsequent to that date, we determined that we had inadvertently omitted the required proposal to stockholders regarding how often (the "Say-On-Frequency Proposal") we will hold future advisory (non-binding) votes regarding the compensation of the Company’s named executive officers (each a "Say-On-Pay Vote"). This Supplement has been prepared to provide our stockholders with information regarding the Say-On-Frequency Proposal and whether future Say-On-Pay Votes should occur every one year, every two years, or every three years.

This Supplement is being furnished to our stockholders of record as of the close of business on

April 22, 2019

, the record date for the determination of stockholders entitled to notice of and to vote at the Meeting or at any adjournments thereof, pursuant to the accompanying Amended Notice. This Supplement and the Amended Notice supplement and amend the Notice of 2019 Annual Meeting of Stockholders and the Proxy Statement, each dated

April 29, 2019

, previously made available to our stockholders. This Supplement relates to the new Proposal 5 to be considered by stockholders at the Annual Meeting and does not provide all of the information that is important to your decisions with respect to voting on all of the proposals that are being presented to stockholders for their vote at the Annual Meeting. Additional information is contained in the Proxy Statement, which is included in this mailing. We encourage you to carefully read this Supplement together with the Proxy Statement.

Except for the addition of Proposal 5, this Supplement does not modify, amend, supplement or otherwise affect any matter presented for consideration in the Proxy Statement.

VOTING RIGHTS AND VOTE REQUIRED

Our Board has fixed the close of business on

April 22, 2019

as the record date (the "Record Date") for determination of stockholders entitled to notice of and to vote at the meeting. On the Record Date,

18,674,147

shares of our common stock ("Common Stock") were issued and outstanding, each of which entitles the holder thereof to one vote on all matters that may come before the Annual Meeting. We do not have any class of voting securities outstanding other than our Common Stock. An abstention or withholding authority to vote will be counted as present for determining whether the quorum requirement is satisfied. If a quorum exists, actions or matters other than the election of the Board are approved if the votes cast in favor of the action exceed the votes cast opposing the action unless a greater number is required by the Delaware General Corporation Law (the "DGCL") or our Second Amended and Restated Certificate of Incorporation. The seven nominees receiving the highest number of votes cast will be elected as directors. Abstentions will not affect the election of directors.

If, as of the Record Date your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then that firm or organization is the stockholder of record for purposes of voting at the Annual Meeting and you are considered the beneficial owner of shares held in "street name." If you are a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares held in your account. If you do not instruct your broker on how to vote your shares, your brokerage firm, in its discretion, may vote your shares on routine matters or they may elect not to vote your shares. The proposal to ratify the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2019 is considered a "routine matter," but the other proposals being voted on at the Annual Meeting are not considered "routine matters" and brokers will not be entitled to vote on those proposals absent specific instructions and authorization from the beneficial owners of the shares. If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute "broker non-votes." A broker non-vote occurs when a nominee holding shares for a beneficial holder does not have discretionary voting power and does not receive voting instructions from the beneficial owner. Broker non-votes on a particular proposal are considered present for purposes of determining a quorum,

but will not be treated as shares present and entitled to vote on any proposal other than the ratification of our public accounting firm and accordingly will have no effect on such vote.

We invite beneficial owners to attend the Annual Meeting. If you are a beneficial owner and not a stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent and bring such proxy to the Annual Meeting. If you want to attend the Annual Meeting, but not vote, you must provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to

April 22, 2019

, a copy of the voting instruction card provided by your broker or other agent or other similar evidence of ownership.

A minimum of one-third of the shares of our Common Stock issued and outstanding must be represented at the meeting in person or by proxy in order to constitute a quorum. Cumulative voting is not allowed for any purpose.

Unless instructions to the contrary are marked, or if no instructions are specified, shares represented by proxies will be voted:

FOR ALL the persons nominated by the Board for Directors, being: Carol Eicher, Brian Leen, Gilbert Li, R. Carter Pate, L. Heath Sampson, J. Taylor Simonton, and L. Spencer Wells;

FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion as set forth under the Executive Compensation section of this Proxy Statement;

FOR the ratification of the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019;

FOR the approval of the Second Amendment of the Company's Tax Asset Protection Plan; and

FOR a frequency of every year for future non-binding, advisory shareholder votes on the compensation paid to our named executive officers.

We do not know of any other matter or motion to be presented at the Annual Meeting. If any other matter or motion should be presented at the Annual Meeting upon which a vote must be properly taken, to the extent permitted by law, the persons named in the accompanying form of proxy intend to vote such proxy in the discretion of such person as the directors of the Company may recommend, including any matter or motion dealing with the conduct of the Annual Meeting.

Voting by Mail, Facsimile, via the Internet or by Telephone

Stockholders whose shares are registered in their own names may vote by mailing or faxing a completed proxy card, via the internet or by telephone. Instructions for voting via the internet or by telephone are set forth on the enclosed proxy card. To vote by mailing or faxing a proxy card, sign and return the available proxy card to the Company and your shares will be voted at the Annual Meeting in the manner you direct. If no directions are specified, your shares will be voted as described above.

If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares over the internet or by telephone rather than by mailing a completed voting instructions card provided by the bank or brokerage firm. Please check the voting instructions card provided by your bank or brokerage house for availability and instructions. If internet or telephone voting is unavailable from your bank or brokerage house, please complete and return the voting instructions card provided by the bank or brokerage firm.

Any stockholder who completes a proxy or votes via the internet or by telephone may revoke the action at any time before it is exercised at the Annual Meeting by delivering written notice of such revocation to the Company's Secretary (Greg P. Marken),

640 Plaza Drive, Suite 270

,

Highlands Ranch, Colorado

,

80129

, by submitting a new proxy executed at a later date, or by attending the Annual Meeting and voting in person.

PROPOSAL FIVE

ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

In addition to providing stockholders an advisory vote on the compensation of our named executive officers (as we are doing with Proposal 2), the SEC rules require us to conduct every six years a non-binding advisory vote on the frequency upon which the Company will conduct such an advisory vote on executive compensation. Under this proposal, stockholders may vote, on an advisory basis, to have the Say-On-Pay Vote every year, every other year or every three years or may abstain. For the last six years, we have held an advisory vote on executive compensation every year for which a proxy was filed and our Board of Directors continues to believe it to be in the best interests of the Company and its stockholders to annually submit to the stockholders an advisory vote to approve the Company’s compensation paid to named executive officers.

Board Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS THAT AN ADVISORY VOTE ON EXECUTIVE COMPENSATION BE HELD EVERY YEAR.

Advanced Emissions Solut... (NASDAQ:ADES)

Historical Stock Chart

From Mar 2024 to Apr 2024

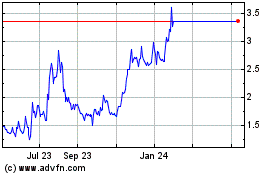

Advanced Emissions Solut... (NASDAQ:ADES)

Historical Stock Chart

From Apr 2023 to Apr 2024