As filed with the Securities and Exchange

Commission on October 30, 2020

Registration

No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ACNB CORPORATION

(Exact name of Registrant as specified in its charter)

|

Pennsylvania

(State or other jurisdiction of

incorporation or organization)

|

23-2233457

(I.R.S. Employer

Identification Number)

|

16 Lincoln Square

Gettysburg, Pennsylvania

17325

(717) 334-3161

(Address, Including

Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

James P. Helt

President and

Chief Executive Officer

ACNB Corporation

16 Lincoln Square

Gettysburg, Pennsylvania

17325

(717) 334-3161

(Name, Address, Including

Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

With copies to:

Erik Gerhard, Esquire

Bybel Rutledge

LLP

1017 Mumma Road,

Suite 302

Lemoyne, Pennsylvania

17043

(717) 731-1700

Approximate date of commencement of proposed sale to the

public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are

being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are

to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities

offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant

to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to

Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

Non-accelerated filer ¨

|

Accelerated filer x

Smaller reporting company x

Emerging growth company ¨

|

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be

registered

|

Amount to be

registered(1)(2)

|

Proposed

maximum

offering price per

unit(1)(2)(3)

|

Proposed maximum

aggregate offering

price(1)(2)(3)

|

Amount of

registration fee(4)

|

|

Common Stock, $2.50 par value

|

|

|

|

|

|

Preferred Stock, $2.50 par value

|

|

|

|

|

|

Debt Securities (5)

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

Units

|

|

|

|

|

|

Total

|

$100,000,000

|

$100,000,000

|

$100,000,000

|

$10,910.00

|

|

|

(1)

|

An unspecified aggregate initial offering price and number of securities of each identified class is being registered as may

from time to time be offered at unspecified prices. Also includes an indeterminate number of shares of voting common stock, preferred

stock, warrants, and units, and such indeterminate principal amount of senior debt securities and subordinated debt securities

as may be issued by the Registrant upon exercise, conversion or exchange of any securities that provide for such issuance, or that

may from time to time become issuable by reason of any stock split, stock dividend or similar transaction, for which no separate

consideration will be received by Registrant. In no event will the aggregate offering price of all types of securities issued by

the Registrant pursuant to this registration statement exceed $100,000,000. Any securities registered hereunder may be sold separately

or together with other securities registered hereunder.

|

|

|

(2)

|

Pursuant to General Instruction II.D of Form S-3, information as to each class of securities to be registered is not specified.

|

|

|

(3)

|

Estimated for the sole purpose of computing the registration fee pursuant to Rule 457(o) under the Securities Act

of 1933, and exclusive of accrued interest and dividends, if any.

|

|

|

(4)

|

Calculated pursuant to Rule 457(o) under the Securities Act, based on the maximum aggregate offering price of all

securities registered hereunder.

|

|

|

(5)

|

Debt Securities may be offered hereunder in one or more series of senior or subordinated debt securities.

|

The Registrant hereby amends this Registration Statement

on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities

and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and is not a solicitation

of an offer to buy these securities in any state or other jurisdiction where the offer or the sale is not permitted.

Subject to completion, dated

October 30, 2020

PROSPECTUS

$100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may offer and sell, from time to time,

in one or more offerings, any combination of the securities described in this prospectus. The total aggregate amount of securities

offered by us under this prospectus will not exceed $100,000,000. We may offer these securities separately or together, in separate

series or classes and in amounts, at prices and on terms described in one or more prospectus supplements. The debt securities,

preferred stock, warrants and units may be convertible or exercisable or exchangeable for debt or equity securities of the Company.

This prospectus provides a general description

of the securities we may offer. Each time we sell securities, we will provide the specific terms of the securities offered in a

supplement to this prospectus. This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

The prospectus supplement and any related free writing prospectus may also add, update, or change information contained in this

prospectus. Please read this prospectus, the applicable prospectus supplement, and any free writing prospectus, as well as any

documents incorporated by reference in this prospectus or any prospectus supplement, carefully before you invest in any of our

securities.

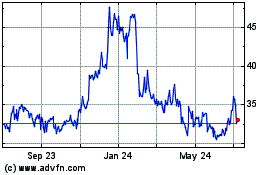

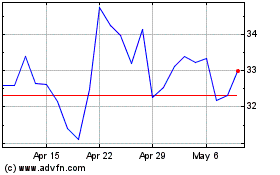

Our common stock is quoted on The

Nasdaq Capital Market under the symbol “ACNB.” On October 29, 2020, the closing price of our common stock

was $21.59 per share. You are urged to obtain current market prices of our common stock. Each prospectus supplement will

indicate if the other securities that may be offered thereby will be listed on any securities exchange.

Investing in our securities

involves risk. You should carefully review and consider the risks and uncertainties described under the heading “Risk

Factors” beginning on page 4 of this prospectus and set forth in the documents incorporated by reference into this

prospectus and the applicable prospectus supplement or free writing prospectus before making any decision to invest in our

securities.

Neither the Securities and Exchange Commission

nor any state securities commission or any other regulatory body has approved or disapproved of these securities or determined

that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

These securities are not savings accounts,

deposits, or obligations of any bank and are not insured by the Federal Deposit Insurance Corporation or any other government agency.

The date of this prospectus is ________,

2020.

Table

of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed with the United States Securities and Exchange Commission (the “SEC”) using a “shelf”

registration process. Under this process, we may offer and sell, from time to time, in one or more offerings, the securities described

in this prospectus with a total aggregate principal amount or initial purchase amount of $100,000,000. This prospectus only provides

a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that

will contain specific information about the terms of each offering.

We may also authorize one or more free writing

prospectuses to be provided to you that may contain material information relating to a specific offering. The applicable prospectus

supplement (and any related free writing prospectus that we may authorize to be provided to you) may also add, update or change

information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus. If there

is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the

information in the prospectus supplement. This prospectus does not contain all of the information set forth in the registration

statement and the exhibits to the registration statement. You should carefully read this prospectus and the applicable prospectus

supplement and any related free writing prospectus together with additional information from the sources described in “Where

You Can Find More Information” and “Incorporation of Certain Documents by Reference” in this prospectus. You

should not assume that the information in this prospectus, the prospectus supplements, any free writing prospectus or any document

incorporated by reference is accurate as of any date other than the date of the applicable document.

You should rely only on the information

provided or incorporated by reference in this prospectus, any free writing prospectus and any prospectus supplement, if applicable.

We have not authorized anyone to provide you with different information.

References to “we,” “us,”

“our,” “ACNB” or the “Company” refer to ACNB Corporation and its directly or indirectly owned

subsidiaries, unless the context otherwise requires. The term “you” refers to a prospective investor.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

INFORMATION

This prospectus, any accompanying

prospectus supplement or free writing prospectus and the documents incorporated by reference herein or therein may contain

forward-looking statements within the meaning and protections of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), and are intended to be covered by the safe harbor provisions for forward-looking statements in

the Private Securities Litigation Reform Act of 1995. We are including this statement for the purpose of invoking those safe

harbor provisions. Examples of forward-looking statements include, but are not limited to, (a) projections or statements

regarding future earnings, expenses, net interest income, other income, earnings or loss per share, asset mix and quality,

growth prospects, capital structure, and other financial terms, (b) statements of plans and objectives of management or

the board of directors, and (c) statements of assumptions, such as economic conditions in the Company’s market

areas. Such forward-looking statements can be identified by the use of forward-looking terminology such as

“believes”, “expects”, “may”, “intends”, “will”,

“should”, “anticipates”, or the negative of any of the foregoing or other variations thereon or

comparable terminology, or by discussion of strategy. Forward-looking statements are subject to certain risks and

uncertainties such as local economic conditions, competitive factors, and regulatory limitations. Actual results may differ

materially from those projected in the forward-looking statements. Such risks, uncertainties and other factors that could

cause actual results and experience to differ from those projected include, but are not limited to, the following:

|

|

·

|

the effects of governmental and fiscal policies, as well as legislative and regulatory changes;

|

|

|

·

|

the effects of new laws and regulations, specifically the impact of the Coronavirus Aid, Relief, and Economic Recovery Act,

the Tax Cuts and Jobs Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act;

|

|

|

·

|

impacts of the capital and liquidity requirements of the Basel III standards;

|

|

|

·

|

the effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Financial

Accounting Standards Board and other accounting standard setters;

|

|

|

·

|

ineffectiveness of the business strategy due to changes in current or future market conditions;

|

|

|

·

|

future actions or inactions of the United States government, including the effects of short- and long-term federal budget and

tax negotiations and a failure to increase the government debt limit or a prolonged shutdown of the federal government;

|

|

|

·

|

the effects of economic conditions particularly with regard to the negative impact of severe, wide-ranging and continuing disruptions

caused by the spread of Coronavirus Disease 2019 (COVID-19) and responses thereto on current customers and the operation of the

Company, specifically the effect of the economy on loan customers’ ability to repay loans;

|

|

|

·

|

the effects of competition, and of changes in laws and regulations on competition, including industry consolidation and development

of competing financial products and services;

|

|

|

·

|

the risks of changes in interest rates on the level and composition of deposits, loan demand, and the values of loan collateral,

securities, and interest rate protection agreements, as well as interest rate risks;

|

|

|

·

|

difficulties in acquisitions and integrating and operating acquired business operations, including information technology difficulties;

|

|

|

·

|

challenges in establishing and maintaining operations in new markets;

|

|

|

·

|

the effects of technology changes;

|

|

|

·

|

volatilities in the securities markets;

|

|

|

·

|

the effect of general economic conditions and more specifically in the Company’s

market areas;

|

|

|

·

|

the failure of assumptions underlying the establishment of reserves for loan losses and estimations of values of collateral

and various financial assets and liabilities;

|

|

|

·

|

acts of war, terrorism, or civil unrest;

|

|

|

·

|

disruption of credit and equity markets;

|

|

|

·

|

the ability to manage current levels of impaired assets;

|

|

|

·

|

the loss of certain key officers;

|

|

|

·

|

the ability to maintain the value and image of the Company’s brand and protect the Company’s intellectual property

rights;

|

|

|

·

|

continued relationships with major customers; and,

|

|

|

·

|

potential impacts to the Company from continually evolving cybersecurity and other technological risks and attacks, including

additional costs, reputational damage, regulatory penalties, and financial losses.

|

Because forward-looking statements are subject

to risks and uncertainties, actual results may differ materially from those expressed or implied by these statements. The foregoing

list of important factors is not exclusive, and you are cautioned not to place undue reliance on these statements. These statements

speak only as of the date of this document or, if made in any document incorporated by reference, as of the date of that document.

We do not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by or

on our behalf.

THE COMPANY

ACNB Corporation, headquartered in Gettysburg,

Pennsylvania, is the financial holding company for the wholly-owned subsidiaries of ACNB Bank, Gettysburg, Pennsylvania, and Russell

Insurance Group, Inc., Westminster, Maryland. Our principal executive offices are located at 16 Lincoln Square, Gettysburg,

PA 17325, telephone number 717-334-3161.

Originally founded in 1857, ACNB Bank serves

its marketplace with banking and wealth management services, including trust and retail brokerage, via a network of community banking

offices located in the four southcentral Pennsylvania counties of Adams, Cumberland, Franklin and York, as well as loan offices

in Lancaster and York, Pennsylvania, and Hunt Valley, Maryland. NWSB Bank, a division of ACNB Bank, serves the local marketplace

with a network of community banking offices located in Carroll County, Maryland. FCB Bank, A Division of ACNB Bank, serves the

local marketplace with a network of community banking offices located in Frederick County, Maryland.

We maintain a website at https://investor.acnb.com.

The information on our website is not incorporated into this prospectus, any prospectus supplement or any free writing prospectus.

RISK FACTORS

An investment in our securities involves

risks. Prior to making a decision about investing in our securities, you should carefully read and consider the risks, uncertainties,

and assumptions discussed in our most recent annual report on Form 10-K as supplemented by our quarterly reports on Form 10-Q

and other reports we file with the SEC from time to time, each of which is incorporated herein by reference, and those specific

risk factors that may be included in the applicable prospectus supplement, together with all of the other information presented

in this prospectus, any prospectus supplement and the documents we incorporate by reference. The risks and uncertainties we have

described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem

immaterial may also affect our business and operations. The occurrence of any of these known or unknown risks might cause you to

lose all or part of your investment in the offered securities.

USE OF PROCEEDS

Unless otherwise set forth in a prospectus

supplement, we intend to use the net proceeds from the sale of any securities offered by us for general corporate purposes. General

corporate purposes may include, among other purposes, contribution to the capital of ACNB Bank to support its lending and investing

activities; funding acquisitions of other institutions or branches, if opportunities for such transactions become available; repurchase

of our capital stock; redemption of outstanding debt securities or preferred stock; and other activities that are permitted for

financial holding companies.

SECURITIES WE MAY OFFER

The securities that may be offered from

time to time through this prospectus are:

|

|

·

|

preferred stock, which we may issue in one or more series;

|

|

|

·

|

debt securities, which we may issue in one or more series;

|

|

|

·

|

warrants entitling the holders to purchase common stock or debt securities; and,

|

|

|

·

|

units consisting of two or more of the above referenced securities.

|

We will describe in a prospectus supplement

that we will deliver with this prospectus, the terms of particular securities that we may offer in the future. This prospectus

may not be used to offer or sell any securities unless accompanied by a prospectus supplement. In each prospectus supplement

we will include, if relevant and material, the following information:

|

|

·

|

type and amount of securities which we propose to sell;

|

|

|

·

|

initial public offering price of the securities;

|

|

|

·

|

original issue discount, if any;

|

|

|

·

|

rates and times of payment of interest, dividends, or other payments, if any;

|

|

|

·

|

redemption, conversion, exercise, exchange, settlement, or sinking fund terms, if any;

|

|

|

·

|

ranking as to priority of payment upon liquidation or right to payment of dividends;

|

|

|

·

|

voting or other rights, if any;

|

|

|

·

|

conversion, exchange or settlement prices or rates, if any, and, if applicable, any provisions for changes to or adjustments

in the conversion, exchange, or settlement prices or rates and in the securities or other property receivable upon conversion,

exchange, or settlement;

|

|

|

·

|

names of the underwriters, agents, or dealers, if any, through or to which we or any selling securityholder will offer and

sell the securities;

|

|

|

·

|

compensation, if any, of those underwriters, agents or dealers;

|

|

|

·

|

details regarding over-allotment options, if any;

|

|

|

·

|

information about any securities exchange or alternative trading system on which the securities will be listed or traded;

|

|

|

·

|

material United States federal income tax considerations applicable to the securities;

|

|

|

·

|

any material risk factors associated with the securities; and,

|

|

|

·

|

any other material information about the offer and sale of the securities.

|

In addition, the applicable prospectus supplement

and any related free writing prospectus may add, update, or change the information contained in this prospectus or in the documents

we have incorporated by reference.

DESCRIPTION OF COMMON STOCK

The following is a description of our common

stock, certain provisions of our articles of incorporation and bylaws and certain provisions of applicable law. The following is

qualified by applicable law and by the provisions of our articles of incorporation and bylaws, copies of which have been filed

with the SEC and are also available upon request from us. You should read the prospectus supplement, which will contain additional

information and which may update or change some of the information below.

General. Our articles of incorporation

provide that we may issue up to 20,000,000 shares of common stock, par value $2.50 per share.

Voting Rights. The holders

of our common stock possess exclusive voting rights. Common shareholders elect our board of directors and act on such other matters

as are required to be presented to them under Pennsylvania law, applicable SEC rules, the rules promulgated by The Nasdaq

Stock Market or our articles of incorporation and bylaws or as are otherwise presented to them by the board of directors. Each

holder of our common stock is entitled to one vote per share and does not have any right to cumulative voting in the election of

directors. At any meeting of the shareholders, the holders of a majority of our outstanding stock then having voting rights, present

in person or by proxy, shall constitute a quorum for all purposes. If a quorum exists, action on a matter (other than the election

of directors) by a voting group is approved if the votes cast within the voting group favoring the action exceeds the votes cast

opposing the action, unless otherwise provided by the Company’s articles of incorporation or bylaws. Certain matters require

the affirmative vote of the holders of at least 75% of the outstanding shares of our common stock.

Dividend Rights. Subject to

the rights that the Company may confer on any series of outstanding preferred stock and all other classes of stock at the time

outstanding having prior rights as to dividends, the holders of common stock are entitled to receive ratably such dividends, if

any, as may be declared from time to time by the board of directors, subject to certain prohibitions on our ability to pay dividends

under Pennsylvania corporate law.

In addition, as a financial holding company,

any dividends paid by us are subject to various federal and state regulatory limitations and also may be subject to the ability

of ACNB Bank to make distributions or pay dividends to us. ACNB Bank is also subject to various legal, regulatory and other restrictions

on its ability to pay dividends and make other distributions and payments to us. Our ability to pay dividends is limited by minimum

capital and other requirements prescribed by law and regulation. Furthermore, we are generally prohibited under Pennsylvania corporate

law from making a distribution to our shareholders to the extent that, at the time of the distribution, after giving effect to

the distribution, we would not be able to pay our debts as they become due in the usual course of business or our total assets

would be less than the sum of our total liabilities plus (unless the articles of incorporation permits otherwise) the amount that

would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution

of any shareholders who may have preferential rights superior to those receiving the distribution. In addition, financing arrangements

that we may enter into in the future may include restrictive covenants that may limit our ability to pay dividends.

Rights Upon Liquidation. In

the event of our liquidation, dissolution or winding up, the holders of our common stock would be entitled to receive, after payment

or provision for payment of all our debts and liabilities and after we have paid, or set aside for payment to, the holders of any

stock having a liquidation preference over the common stock, all of our assets available for distribution. In the event of any

liquidation, dissolution or winding up of ACNB Bank, we, as a holder of ACNB Bank’s capital stock, would be entitled to receive,

after payment or provision for payment of all debts and liabilities of the Bank (including all deposit accounts and accrued interest

thereon), all assets of the Bank available for distribution.

Other Rights. The holders

of our common stock have no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund

provisions applicable to the common stock. The rights, preferences, and privileges of holders of our common stock are subject to,

and may be adversely affected by, the rights of holders of our preferred stock.

Shareholder Liability. All

outstanding shares of our common stock are fully paid and nonassessable. Under the Pennsylvania Business Corporation Law of 1988,

as amended, shareholders generally are not personally liable for a corporation’s acts or debts.

The Nasdaq Capital

Market. Our common stock is quoted on The Nasdaq Capital Market under the symbol “ACNB.” On

October 29, 2020, the closing price of our common stock was $21.59 per share.

Anti-Takeover Articles of Incorporation

and Bylaw Provisions. Our articles of incorporation and bylaws contain a number of provisions relating to corporate governance

and rights of shareholders that might discourage future takeover attempts. As a result, shareholders who might desire to participate

in such transactions may not have an opportunity to do so. In addition, these provisions may also render the removal of our board

of directors or management more difficult. Among other things, these provisions:

|

|

·

|

Require that 75% of the outstanding shares of our common stock approve a merger, consolidation, liquidation, or dissolution

of the Company, which has not received prior board approval;

|

|

|

·

|

Empower our board of directors, without shareholder approval, to issue one or more series of preferred stock the terms of which,

including voting power, are set by our board of directors;

|

|

|

·

|

Divide our board of directors into three classes serving staggered three-year terms;

|

|

|

·

|

Require that shares with at least 75% of total voting power approve the repeal or amendment of certain provisions of our articles

of incorporation;

|

|

|

·

|

Require advance notice of nominations for the election of directors and the presentation of shareholder proposals at meetings

of shareholders;

|

|

|

·

|

Restrict the ability of shareholders to call special meetings;

|

|

|

·

|

Eliminate cumulative voting in the election of directors; and,

|

|

|

·

|

Permit the board to consider pertinent issues when opposing a tender, or other offer, for ACNB’s securities.

|

DESCRIPTION OF PREFERRED STOCK

The following outlines the general provisions

of the shares of preferred stock, $2.50 par value per share, which we may issue from time to time and in one or more series. The

complete terms of the preferred stock will be contained in the prospectus supplement and in the applicable certificate of designation

creating one or more series of preferred stock that may be adopted by our board of directors in the future. You should read the

applicable certificate of designation and the prospectus supplement, which will contain additional information and which may update

or modify some of the information below.

General. Our articles of incorporation

provide that we may issue up to 20,000,000 shares of preferred stock, par value $2.50 per share.

Our board of directors has the authority,

without shareholder consent, subject to certain limitations imposed by Pennsylvania law, to issue preferred stock from time to

time in one or more series and to establish the number of shares to be included in each such series, and to fix the voting rights,

preferences, limitations and special rights, if any, of the shares of each such series and the qualifications or restrictions

thereof. These rights, preferences and restrictions will be fixed by a statement with respect to shares relating to each particular

series. As of the date of this prospectus, we have no shares of preferred stock issued and outstanding.

The issuance of preferred stock may have

the effect of delaying, deferring or preventing a change in control of ACNB without further action by the shareholders and may

adversely affect the voting and other rights of the holders of common stock. The authority of the board of directors with respect

to each such series of preferred stock includes, among others:

|

|

·

|

the number of shares constituting the series and the distinctive designation thereof;

|

|

|

·

|

preferential cumulative or noncumulative dividend rights;

|

|

|

·

|

conversion or exchange rights;

|

|

|

·

|

preferential liquidation, dissolution or winding up rights;

|

|

|

·

|

general or specific voting rights;

|

|

|

·

|

generally to fix the other rights and privileges and any qualifications, limitations or restrictions of such rights and privileges

of such series; and,

|

|

|

·

|

whether the preferred stock will be perpetual or of limited duration.

|

We may issue shares of, or rights to purchase shares of, one

or more series of our preferred stock that have been designated from time to time, the terms of which might:

|

|

·

|

adversely affect

the voting or other rights evidenced by, or amounts otherwise payable with respect to,

the common stock or other series of preferred stock;

|

|

|

·

|

discourage

an unsolicited proposal to acquire us; or,

|

|

|

·

|

facilitate

a particular business combination involving us.

|

Terms Contained in the Prospectus

Supplement. The applicable prospectus supplement may contain the dividend, voting, conversion, redemption, sinking fund,

liquidation and other designations, preferences, qualifications, limitations, restrictions and special or relative rights granted

to or imposed upon any series of preferred stock. The applicable prospectus supplement may describe the following terms of a series

of preferred stock:

|

|

·

|

the designation

of preferred stock and the number of shares of preferred stock offered;

|

|

|

·

|

the initial

public offering price at which we will issue the preferred stock;

|

|

|

·

|

whether the

shares will be listed on any securities exchange;

|

|

|

·

|

the dividend

rate or method of calculation, the payment dates for dividends and the dates from which

dividends will start to accrue;

|

|

|

·

|

whether upon

non-payment, the unpaid dividends accumulate or are non-cumulative;

|

|

|

·

|

any redemption

or sinking fund provisions;

|

|

|

·

|

the amount

of liquidation preference per share;

|

|

|

·

|

any additional

dividend, voting, conversion, redemption, sinking fund, liquidation and other rights

or restrictions; and,

|

|

|

·

|

whether the

preferred stock will be listed on a national securities exchange or alternative trading

system.

|

The applicable prospectus supplement may

also describe some of the U.S. federal income tax consequences of the purchase and ownership of the series of preferred stock.

DESCRIPTION OF DEBT SECURITIES

We may issue senior debt securities or

subordinated debt securities. Senior debt securities will be issued under an indenture, referred to as the “senior indenture,”

between us and a senior indenture trustee to be named in the applicable prospectus supplement. Subordinated debt securities will

be issued under a separate indenture, referred to as the “subordinated indenture,” between us and a subordinated indenture

trustee to be named in the applicable prospectus supplement. The senior indenture and the subordinated indenture are sometimes

collectively referred to in this prospectus as the “indentures.” The indentures will be subject to, and governed by,

the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”). A copy of the form of each of these indentures

is included as an exhibit to the registration statement of which this prospectus is a part.

The following briefly describes the general

terms and provisions of the debt securities which may be offered by us and the indentures governing them. The particular terms

of the debt securities offered, and the extent, if any, to which these general provisions may apply to the debt securities so

offered, will be described in more detail in the applicable prospectus supplement relating to those securities. The following

descriptions of the indentures are not complete and are subject to, and are qualified in their entirety by reference to, all the

provisions of the respective indentures.

General Terms of Debt Securities.

The indentures permit us to issue the debt securities from time to time, without limitation as to aggregate principal

amount, and in one or more series. The indentures also do not limit or otherwise restrict the amount of other indebtedness which

we may incur or other securities which we or our subsidiaries may issue, including indebtedness which may rank senior to the debt

securities. Nothing in the subordinated indenture prohibits the issuance of securities representing subordinated indebtedness

that is senior or junior to the subordinated debt securities.

Unless we give you different

information in the prospectus supplement, the senior debt securities will be unsecured and unsubordinated obligations and

will rank equally with all of our other unsecured and unsubordinated senior indebtedness. Payments on the subordinated debt

securities will be subordinated to the prior payment in full of all of our senior debt, as described under “Description of Debt Securities ¾Subordination” of this prospectus and in the applicable prospectus supplement.

With respect to any debt securities that

we issue, we will describe in each prospectus supplement the following terms relating to a series of debt securities:

|

|

·

|

the title of

the debt security;

|

|

|

·

|

the principal

amount being offered, and if a series, the total amount authorized and the total amount

outstanding;

|

|

|

·

|

any limit on

the amount that may be issued;

|

|

|

·

|

whether or

not we will issue the series of debt securities in global form, and if so, the terms

and conditions relating thereto and identification of the depository;

|

|

|

·

|

the principal

amount due at maturity;

|

|

|

·

|

whether and

under what circumstances, if any, we will pay additional amounts on any debt securities

held by a person who is not a United States person for tax purposes, and whether we can

redeem the debt securities if we have to pay such additional amounts;

|

|

|

·

|

whether repayment

will be guaranteed and the terms of such guaranty, if any, and the identity of the guarantor;

|

|

|

·

|

the annual

interest rate, which may be fixed or variable, or the method for determining the rate

and the date interest will begin to accrue, the dates interest will be payable and the

regular record dates for interest payment dates or the method for determining such dates;

|

|

|

·

|

whether, upon

non-payment, the interest accumulates or is non-cumulative;

|

|

|

·

|

whether or

not the debt securities will be convertible into shares of our common stock, preferred

stock, other indebtedness, or warrants and, if so, the terms of such conversion;

|

|

|

·

|

whether or

not the debt securities will be secured or unsecured by some or all of our assets, and

the terms of any secured debt;

|

|

|

·

|

the terms of

the subordination of any series of subordinated debt;

|

|

|

·

|

the place where

interest payments will be payable;

|

|

|

·

|

restrictions

on transfer, sale, or other assignment, if any;

|

|

|

·

|

our right,

if any, to defer payment or interest and the maximum length of any such deferral period;

|

|

|

·

|

the date, if

any, after which and the conditions upon which, and the price at which, we may, at our

option, redeem the series of debt securities pursuant to any optional or provisional

redemption provisions and the terms of those redemption provisions;

|

|

|

·

|

the date, if

any, on which, and the price at which we are obligated, pursuant to any mandatory sinking

fund or analogous fund provisions or otherwise, to redeem, or at the holder’s option

to purchase, the series of debt securities and the currency or currency unit in which

such purchase or redemption is payable;

|

|

|

·

|

whether the

indenture will restrict our ability to pay dividends, or will require us to maintain

any asset ratios, reserves, or other specified financial metrics;

|

|

|

·

|

whether we

will be restricted from incurring any additional indebtedness, issuing additional securities,

or entering into a merger, consolidation, or sale of our business;

|

|

|

·

|

a discussion

of any material or special United States federal income tax considerations applicable

to the debt securities;

|

|

|

·

|

information

describing any book-entry features;

|

|

|

·

|

any provisions

for payment of additional amounts for taxes;

|

|

|

·

|

whether the

debt securities are to be offered at a price such that they will be deemed to be offered

at an “original issue discount” as defined in paragraph (a) of Section 1273

of the Internal Revenue Code of 1986, as amended;

|

|

|

·

|

the denominations

in which we will issue the series of debt securities, if other than denominations of

$1,000 and any integral multiple thereof;

|

|

|

·

|

whether we

and/or the indenture trustee may change an indenture without the consent of any holders;

|

|

|

·

|

the form of

debt security and how it may be exchanged and transferred;

|

|

|

·

|

description

of the indenture trustee and paying agent, and the method of payments; and,

|

|

|

·

|

any other specified

terms, preferences, rights or limitations of, or restrictions on, the debt securities

and any terms that may be required by us or advisable under applicable laws or regulations.

|

Terms of Indenture. We summarize

below the material terms of the form of indenture or indicate which material terms will be described in the applicable prospectus

supplement. The indenture:

|

|

·

|

does not limit

the amount of debt securities that we may issue;

|

|

|

·

|

allows us to

issue debt securities in one or more series;

|

|

|

·

|

does not require

us to issue all of the debt securities of a series at the same time;

|

|

|

·

|

allows us to

reopen a series to issue additional debt securities without the consent of the holders

of the debt securities of such series; and,

|

|

|

·

|

provides that

the debt securities will be unsecured, except as may be set forth in the applicable prospectus

supplement.

|

Ranking of Debt Securities; Holding

Company Structure. Payment of the principal of, premium, if any, and interest on senior debt securities will rank on a

parity with all of our other unsecured and unsubordinated senior debt.

Payment of the principal of, premium, if

any, and interest on subordinated debt securities will be junior in right of payment to the prior payment in full of all of our

senior debt securities. We will state in the applicable prospectus supplement relating to any subordinated debt securities the

subordination terms of the securities as well as the aggregate amount of outstanding debt, as of the most recent practicable date,

that by its terms would be senior to those subordinated debt securities. As of June 30, 2020, the Company had no outstanding

debt that by its terms would be senior to any subordinated debt securities that may be issued under the subordinated indenture.

The indentures do not limit the issuance of additional senior debt.

As of September 30, 2020, the Company had

outstanding $6,186,000 principal amount of Junior Subordinated Debt Securities due December 15, 2036 and $5,155,000 principal

amount of Junior Subordinated Debt Securities due June 23, 2035.

The debt securities will be our exclusive

obligations. We are a financial holding company and substantially all of our consolidated assets are held by our subsidiary, ACNB

Bank. Accordingly, our cash flows and our ability to service our debt, including the debt securities, are dependent upon the results

of operations of ACNB Bank and the distribution of funds by ACNB Bank to us. Various statutory and regulatory restrictions, however,

limit directly or indirectly the amount of dividends ACNB Bank can pay, and also restrict ACNB Bank from making investments in

or loans to us.

Because we are a financial holding company,

the debt securities will be effectively subordinated to all existing and future liabilities, including indebtedness, customer

deposits, trade payables, guarantees and lease obligations, of ACNB Bank. Therefore, our rights and the rights of our creditors,

including the holders of the debt securities, to participate in the assets of any subsidiary upon that subsidiary’s liquidation

or reorganization will be subject to the prior claims of the subsidiary’s creditors and, if applicable, its depositors,

except to the extent that we may ourselves be a creditor with recognized claims against the subsidiary, in which case our claims

would still be effectively subordinate to any security interest in, or mortgages or other liens on, the assets of ACNB Bank and

would be subordinate to any indebtedness of ACNB Bank senior to that held by us. If a receiver or conservator were appointed for

ACNB Bank, the Federal Deposit Insurance Act recognizes a priority in favor of the holders of withdrawable deposits (including

the FDIC as subrogee or transferee) over general creditors. Claims for customer deposits would have a priority over any claims

that we may ourselves have as a creditor of ACNB Bank. The indentures do not limit the amount of indebtedness or other liabilities

that we and ACNB Bank may incur.

Subordination. The subordinated

debt securities will be subordinated in right of payment to all “senior indebtedness,” as defined in the subordinated

indenture. In certain circumstances relating to our liquidation, dissolution, receivership, reorganization, insolvency or similar

proceedings:

|

|

·

|

the holders

of all senior indebtedness will first be entitled to receive payment of principal and

accrued but unpaid interest before the holders of the subordinated debt securities will

be entitled to receive any payment of principal or accrued but unpaid interest on the

subordinated debt securities; and,

|

|

|

·

|

until the senior

indebtedness is paid in full, any distributions to which the holders of subordinated

debt would be entitled shall be made to holders of senior indebtedness, except that holders

of subordinated debt may receive securities that are subordinated to senior indebtedness.

|

In addition, we may make no payment on

the subordinated debt securities in the event that any default occurs with respect to any senior indebtedness permitting the holders

of the senior indebtedness to accelerate the maturity of the senior indebtedness, if either of the following occur:

|

|

·

|

notice of such

default has been given to the Company and to the indenture trustee, provided that judicial

proceedings shall be commenced in respect of such default within 180 days in the case

of a default in payment of principal or interest and within 90 days in the case of any

other default after the giving of such notice, and provided further that only one such

notice shall be given in any twelve-month period; or,

|

|

|

·

|

judicial proceedings

are pending in respect of such default.

|

By reason of this subordination in favor

of the holders of senior indebtedness, in the event of our insolvency, our creditors who are not holders of senior indebtedness

or the subordinated debt securities may recover less, proportionately, than holders of senior indebtedness and may recover more

proportionately, than holders of the subordinated debt securities.

Unless otherwise specified in the prospectus

supplement relating to the particular series of subordinated debt securities, “senior indebtedness” includes (i) the

principal and any premium or interest for money borrowed or purchased by the Company; (ii) the principal and any premium

or interest for money borrowed or purchased by another person and guaranteed by the Company; (iii) any deferred obligation

for the payment of the purchase price of property or assets evidenced by a note or similar instrument or agreement; (iv) an

obligation arising from direct credit substitutes; and (v) any obligation associated with derivative products such as interest

and foreign exchange rate contracts, commodity contracts and similar arrangements; in each case, whether outstanding on the date

the subordinated indenture becomes effective, or created, assumed or incurred after that date. Senior indebtedness excludes any

indebtedness that: (a) expressly states that it is junior to, or ranks equally in right of payment with, the subordinated

debt securities; or (b) is identified as junior to, or equal in right of payment with, the subordinated debt securities in

any board resolution or in any supplemental indenture.

The subordinated indenture does not limit

or prohibit the incurrence of additional senior indebtedness, which may include indebtedness that is senior to the subordinated

debt securities, but subordinate to our other obligations. Any prospectus supplement relating to a particular series of subordinated

debt securities will set forth the aggregate amount of our indebtedness senior to the subordinated debt securities as of the most

recent practicable date.

The prospectus supplement may further describe

the provisions, if any, which may apply to the subordination of the subordinated debt securities of a particular series.

Conversion or Exchange Rights. Our

debt securities may be convertible into or exchangeable for shares of our common stock, shares of our preferred stock (which may

be represented by depositary shares), other indebtedness of the Company, or warrants for our common stock, preferred stock or

debt securities of the Company. If our debt securities are convertible into or exchangeable for other securities, the terms of

conversion or exchange will be stated in the applicable prospectus supplement. The terms will include the following:

|

|

·

|

the initial

conversion or exchange price, rate or ratio;

|

|

|

·

|

the conversion

or exchange period;

|

|

|

·

|

the manner

in which such conversion or exchange shall be affected;

|

|

|

·

|

applicable

adjustments, if any; and,

|

|

|

·

|

any other provision

in addition to or in lieu of those described in the indentures.

|

The securities into which our debt securities

are convertible or exchangeable are limited to those registered with the SEC on the registration statement of which this prospectus

is a part.

Absence of Limitation on Indebtedness.

The indentures do not limit the amount of indebtedness, guarantees or other liabilities that we and our subsidiaries may

incur and will not prohibit us or our subsidiaries from creating or assuming liens on our properties, including the capital stock

of our subsidiaries.

Events of Default. Unless

otherwise indicated in the applicable prospectus supplement, if an event of default (other than default due to bankruptcy or insolvency)

occurs and is continuing for any series of senior or subordinated debt securities, the indenture trustee or the holders of not

less than 25% in principal amount of the outstanding senior or subordinated debt securities of that series may declare the principal

of all senior or subordinated debt securities of that series, or any lesser amount provided for in the indenture relating to the

senior or subordinated debt securities of that series, to be immediately due and payable. Upon any such declaration, the principal

or lesser amount, together with any accrued and unpaid interest, will become immediately due and payable.

Unless otherwise indicated in the applicable

prospectus supplement, if an event of default due to bankruptcy or insolvency occurs, then the principal amount of all senior

or subordinated debt securities of that series, together with any accrued and unpaid interest, will become immediately due and

payable, without any declaration or other action on the part of the indenture trustee or any holder of such senior or subordinated

debt securities.

At any time after a declaration of acceleration

with respect to any series of senior or subordinated debt securities has been made and before a judgment or decree for payment

of the money due has been obtained by the applicable indenture trustee, the holders of at least a majority in principal amount

of the outstanding debt securities of that series may rescind and annul the declaration of acceleration and its consequences,

provided that all payments due, other than those due as a result of acceleration, have been made and all events of default have

been cured or waived.

The holders of at least a majority in principal

amount of any series of outstanding debt securities may waive any past default with respect to that series, except a default:

|

|

·

|

in the payment

of principal and any premium or interest on or additional amounts payable in respect

of any debt security of that series; or,

|

|

|

·

|

in respect

of a covenant or provision which cannot be modified or amended without the consent of

the holder of each outstanding debt security of the series of debt securities affected.

|

The holders of a majority in principal

amount of the outstanding debt securities of a series may direct the time, method, and place of conducting any proceeding for

any remedy available to the applicable indenture trustee or exercising any trust or power conferred on the indenture trustee with

respect to debt securities of that series, provided that (1) such direction is not in conflict with any rule of law

or the applicable indenture, (2) the trustee may take any other action it deems proper which is not inconsistent with such

direction, and (3) such direction is not unduly prejudicial to the rights of the other holders of the series of debt securities.

The trustee is under no obligation to exercise any of the rights or powers vested in it at the direction of the holders unless

the holders have offered security or indemnity to the trustee against the costs, expenses, and liabilities which it might incur

in complying with such request or direction.

A holder of any debt security of any series

will have the right to institute a proceeding with respect to the applicable indenture or for any remedy under the indenture,

if:

|

|

·

|

the holder

has previously given written notice to the trustee of a continuing event of default;

|

|

|

·

|

the holders

of at least 25% in principal amount of the outstanding debt securities of the series

have made written request to the trustee to institute proceedings in respect of such

event of default in its own name as trustee;

|

|

|

·

|

such holder

or holders have offered indemnity reasonably satisfactory to the trustee against the

costs, expenses and liabilities to be incurred in compliance with such request;

|

|

|

·

|

the trustee

for 60 days after its receipt of such notice, request and offer of indemnity has failed

to institute any such proceeding; and,

|

|

|

·

|

no direction

inconsistent with such written request has been given to the trustee during such 60-day

period by the holders of a majority in principal amount of the outstanding debt securities

of such series.

|

However, the holder of any debt security

has the right to receive payment of the principal of (and premium, if any) and interest on, and any additional amount in respect

of, such debt security and to institute suit for the enforcement of any such payment.

The Company is required to deliver an annual

statement to the trustee as to the performance of the Company’s obligations under the indentures and as to any default in

that performance of which we are aware. We are also required to notify the trustee of any event which, after notice or lapse of

time or both, would become an event of default within five days after the occurrence of such event.

Governing Law. Unless indicated

otherwise in the applicable prospectus supplement, the indentures and the debt securities will be governed by, and construed in

accordance with, the laws of the State of New York.

DESCRIPTION OF WARRANTS

The complete terms of the warrants will

be contained in the applicable warrant agreement and warrant. These documents have been or will be included or incorporated by

reference as exhibits to the registration statement of which this prospectus is a part. You should read the warrant and warrant

agreement. You should also read any prospectus supplement applicable to the issuance of warrants, which will contain additional

information and which may update or change some of the information below.

We may issue warrants for the purchase

of common stock, preferred stock and/or debt securities in one or more series. If we offer warrants, we will describe the terms

in a prospectus supplement and any free writing prospectus. Warrants may be offered independently, together with other securities

offered by any prospectus supplement, or through a dividend or other distribution to shareholders and may be attached to, or separate

from, other securities. Warrants may be issued under a written warrant agreement to be entered into between us and the holder

or beneficial owner, or under a written warrant agreement with a warrant agent specified in a prospectus supplement. A warrant

agent would act solely as our agent in connection with the warrants of a particular series and would not assume any obligation

or relationship of agency or trust for or with any holders or beneficial owners of those warrants.

The following are some of the terms relating

to a series of warrants that could be described in a prospectus supplement:

|

|

·

|

aggregate number

of warrants;

|

|

|

·

|

price or prices

at which the warrants will be issued;

|

|

|

·

|

designation,

number, aggregate principal amount, denominations and terms of the securities that may

be purchased on exercise of the warrants;

|

|

|

·

|

date, if any,

on and after which the warrants and the common stock or debt securities offered for purchase

or exchange by the warrants, if any, will be separately transferable;

|

|

|

·

|

purchase price

for each security purchasable on exercise of the warrants;

|

|

|

·

|

dates on which

the right to purchase certain securities upon exercise of the warrants will begin and

end;

|

|

|

·

|

minimum or

maximum number of securities that may be purchased at any one time upon exercise of the

warrants;

|

|

|

·

|

anti-dilution

provisions or other adjustments to the exercise price of the warrants;

|

|

|

·

|

terms of any

right that we may have to redeem the warrants;

|

|

|

·

|

effect of any

merger, consolidation, sale or other transfer of our business on the warrants and the

applicable warrant agreement;

|

|

|

·

|

name and address

of the warrant agent, if any;

|

|

|

·

|

information

with respect to book-entry procedures;

|

|

|

·

|

a discussion

of material U.S. federal income tax considerations;

|

|

|

·

|

other material

terms, including terms relating to transferability, exchange, exercise, cancellation

or amendments of the warrants; and,

|

|

|

·

|

whether the

warrants will be listed on a national securities exchange or alternative trading system.

|

Until any warrants to purchase our securities

are exercised, holders of the warrants will not have any rights of holders of the securities into which they may be exercised.

DESCRIPTION OF UNITS

The complete terms of the units will be

contained in the unit agreement and any related document applicable to any units. These documents have been or will be included

or incorporated by reference as exhibits to the registration statement of which this prospectus is a part. You should read the

unit agreement and any related document. You should also read the prospectus supplement, which will contain additional information

and which may update or change some of the information below.

We may issue units, in one or more series,

consisting of common stock, preferred stock, debt securities and/or warrants for the purchase of common stock, preferred stock

and/or debt securities in any combination. If we offer units, we will describe the terms in a prospectus supplement and any free

writing prospectus. Units may be issued under a written unit agreement to be entered into between us and the holder or beneficial

owner, or we could issue units under a written unit agreement with a unit agent specified in a prospectus supplement. A unit agent

would act solely as our agent in connection with the units of a particular series and would not assume any obligation or relationship

of agency or trust for or with any holders or beneficial owners of those units.

Each unit will be issued so that the holder

of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations

of a holder of each included security.

The following are some of the unit terms

that could be described in a prospectus supplement:

|

|

·

|

aggregate number

of units;

|

|

|

·

|

price or prices

at which the units will be issued;

|

|

|

·

|

designation

and terms of the units and of the securities comprising the units, including whether

and under what circumstances those securities may be held or transferred separately;

|

|

|

·

|

effect of any

merger, consolidation, sale or other transfer of our business on the units and the applicable

unit agreement;

|

|

|

·

|

name and address

of the unit agent;

|

|

|

·

|

information

with respect to book-entry procedures;

|

|

|

·

|

a discussion

of material U.S. federal income tax considerations; and,

|

|

|

·

|

other material

terms, including terms relating to transferability, exchange, exercise or amendments

of the units.

|

The provisions described in this section,

as well as those described under “Description of Common Stock,” “Description of Preferred Stock,” “Description

of Debt Securities” and “Description of Warrants” will apply to each unit and to any common stock, preferred

stock, debt security or warrant included in each unit, respectively.

Unless otherwise provided in the applicable

prospectus supplement, the unit agreements will be governed by the laws of the Commonwealth of Pennsylvania. The unit agreement

under which a unit is issued may provide that the securities included in the unit may not be held or transferred separately, at

any time or at any time before a specified date. We will file as an exhibit to a filing with the SEC that is incorporated by reference

into this prospectus the forms of the unit agreements containing the terms of the units being offered. The description of units

in any prospectus supplement will not necessarily describe all of the terms of the units in detail. You should read the applicable

unit agreements for a complete description of all of the terms.

PLAN OF DISTRIBUTION

We may sell the securities from time to

time pursuant to public offerings, negotiated transactions, block trades or a combination of these methods. We may sell the securities

to or through an underwriter or group of underwriters managed or co-managed by one or more underwriters, or to or through dealers,

through agents, directly to one or more investors or through a combination of such methods of sale.

We may distribute securities from time

to time in one or more transactions:

|

|

·

|

at a fixed

price or prices which may be changed;

|

|

|

·

|

at market prices

prevailing at the time of sale;

|

|

|

·

|

at prices related

to such prevailing market prices; or,

|

Each time we sell securities we will file

a prospectus supplement will describe the method of distribution of the securities and any applicable restrictions.

The prospectus supplement or supplements

will describe the terms of the offering of the securities, including:

|

|

·

|

the name or

names of the underwriters, placement agents or dealers, if any;

|

|

|

·

|

the purchase

price of the securities and the amount of proceeds we will receive from the sale;

|

|

|

·

|

any over-allotment

options under which underwriters may purchase additional securities from us;

|

|

|

·

|

any agency

fees or underwriting discounts and other items constituting agents’ or underwriters’

compensation;

|

|

|

·

|

any discounts

or concessions allowed or reallowed to be paid to dealers (which may be changed at any

time); and,

|

|

|

·

|

any national

securities exchange or alternative trading system on which the securities may be listed

or quoted.

|

Unless stated otherwise in the applicable

prospectus supplement, the obligations of any underwriter to purchase securities will be subject to certain conditions set forth

in the applicable underwriting agreement, and generally the underwriters will be obligated to purchase all of the securities if

they purchase any of the securities. If underwriters are used in the sale of any securities, the securities will be acquired by

the underwriters for their own account and may be resold from time to time in one or more transactions described above. The securities

may be either offered to the public through underwriting syndicates represented by managing underwriters, or directly by underwriters.

Generally, the underwriters’ obligations to purchase the securities will be subject to certain conditions precedent. If

a dealer is used in a sale, we may sell the securities to the dealer as principal. The dealer may then resell the securities to

the public at varying prices to be determined by the dealer at the time of resale.

We or our agents may solicit offers to

purchase securities from time to time. Unless stated otherwise in the applicable prospectus supplement, any agent will be acting

on a best efforts basis for the period of its appointment.

In connection with the sale of securities,

underwriters or agents may receive compensation (in the form of fees, discounts, concessions or commissions) from us or from purchasers

of securities for whom they may act as agents. Underwriters may sell securities to or through dealers, and such dealers may receive

compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers

for whom they may act as agents. Underwriters, dealers and agents that participate in the distribution of securities may be deemed

to be “underwriters,” as that term is defined in the Securities Act, and any discounts or commissions received by

them from us and any profits on the resale of the securities by them may be deemed to be underwriting discounts and commissions

under the Securities Act. We will identify any such underwriter or agent, and we will describe any compensation we may pay to

them, in the related prospectus supplement.

Underwriters, dealers and agents may be

entitled under agreements with us to indemnification against, and contribution toward, certain civil liabilities, including liabilities

under the Securities Act, or contribution with respect to payments that the underwriters, dealers or agents may make with respect

to these liabilities.

If stated in the applicable prospectus

supplement, we may authorize underwriters, dealers or agents to solicit offers by certain investors to purchase securities from

us at the public offering price set forth in the prospectus supplement under delayed delivery contracts providing for payment

and delivery on a specified date in the future. These contracts will be subject only to those conditions set forth in the applicable

prospectus supplement and the applicable prospectus supplement will set forth the commission payable for solicitation of these

contracts.

The securities we may offer, other than

common stock, will be new issues of securities with no established trading market. No assurance can be given as to the liquidity

of the trading market for any of our securities. Any underwriter may make a market in these securities; however, no underwriter

will be obligated to do so, and any underwriter may discontinue any market making activity at any time, without prior notice.

Any underwriter may engage in over-allotment,

stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation M under the Exchange Act.

Over-allotment involves sales in excess of the offering size, which create a short position. Stabilizing transactions permit bids

to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum price. Syndicate-covering

or other short-covering transactions involve purchases of the securities, either through exercise of the over-allotment option

or in the open market after the distribution is completed, to cover short positions. Penalty bids permit the underwriters to reclaim

a selling concession from a dealer when the securities originally sold by the dealer are purchased in a stabilizing or covering

transaction to cover short positions. Those activities may cause the price of the securities to be higher than it would otherwise

be. If commenced, the underwriters may discontinue any of these activities at any time.

Any underwriters who are qualified market

makers on Nasdaq (or any exchange or quotation system on which our securities are listed) may engage in passive market making

transactions in our common stock, preferred stock, debt securities and warrants, as applicable, on Nasdaq in accordance with Rule 103

of Regulation M of the Exchange Act, during the business day prior to the pricing of the offering, before the commencement of

offers or sales of the securities. Passive market makers must comply with applicable volume and price limitations and must be

identified as passive market makers. In general, a passive market maker must display its bid at a price not in excess of the highest

independent bid for such security; if all independent bids are lowered below the passive market maker’s bid, however, the

passive market maker’s bid must then be lowered when certain purchase limits are exceeded. Passive market making may stabilize

the market price of the securities at a level above that which might otherwise prevail in the open market and, if commenced, may

be discontinued at any time.

Certain of the underwriters or agents and

their associates may engage in transactions with and perform services for us or our affiliates in the ordinary course of their

respective businesses.

LEGAL MATTERS

Unless otherwise indicated in the applicable

prospectus supplement, the validity of the securities offered hereby will be passed upon by Bybel Rutledge LLP, Lemoyne, Pennsylvania.

If the validity of the securities offered hereby in connection with offerings made pursuant to this prospectus are passed upon

by counsel for underwriters, dealers or agents, if any, such counsel will be named in the prospectus supplement related to such

offering.

EXPERTS

The consolidated financial statements