EA's Star Wars Game Helps Lift Sales, Profit -- Update

January 30 2020 - 6:03PM

Dow Jones News

By Sarah E. Needleman

Electronic Arts Inc.'s latest Star Wars game helped the company

deliver robust holiday-quarter results, though the publisher will

have a thin release slate this year as next-generation gaming

consoles are primed to hit the market.

EA said it earned $1.18 a share in its fiscal third quarter, up

from 86 cents a share a year earlier. Revenue rose 24% to $1.59

billion.

On an adjusted basis EA's profit rose to $2.52 a share while net

bookings climbed 23% to about $2 billion, with both figures coming

in slightly ahead of analysts' expectations.

EA's "Star Wars Jedi: Fallen Order" made its debut in November

and sold around eight million units during the quarter. The company

previously forecast selling between six million and eight million

units of the single-player game by March 31. It now projects sales

of around 10 million units by that date.

Analysts are also expecting strong quarterly results for

Take-Two Interactive Software Inc. and Activision Blizzard Inc.

based on viewership statistics from Amazon.com Inc.'s Twitch

streaming service, critics' reviews and company statements about

holiday-season releases. Both companies are scheduled to release

their quarterly reports on Feb. 6. Take-Two faces a somewhat

tougher comparison, though, because its 2018 holiday release, "Red

Dead Redemption II," was a smash hit that generated opening-weekend

sales of about $725 million.

Wavering interest in Epic Games Inc.'s megahit "Fortnite" also

likely helped the big publishers' performance during the holiday

season, analysts have said. In the fourth quarter, digital revenue

for "Fortnite" across platforms, including consoles, was down 70%

from the year-earlier period, according to estimates from Nielsen

Holdings PLC's SuperData.

Wall Street's earnings forecasts for later this year, though,

are more muted. And EA's shares fell in after-hours trading, as the

company's guidance for net bookings in the current quarter fell

short of analysts' forecasts.

EA doesn't have plans to release any games in this quarter or

next. The company has also said it would wait to release the next

installment of its "Battlefield" franchise until the 2021 holiday

season, when more people are likely to own new gaming consoles

coming to the market later this year from Microsoft Corp. and Sony

Corp. Usually the war series, one of the company's best-selling

properties, comes out every two years, so it had been expected to

be on tap for the 2020 holiday season instead.

"The publishers don't want to rush out their biggest hits before

people have had time to buy the new consoles," said Jefferies

analyst Alex Giaimo.

For now, EA has indicated that it plans to grow its business

this year by focusing on live services, which consists of revenue

from in-game purchases and subscriptions. The strategy reflects a

broader industry trend where game companies work to generate

revenue from hits long after their release.

Other game publishers also are likely to keep their release

slates light until after the new consoles hit store shelves.

Analysts expect companies to lean on annualized franchises like

"Call of Duty" and Take-Two's "NBA 2K" to drive results.

EA, Activision and Take-Two historically have dominated

game-industry sales with their blockbuster console games. But these

days such titles account for a shrinking slice of the overall

market as more people opt to play games on smartphones and tablets

-- platforms where the three publishers have a smaller

presence.

Global revenue from console games rose 7.3% last year to reach

$45.3 billion, according to gaming and esports research firm Newzoo

BV. Yet mobile games took in the largest chunk of the industry's

$148.8 billion world-wide revenue, accounting for $68.2 billion, or

46% of the total, Newzoo says. Console games accounted for just

under a third of that total.

Activision also hasn't announced any major games for 2020 aside

from "Call of Duty" and introducing new content within its "World

of Warcraft" game, though it has said a sequel to "Overwatch" and a

new "Diablo" action game are under development. Meanwhile, Take-Two

hasn't said whether it will release a marquee title for the 2020

holiday season.

Mr. Giaimo of Jefferies cautioned that it is possible the

companies will release a surprise hit akin to last year's "Apex

Legends," a popular, free combat game from EA that generates

revenue from in-game purchases. The company didn't promote the free

combat game ahead of its release, and its swift success caught

investors off guard.

Over the past 12 months through Thursday, shares in all three

companies are up between 24% and 31%, compared with a 23% rise in

the S&P 500 and a 29% gain in the tech-heavy Nasdaq Composite

Index.

Alex Perez, 44 years old, is waiting until publishers start

releasing games made for the new machines before adding any more

titles to his library. He doesn't care that Microsoft and Sony have

said their new consoles will be capable of playing older games.

"I want the full immersive experience," said Mr. Perez, an

elementary school principal in Long Beach, Calif., who intends to

buy the PlayStation 5 on launch day. "I'll hang tight."

Write to Sarah E. Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

January 30, 2020 17:48 ET (22:48 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

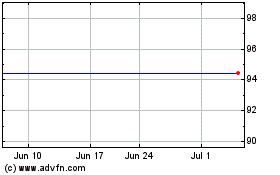

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

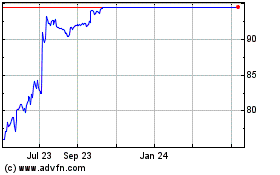

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Apr 2023 to Apr 2024