Activision Blizzard to Cut Jobs -- WSJ

February 13 2019 - 3:02AM

Dow Jones News

By Patrick Thomas and Sarah E. Needleman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 13, 2019).

Activision Blizzard Inc. said it plans to cut about 8% of its

workforce as it grapples with changes in how people buy and play

videogames.

The cuts will eliminate around 775 people from Activision

Blizzard's workforce of about 9,800. The company expects to record

$150 million in pretax charges in connection with the moves, most

of which will be incurred this year.

The job cuts underscore the tough environment videogame makers

face as players increasingly sink their time and money into only a

handful of games they can play in perpetuity -- the current king

being "Fortnite." The stakes are high: Players who aren't kept busy

in one game might take their time -- and money -- to a rival.

Activision Blizzard sounded that theme again Tuesday, telling

analysts it plans to add to its developer team to produce content

for existing franchises more quickly. As part of the restructuring,

Activision Blizzard plans to boost its number of developers by

about 20% in 2019 to ramp up new content for its biggest

franchises, such as the shooter game "Call of Duty".

Releasing new content has been a critical strategy for Epic

Games Inc., the maker of "Fortnite." While the combat game's

popular battle-royale mode is free, it is estimated to have made

$2.4 billion in revenue from virtual goods since launching in

September 2017, according to SuperData Research. Electronic Arts

Inc. on its earnings call last week blamed intense competition from

"Fortnite" and other games for turning in quarterly revenue below

guidance.

On Activision Blizzard's call, analysts asked whether the

company would consider making its shooter game "Overwatch" free,

particularly after Electronic Arts launched a free battle-royale

game last week called "Apex Legends." Operating chief Collister

Johnson demurred, saying the company prefers to focus on creating

compelling content.

Activision Blizzard's three main units -- Activision Publishing,

Blizzard Entertainment and King -- operate with some autonomy, and

the cuts are aimed at centralizing sales, marketing and other

functions with the parent company.

Shares rose 3.3% after hours, despite Activision Blizzard's

softer-than-expected guidance for 2019. The stock has lost more

than half its value since closing at $83.39 on Oct. 2, dragged

lower as part of the broad tech selloff in the fall, and hammered

again last week following earnings from rivals Electronic Arts and

Take-Two Interactive Software Inc.

Activision Blizzard reported profit of $650 million, or 84 cents

a share, compared with a loss of $584 million, or 77 cents a share,

a year earlier, when the company took a hit from the new U.S. tax

law. On an adjusted basis, Activision Blizzard earned 90 cents a

share, ahead of the 84 cents expected by analysts, according to

FactSet.

Revenue rose 17% to $2.38 billion. On an adjusted basis, revenue

came to $2.84 billion, below the $3.04 billion analysts

expected.

"We didn't execute as well as we hoped to in 2018," Chief

Executive Bobby Kotick told analysts, "and our current outlook for

2019 falls below what is possible in an industry filled with growth

opportunities."

For the full year, the company projected adjusted earnings of

$1.85 a share on $6.03 billion in revenue. Analysts had expected

$2.34 a share on $7.45 billion in revenue.

Exacerbating Activision Blizzard's woes is a thin slate of games

for the coming year. The company's Blizzard Entertainment unit

didn't announce release dates for any new games at its annual

convention in November.

"We're making changes to enable our development teams to create

better content for our biggest franchises more quickly," Mr. Kotick

told analysts. Activision Blizzard also plans to launch a new

city-based league for "Call of Duty," akin to its existing

"Overwatch" league.

In its latest quarter, the company said its number of monthly

active users rose about 11 million to 356 million after declining

for three consecutive quarters.

Separately, several top executives have left Activision Blizzard

in the past year, including Blizzard founder Mike Morhaime and the

unit's finance chief, Amrita Ahuja. The parent company fired its

finance chief, Spencer Neumann, in early January after he was

poached by Netflix Inc. for the same position.

On Tuesday the company said its board had approved a new program

to buy back up to $1.5 billion of its stock over the next two

years.

Write to Patrick Thomas at Patrick.Thomas@wsj.com and Sarah E.

Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

February 13, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

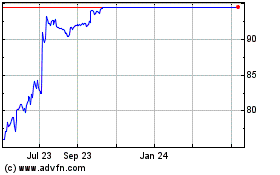

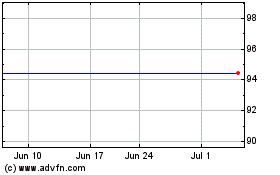

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Apr 2023 to Apr 2024