Advanced Emissions Solutions, Inc. (NASDAQ: ADES) (the "Company" or

"ADES") today filed its Quarterly Report on Form 10-Q and reported

financial results for the second quarter ended June 30, 2019,

including information about its equity investments in Tinuum Group,

LLC ("Tinuum Group") and Tinuum Services, LLC ("Tinuum Services")

(collectively "Tinuum"), of which ADES owns 42.5% and 50%,

respectively.

Second Quarter Segment

Highlights

Tinuum & Refined Coal (“RC”)

Highlights

- Tinuum distributions to ADES were $18.6 million during the

second quarter of 2019, a year-over-year increase of 26%

- ADES earnings from Tinuum were $20.9 million, significantly

higher than the prior year, which was impacted by the adopted

change in lease and revenue accounting standards by Tinuum

effective January 1, 2019

- Royalty earnings from Tinuum were $4.2 million, a

year-over-year increase of 19%

- RC Segment operating income was $24.6 million, a year-over-year

increase of 35%

- RC invested facilities increased to 21 as of June 30,

2019; new facility is royalty bearing to ADES

- Based on the 21 invested RC facilities as of June 30, 2019

and cash distributions received during the three months ended

June 30, 2019, expected future net RC cash flows to ADES are

projected to be between $175 million and $200 million through year

end 2021.

Power Generation and Industrials ("PGI")

Highlights

- Recognized segment revenue of $11.0 million, compared to $0.8

million during the second quarter of 2018, driven by

consumables

- Segment operating loss was $3.9 million compared to an

operating loss of $1.4 million in the second quarter of 2018

- Segment EBITDA loss was $3.1 million, inclusive of a $1.3

million adjustment to cost of sales due to the step-up in basis of

inventory acquired related to purchase accounting, compared to a

segment loss of $1.3 million in the second quarter of 2018

ADES Consolidated

Highlights

- Recognized consolidated revenues of $15.6 million compared to

$4.3 million in the second quarter of 2018

- Consolidated net income was $8.1 million, a decrease of 47%

from the prior year

- Fully diluted earnings per share in the second quarter was

$0.44, a 41% decrease year-over-year

- Consolidated EBITDA was $17.4 million, an increase of $3.0

million over prior year

- Made quarterly principal payments of $10.0 million on the

Company's $70.0 million initial face value term loan, which

accounted for $1.6 million in interest expense during the second

quarter, and reduced the term loan principal balance to $54.0

million

- Ended the second quarter 2019 with a total cash balance of

$20.4 million, a decrease of $3.4 million from December 31,

2018

- Paid quarterly dividend of $0.25 per share and utilized capital

to repurchase 184,715 shares for $2.1 million

L. Heath Sampson, President and CEO of ADES commented, “During

the second quarter Tinuum was able to obtain a tax-equity investor

for an additional refined coal facility, bringing the number of

operating units to 21. The timing of the incremental tonnage that

has come online thus far in 2019 has met our expectations, and we

maintain line of sight into the remaining 5 to 6 million tons to

meet our previously provided outlook.”

Sampson continued, “In our PGI segment, the

integration and customer retention rates are on track to meet our

expectations as we combine our suite of pollution control products.

We did experience some industry softness during the second quarter,

as regular seasonality effects were exacerbated by abnormally mild

weather and cheap natural gas. As a result, pressure on coal

dispatch affected both our RC and PGI segments. Despite these

factors, I am encouraged by our strong execution and the ongoing

feedback from key customers. In fact, during the second quarter we

reacquired a large industrial customer that was previously lost

prior to the acquisition of Carbon Solutions. Positive developments

like this have begun to drive incremental volumes and will continue

to do so into 2020. In addition, customer retention rates remain

high, and we are proving our competitive position in this market as

the solutions provider of choice for mercury control.”

Second Quarter and First Half 2019

Results

Second quarter revenue and cost of revenue were

$15.6 million and $12.3 million, respectively, compared with $4.3

million and $0.7 million in the second quarter of 2018. Revenue and

cost of revenue during the first six months of the year totaled

$34.9 million and $26.4 million, respectively, compared to $8.2

million and $1.3 million during the first half of 2018. The

increase in revenues during the second quarter and first half of

2019 was almost entirely driven by the increase in consumables

sales resulting from the contribution of the Company's PGI segment

which contains the majority of the newly acquired activated carbon

assets. Costs of revenue and margins were negatively impacted by

low coal-fired power dispatch driven by mild weather conditions as

well as power generation from sources other than coal and by the

planned turnaround at the Company's carbon production facility. Our

experience is consistent with the most recent U.S. Energy

Information Administration Outlook for 2019 in which its forecast

decreased 7% since its December 2018 estimate. Also negatively

impacting cost of revenue and margins during the three and six

months ended June 30, 2019 was a $1.4 million and $5.0 million

adjustment, respectively, to cost of revenue due to the step-up in

basis of inventory acquired related to purchase accounting.

Revenue was also positively impacted by royalty

earnings from Tinuum of $4.2 million, an increase of 19% compared

to $3.5 million in the second quarter of 2018, driven by the

increased number of RC facilities and earnings from the respective

RC facilities. Royalty earnings in the first half of 2019 totaled

$8.4 million compared to $6.8 million in the comparable period in

2018.

Second quarter other operating expenses were

$7.5 million compared to $5.1 million in the second quarter of

2018. First half other operating expenses totaled $16.3 million

compared to $10.2 million in the first half of 2018. The increase

during the second quarter and first half of 2019 were driven by

higher legal and professional, general and administrative costs

incurred, as well as depreciation, amortization, depletion and

accretion expenses, resulting in $2.4 million and $5.8 million of

the increase, respectively, related to the Carbon Solutions

acquisition.

Second quarter earnings from equity method investments were

$20.9 million, compared to $15.9 million for the second quarter of

2018. First half earnings from equity method investments were $42.6

million compared to $28.1 million during the first six months of

2018. The significant increases were driven by additional operating

RC facilities year over year as well as the impact of the adoption

of new lease and revenue accounting standards by Tinuum. The change

leads to the point-in-time revenue recognition of certain RC

contracts by Tinuum Group and may affect the timing of revenue

recognition related to future closures of RC facilities. However,

this change does not impact the timing or total expected future

cash flows from Tinuum but may impact the timing of equity earnings

related to future RC deals. Excluding the impacts of this adoption,

Tinuum equity earnings would have totaled $18.7 million in the

second quarter of 2019, an increase of over 18% year-over-year.

Second quarter interest expense was $2.0

million, compared to $0.4 million in the second quarter of 2018.

First half interest expense was $4.1 million compared to $0.7

million during the first half of 2018. The increase was driven by

the interest expense related to the term loan used to fund the

Carbon Solutions acquisition.

Second quarter income tax expense was $6.6

million, compared to a benefit of $1.3 million in the second

quarter of 2018. Income tax expense for the first six months of

2019 was $8.3 million compared to $1.2 million during the first

half of 2018, primarily driven by an increase in the valuation

allowance against the Company's deferred tax assets during the

current year periods compared to a reduction in the valuation

allowance during the 2018 periods.

Pre-tax income for the second quarter was $14.7

million, compared to pre-tax income of $13.9 million for the second

quarter of 2018. Net income for the second quarter was $8.1

million, compared to net income of $15.3 million for the second

quarter of 2018. Net income during the first six months totaled

$22.5 million, a 2% decrease from $23.0 million during the first

six months of 2018. The decrease in the second quarter net income

was driven by the increase in the valuation allowance against the

Company's deferred tax assets. The decrease in net income for the

first six months of 2019 was primarily driven by higher interest

expense, non-cost of revenue expenses and income tax expense, which

were largely offset by higher consumables revenue resulting from

the contribution of the PGI segment, higher earnings from Tinuum

resulting from additional operating RC facilities and the

accounting change, as well as higher royalty income from the RC

business.

PGI segment EBITDA (segment operating loss

adjusted for depreciation, amortization, depletion and accretion

and interest expense) for the second quarter was a loss of $3.1

million, inclusive of a $1.3 million adjustment to cost of sales

due to the step-up in basis of inventory acquired related to

purchase accounting, compared to a segment loss of $1.3 million in

the second quarter of 2018, mostly driven by an increase in segment

operating loss of $2.5 million, which was partially offset by

additional depreciation, amortization, depletion and accretion

expense of $0.6 million related to assets acquired from the Carbon

Solutions acquisition. During the second quarter we also incurred

expenses related to the planned mandatory turnaround at our

activated carbon plant.

Consolidated EBITDA (earnings before interest

expense, income tax expense and depreciation, amortization,

depletion and accretion and interest expense) for the second

quarter was $17.4 million, an increase of $3.0 million over the

second quarter of 2018, driven by increased earnings as well as

higher expense related to interest and depreciation, amortization,

depletion and accretion and income tax expense.

Segment EBITDA and Consolidated EBITDA are

non-GAAP measures of certain financial performance. See below for

reconciliation of such measures to their most directly comparable

GAAP financial measure.

As of June 30, 2019, the Company had cash

and cash equivalents and restricted cash of $20.4 million, a

decrease of $3.4 million compared to $23.8 million as of

December 31, 2018. This decrease is the result of dividends

paid, principal repayments on the term loan, as well as share

repurchase activity during the quarter.

Long-Term Borrowings

In November 2018 the Company entered into a $70.0 million,

three-year senior term loan to finance the Carbon Solutions

acquisition. The senior term loan is subject to customary covenants

as well as quarterly principal payments of $6.0 million that began

on March 1, 2019. As of June 30, 2019, the outstanding balance

of the senior term loan, net of debt issuance costs and debt

discount, was $50.8 million.

Dividend

Today, the Board of Directors declared a

quarterly cash dividend of $0.25 per share of common stock. The

dividend is payable on September 6, 2019 to stockholders of

record at the close of business on August 19, 2019.

Conference Call and Webcast

Information

The Company has scheduled a conference call to

begin at 9:00 a.m. Eastern Time on Tuesday, August 6, 2019.

The conference call will be webcast live via the Investor section

of ADES's website at www.advancedemissionssolutions.com. Interested

parties may also participate in the call by dialing (833) 227-5845

(Domestic) or (647) 689-4072 (International) conference ID 2399184.

A supplemental investor presentation will be available on the

Company's investor relations website prior to the start of the

conference call.

About Advanced Emissions Solutions,

Inc.Advanced Emissions Solutions, Inc. serves as the

holding entity for a family of companies that provide emissions

solutions to customers in the power generation and other

industries.

| ADA

brings together ADA Carbon Solutions, LLC, a leading provider of

powder activated carbon ("PAC") and ADA-ES, Inc., the providers of

ADA® M-Prove™ Technology. We provide products and services to

control mercury and other contaminants at coal-fired power

generators and other industrial companies. Our broad suite of

complementary products control contaminants and help our customers

meet their compliance objectives consistently and reliably. |

| |

| CarbPure

Technologies LLC, (“CarbPure”), formed in 2015 provides

high-quality PAC and granular activated carbon

ideally suited for treatment of potable water and wastewater. Our

affiliate company, ADA Carbon Solutions, LLC manufactures the

products for CarbPure. |

| |

| Tinuum

Group, LLC (“Tinuum Group”) is a 42.5% owned joint venture by ADA

that provides patented Refined Coal (“RC”) technologies to enhance

combustion of and reduce emissions of NOx and mercury from

coal-fired power plants. |

Caution on Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, which provides a “safe harbor” for such

statements in certain circumstances. The forward-looking statements

include projection on future RC cash flows, anticipated tonnage

sales and expectations about potential transactions with tax-equity

investors as well as expectation of growth opportunities in the PGI

segment. These forward-looking statements involve risks and

uncertainties. Actual events or results could differ materially

from those discussed in the forward-looking statements as a result

of various factors including, but not limited to, timing of new and

pending regulations and any legal challenges to or extensions of

compliance dates of them; the US government’s failure to promulgate

regulations that benefit our business; changes in laws and

regulations, IRS interpretations or guidance, accounting rules, any

pending court decisions, prices, economic conditions and market

demand; impact of competition; availability, cost of and demand for

alternative energy sources and other technologies; technical, start

up and operational difficulties; failure of the RC facilities to

produce RC; inability to sell or lease additional RC facilities;

termination of or amendments to the contracts for sale or lease of

RC facilities; customer demand for mercury removal products;

competition within the industries in which we operate; availability

or opportunities to scale and further grow our PGI business;

decreases in the production of RC; loss of key personnel; as well

as other factors relating to our business, as described in our

filings with the SEC, with particular emphasis on the risk factor

disclosures contained in those filings. You are cautioned not to

place undue reliance on the forward-looking statements and to

consult filings we have made and will make with the SEC for

additional discussion concerning risks and uncertainties that may

apply to our business and the ownership of our securities. The

forward-looking statements speak only as to the date of this press

release.

Source: Advanced Emissions Solutions, Inc.

Investor Contact:

Alpha IR GroupChris Hodges or Ryan

Coleman312-445-2870ADES@alpha-ir.com

TABLE 1

Advanced Emissions Solutions, Inc. and

SubsidiariesCondensed Consolidated Balance

Sheets(Unaudited)

| |

|

As of |

| (in thousands, except share

data) |

|

June 30, 2019 |

|

December 31, 2018 |

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash, cash equivalents and restricted cash |

|

$ |

15,420 |

|

|

$ |

18,577 |

|

|

Receivables, net |

|

5,606 |

|

|

9,554 |

|

|

Receivables, related parties |

|

4,189 |

|

|

4,284 |

|

|

Inventories, net |

|

17,798 |

|

|

21,791 |

|

|

Prepaid expenses and other assets |

|

5,598 |

|

|

5,570 |

|

|

Total current assets |

|

48,611 |

|

|

59,776 |

|

| Restricted cash,

long-term |

|

5,000 |

|

|

5,195 |

|

| Property, plant and equipment,

net of accumulated depreciation of $4,179 and $1,499,

respectively |

|

44,825 |

|

|

42,697 |

|

| Intangible assets, net |

|

4,501 |

|

|

4,830 |

|

| Equity method investments |

|

48,403 |

|

|

6,634 |

|

| Deferred tax assets, net |

|

19,179 |

|

|

32,539 |

|

| Other long-term assets,

net |

|

16,553 |

|

|

7,993 |

|

|

Total Assets |

|

$ |

187,072 |

|

|

$ |

159,664 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

6,631 |

|

|

$ |

6,235 |

|

|

Accrued payroll and related liabilities |

|

3,450 |

|

|

8,279 |

|

|

Current portion of long-term debt |

|

24,025 |

|

|

24,067 |

|

|

Other current liabilities |

|

5,552 |

|

|

2,138 |

|

|

Total current liabilities |

|

39,658 |

|

|

40,719 |

|

| Long-term debt |

|

34,204 |

|

|

50,058 |

|

| Other long-term

liabilities |

|

5,449 |

|

|

940 |

|

|

Total Liabilities |

|

79,311 |

|

|

91,717 |

|

| Commitments and

contingencies |

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

Preferred stock: par value of $.001 per share, 50,000,000 shares

authorized, none outstanding |

|

— |

|

|

— |

|

|

Common stock: par value of $.001 per share, 100,000,000 shares

authorized, 22,867,405 and 22,640,677 shares issued, and 18,554,626

and 18,576,489 shares outstanding at June 30, 2019 and December 31,

2018, respectively |

|

23 |

|

|

23 |

|

|

Treasury stock, at cost: 4,312,779 and 4,064,188 shares as of June

30, 2019 and December 31, 2018, respectively |

|

(44,571 |

) |

|

(41,740 |

) |

|

Additional paid-in capital |

|

97,354 |

|

|

96,750 |

|

|

Retained earnings |

|

54,955 |

|

|

12,914 |

|

|

Total stockholders’ equity |

|

107,761 |

|

|

67,947 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

187,072 |

|

|

$ |

159,664 |

|

TABLE 2

Advanced Emissions Solutions, Inc. and

SubsidiariesCondensed Consolidated Statements of

Operations(Unaudited)

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| (in

thousands, except per share data) |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| Revenues: |

|

|

|

|

|

|

|

|

|

Consumables |

|

$ |

11,386 |

|

|

$ |

726 |

|

|

$ |

26,495 |

|

|

$ |

1,347 |

|

|

License royalties, related party |

|

4,191 |

|

|

3,523 |

|

|

8,411 |

|

|

6,753 |

|

|

Other |

|

— |

|

|

24 |

|

|

— |

|

|

72 |

|

| Total revenues |

|

15,577 |

|

|

4,273 |

|

|

34,906 |

|

|

8,172 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Consumables cost of revenue, exclusive of depreciation and

amortization |

|

12,286 |

|

|

902 |

|

|

26,394 |

|

|

1,613 |

|

|

Other sales cost of revenue, exclusive of depreciation and

amortization |

|

6 |

|

|

(198 |

) |

|

6 |

|

|

(346 |

) |

|

Payroll and benefits |

|

2,798 |

|

|

2,759 |

|

|

5,354 |

|

|

4,973 |

|

|

Legal and professional fees |

|

1,569 |

|

|

1,213 |

|

|

3,545 |

|

|

2,761 |

|

|

General and administrative |

|

2,421 |

|

|

1,094 |

|

|

4,563 |

|

|

2,264 |

|

|

Depreciation, amortization, depletion and accretion |

|

757 |

|

|

72 |

|

|

2,859 |

|

|

188 |

|

| Total operating expenses |

|

19,837 |

|

|

5,842 |

|

|

42,721 |

|

|

11,453 |

|

| Operating loss |

|

(4,260 |

) |

|

(1,569 |

) |

|

(7,815 |

) |

|

(3,281 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

Earnings from equity method investments |

|

20,935 |

|

|

15,889 |

|

|

42,625 |

|

|

28,142 |

|

|

Interest expense |

|

(1,987 |

) |

|

(412 |

) |

|

(4,091 |

) |

|

(748 |

) |

|

Other |

|

60 |

|

|

34 |

|

|

130 |

|

|

60 |

|

| Total other income |

|

19,008 |

|

|

15,511 |

|

|

38,664 |

|

|

27,454 |

|

| Income before income tax

expense |

|

14,748 |

|

|

13,942 |

|

|

30,849 |

|

|

24,173 |

|

| Income tax expense

(benefit) |

|

6,634 |

|

|

(1,349 |

) |

|

8,333 |

|

|

1,220 |

|

| Net income |

|

$ |

8,114 |

|

|

$ |

15,291 |

|

|

$ |

22,516 |

|

|

$ |

22,953 |

|

| Earnings per common

share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.45 |

|

|

$ |

0.76 |

|

|

$ |

1.23 |

|

|

$ |

1.13 |

|

|

Diluted |

|

$ |

0.44 |

|

|

$ |

0.75 |

|

|

$ |

1.22 |

|

|

$ |

1.12 |

|

| Weighted-average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

18,172 |

|

|

20,062 |

|

|

18,219 |

|

|

20,275 |

|

|

Diluted |

|

18,377 |

|

|

20,195 |

|

|

18,412 |

|

|

20,386 |

|

TABLE 3

Advanced Emissions Solutions, Inc. and

SubsidiariesCondensed Consolidated Statements of

Cash Flows(Unaudited)

| |

|

Six Months Ended June 30, |

| (in

thousands) |

|

2019 |

|

2018 |

| Cash flows from operating

activities |

|

|

|

|

|

Net income |

|

$ |

22,516 |

|

|

$ |

22,953 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

Increase (decrease) in valuation allowance on deferred tax

assets |

|

849 |

|

|

(498 |

) |

|

Depreciation, amortization, depletion and accretion |

|

2,859 |

|

|

188 |

|

|

Amortization of debt discount and debt issuance costs |

|

851 |

|

|

— |

|

|

Stock-based compensation expense |

|

858 |

|

|

1,010 |

|

|

Earnings from equity method investments |

|

(42,625 |

) |

|

(28,142 |

) |

|

Other non-cash items, net |

|

474 |

|

|

192 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Receivables and related party receivables |

|

4,044 |

|

|

(64 |

) |

|

Prepaid expenses and other assets |

|

47 |

|

|

(375 |

) |

|

Costs incurred on uncompleted contracts |

|

— |

|

|

15,945 |

|

|

Inventories |

|

3,794 |

|

|

— |

|

|

Deferred tax assets, net |

|

4,097 |

|

|

(246 |

) |

|

Other long-term assets |

|

1,470 |

|

|

— |

|

|

Accounts payable |

|

(758 |

) |

|

323 |

|

|

Accrued payroll and related liabilities |

|

(4,829 |

) |

|

152 |

|

|

Other current liabilities |

|

862 |

|

|

(1,505 |

) |

|

Billings on uncompleted contracts |

|

— |

|

|

(15,945 |

) |

|

Operating lease liabilities |

|

(1,563 |

) |

|

— |

|

|

Other long-term liabilities |

|

(462 |

) |

|

(135 |

) |

|

Distributions from equity method investees, return on

investment |

|

38,088 |

|

|

2,700 |

|

|

Net cash provided by (used in) operating activities |

|

30,572 |

|

|

(3,447 |

) |

| Cash flows from investing

activities |

|

|

|

|

|

Distributions from equity method investees in excess of cumulative

earnings |

|

— |

|

|

25,500 |

|

|

Acquisition of business |

|

(661 |

) |

|

— |

|

|

Acquisition of property, plant, equipment, and intangible

assets |

|

(3,797 |

) |

|

(131 |

) |

|

Mine development costs |

|

(521 |

) |

|

— |

|

|

Contributions to equity method investees |

|

— |

|

|

(750 |

) |

|

Net cash (used in) provided by investing activities |

|

(4,979 |

) |

|

24,619 |

|

| Cash flows from financing

activities |

|

|

|

|

|

Principal payments on term loan |

|

(16,000 |

) |

|

— |

|

|

Principal payments on finance lease obligations |

|

(681 |

) |

|

— |

|

|

Dividends paid |

|

(9,179 |

) |

|

(10,216 |

) |

|

Repurchase of common shares |

|

(2,831 |

) |

|

(9,111 |

) |

|

Repurchase of common shares to satisfy tax withholdings |

|

(254 |

) |

|

(359 |

) |

|

Net cash used in financing activities |

|

(28,945 |

) |

|

(19,686 |

) |

|

(Decrease) increase in Cash and Cash Equivalents and Restricted

Cash |

|

(3,352 |

) |

|

1,486 |

|

| Cash and Cash Equivalents and

Restricted Cash, beginning of period |

|

23,772 |

|

|

30,693 |

|

| Cash and Cash Equivalents and

Restricted Cash, end of period |

|

$ |

20,420 |

|

|

$ |

32,179 |

|

| Supplemental disclosure of

non-cash investing and financing activities: |

|

|

|

|

|

Acquisition of property, plant and equipment through accounts

payable |

|

$ |

1,561 |

|

|

$ |

— |

|

|

Dividends declared, not paid |

|

$ |

113 |

|

|

$ |

63 |

|

Note on Non-GAAP Financial Measures

To supplement the Company's financial information presented in

accordance with U.S. generally accepted accounting principles, or

GAAP, the Press Release includes non-GAAP measures of certain

financial performance. These non-GAAP measures include Consolidated

EBITDA and Segment EBITDA. The Company included non-GAAP measures

because management believes that they help to facilitate comparison

of operating results between periods. The Company believes the

non-GAAP measures provide useful information to both management and

users of the financial statements by excluding certain expenses

that may not be indicative of core operating results and business

outlook. These non-GAAP measures are not in accordance with, or an

alternative to, measures prepared in accordance with GAAP and may

be different from non-GAAP measures used by other companies. In

addition, these non-GAAP measures are not based on any

comprehensive set of accounting rules or principles. These measures

should only be used to evaluate the Company's results of operations

in conjunction with the corresponding GAAP measures.

The Company has defined Consolidated EBITDA as net income,

adjusted for the impact of the following items that are either

non-cash or that the Company does not consider representative of

its ongoing operating performance: depreciation, amortization,

depletion and accretion, interest expense, net and income tax

expense. Because Consolidated EBITDA omits certain non-cash items,

the Company believes that the measure is less susceptible to

variances that affect the Company's operating performance.

Segment EBITDA is calculated as Segment operating income (loss)

adjusted for the impact of the following items that are either

non-cash or that the Company does not consider representative of

its ongoing operating performance: depreciation, amortization,

depletion and accretion and interest expense, net. When used in

conjunction with GAAP financial measures, Segment EBITDA is a

supplemental measure of operating performance that management

believes is a useful measure related the Company's PGI segment

performance relative to the performance of its competitors as well

as performance period over period. Additionally, the Company

believes the measure is less susceptible to variances that affect

its operating performance results.

The Company presents Consolidated EBITDA and Segment EBITDA

because the Company believes they are useful as supplemental

measures in evaluating the performance of the Company's operating

performance and provide greater transparency into the results of

operations. The Company's management uses Consolidated EBITDA and

Segment EBITDA as factors in evaluating the performance of its

business.

The adjustments to Consolidated EBITDA and Segment EBITDA in

future periods are generally expected to be similar. Consolidated

EBITDA and Segment EBITDA have limitations as analytical tools, and

you should not consider these measures in isolation or as a

substitute for analyzing the Company's results as reported under

GAAP.

TABLE 4

Advanced Emissions Solutions, Inc. and

SubsidiariesConsolidated EBITDA Reconciliation to

Net Income(Amounts in

thousands)(Unaudited)

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| (in

thousands) |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net income |

|

$ |

8,114 |

|

|

$ |

15,291 |

|

|

$ |

22,516 |

|

|

$ |

22,953 |

|

|

Depreciation, amortization, depletion and accretion |

|

757 |

|

|

72 |

|

|

2,859 |

|

|

188 |

|

|

Interest expense, net |

|

1,921 |

|

|

383 |

|

|

3,956 |

|

|

686 |

|

|

Income tax expense (benefit) |

|

6,634 |

|

|

(1,349 |

) |

|

8,333 |

|

|

1,220 |

|

| Consolidated EBITDA |

|

$ |

17,426 |

|

|

$ |

14,397 |

|

|

$ |

37,664 |

|

|

$ |

25,047 |

|

TABLE 5

Advanced Emissions Solutions, Inc. and

SubsidiariesPGI Segment EBITDA Reconciliation to

Segment Operating Loss(Amounts in

thousands)(Unaudited)

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| (in

thousands) |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Segment operating loss |

|

$ |

(3,862 |

) |

|

$ |

(1,387 |

) |

|

$ |

(7,324 |

) |

|

$ |

(2,325 |

) |

|

Depreciation, amortization, depletion and accretion |

|

685 |

|

|

41 |

|

|

2,645 |

|

|

71 |

|

|

Interest expense, net |

|

57 |

|

|

— |

|

|

188 |

|

|

— |

|

| Segment EBITDA loss |

|

$ |

(3,120 |

) |

|

$ |

(1,346 |

) |

|

$ |

(4,491 |

) |

|

$ |

(2,254 |

) |

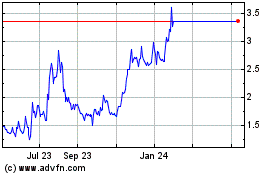

Advanced Emissions Solut... (NASDAQ:ADES)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Emissions Solut... (NASDAQ:ADES)

Historical Stock Chart

From Apr 2023 to Apr 2024