Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

October 23 2020 - 12:30PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-239967

PROSPECTUS SUPPLEMENT NO. 9

(to Prospectus dated July 29, 2020)

AdaptHealth

Corp.

Secondary

Offering of

2,545,455

shares of Class A Common Stock

This prospectus supplement

supplements the prospectus dated July 29, 2020 (the “Prospectus”), which forms a part of our registration statement

on Form S-1 (No. 333-239967). This prospectus supplement is being filed to update and supplement the information in the Prospectus

with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (the “Commission”)

on October 22, 2020 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and

this prospectus supplement relate to the offer and sale from time to time in one or more offerings by the selling securityholder

identified in the Prospectus of up to 2,545,455 shares of our Class A Common Stock issuable upon conversion of our Series B-1 Preferred

Stock issuable upon conversion of our Series B-2 Preferred Stock issued to Deerfield Partners, L.P. in a private placement on July

1, 2020.

Our Class A Common

Stock is listed on the Nasdaq Capital Market and trades under the symbol “AHCO”. On October 22, 2020, the closing price

of our Class A Common Stock was $26.45.

This prospectus supplement

should be read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement. This prospectus supplement

is qualified by reference to the Prospectus, except to the extent that the information in this prospectus supplement updates and

supersedes the information contained in the Prospectus.

This prospectus supplement

is not complete without, and may not be delivered or utilized except in connection with, the Prospectus.

__________________

See the section entitled “Risk

Factors” beginning on page 9 of the Prospectus and any similar section contained in any applicable prospectus supplement

to read about factors you should consider before buying our securities.

We are an “emerging growth company”

as defined in Section 2(a) of the Securities Act and are subject to reduced public company reporting requirements. We are also

a “smaller reporting company” as defined by Rule 12b-2 of the Exchange Act and are subject to reduced public company

reporting requirements. See “Risk Factors.”

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

__________________

The date of this prospectus supplement is

October 23, 2020

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

AdaptHealth

Corp.

(Exact

name of registrant as specified in its charter)

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of The

Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): October 16, 2020

|

Delaware

|

|

001-38399

|

|

82-3677704

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

220 West Germantown Pike, Suite 250

Plymouth

Meeting, PA

|

|

19462

|

|

(Address of principal executive offices)

|

|

(Zip

Code)

|

(610) 630-6357

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed

since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation

of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant

to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.0001 per share

|

|

AHCO

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01.

|

Entry Into A Material Definitive Agreement.

|

Amendment to Put/Call Option and

Consent Agreement

On

October 16, 2020, AdaptHealth Corp., a Delaware corporation (the “Company”), and AdaptHealth Holdings LLC, a

Delaware limited liability company (“AdaptHealth Holdings”), entered into an Amendment to the Put/Call Option and

Consent Agreement (the “Amendment”) with BlueMountain Foinaven Master Fund L.P., a Delaware limited partnership,

BMSB L.P., a Delaware limited partnership, BlueMountain Fursan Fund L.P., a Delaware limited partnership, and BlueMountain

Summit Opportunities Fund II (US) L.P., a Delaware limited partnership (collectively, the “Option Parties”), that

amends that certain Put/Call Option and Consent Agreement, dated May 25, 2020 (the “Put/Call Agreement”), by

and among the Company, AdaptHealth Holdings and the Option Parties, pursuant to which certain put and call rights were

granted to the parties with respect to shares of Class A Common Stock, par value $0.0001 per share, of the Company,

shares of Class B Common Stock, par value $0.0001 per share, of the Company and Common Units of AdaptHealth Holdings

held by the Option Parties.

Pursuant to the Amendment,

the Option Period (as defined in the Put/Call Agreement) was extended from October 31, 2020 to December 31, 2020.

The foregoing summary

of the Amendment is qualified in its entirety by the full text thereof, which is filed as Exhibit 10.1 hereto and incorporated

by reference herein.

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

|

The information provided

under the heading “Amendment to Put/Call Option and Consent Agreement” in Item 1.01 is incorporated by reference into

this Item 2.03.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirement of the Securities Exchange Act of

1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 22, 2020

|

|

ADAPTHEALTH CORP.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jason Clemens

|

|

|

|

Name: Jason Clemens

|

|

|

|

Title: Chief Financial Officer

|

|

|

|

|

Exhibit 10.1

AMENDMENT TO PUT/CALL OPTION AND CONSENT

AGREEMENT

This Amendment to Put/Call

Option and Consent Agreement (this “Amendment”) is dated as of October 16, 2020 (the “Amendment

Date”) by and among AdaptHealth Corp., a Delaware corporation (“Pubco”), AdaptHealth Holdings

LLC, a Delaware limited liability company (the “Company”), and the stockholders of Pubco or noteholders

of the Company, as applicable, listed on the signature pages hereto (each, a “Holder” and collectively,

the “Holders”). Pubco, the Company and the Holders are each referred to as a “Party”

and, collectively, they are sometimes referred to as the “Parties.”

WHEREAS,

the Parties are party to that certain Put/Call Option and Consent Agreement, dated as of May 25, 2020 (as amended or supplemented

prior to the date hereof, the “Agreement”); and

WHEREAS,

the Parties desire to amend the Agreement, pursuant to Section 7.3 of the Agreement, as set forth in this Amendment.

NOW,

THEREFORE, in consideration of the foregoing premises and other good and valuable consideration, the receipt and adequacy

of which are hereby acknowledged, the Parties agree as follows:

1. Amendments.

Sections 2.1 and 5.4(a) in the Agreement are each hereby amended to replace the reference to “October 31, 2020”

therein with “December 31, 2020”.

2. No

Additional Changes. Except as expressly and specifically amended by this Amendment, all

provisions of the Agreement shall remain in full force and effect in accordance with their terms. This Amendment is limited precisely

as written and shall not be deemed to be an amendment to any other term or condition of the Agreement or any of the documents referenced

therein. This Amendment shall form a part of the Agreement for all purposes, and each party thereto and hereto shall be bound hereby.

From and after the date hereof, all referenced in the Agreement to “this Agreement” shall mean the Agreement as amended

by this Amendment.

3. Capitalized

Terms. All capitalized terms not otherwise defined herein shall have the meanings ascribed to them in the Agreement.

4. Miscellaneous.

Article VII of the Agreement is hereby incorporated herein in its entirety, mutatis mutandis.

[signature page follows]

IN

WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first written above.

|

|

ADAPTHEALTH CORP.

|

|

|

|

|

|

By:

|

/s/ Luke McGee

|

|

|

Name: Luke McGee

|

|

|

Title: Chief Executive Officer

|

|

|

|

|

|

|

|

|

ADAPTHEALTH HOLDINGS LLC

|

|

|

|

|

|

By:

|

/s/ Luke McGee

|

|

|

Name: Luke McGee

|

|

|

Title: Chief Executive Officer

|

[Signature page to

Amendment to Put/Call Option and Consent Agreement]

|

|

BLUEMOUNTAIN FOINAVEN MASTER FUND L.P.

|

|

|

|

|

|

By:

|

/s/ Richard Horne

|

|

|

Name: Richard Horne

|

|

|

Title: Deputy General Counsel, Tax

|

|

|

|

|

|

|

|

|

BMSB L.P.

|

|

|

|

|

|

By:

|

/s/ Richard Horne

|

|

|

Name: Richard Horne

|

|

|

Title: Deputy General Counsel, Tax

|

|

|

|

|

|

|

|

|

BLUEMOUNTAIN FURSAN FUND L.P.

|

|

|

|

|

|

By:

|

/s/ Richard Horne

|

|

|

Name: Richard Horne

|

|

|

Title: Deputy General Counsel, Tax

|

|

|

|

|

|

|

|

|

BLUE MOUNTAIN SUMMIT OPPORTUNITIES FUND II (US) L.P.

|

|

|

|

|

|

By:

|

/s/ Richard Horne

|

|

|

Name: Richard Horne

|

|

|

Title: Deputy General Counsel, Tax

|

[Signature page to Amendment to

Put/Call Option and Consent Agreement]

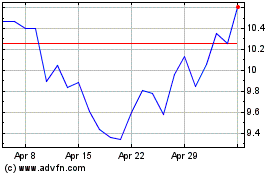

AdaptHealth (NASDAQ:AHCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

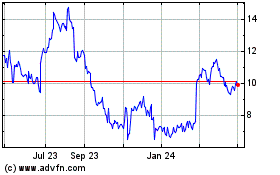

AdaptHealth (NASDAQ:AHCO)

Historical Stock Chart

From Apr 2023 to Apr 2024