Notice of Exempt Solicitation. Definitive Material. (px14a6g)

June 03 2020 - 3:50PM

Edgar (US Regulatory)

SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

NOTICE OF EXEMPT SOLICITATION (VOLUNTARY SUBMISSION)

NAME OF REGISTRANT: Activision Blizzard, Inc.

NAME OF PERSON RELYING ON EXEMPTION: CtW Investment Group

ADDRESS OF PERSON RELYING ON EXEMPTION: 1900 L Street, N.W., Washington, D.C. 20036

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934:

_____________________________________________________________________________________________________________________________________________________________________

At Activision Blizzard Inc.’s Annual Meeting on June 11, 2020, please vote AGAINST the “Say-On-Pay” proposal (Proposal 2).

· Leading proxy voting advisor Institutional Shareholder Services (“ISS”) has recommended a vote AGAINST the Management Say On Pay proposal for fiscal 2019. ISS, along with Glass Lewis, recommended against Activision Blizzard’s MSOP every year from 2012 to 2017.1

· Despite repeated low approval votes from shareholders, Activision Blizzard maintains multiple, overlapping opportunities for its CEO to earn outsize equity awards, even when performance-related vesting thresholds have not been met.

· Despite failing to disclose pertinent information on performance targets for its Short Term Incentive Plan, Activision Blizzard’s proxy statement reveals significant human capital management challenges.

The CtW Investment Group works with union-sponsored pension funds to enhance long-term stockholder value through active ownership. These funds have over $250 billion in assets under management and are substantial Activision Blizzard shareholders.

Activision Blizzard Finds Multiple Ways to Unnecessarily Enrich Its CEO

Over the past four years, Activision Blizzard CEO Robert Kotick has received over $20 million in combined stock/option equity per year.2 These equity grants have consistently been larger than the totalpay (the sum of base salary, annual bonus, and equity pay) of CEO peers at similar companies. Specifically, over the past four years, Kotick has received $96.5 million3cumulatively in combined stock/option awards alone. In just 2019, he received over $28 million in combined equity,4primarily consisting of options (over $20 million) that are substantially “in the money.” While equity grants that exceed the total pay of peer companies would be objectionable in most circumstances, it is of special concern in this case because Activision Blizzard employees face job insecurity following layoffs of 800 employees in 2019, and typically earn less than 1/3 of 1% of the CEO’s earnings, with some employees, such as Junior Developers, making less than $40,000 a year while living in high-cost areas such as southern California.5

Kotick’s employment agreement with Activision Blizzard contains multiple, overlapping award provisions. One such provision is the “Shareholder Value Creation Incentive” which allows most equity awards granted to Kotick in 2017, 2018 or 2019 that are outstanding to immediately vest at maximum performance (plus an accelerated payment within 120 days of any annual equity grants remaining to be made through 2021 also assuming maximum performance), if at any time prior to Dec. 31, 2021 the average closing price of Activision Blizzard’s shares exceeds two times the average closing price during

the 4th quarter of 2016 for 90 consecutive trading days (i.e. increasing from $39.98 to $79.96 per share). While doubling the company’s stock price is a laudable goal, the achievement does not justify such generous rewards. An equity award scheme that allows “multiple bites at the apple” for past unearned equity, as well as acceleration of equity that hasn’t yet vested, is antithetical to pay for performance.

1Proxy Insight Reports 2012-2019 (p. 1)

2ISS Proxy Analysis & Benchmark Policy Voting Recommendations Activision Blizzard 2020 (p. 15) & 2019 (p. 13)

5Business Insider, “People in the video game industry are rallying around the 800 employees laid off by Activision Blizzard,” February 15, 2019. https://www.businessinsider.com/activision-blizzard-layoffs-reaction-2019-2; Activision Blizzard DEF 14A filed April 24, 2020 pg. 83. CEO to median pay ratio 319:1.; https://www.glassdoor.com/Job/activision-blizzard-jobs-SRCH_KE0,19.htmdownloaded June 2, 2020.

Another problematic provision is the “Transformative Transaction” Awards, an incentive tied to merger-like transactions that result in increasing the company’s market capitalization for a sustained period of time, which allow Kotick to receive a special award between 100 and 150 percent of his 2021 long-term performance incentive grant value (approximately $7.5 to $15 million). Such incentives should be unnecessary: executives are already well compensated in the event of a merger or other strategic transaction without additional incentives because they typically hold large amounts of vested equity. Moreover, it is one of the CEO’s core responsibilities to pursue transactions that would be favorable and in the best interest of the company. There is no justification for providing an executive with additional incentives to pursue a merger or similar strategic transaction when that executive has already accumulated substantial holdings through equity grants.

Activision Blizzard’s annual cash incentive plan is also problematic. ISS points out that financial targets were set below the prior year's goal targets and actual results without a corresponding reduction in payout opportunities. Further, the strategic objectives portion of the plan, which comprises a significant portion of the total, was achieved below target. Disclosure surrounding the strategic objectives portion is severely lacking and merely cites “attracting, retaining and motivating top talent; cultivating new business opportunities and expanding existing ones; delivering production and development milestones; and increasing productivity.” We note that three of these objectives are clearly related to human capital management, and that Kotick’s apparent failure to achieve more than half of the targeted performance strongly suggests that Activision Blizzard’s skewed approach to human capital management – lavishing multi-million dollar rewards on the CEO as employees face layoffs – needs to be addressed before it manifests in deeper operational problems.

Therefore, we urge you to vote AGAINST the Management Say-On-Pay proposal (Proposal 2) at Activision Blizzard’s annual meeting on June 11, 2020.

Sincerely,

Dieter Waizenegger

Executive Director

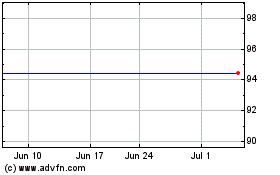

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

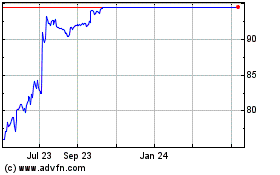

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Apr 2023 to Apr 2024