ADMA Biologics, Inc. (Nasdaq: ADMA) (“ADMA” or the “Company”), an

end-to-end commercial biopharmaceutical company dedicated to

manufacturing, marketing and developing specialty plasma-derived

biologics, today reported financial results for the three months

ended September 30, 2021, its fiscal third quarter, and provided an

overview of recent progress and accomplishments.

“Achieving a positive gross profit and 101% year-over-year

revenue growth represents a key inflection point for the Company as

we continue our ongoing commercial and production ramp up. These

financial milestones and accomplishments would not have been

possible without the dedication and focus of ADMA’s staff,

leadership and advisors. We commend the entire team for their

extraordinary efforts focused on improving healthcare for U.S.

patients,” said Adam Grossman, President and Chief Executive

Officer of ADMA. “The investments we have made into our

manufacturing facility and our ADMA BioCenters plasma collection

operations are yielding positive results and we are encouraged by

the contributions from each segment to our overall operations.

Additionally, we strengthened our balance sheet with the recent

closing of an underwritten public equity offering of $57.5 million

in gross proceeds which, in combination with our active engagement

with prospective debt lenders to raise additional non-dilutive

capital has the potential to substantially fund our business to

profitability no later than the first quarter of 2024.”

Mr. Grossman continued, “During the third quarter, our inventory

and property and equipment balances continued to grow, which will

support the significant revenue growth we anticipate over the

coming quarters. We believe our organization, through its

operational execution, has clearly demonstrated strength and

resilience, and is well-positioned to meet or exceed all previously

disclosed financial targets and unlock significant value for

stockholders in the periods ahead. The ADMA BioCenters segment

continues to excel and remains on track to have 10 or more plasma

collection facilities FDA-licensed by year-end 2023. The rapid

expansion of our plasma collection center network, in addition to

the yield enhancements from the implementation of Haemonetics’

Persona® technology, will firm up internal plasma self-sufficiency,

help to insulate ADMA from the challenges presently impacting the

broader plasma collection industry and ensure continuity of product

supply for ADMA’s commercial immune globulin (IG) portfolio to

assist in meeting the increasing prescriber demands in the growing

U.S. IG market.”

“The commercial, regulatory and operational milestones achieved

during 2021 firmly establish ADMA as a vertically integrated,

cGMP-compliant fractionator capable of successfully competing in

the rapidly growing U.S. IG market. With the more substantive

investments now behind the Company, the pathway to profitability is

well-defined and rapidly approaching, and we continue to reiterate

all previously communicated strategic and financial objectives.

Looking forward, ADMA anticipates continued commercial execution

and remains committed to unlocking the yet-to-be-realized fair

value that this asset base now commands,” concluded Mr.

Grossman.

Select Third Quarter 2021 Achievements & Recent

Corporate Developments:

- Continued Commercial Execution:

- Achieved record third quarter 2021 total revenues of $20.7

million, compared to $10.3 million for the third quarter of 2020,

reflecting a 101% increase.

- Generated a positive gross profit for the first time in Company

history, and successfully narrowed sequential net quarterly

losses.

- Strengthened Cash Position. On October 25,

2021, ADMA closed an underwritten public offering, raising

approximately $53.9 million, net of all underwriting discounts and

expenses associated with the offering. ADMA continues to actively

engage prospective debt lenders to potentially raise additional,

non-dilutive capital, which if successful, has the potential to

fund the Company to profitability.

- Completed Multi-Year Supply Chain Robustness and

Remediation Processes. In addition to the significant

operating and cost efficiencies expected from the VanRx SA25

Workcell aseptic filling machine which was recently approved by the

U.S. Food and Drug Administration (FDA), ADMA’s in-house

fill-finish capabilities position the Company as the only

U.S.-domiciled fractionator of plasma-derived products with

complete end-to-end control of its critical manufacturing

functions. The VanRx approval will also enable ADMA to explore

potentially accretive contract manufacturing opportunities with

third parties not currently contemplated in ADMA’s financial

guidance. The Company will communicate contract manufacturing

developments as appropriate.

- Continued ADMA BioCenters Plasma Collection Network

Expansion. ADMA currently has nine plasma collection

facilities under its corporate umbrella at various stages of FDA

approval and development, including five facilities that are

currently operational and collecting plasma. The Company remains on

track to have 10 or more plasma collection centers FDA-licensed by

year-end 2023. The anticipated yield enhancement resulting from the

recent Persona® implementation, in combination with the Company’s

growing BioCenters network, has ADMA well-positioned to achieve

source plasma self-sufficiency and contribute to

quarter-over-quarter revenue and plasma collections growth

throughout 2021 and beyond. These activities will help ensure

continuity of commercial product supply to customers and patients

in the growing U.S. IG market.

- Strengthened Board of Directors. The

appointment of Young T. Kwon, Ph.D. to its Board of Directors

meaningfully strengthens ADMA’s ability to navigate the contours of

the commercial IG landscape and effectively evaluate strategic

business opportunities. Over the course of his career, Dr. Kwon has

held a variety of C-suite leadership positions, in which he played

pivotal roles involving multibillion-dollar mergers and

acquisitions. Dr. Kwon recently served as Chief Financial and

Business Officer of Momenta Pharmaceuticals, where he led the sale

to Johnson & Johnson for approximately $6.5 billion in

2020.

- Demonstrated Commitment to Stockholders. As

previously disclosed, ADMA has engaged Morgan Stanley as an advisor

to evaluate a variety of strategic and financing alternatives. The

evaluation of these alternatives as well as the formal engagement

with Morgan Stanley demonstrates ADMA’s management and Board of

Directors’ unwavering commitment to optimizing value for its

stockholders.

Third Quarter 2021 Financial Results

Total revenues for the quarter ended September 30, 2021 were

approximately $20.7 million, compared to approximately $10.3

million for the quarter ended September 30, 2020, representing an

increase of approximately $10.4 million, or 101%. The revenue

growth for the quarter ended September 30, 2021, compared to the

quarter ended September 30, 2020, was favorably impacted by the

continued commercial ramp-up of ADMA’s intravenous immune globulin

(IVIG) product portfolio and sale of intermediate fractions. Gross

profit during the third quarter of 2021 was approximately $0.4

million compared to a gross loss of approximately $1.6 million for

the three months ended September 30, 2020. The improved gross

profit year-over-year was primarily attributable to increased sales

of ADMA’s higher margin hyperimmune globulin product portfolio,

along with a portion of the sales generated from conformance

batches.

Consolidated net loss was $17.7 million, or $0.13 per basic and

diluted share, for the three months ended September 30, 2021, as

compared to $16.9 million, or $0.19 per basic and diluted share,

for the three months ended September 30, 2020. The $0.8 million

increase in net loss was primarily due to the increased operating

loss for the quarter of $0.6 million, as the improved revenues and

gross profit were more than offset by increases in plasma center

operating expenses and selling, general administrative expenses,

and to the increase in interest expense.

At September 30, 2021, ADMA had cash and cash equivalents of

approximately $34.4 million and accounts receivable of

approximately $20.4 million, compared to cash and cash equivalents

of approximately $55.9 million and accounts receivable of

approximately $13.2 million as of December 31, 2020. Subsequent to

the end of the third quarter, on October 25, 2021, the Company

closed an underwritten public offering whereby the Company received

gross proceeds of $57.5 million, amounting to net proceeds, after

deducting underwriting discounts and expenses associated with the

offering, of approximately $53.9 million.

Conference Call Information

ADMA will host a conference call today, November 10, 2021, at

4:30 p.m. Eastern Time, to discuss the fiscal third quarter 2021

financial results and recent corporate updates. To access the

conference call, please dial (855) 884-8773 (local) or (615)

622-8043 (international) at least 10 minutes prior to the start

time and refer to conference ID 4459844. A live audio webcast of

the call will be available under "Events & Webcasts" in the

Investor section of the Company's website,

https://ir.admabiologics.com/events-webcasts. An archived webcast

will be available on the Company's website approximately two hours

after the event.

About ADMA BioCenters

ADMA BioCenters operates FDA-licensed facilities

specializing in the collection of human plasma used to make special

medications for the treatment and prevention of certain infectious

diseases. Managed by a team of experts who have decades of

experience in the specialized field of plasma collection, ADMA

BioCenters provides a safe, professional and pleasant donation

environment. ADMA BioCenters strictly follows FDA regulations and

guidance and enforces current good manufacturing practices (cGMP)

in all of its facilities. For more information about ADMA

BioCenters, please visit www.admabiocenters.com.

About ADMA Biologics, Inc.

(ADMA)

ADMA is an end-to-end American commercial

biopharmaceutical company dedicated to manufacturing, marketing and

developing specialty plasma-derived biologics for the treatment of

immunodeficient patients at risk for infection and others at risk

for certain infectious diseases. ADMA currently manufactures and

markets three FDA-approved plasma-derived biologics for the

treatment of immune deficiencies and the prevention of certain

infectious diseases: BIVIGAM® (immune globulin intravenous, human)

for the treatment of primary humoral immunodeficiency (PI);

ASCENIV™ (immune globulin intravenous, human – slra 10% liquid) for

the treatment of PI; and NABI-HB® (hepatitis B immune globulin,

human) to provide enhanced immunity against the Hepatitis B virus.

ADMA manufactures its immune globulin products at its FDA-licensed

plasma fractionation and purification facility located in Boca

Raton, Florida. Through its ADMA BioCenters subsidiary, ADMA also

operates as an FDA-approved source plasma collector in the U.S.,

which provides a portion of its blood plasma for the manufacture of

its products. ADMA’s mission is to manufacture, market and develop

specialty plasma-derived, human immune globulins targeted to niche

patient populations for the treatment and prevention of certain

infectious diseases and management of immune compromised patient

populations who suffer from an underlying immune deficiency, or who

may be immune compromised for other medical reasons. ADMA has

received U.S. Patents 9,107,906, 9,714,283, 9,815,886, 9,969,793

and 10,259,865 related to certain aspects of its products and

product candidates. For more information, please visit

www.admabiologics.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains “forward-looking

statements” pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995 about ADMA Biologics, Inc.

and its subsidiaries (collectively, “we,” “our” or the “Company”).

Forward-looking statements include, without limitation, any

statement that may predict, forecast, indicate, or imply future

results, performance or achievements, and may contain such words as

“estimate,” “project,” “intend,” “forecast,” “target,”

“anticipate,” “plan,” “potential,” “planning,” “expect,” “believe,”

“will,” “should,” “could,” “would,” “may,” or, in each case, their

negative, or words or expressions of similar meaning. These

forward-looking statements also include, but are not limited to,

statements about ADMA’s future results of operations, including our

anticipated timing for reaching profitability; execution of the

Company’s commercial goals; the Company’s ability to refinance and

expand its senior credit facility; expected benefits from the VanRx

aseptic fill-finish machine, including operating and cost

efficiencies and contract manufacturing opportunities; the

anticipated benefits from the recent implementation of Haemonetics’

Persona® technology combined with our plasma collection center

network; the goal of having 10 or more FDA-licensed plasma

collection centers by year-end 2023; the Company’s plasma

collections and production; and our ability to maintain sufficient

plasma supply. Actual events or results may differ materially from

those described in this press release due to a number of important

factors. Current and prospective security holders are cautioned

that there also can be no assurance that the forward-looking

statements included in this press release will prove to be

accurate. Except to the extent required by applicable laws or

rules, ADMA does not undertake any obligation to update any

forward-looking statements or to announce revisions to any of the

forward-looking statements. Forward-looking statements are subject

to many risks, uncertainties and other factors that could cause our

actual results, and the timing of certain events, to differ

materially from any future results expressed or implied by the

forward-looking statements, including, but not limited to, the

risks and uncertainties described in our filings with the U.S.

Securities and Exchange Commission, including our most recent

reports on Form 10-K, 10-Q and 8-K, and any amendments thereto.

COMPANY CONTACT: Skyler Bloom Director,

Investor Relations and Corporate Strategy | 201-478-5552 |

sbloom@admabio.com

INVESTOR RELATIONS CONTACT:Michelle Pappanastos

Senior Managing Director, Argot Partners | 212-600-1902 |

michelle@argotpartners.com

ADMA BIOLOGICS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

|

|

REVENUES: |

|

|

|

|

|

|

|

|

|

Product revenue |

|

$ |

20,644,842 |

|

|

$ |

10,240,650 |

|

|

$ |

54,452,633 |

|

|

$ |

28,156,571 |

|

|

License revenue |

|

|

35,708 |

|

|

|

35,708 |

|

|

|

107,125 |

|

|

|

107,125 |

|

|

Total revenues |

|

|

20,680,550 |

|

|

|

10,276,358 |

|

|

|

54,559,758 |

|

|

|

28,263,696 |

|

| |

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

Cost of product revenue (exclusive of amortization expense shown

below) |

|

|

20,295,213 |

|

|

|

11,855,464 |

|

|

|

56,897,959 |

|

|

|

42,180,319 |

|

|

Research and development |

|

|

770,557 |

|

|

|

1,708,391 |

|

|

|

2,917,072 |

|

|

|

4,893,549 |

|

|

Plasma center operating expenses |

|

|

3,146,221 |

|

|

|

1,218,898 |

|

|

|

8,191,890 |

|

|

|

2,597,444 |

|

|

Amortization of intangible assets |

|

|

178,838 |

|

|

|

178,838 |

|

|

|

536,514 |

|

|

|

536,514 |

|

|

Selling, general and administrative |

|

|

10,726,797 |

|

|

|

9,115,744 |

|

|

|

31,198,880 |

|

|

|

25,750,458 |

|

|

Total operating expenses |

|

|

35,117,626 |

|

|

|

24,077,335 |

|

|

|

99,742,315 |

|

|

|

75,958,284 |

|

| |

|

|

|

|

|

|

|

|

|

LOSS FROM OPERATIONS |

|

|

(14,437,076 |

) |

|

|

(13,800,977 |

) |

|

|

(45,182,557 |

) |

|

|

(47,694,588 |

) |

| |

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

4,256 |

|

|

|

1,164 |

|

|

|

32,241 |

|

|

|

268,643 |

|

|

Interest expense |

|

|

(3,298,680 |

) |

|

|

(3,091,200 |

) |

|

|

(9,741,110 |

) |

|

|

(8,875,597 |

) |

|

Other expense |

|

|

18,546 |

|

|

|

(26,440 |

) |

|

|

(106,772 |

) |

|

|

(39,232 |

) |

|

Other expense, net |

|

|

(3,275,878 |

) |

|

|

(3,116,476 |

) |

|

|

(9,815,641 |

) |

|

|

(8,646,186 |

) |

|

|

|

|

|

|

|

|

|

|

|

NET LOSS |

|

$ |

(17,712,954 |

) |

|

$ |

(16,917,453 |

) |

|

$ |

(54,998,198 |

) |

|

$ |

(56,340,774 |

) |

| |

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED LOSS PER COMMON SHARE |

|

$ |

(0.13 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.44 |

) |

|

$ |

(0.68 |

) |

| |

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

133,770,147 |

|

|

|

87,698,258 |

|

|

|

125,682,400 |

|

|

|

82,627,753 |

|

| |

|

|

|

|

|

|

|

|

ADMA BIOLOGICS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

| |

September 30, |

|

December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

| |

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

34,410,570 |

|

|

$ |

55,921,152 |

|

|

Accounts receivable, net |

|

20,392,621 |

|

|

|

13,237,290 |

|

|

Inventories |

|

114,122,873 |

|

|

|

81,535,599 |

|

|

Prepaid expenses and other current assets |

|

5,859,046 |

|

|

|

3,046,466 |

|

|

Total current assets |

|

174,785,110 |

|

|

|

153,740,507 |

|

|

Property and equipment, net |

|

48,393,723 |

|

|

|

41,593,090 |

|

|

Intangible assets, net |

|

1,907,607 |

|

|

|

2,444,121 |

|

|

Goodwill |

|

3,529,509 |

|

|

|

3,529,509 |

|

|

Right to use assets |

|

6,690,943 |

|

|

|

4,259,191 |

|

|

Deposits and other assets |

|

3,333,514 |

|

|

|

2,106,976 |

|

|

TOTAL ASSETS |

$ |

238,640,406 |

|

|

$ |

207,673,394 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

17,282,841 |

|

|

$ |

11,073,708 |

|

|

Accrued expenses and other current liabilities |

|

14,410,329 |

|

|

|

8,365,143 |

|

|

Current portion of deferred revenue |

|

142,834 |

|

|

|

142,834 |

|

|

Current portion of lease obligations |

|

501,239 |

|

|

|

365,682 |

|

|

Total current liabilities |

|

32,337,243 |

|

|

|

19,947,367 |

|

|

Senior notes payable, net of discount |

|

94,363,008 |

|

|

|

92,968,866 |

|

|

Deferred revenue, net of current portion |

|

2,011,573 |

|

|

|

2,118,698 |

|

|

Lease obligations, net of current portion |

|

6,915,750 |

|

|

|

4,334,151 |

|

|

Other non-current liabilities |

|

232,665 |

|

|

|

54,886 |

|

|

TOTAL LIABILITIES |

|

135,860,239 |

|

|

|

119,423,968 |

|

| |

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

| |

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

Preferred Stock, $0.0001 par value, 10,000,000 shares

authorized, |

|

|

|

|

no shares issued and outstanding |

|

- |

|

|

|

- |

|

|

Common Stock - voting, $0.0001 par value, 300,000,000 and

150,000,000 shares authorized, |

|

|

|

|

131,872,026 and 104,902,888 shares issued and outstanding |

|

13,831 |

|

|

|

10,490 |

|

|

Additional paid-in capital |

|

498,229,637 |

|

|

|

428,704,039 |

|

|

Accumulated deficit |

|

(395,463,301 |

) |

|

|

(340,465,103 |

) |

|

TOTAL STOCKHOLDERS' EQUITY |

|

102,780,167 |

|

|

|

88,249,426 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

$ |

238,640,406 |

|

|

$ |

207,673,394 |

|

| |

|

|

|

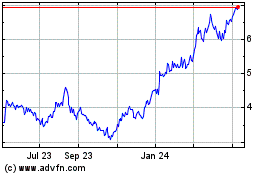

Adma Biologics (NASDAQ:ADMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

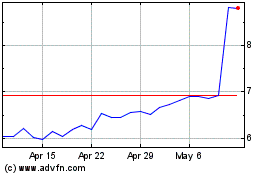

Adma Biologics (NASDAQ:ADMA)

Historical Stock Chart

From Apr 2023 to Apr 2024