Filed by Acies Acquisition

Corp.

Pursuant to Rule 425

under the Securities Act of 1933

And deemed filed pursuant

to Rule 14a-12

Of the Securities Exchange

Act of 1934

Subject Company: PLAYSTUDIOS

Inc.

Commission File No.

001-39652

Date: February 1, 2021

MGM-Backed Playstudios Agrees to $1.1 Billion

SPAC Deal

Yahoo

By: Christopher Palmeri and Gillian Tan

February 1, 2021

(Bloomberg) -- Playstudios Inc., an

online game operator backed by casino giant MGM Resorts International, is going public via a $1.1 billion merger with a special

purpose acquisition company.

The Las Vegas-based business, which

offers free-to-play online blackjack and slot-machine games, said Monday it’s combining with Acies Acquisition Corp., a shell

company founded last year. Acies’s chairman is Jim Murren, former chief executive officer of MGM. Bloomberg News reported

on talks between the parties last week.

Playstudios’ founder and CEO,

Andrew Pascal, will continue in that role with the new company. Playstudios shareholders will receive $150 million in cash and

own about 64% of the shares of the new entity.

Institutional investors are putting

$250 million into the business. Those investors include BlackRock Inc., Neuberger Berman Funds and MGM Resorts, which offers perks

like free rooms to Playstudios players to build loyalty. MGM will own about 10% after its additional investment.

As with most social online games, customers

can opt to purchase an in-game currency to continue playing and reach higher levels. Playstudios’ twist is that they simultaneous

earn points in the company’s own loyalty program, which can be traded in for real-world prizes like tickets to shows or discounted

meals.

The company plans to release a prerecorded

investor presentation on Tuesday at 8:30 a.m. New York time.

In an interview, Pascal, 55, said he’ll

use the money raised through offering to grow the business.

“We’ll now have the currency

and capital to go acquire other companies and games,” he said.

(Updates with comments from CEO starting

in seventh paragraph.)

IMPORTANT LEGAL INFORMATION

Additional Information and Where to Find It

This communication relates to a proposed transaction between

PLAYSTUDIOS Inc. (“PLAYSTUDIOS”) and Acies Acquisition Corp. (“Acies”). This communication

does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. Acies intends to file a registration statement on Form S-4

with the U.S. Securities and Exchange Commission (the “SEC”), which will include a document that serves as a

prospectus and proxy statement of Acies, referred to as a proxy statement / prospectus. A proxy statement / prospectus will be

sent to all Acies shareholders. Acies also will file other documents regarding the proposed transaction with the SEC. Before making

any voting decision, investors and security holders of Acies are urged to read the registration statement, the proxy statement

/ prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction

as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies

of the registration statement, the proxy statement / prospectus and all other relevant documents filed or that will be filed with

the SEC by Acies through the website maintained by the SEC at www.sec.gov.

The documents filed by Acies with the SEC also may be obtained

free of charge at Acies’ website at https://aciesacq.com/sec-filings/ or upon written request to 1219 Morningside Drive,

Suite 110 Manhattan Beach, California 90266.

Participants in Solicitation

Acies and PLAYSTUDIOS and their respective directors and executive

officers may be deemed to be participants in the solicitation of proxies from Acies’ shareholders in connection with the

proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in

the business combination will be contained in the proxy statement / prospectus when available. You may obtain free copies of these

documents as described in the preceding paragraph.

Forward-Looking Statements Legend

This communication contains certain forward-looking statements

within the meaning of the federal securities laws with respect to the proposed transaction between PLAYSTUDIOS and Acies. These

forward-looking statements generally are identified by the words “forecast,” “believe,” “budget,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,”

“future,” “opportunity,” “plan,” “may,” “should,” “will,”

“would,” “will be,” “will continue,” “will likely result,” and similar expressions.

Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations

and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ

materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction

may not be completed in a timely manner or at all, which may adversely affect the price of Acies’ securities, (ii) the risk

that the transaction may not be completed by Acies’ business combination deadline and the potential failure to obtain an

extension of the business combination deadline if sought by Acies, (iii) the failure to satisfy the conditions to the consummation

of the transaction, including the approval of the related merger agreement by the shareholders of Acies, the satisfaction of the

minimum trust account amount following any redemptions by Acies’ public shareholders and the receipt of certain governmental

and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction,

(v) the inability to complete the related PIPE investment, (vi) the occurrence of any event, change or other circumstance that

could give rise to the termination of the related merger agreement, (vii) the effect of the announcement or pendency of the transaction

on PLAYSTUDIOS’ business relationships, operating results and business generally, (viii) risks that the proposed transaction

disrupts current plans and operations of PLAYSTUDIOS, (ix) the outcome of any legal proceedings that may be instituted against

PLAYSTUDIOS or against Acies related to the related merger agreement or the proposed transaction, (x) the ability to maintain

the listing of Acies’ securities on a national securities exchange, (xi) changes in the competitive and regulated industries

in which PLAYSTUDIOS operates, variations in operating performance across competitors, changes in laws and regulations affecting

PLAYSTUDIOS’ business and changes in the combined capital structure, (xii) the ability to implement business plans, forecasts,

and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xiii)

PLAYSTUDIOS’ ability to raise financing in the future, (xiv) the impact of COVID-19 on PLAYSTUDIOS’ business and/or

the ability of the parties to complete the proposed transaction, (xv) costs related to the transaction and the failure to realize

anticipated benefits of the transaction or to realize any financial projections or estimated pro forma results and the related

underlying assumptions, including with respect to estimated Acies shareholder redemptions, and (xvi) other risks and uncertainties

indicated from time to time in the registration statement containing the proxy statement / prospectus discussed below relating

to the proposed business combination, including those under “Risk Factors” therein, and in Acies’ other filings

with the SEC. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other

risks and uncertainties described in the “Risk Factors” section of Acies’ registration on Form S-1 (File No.

333-249297) and on the registration statement on Form S-4 to be filed by Acies with the SEC, and other documents filed by Acies

from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual

events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak

only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and PLAYSTUDIOS

and Acies assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of

new information, future events or otherwise. Neither PLAYSTUDIOS nor Acies gives any assurance that either PLAYSTUDIOS or Acies,

or the combined company, will achieve its expectations.

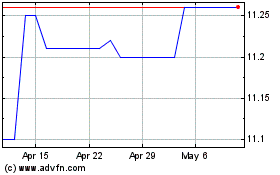

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

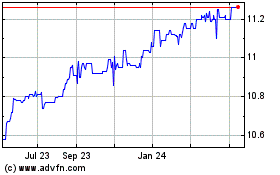

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Apr 2023 to Apr 2024