ADDvantage Technologies to Divest Cable TV Segment Operations

December 27 2018 - 4:10PM

ADDvantage Technologies Group, Inc. (NASDAQ:

AEY), today announced it has entered into an agreement to

sell the Cable TV segment business for $10.3 million to Leveling 8

Inc, a company controlled by David Chymiak, the Company’s Chief

Technology Officer, director and a substantial shareholder. The

purchase price will consist of $3.9 million of cash and a $6.4

million promissory note to be paid in semi-annual installments over

five years with an interest rate of 6.0%. The transaction was

negotiated and approved by a committee of independent directors and

is subject to shareholder approval, including approval by the

holders of a majority of the shares which are unaffiliated with the

buyer, and is anticipated to occur in the third fiscal quarter of

2019.

Although the Company is prohibited from

soliciting other offers for its Cable TV segment, the agreement

does permit its board of directors to consider and approve a

superior unsolicited acquisition proposal.

In November 2018, the Company completed the sale

of the Cable TV segment’s Broken Arrow, Oklahoma facility for $5.0

million.

The Cable TV segment sells new, surplus and

refurbished cable television equipment to cable television

operators or other resellers that sell to customers throughout

North America, Central America, South America and, to a lesser

extent, other international regions that utilize the same

technology. In addition, this segment repairs cable television

equipment for various companies. The Cable TV segment has

experienced top-line revenue declines since 2008 as the

consolidation of cable television operators and original equipment

manufacturers and an overall decrease in equipment upgrades by the

cable television operators led to a reduction in the size of the

market.

Divesting the Cable TV segment is in line with

the Company’s long term strategy to drive growth through organic

growth and acquisitions within the telecommunications industry.

Transitioning out of the Cable TV segment will allow the Company to

direct additional cash into the wireless and wireline Telecom

segment, where there is a significantly larger growth

opportunity.

Joe Hart, Chief Executive Officer, said,

“Pursuing the sale of the Cable TV segment is a milestone event for

us as it has been the foundation of the company for more than 30

years. For some time now, the Cable TV market has been shrinking

and, despite our best efforts, we have not been able to achieve

sustainable topline growth in this segment. The sale of the Cable

TV segment, combined with the recent sale of the Broken Arrow,

Oklahoma facility, will inject over $15 million into our business.

This will enable our leadership team to focus all our time and

resources on building out our Telco segment operations, where we

have several exciting growth initiatives in place with our Nave and

Triton subsidiaries, as well as our recently announced plans to

offer wireless infrastructure services. We are excited to enter

this new chapter in our development and look forward to improving

the long term growth prospects of ADDvantage Technologies.”

Mr. Chymiak is the original founder of Tulsat,

one of the major subsidiaries within the Cable TV segment. We

believe that this sale will allow Mr. Chymiak the flexibility to

rejuvenate the Cable TV business as he sees fit and provide a fresh

start for the dedicated employees within the Cable TV business.

Although Mr. Chymiak will no longer be an employee of our Company

as he focuses exclusively on the Cable TV business, he will remain

on the Board of the Company.

About ADDvantage Technologies Group,

Inc.

ADDvantage Technologies Group, Inc.

(NASDAQ: AEY) supplies the cable television (Cable TV) and

telecommunications industries with a comprehensive line of new and

used system-critical network equipment and hardware from a broad

range of leading manufacturers. The equipment and hardware

ADDvantage distributes is used to acquire, distribute, and protect

the communications signals carried on fiber optic, coaxial cable

and wireless distribution systems, including television

programming, high-speed data (Internet) and telephony. The Company

is also launching a services business to provide turn-key wireless

infrastructure services, such as the installation and

decommissioning of equipment on cell towers, for wireless carriers,

contractors supporting the wireless carriers, and equipment

manufacturers. In addition, ADDvantage operates a national

network of technical repair centers focused primarily on Cable TV

equipment and recycles surplus and obsolete Cable TV and

telecommunications equipment.

ADDvantage operates through its subsidiaries,

Tulsat, Tulsat-Atlanta, Tulsat-Texas, NCS Industries, ComTech

Services, Nave Communications and Triton Datacom. For more

information, please visit the corporate web site

at www.addvantagetechnologies.com.

The information in this announcement may include

forward-looking statements. All statements, other than

statements of historical facts, which address activities, events or

developments that the Company expects or anticipates will or may

occur in the future, are forward-looking statements. These

statements are subject to risks and uncertainties, which could

cause actual results and developments to differ materially from

these statements. A complete discussion of these risks and

uncertainties is contained in the Company’s reports and documents

filed from time to time with the Securities and Exchange

Commission.

For further informationCompany Contact:Scott Francis (918)

251-9121

KCSA Strategic CommunicationsElizabeth Barker(212)

896-1203ebarker@kcsa.com

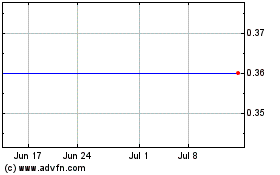

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

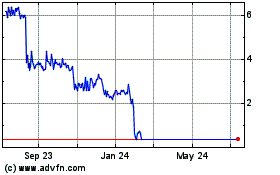

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Apr 2023 to Apr 2024