SEC Pushes Adobe to Expand Disclosures Under New Accounting Rules

July 03 2019 - 5:16PM

Dow Jones News

By Mark Maurer

The Securities and Exchange Commission's queries to Adobe Inc.

on how it is implementing the new revenue accounting standard shows

the regulator's efforts to push companies into revealing more about

how they are complying with the new rules.

The San Jose, Calif.-based software company is the latest U.S.

firm to grapple with the new accounting guidelines, which came into

effect at the start of last year for most public companies and aim

to unify how companies from different industries account for

revenue from sales and services. Adobe was one of the later

adopters of the new standard because its fiscal year ended on Nov.

30. Adobe implemented the rule on Dec. 1 for the first quarter of

the 2019 fiscal year.

The SEC, in letters sent this spring as part of a routine

review, has questioned Adobe on why in its first-quarter earnings

filings it combined the reporting of revenue from its software

licensing and cloud services into a single performance obligation,

instead of accounting them separately.

Adobe, in its response, said its Creative Cloud and Document

Cloud program's cloud-based features, functionalities and software

licenses constitute a single performance obligation that should be

recognized over a customer's subscription period.

After some back-and-forth, the SEC agreed with Adobe's logic but

asked the company to include additional disclosure in all future

periodic filings that the software licenses and cloud services for

those two Cloud programs are entwined.

The correspondence illuminates the level of detail and effort

that executives have to expend to comply with the new accounting

standard, said Matthew Kaplan, a securities attorney at law firm

Debevoise & Plimpton.

The involvement of the company's auditors in fielding the SEC's

questions shows how all parties involved with preparing financial

statements continue to grapple with the new revenue rules. Adobe's

thorough and nuanced responses can serve as guidance to other

companies in similar situations, Mr. Kaplan said.

The SEC judged the matter resolved without further action,

according to a letter the regulator sent to the company June 4. The

documents were made public Tuesday.

About 50 companies have exchanged letters with the SEC over the

separation of performance obligations in the new standard since

2017, seven of which were software companies such as Microsoft

Corp. and Autodesk Inc., according to consulting firm Audit

Analytics.

"It doesn't seem SEC has required anyone to change their

accounting, but instead required them to disclose the changes more

comprehensively," said Derryck Coleman, an analyst at Audit

Analytics.

Both the SEC and Adobe declined to comment.

Adobe, founded in 1982, made its largest purchase to-date last

year with the $4.75 billion acquisition of marketing-software

manager Marketo. The company posted better-than-expected

second-quarter earnings last month with revenue of $2.74 billion, a

25% increase from a year earlier.

Write to Mark Maurer at Mark.Maurer@wsj.com

(END) Dow Jones Newswires

July 03, 2019 17:01 ET (21:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

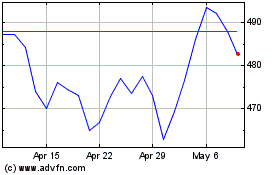

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

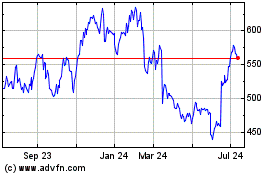

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024