ADTRAN, Inc. (NASDAQ:ADTN) reported results for the first

quarter 2019. For the quarter, sales were $143.8 million compared

to $120.8 million for the first quarter of 2018. Net income was

$0.8 million compared to a net loss of $10.8 million for the first

quarter of 2018. Earnings per share, assuming dilution, were $0.02

compared to a loss per share of $0.22 for the first quarter of

2018. Non-GAAP net income was $4.9 million compared to a net loss

of $15.8 million for the first quarter of 2018. Non-GAAP earnings

per share, assuming dilution, were $0.10 compared to a loss per

share of $0.33 for the first quarter of 2018. Non-GAAP earnings per

share exclude stock-based compensation expense, acquisition related

amortizations and other expenses, restructuring expenses, gain on

bargain purchase of a business, and amortization of pension

actuarial losses. The reconciliation between GAAP net income (loss)

and earnings (loss) per share to non-GAAP net income (loss) and

non-GAAP earnings (loss) per share is in the table provided.

ADTRAN Chairman and Chief Executive Officer Tom

Stanton stated, “We are pleased with our progress in the first

quarter of 2019. Our revenue was diverse and well balanced

with material contributions across the LATAM, EMEA, North America,

and Pacific Rim regions. Furthermore, our broad portfolio of

next-generation solutions continues to gain market traction with a

growing number of customers in an expanding range of market

segments. This progress underscores the company’s global

strategy of diversification across geographies and markets.”

The Company also announced that its Board of Directors declared

a cash dividend for the first quarter of 2019. The quarterly cash

dividend is $0.09 per common share to be paid to holders of record

at the close of business on May 2, 2019. The ex-dividend date is

May 1, 2019, and the payment date is May 16, 2019.

The Company confirmed that it will hold a conference call to

discuss its first quarter results Thursday, April 18, 2019, at 9:30

a.m. Central Time. ADTRAN will webcast this conference call. To

listen, simply visit the Investor Relations site at

www.investors.adtran.com approximately 10 minutes prior to the

start of the call and click on the conference call link

provided.

An online replay of the conference call, as well as the text of

the Company's earnings release, will be available on the Investor

Relations site approximately 24 hours following the call and will

remain available for at least 12 months. For more information,

visit www.investors.adtran.com or via email

at investor.relations@adtran.com.

At ADTRAN, we believe amazing things happen when people connect.

From the cloud edge to the subscriber edge, we help communications

service providers around the world manage and scale services that

connect people, places and things to advance human progress.

Whether rural or urban, domestic or international, telco or cable,

enterprise or residential—ADTRAN solutions optimize existing

technology infrastructures and create new, multi-gigabit platforms

that leverage cloud economics, data analytics, machine learning and

open ecosystems—the future of global networking. Find more at

ADTRAN, LinkedIn and Twitter.

This press release contains forward-looking statements which

reflect management’s best judgment based on factors currently

known. However, these statements involve risks and uncertainties,

including the successful development and market acceptance of new

products, the degree of competition in the market for such

products, the product and channel mix, component costs,

manufacturing efficiencies, and other risks detailed in our annual

report on Form 10-K for the year ended December 31, 2018.

These risks and uncertainties could cause actual results to differ

materially from those in the forward-looking statements included in

this press release.

To provide additional transparency, we have disclosed non-GAAP

operating income (loss) which has been reconciled to operating

income (loss) and non-GAAP net income (loss) and non-GAAP adjusted

earnings (loss) per share - basic and diluted which have been

reconciled to net income (loss) and earnings (loss) per share -

basic and diluted as reported based on Generally Accepted

Accounting Principles in the United States (U.S. GAAP). These

measures exclude certain items which management believes are not

reflective of the ongoing operating performance of the business. We

believe this information is useful in providing period-to-period

comparisons of the results of our ongoing operations. Additionally,

these measures are used by management in our ongoing planning and

annual budgeting processes. The presentation of non-GAAP operating

income (loss), non-GAAP net income (loss) and non-GAAP earnings

(loss) per share- basic and diluted, when combined with the U.S.

GAAP presentation of operating income (loss), net income (loss),

and net income (loss) per share is beneficial to the overall

understanding of ongoing operating performance of the company.

These measures are not in accordance with, or an alternative

for, U.S. GAAP and therefore should not be considered in isolation

or as a substitution for analysis of our results as reported under

U.S. GAAP. Our calculation of non-GAAP operating income (loss),

non-GAAP net income (loss) and non-GAAP earnings (loss) per share -

basic and diluted may not be comparable to similar measures

calculated by other companies.

Condensed Consolidated Balance Sheet

(Unaudited)

(In thousands)

March 31, December

31, 2019 2018 Assets Cash and cash

equivalents $ 109,119 $ 105,504 Short-term investments 31,290 3,246

Accounts receivable, net 99,032 99,385 Other receivables 34,583

36,699 Inventory, net 93,609 99,848 Prepaid expenses and other

current assets 9,683 10,744

Total Current

Assets 377,316 355,426 Property, plant and

equipment, net 79,505 80,635 Deferred tax assets, net 36,891 37,187

Goodwill 6,982 7,106 Intangibles, net 31,817 33,183 Other assets

14,885 5,668 Long-term investments 85,227 108,822

Total Assets $ 632,623 $ 628,027

Liabilities and Stockholders' Equity Accounts payable

$ 60,116 $ 60,054 Bonds payable 25,600 1,000 Unearned revenue

15,230 17,940 Accrued expenses 14,039 11,746 Accrued wages and

benefits 15,105 14,752 Income tax payable, net 11,785

12,518

Total Current Liabilities 141,875

118,010 Non-current unearned revenue 4,514 5,296

Other non-current liabilities 42,687 33,842 Bonds payable —

24,600

Total Liabilities 189,076

181,748 Stockholders' Equity

443,547 446,279 Total Liabilities

and Stockholders' Equity $ 632,623 $

628,027 Consolidated Statements of

Income (Unaudited) (In thousands, except per share

data) Three Months Ended

March 31, 2019 2018 Sales

Products $ 125,822 $ 105,253 Services 17,969

15,553

Total Sales 143,791 120,806

Cost of Sales Products 70,734 68,612 Services 12,445

12,461

Total Cost of Sales

83,179 81,073 Gross Profit 60,612

39,733 Selling, general and administrative expenses 35,132

33,531 Research and development expenses 31,647

32,849

Operating Loss (6,167 )

(26,647 ) Interest and dividend income 591 866

Interest expense (127 ) (132 ) Net investment gain (loss) 5,926 (97

) Other income (expense), net 855 (57 ) Gain on bargain purchase of

a business — 11,322

Income (Loss)

Before Provision for Income Taxes 1,078 (14,745

) (Provision) benefit for income taxes (308 )

3,931

Net Income (Loss) $ 770

$ (10,814 ) Weighted average shares

outstanding – basic 47,782 48,232 Weighted average shares

outstanding – diluted(1) 47,853 48,292 Earnings (loss) per

common share – basic $ 0.02 $ (0.22 ) Earnings (loss) per common

share – diluted(1) $ 0.02 $ (0.22 )

(1) Assumes exercise of dilutive stock options calculated under

the treasury stock method.

Consolidated Statements of

Comprehensive Income

(Unaudited) (In thousands)

Three Months Ended March 31, 2019

2018 Net Income (Loss) $ 770 $

(10,814 )

Other Comprehensive Loss, net of tax Net

unrealized gains (losses) on available-for-sale securities 185

(3,412 ) Defined benefit plan adjustments 121 62 Foreign currency

translation (1,160 ) 842

Other

Comprehensive Loss, net of tax (854 )

(2,508 ) Comprehensive Loss, net of tax

$ (84 ) $ (13,322 )

Consolidated Statements of Cash Flows

(Unaudited) (In thousands)

Three Months Ended March 31,

2019 2018 Cash flows from operating

activities: Net income (loss) $ 770 $ (10,814 ) Adjustments to

reconcile net income (loss) to net cash provided by operating

activities: Depreciation and amortization 4,496 3,614 Amortization

of net premium on available-for-sale investments 6 42 Net (gain)

loss on long-term investments (5,926 ) 97 Net (gain) loss on

disposal of property, plant and equipment (6 ) 67 Gain on bargain

purchase of a business — (11,322 ) Stock-based compensation expense

1,859 1,819 Deferred income taxes 235 (1,877 ) Changes in operating

assets and liabilities: Accounts receivable, net 170 63,904 Other

receivables 1,185 (6,598 ) Inventory 5,974 3,368 Prepaid expenses

and other assets (566 ) 10,583 Accounts payable 166 (10,233 )

Accrued expenses and other liabilities (2,355 ) 826 Income tax

payable (487 ) 2,753

Net cash provided by

operating activities 5,521

46,229 Cash flows from investing

activities: Purchases of property, plant and equipment (1,872 )

(1,950 ) Proceeds from sales and maturities of available-for-sale

investments 17,039 49,074 Purchases of available-for-sale

investments (11,127 ) (75,960 ) Acquisition of business —

(7,806 )

Net cash provided by (used in) investing

activities 4,040 (36,642

) Cash flows from financing activities:

Proceeds from stock option exercises — 369 Purchases of treasury

stock (184 ) (10,171 ) Dividend payments (4,301 )

(4,367 )

Net cash used in financing activities

(4,485 ) (14,169 ) Net

increase (decrease) in cash and cash equivalents 5,076 (4,582 )

Effect of exchange rate changes (1,461 ) 772

Cash and cash

equivalents, beginning of period 105,504

86,433 Cash and cash equivalents,

end of period $ 109,119 $

82,623 Supplemental disclosure of non-cash

investing activities: Purchases of property, plant and equipment

included in accounts payable $ 273 $ 95 Right-of-use asset obtained

in exchange for lease obligations $ 10,371 $ —

Supplemental Information Reconciliation of Operating Loss

to Non-GAAP Operating Income (Loss) (Unaudited)

Three Months EndedMarch

31,

2019 2018 Operating

Loss $ (6,167) $ (26,647)

Acquisition related expenses, amortizations and adjustments 1,497

(1) 583 (5) Stock-based compensation expense 1,859 (2) 1,819 (6)

Restructuring expenses 2,063 (3) 5,950 (7) Deferred compensation

investment fluctuations 2,124 (4) (386) (4)

Non-GAAP Operating Income (Loss) $ 1,376

$ (18,681)

(1) $0.5 million is included in total cost

of sales, $0.5 million is included in selling, general and

administrative expenses and $0.5 million is included in research

and development expenses on the consolidated statements of

income.

(2) $0.1 million is included in total cost of sales, $1.1

million is included in selling, general and administrative expenses

and $0.7 million is included in research and development expenses

on the consolidated statements of income. (3) $0.6 million

is included in total cost of sales, $0.8 million is included in

selling, general and administrative expenses and $0.6 million is

included in research and development expenses on the consolidated

statements of income. (4) Includes non-cash change in fair

value of equity investments held in the ADTRAN, Inc. Deferred

Compensation Program for Employees (as amended and restated as of

June 1, 2010) per ASU 2016-01, all of which is included in selling,

general and administrative expenses on the consolidated statements

of income. (5) $0.3 million is included in selling, general

and administrative expenses and $0.3 million is included in

research and development expenses on the consolidated statements of

income. (6) $0.1 million is included in total cost of sales,

$1.0 million is included in selling, general and administrative

expenses and $0.7 million is included in research and development

expenses on the consolidated statements of income. (7) $2.4

million is included in total cost of sales, $1.8 million is

included in selling, general and administrative expenses and $1.8

million is included in research and development expenses on the

consolidated statements of income.

Supplemental

Information Reconciliation of Net Income (Loss) and Earnings

(Loss) per Share – Basic and Diluted to Non-GAAP Net Income

(Loss) and Non-GAAP Earnings (Loss) per Share – Basic and

Diluted (Unaudited)

Three Months EndedMarch

31,

2019 2018 Net Income

(Loss) $ 770 $ (10,814)

Restructuring expenses 2,063 5,950 Acquisition related expenses,

amortizations and adjustments 1,497 583 Stock-based compensation

expense 1,859 1,819 Pension expense 203 (1) 64 (1) Gain on bargain

purchase of a business — (11,322) Tax effect of adjustments to Net

Income (Loss) (1,524) (2,107)

Non-GAAP Net Income

(Loss) $ 4,868 $ (15,827)

Weighted average shares outstanding – basic 47,782 48,232 Weighted

average shares outstanding – diluted 47,853 48,292

Earnings (loss) per common share - basic $

0.02 $ (0.22) Earnings (loss) per common

share - diluted $ 0.02 $ (0.22)

Non-GAAP earnings (loss) per common share - basic

$ 0.10 $ (0.33) Non-GAAP earnings

(loss) per common share - diluted $ 0.10 $

(0.33)

(1) Includes amortization of actuarial losses related to the

Company's pension plan for employees in certain foreign

countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190417006019/en/

Investor Services/Assistance:Cathy Hoffman-Young,

256-963-7054investor@adtran.com

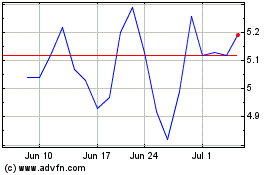

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Apr 2023 to Apr 2024