ADDvantage Technologies Group, Inc. (NASDAQ: AEY) (“ADDvantage

Technologies” or the “Company”) today reported its financial

results for the three-month period ended December 31, 2019.

“We continue to make progress in the Company’s

transformation and achieved year-over-year revenue growth across

the company during this pivotal phase of the company’s

transition. During the Quarter, we did experience the

expected impact of weather and the holiday season, as well as

unexpected geographic shifts in customer demand at Fulton.

These factors negatively impacted margins and profitability, but

are not unusual for this industry from time to time,” said Joe

Hart, President and CEO. “The steps taken in the second half of

2019 to prepare the company for future growth are beginning to

yield results as we have a robust pipeline of opportunities and

continue to see a significant market opportunity with 5G across all

of ADDvantage’s businesses. The weather impact at Fulton will

continue in the second fiscal quarter, but similar to last year, we

expect significant top and bottom line improvements in the second

half of the year during the industry’s high season. Warmer weather

also leads to increased productivity and special events work in the

Midwest.”

“We are also excited about the outlook of our

Telecom Segment, which is pointing towards strong growth in the

second half of the year, as we expand our product lines and ramp up

our recycle business, which was recently moved to Huntsville,

Alabama,” continued Mr. Hart. “Q1 was also impacted by costs and

lost revenue related to the relocation of Triton, which will not

repeat in future periods. We have double digit growth expectations

for both Nave and Triton year over year.”

“In our Wireless Segment, our near-term focus

continues to be the expansion of our customer base within our

existing markets while widening our addressable market in the

adjacent regions to better position us for the 5-G rollout

nationwide,” continued Mr. Hart. “During the quarter, a large

carrier completed its work in the Southern United States earlier

than expected, requiring us to reposition crews to the Northern

region. The repositioning took several weeks, creating unforeseen

costs and lost revenue. In aggregate, the time required to

reposition crews, plus the expected weather and holiday impact,

resulted in approximately three weeks of lost productivity,

significantly impacting our revenue, margin, and profitability. We

believe this situation is not representative of the normalized

business in the future. We remain optimistic about the future of

both our business Segments and are looking forward to substantial

growth and positive results for this fiscal year.”

Financial Results for the Three Months

ended December 31, 2019

Sales increased 105% to $14.0 million for the

three months ended December 31, 2019 compared with $6.8 million for

the three months ended December 31, 2018. The increase in sales was

driven by an increase in revenue in our Telco segment and the

January 4, 2019 acquisition of Fulton Technologies to create our

Wireless Segment

Revenues for the Wireless segment were $6.8

million for the three months ended December 31, 2019. The Company

did not report any revenues for the Wireless segment for the three

months ended December 31, 2018.

Sales for the Telco segment increased $314,000,

or 5%, to $7.2 million for the three months ended December 31, 2019

from $6.8 million for the same period last year. The increase in

sales resulted primarily from an increase in equipment sales

combined with a modest increase in recycling revenue.

Gross profit increased $1.9 million, or 108%, to

$3.6 million compared with $1.7 million for the prior year three

months period due to an increase in the Wireless segment of $1.9

million, partially offset by a negligible decrease in the Telco

segment due primarily to the overall mix of equipment sales.

Operating expenses increased $1.4 million, or

284%, to $1.9 million for the three months ended December 31, 2019

compared with $493,000 the same period last year. The

increase in operating expenses was due to the addition of the

Wireless segment of $1.2 million and an increase in expenses in the

Telco segment due primarily to additional facility costs as a

result of moving into Triton’s new facility in the first fiscal

quarter of 2020 as well as added personnel costs.

Selling, general and administrative expenses

increased $1.1 million, or 55%, to $3.0 million for the three

months ended December 31, 2019 compared with $1.9 million for the

same period last year. This was primarily due to the addition of

the Wireless segment of $1.6 million, partially offset by a

decrease in expense in the Telco segment.

Other income was $30,000 for the three months

ended December 31, 2019 compared with other expense of $23,000 for

the year ago period. The change was due primarily to interest

income in the current period of $89,000 consisting primarily of

interest earned on the promissory note from the sale of the

company’s Cable TV segment, income from an equity investment of

$22,000, which was partially offset by other expense of $57,000

related to the company’s factoring arrangements within its Wireless

segment. Interest expense, which is related to outstanding term

loans that were extinguished in the first quarter of fiscal year

2019, remained roughly flat year-over-year.

The Company recorded a benefit for income taxes

of $15,000 for the three months ended December 31, 2019, compared

with a provision for income taxes of $172,000 for the three months

ended December 31, 2018. The decrease in the tax provision was due

primarily to the valuation allowance netting the deferred tax

assets to zero.

Loss from continuing operations for the three

months ended December 31, 2019, was $1.7 million, or $0.17 per

diluted share, compared with a loss from continuing operations of

$1.2 million, or $0.12 per diluted share, for the same period of

2018.

Adjusted EBITDA for the three months ended

December 31, 2019 was a loss of $1.3 million compared with a loss

of $655,000 for the same period ended December 31, 2018.

Balance sheet

Cash and cash equivalents were $608,000 as of

December 31, 2019, compared with $1.2 million as of September 30,

2019. As of December 31, 2019, the Company had inventories of $8.2

million, compared with $7.6 million as of September 30, 2019.

Management has begun evaluating alternative

sources of capital to enhance the Company’s cash position and

assist in its working capital needs, especially related to

anticipated growth.

Earnings Conference Call

The Company will host a conference call today,

Thursday, February 13, at 4:30 p.m. Eastern Time featuring remarks

by Joseph Hart, President and Chief Executive Officer, Kevin Brown,

Chief Financial Officer, Colby Empey, President of the Wireless

Services Division, Don Kinison, President of the Telecommunications

Division, and Scott Francis, Chief Accounting Officer. The

conference call will be available via webcast and can be accessed

through the Investor Relations section of ADDvantage's website,

www.addvantagetechnologies.com.

Please allow extra time prior to the call to

visit the site and download any necessary software to listen to the

Internet broadcast. The dial-in number for the conference call is

1-800-289-0438 (domestic) or 1-323-794-2423 (international). All

dial-in participants must use the following code to access the

call: 5216692. Please call at least five minutes before the

scheduled start time.

A replay of the call will be available through

February 27, 2020 at 1-844-512-2921 (domestic) or 1-412-317-6671

(international). Participants must use the following code to access

the replay of the call: 5216692. An online archive of the webcast

will be available on the Company's website for 30 days following

the call.

About ADDvantage Technologies Group,

Inc.

ADDvantage Technologies Group, Inc. (Nasdaq:

AEY) is a communications infrastructure services and equipment

provider operating a diversified group of companies through its

Wireless Infrastructure Services and Telecommunications segments.

Through its Wireless segment, Fulton Technologies provides turn-key

wireless infrastructure services including the installation,

modification and upgrading of equipment on communication towers and

small cell sites for wireless carriers, national integrators, tower

owners and major equipment manufacturers. Through its

Telecommunications segment, Nave Communications and Triton Datacom

sell equipment and hardware used to acquire, distribute, and

protect the communications signals carried on fiber optic, coaxial

cable and wireless distribution systems. The Telecommunications

segment also offers repair services focused on telecommunication

equipment and recycling surplus and related obsolete

telecommunications equipment.

ADDvantage operates through its subsidiaries,

Fulton Technologies, Nave Communications, and Triton Datacom. For

more information, please visit the corporate web site at

www.addvantagetechnologies.com.

Cautions Regarding Forward-Looking

Statements

The information in this announcement may include

forward-looking statements. All statements, other than statements

of historical facts, which address activities, events or

developments that the Company expects or anticipates will or may

occur in the future, are forward-looking statements. These

statements are subject to risks and uncertainties, which could

cause actual results and developments to differ materially from

these statements. A complete discussion of these risks and

uncertainties is contained in the Company’s reports and documents

filed from time to time with the Securities and Exchange

Commission.

Non-GAAP Financial Measures

Adjusted EBITDA is a supplemental, non-GAAP

financial measure. EBITDA is defined as earnings before interest

expense, income taxes, depreciation and amortization.

Adjusted EBITDA as presented also excludes restructuring expense,

stock compensation expense, other income, other expense, interest

income and income from equity method investment. Management

believes providing Adjusted EBITDA is presented below because this

metric is used by the financial community as a method of measuring

our financial performance and of evaluating the market value of

companies considered to be in similar businesses. Since Adjusted

EBITDA is not a measure of performance calculated in accordance

with GAAP, it should not be considered in isolation of, or as a

substitute for, net earnings as an indicator of operating

performance. Adjusted EBITDA, as calculated in the table below, may

not be comparable to similarly titled measures employed by other

companies. In addition, Adjusted EBITDA is not necessarily a

measure of our ability to fund our cash needs.

For further information: Hayden IRBrett

Maas(646) 536-7331aey@haydenir.com

-- Tables follow –

ADDVANTAGE TECHNOLOGIES GROUP, INC.CONSOLIDATED

CONDENSED STATEMENTS OF OPERATIONS(UNAUDITED)

| |

Three Months Ended December 31, |

|

|

|

2019 |

|

|

|

2018 |

|

| Sales |

$ |

13,962,358 |

|

|

$ |

6,810,097 |

|

| Cost of sales |

|

10,370,376 |

|

|

|

5,086,708 |

|

| Gross profit |

|

3,591,982 |

|

|

|

1,723,389 |

|

| Operating expenses |

|

1,887,726 |

|

|

|

492,823 |

|

| Selling, general and

administrative expenses |

|

3,019,402 |

|

|

|

1,939,605 |

|

| Depreciation and amortization

expense |

|

447,575 |

|

|

|

299,385 |

|

| Loss from operations |

|

(1,762,721 |

) |

|

|

(1,008,424 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

88,631 |

|

|

|

‒ |

|

|

Income from equity method investment |

|

22,000 |

|

|

|

‒ |

|

|

Other income (expense) |

|

(57,042 |

) |

|

|

90 |

|

|

Interest expense |

|

(23,560 |

) |

|

|

(22,977 |

) |

| Total other income (expense),

net |

|

30,029 |

|

|

|

(22,887 |

) |

| |

|

|

|

|

|

|

|

| Loss before income taxes |

|

(1,732,692 |

) |

|

|

(1,031,311 |

) |

| Provision (benefit) for income

taxes |

|

(15,000 |

) |

|

|

172,000 |

|

| Loss from continuing

operations |

|

(1,717,692 |

) |

|

|

(1,203,311 |

) |

| |

|

|

|

|

|

|

|

| Income from discontinued

operations, net of tax |

|

‒ |

|

|

|

164,330 |

|

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(1,717,692 |

) |

|

$ |

(1,038,981 |

) |

| |

|

|

|

|

|

|

|

| Income (loss) per share: |

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(0.17 |

) |

|

$ |

(0.12 |

) |

|

Discontinued operations |

|

‒ |

|

|

|

0.02 |

|

|

Net loss |

$ |

(0.17 |

) |

|

$ |

(0.10 |

) |

|

Diluted |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(0.17 |

) |

|

$ |

(0.12 |

) |

|

Discontinued operations |

|

‒ |

|

|

|

0.02 |

|

|

Net loss |

$ |

(0.17 |

) |

|

$ |

(0.10 |

) |

| Shares used in per share

calculation: |

|

|

|

|

|

|

|

|

Basic |

|

10,361,292 |

|

|

|

10,361,292 |

|

|

Diluted |

|

10,361,292 |

|

|

|

10,361,292 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A reconciliation by segment of loss from operations to Adjusted

EBITDA follows:

| |

Three Months Ended December 31, 2019 |

|

Three Months Ended December 31, 2018 |

| |

Wireless |

|

Telco |

|

Total |

|

Wireless |

|

Telco |

|

Total |

|

Loss from operations |

$ |

(1,087,443 |

) |

|

$ |

(675,278 |

) |

|

$ |

(1,762,721 |

) |

|

$ |

‒ |

|

$ |

(1,008,423 |

) |

|

$ |

(1,008,423 |

) |

| Depreciation and amortization

expense |

|

146,696 |

|

|

|

300,879 |

|

|

|

447,575 |

|

|

|

‒ |

|

|

299,385 |

|

|

|

299,385 |

|

| Stock compensation expense |

|

8,804 |

|

|

|

8,835 |

|

|

|

17,639 |

|

|

|

− |

|

|

54,320 |

|

|

|

54,320 |

|

| Adjusted

EBITDA |

$ |

(931,943 |

) |

|

$ |

(365,564 |

) |

|

$ |

(1,297,507 |

) |

|

$ |

‒ |

|

$ |

(654,718 |

) |

|

$ |

(654,718 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDVANTAGE TECHNOLOGIES GROUP, INC.CONSOLIDATED

CONDENSED BALANCE SHEETS(UNAUDITED)

| |

December 31, 2019 |

|

September 30, 2019 |

|

Assets |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

608,105 |

|

|

$ |

1,242,143 |

|

|

Restricted cash |

|

296,174 |

|

|

|

351,909 |

|

|

Accounts receivable, net of allowance for doubtful accounts of

$150,000 |

|

4,777,580 |

|

|

|

4,826,716 |

|

|

Unbilled revenue |

|

2,679,442 |

|

|

|

2,691,232 |

|

|

Promissory note – current |

|

1,400,000 |

|

|

|

1,400,000 |

|

|

Income tax receivable |

|

36,350 |

|

|

|

21,350 |

|

|

Inventories, net of allowance for excess and obsolete inventory of

$1,275,000 |

|

8,161,656 |

|

|

|

7,625,573 |

|

|

Prepaid expenses |

|

650,818 |

|

|

|

543,762 |

|

|

Other assets |

|

77,103 |

|

|

|

262,462 |

|

| Total current assets |

|

18,687,228 |

|

|

|

18,965,147 |

|

| |

|

|

|

|

|

|

|

| Property and equipment, at

cost: |

|

|

|

|

|

|

|

|

Machinery and equipment |

|

2,575,220 |

|

|

|

2,475,545 |

|

|

Leasehold improvements |

|

1,014,643 |

|

|

|

190,984 |

|

| Total property and equipment, at

cost |

|

3,589,863 |

|

|

|

2,666,529 |

|

| Less: Accumulated

depreciation |

|

(993,427 |

) |

|

|

(835,424 |

) |

| Net property and equipment |

|

2,596,436 |

|

|

|

1,831,105 |

|

| |

|

|

|

|

|

|

|

| Right-of-use operating lease

assets |

|

4,420,053 |

|

|

|

‒ |

|

| Promissory note – noncurrent |

|

4,390,738 |

|

|

|

4,975,000 |

|

| Intangibles, net of accumulated

amortization |

|

5,738,457 |

|

|

|

6,002,998 |

|

| Goodwill |

|

4,877,739 |

|

|

|

4,877,739 |

|

| Other assets |

|

205,099 |

|

|

|

176,355 |

|

| |

|

|

|

|

|

|

|

| Total assets |

$ |

40,915,750 |

|

|

$ |

36,828,344 |

|

| |

|

|

|

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

4,188,259 |

|

|

$ |

4,730,537 |

|

|

Accrued expenses |

|

1,478,122 |

|

|

|

1,617,911 |

|

|

Deferred revenue |

|

290,977 |

|

|

|

97,478 |

|

|

Bank line of credit |

|

1,700,000 |

|

|

|

‒ |

|

|

Lease obligations – current |

|

1,403,288 |

|

|

|

‒ |

|

|

Other current liabilities |

|

‒ |

|

|

|

757,867 |

|

| Total current liabilities |

|

9,060,646 |

|

|

|

7,203,793 |

|

| |

|

|

|

|

|

|

|

|

Lease obligations – noncurrent |

|

3,923,221 |

|

|

|

‒ |

|

|

Other liabilities |

|

189,085 |

|

|

|

177,951 |

|

| Total liabilities |

|

13,172,952 |

|

|

|

7,381,744 |

|

| |

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

Common stock, $.01 par value; 30,000,000 shares authorized;

10,861,950 and 10,861,950 shares issued, respectively; 10,361,292

and 10,361,292 shares outstanding, respectively |

|

108,620 |

|

|

|

108,620 |

|

|

Paid in capital |

|

(4,363,213 |

) |

|

|

(4,377,103 |

) |

|

Retained earnings |

|

32,997,405 |

|

|

|

34,715,097 |

|

|

Total shareholders’ equity before treasury stock |

|

28,742,812 |

|

|

|

30,446,614 |

|

|

Less: Treasury stock, 500,658 shares, at cost |

|

(1,000,014 |

) |

|

|

(1,000,014 |

) |

| Total shareholders’ equity |

|

27,742,798 |

|

|

|

29,446,600 |

|

| |

|

|

|

|

|

|

|

| Total liabilities and

shareholders’ equity |

$ |

40,915,750 |

|

|

$ |

36,828,344 |

|

| |

|

|

|

|

|

|

|

See notes to unaudited consolidated condensed

financial statements.

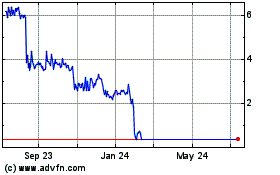

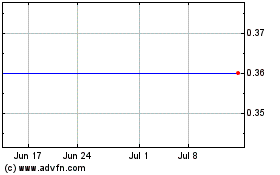

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Apr 2023 to Apr 2024