ADTRAN, Inc. (NASDAQ: ADTN) (“ADTRAN” or the “Company”)

announced today preliminary estimates of certain financial results

for the third quarter ended September 30, 2019. Based upon

preliminary information, revenue for the quarter is expected to be

approximately $114 million. Earnings per share for the quarter,

assuming dilution, is expected to be a loss of approximately $0.96.

Non-GAAP earnings per share for the quarter, assuming dilution, is

expected to be a loss of approximately $0.06. Earnings per share is

expected to be affected by a one-time, non-cash, valuation

allowance of approximately $37 million, that will be recorded to

income tax expense in the Company’s consolidated income statement

to reduce the carrying value of the Company’s deferred tax

assets.

ADTRAN Chief Executive Officer Tom Stanton stated, “Our revenue

this quarter has been significantly impacted by a pause in

shipments to a Tier 1 customer in Latin America and the continued

slowdown in the spending at an international Tier 1 customer. With

the exception of these two large customers, revenues generated from

the rest of our business grew 20% over the previous quarter.

Although we expect our Latin American customer sales to rebound,

our current visibility regarding timing is limited. For the

international Tier 1 customer, we expect that sales should resume

with the new capital cycle in 2020.”

Our current expectation for revenue for the fourth quarter of

2019, is that it will be flat to slightly down from the third

quarter. Additionally, we plan for our non-GAAP operating expenses

during the fourth quarter to be approximately 10% below our second

quarter non-GAAP expense rate.

In connection with our confirmation at the end of the third

quarter of the extent of the decline in revenue during the quarter

(which fell below our expectations) and management’s current

expectations for revenue in the fourth quarter of 2019, we are

establishing a valuation allowance against our deferred tax assets.

The deferred tax assets represent timing differences in the

recognition of certain tax benefits for accounting and income tax

purposes, including the expected value of future tax savings that

will be available to offset future taxable income through the

Company’s net operating loss carryforwards. In future periods, the

Company may be able to reduce some or all of the valuation

allowance upon a determination that it will be able to realize such

tax savings, thereby reducing its future tax liability and

recognizing an income tax benefit within the consolidated income

statement.

Non-GAAP earnings per share excludes the effect of the valuation

allowance, restructuring expenses, stock-based compensation

expenses, asset impairments, amortization of losses related to the

Company’s pension plan, and acquisition-related expenses,

amortizations and adjustments.

The Company confirmed that it will hold a conference call to

discuss its third quarter results Thursday, October 31, 2019, at

9:30 a.m. Central Time. ADTRAN will webcast this conference call.

To listen, simply visit the Investor Relations site at

www.investors.adtran.com approximately 10 minutes prior to the

start of the call and click on the conference call link

provided.

An online replay of the conference call, as well as the text of

the Company's earnings release, will be available on the Investor

Relations site approximately 24 hours following the call and will

remain available for at least 12 months. For more information,

visit www.investors.adtran.com or via email at

investor.relations@adtran.com.

At ADTRAN, we believe amazing things happen when people connect.

From the cloud edge to the subscriber edge, we help communications

service providers around the world manage and scale services that

connect people, places and things to advance human progress.

Whether rural or urban, domestic or international, telco or cable,

enterprise or residential—ADTRAN solutions optimize existing

technology infrastructures and create new, multi-gigabit platforms

that leverage cloud economics, data analytics, machine learning and

open ecosystems—the future of global networking. Find more at

ADTRAN, LinkedIn and Twitter.

This press release contains forward-looking statements which

reflect management’s best judgment based on factors currently

known. However, these statements involve risks and uncertainties,

including the degree to which sales to the Latin American Tier 1

customer and international Tier 1 customer rebound and the timing

thereof, whether we will be able to reduce some or all of the

valuation allowance against our deferred tax assets in future

periods, the successful development and market acceptance of new

products, the degree of competition in the market for such

products, the product and channel mix, component costs,

manufacturing efficiencies, and other risks detailed in our annual

report on Form 10-K and Form 10-K/A for the year ended December 31,

2018 and our quarterly reports on Form 10-Q for the quarters ended

March 31 and June 30, 2019. These risks and uncertainties could

cause actual results to differ materially from those in the

forward-looking statements included in this press release. We do

not undertake any obligation to publicly update or revise any

forward-looking statements to reflect future events, information or

circumstances that arise after the date of this release.

Additionally, the financial measures presented herein are

preliminary estimates and are subject to risks and uncertainties,

including, among others, changes in connection with quarter end

adjustments. Any variation between the Company’s actual results and

the preliminary financial information set forth herein may be

material.

To provide additional transparency, we have disclosed estimated

non-GAAP net income (loss) and earnings (loss) per share - diluted,

which has been reconciled to estimated net income (loss) and

earnings (loss) per share - diluted as reported based on Generally

Accepted Accounting Principles in the United States (U.S. GAAP).

This non-GAAP measure excludes certain items which management

believes are not reflective of the ongoing operating performance of

the business. We believe this information is useful in providing

period-to-period comparisons of the results of our ongoing

operations. Additionally, this measure is used by management in our

ongoing planning and annual budgeting processes. The presentation

of non-GAAP net income (loss) and non-GAAP earnings (loss) per

share- diluted, when combined with the U.S. GAAP presentation of

net income (loss) and earnings (loss) per share- diluted is

beneficial to the overall understanding of the ongoing operating

performance of the Company.

This measure is not in accordance with, or an alternative for,

U.S. GAAP and therefore should not be considered in isolation or as

a substitution for analysis of our results as reported under U.S.

GAAP. Our calculation of non-GAAP net income (loss) and non-GAAP

earnings (loss) per share - diluted may not be comparable to

similar measures calculated by other companies.

Reconciliation of Net Income

(Loss) and Earnings (Loss) per Common Share – Basic and Diluted to

Non-GAAP

Net Income (Loss) and Non-GAAP

Earnings (Loss) per Common Share – Basic and Diluted

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2019

2018

2019

2018

Net Income (Loss)

$

(46,027

)

$

7,589

$

(41,262

)

$

(10,895

)

Acquisition related expenses,

amortizations and adjustments

1,343

926

4,346

2,651

Stock-based compensation expense

1,871

1,640

5,184

5,243

Restructuring expenses

1,195

261

4,658

7,236

Pension expense(1)

198

61

600

187

Asset impairment

3,872

—

3,872

—

Valuation allowance

37,055

—

37,055

—

Gain on contingency

—

—

(1,230

)

—

Settlement income

—

—

(746

)

—

Gain on bargain purchase of a business

—

—

—

(11,322

)

Tax effect of adjustments to net income

(loss)

(2,228

)

(624

)

(4,466

)

(3,657

)

Non-GAAP Net Income (Loss)

$

(2,721

)

$

9,853

$

8,011

$

(10,557

)

Weighted average shares outstanding –

basic

47,824

47,810

47,803

47,927

Weighted average shares outstanding –

diluted

47,824

47,834

47,803

47,927

Earnings (loss) per common share -

basic

$

(0.96

)

$

0.16

$

(0.86

)

$

(0.23

)

Earnings (loss) per common share -

diluted

$

(0.96

)

$

0.16

$

(0.86

)

$

(0.23

)

Non-GAAP earnings (loss) per common

share - basic

$

(0.06

)

$

0.21

$

0.17

$

(0.22

)

Non-GAAP earnings (loss) per common

share - diluted

$

(0.06

)

$

0.21

$

0.17

$

(0.22

)

(1) Includes amortization of actuarial

losses related to the Company's pension plan for employees in

certain foreign countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191009005806/en/

Investor Relations Rhonda Lambert 256-963-7054

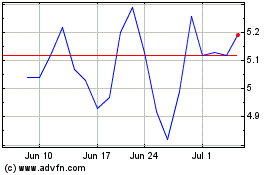

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Apr 2023 to Apr 2024