Six in Ten U.S. Adults are Concerned with Data Security at Fuel Pumps and Convenience Stores

April 15 2019 - 8:00AM

Business Wire

Despite safety of digital wallets, only seven

percent of Americans prefer to use a mobile app for payments

Over six in ten (62%) U.S. adults are concerned with the

security of their financial data when paying at fuel pumps and

convenience stores, according to an online survey of 1,270 adults

by YouGov and ACI Worldwide (NASDAQ: ACIW), a leading global

provider of real-time electronic payment and

banking solutions. The study, which surveyed shopping and

payment habits of Americans at grocery stores and fuel and

convenience stores, also noted that few respondents (7%) prefer to

pay with a mobile app at fuel and convenience stores. Yet, of those

who have used a mobile app (10%), four in five (83%) are satisfied

with their experience – in terms of speed and convenience.

“Skimming devices at gas pumps are frequently used to steal

consumers’ financial data, hence the high level of concern with

data security at gas pumps,” said Benny Tadele, vice president,

Merchant Solutions, ACI Worldwide. “However, few consumers are

aware that digital wallet payments are not only faster and easier,

but they are generally more secure than traditional methods of

payment.”

Other key findings and trends

include:

Fuel & Convenience

- Mobile & Digital Payments

- When it comes to digital payments at

the gas pump and/or convenience stores, 62 percent of respondents

are concerned with the security of their financial data and 52

percent with the privacy of financial data

- Baby Boomers (70%) are more concerned

about the security of their financial data than the younger

generations

- Payment experience:

- When it comes to the purchasing

experience at fuel and convenience stores, more respondents (36%)

are only ‘somewhat satisfied’ compared to those who are very

satisfied (27%) with their overall payment experience, and 21

percent are neither satisfied nor dissatisfied

- More Baby Boomers (69%) are satisfied

with their payment experience at gas pumps than the younger

generations

- When asked which method of payment is

preferred at fuel and convenience stores, 55 percent prefer

credit/debit card and 21 percent prefer cash

- Regionally, Northeast respondents

prefer credit/debit card the least (47%) compared to the Midwest

(64%), the West (56%) and the South (52%)

- In addition, the Northeast prefers cash

the most (26%) compared to the Midwest (18%), the West (22%) and

the South (21%)

Grocery Store

- Digital Payments

- 86 percent of grocery shoppers say the

store they most often visit offers a standard cashier as a payment

option, and 60 percent shop at stores that offer

self-checkout/unmanned kiosk as a payment option.

- Only 19 percent of respondents shop at

stores that offer a digital wallet payment option and 18 percent

shop at stores that offer a self-managed mobile app or scanning

option for checkout

- Shopping Experience:

- Nearly nine in 10 (87%) Americans

grocery shop in-store, while 14 percent order online with home

delivery, and 12 percent order online with in-store pick up

- Fewer Millennials (79%) than Gen Xers

(86%) say they shop in-store; in contrast, Millennials are more

likely than Gen Xers to order online and pick up in-store (17% and

13% respectively)

- While ‘better prices’ was the most

common item grocery shoppers said would improve their shopping

experience, faster checkout/payment process (39%) and more checkout

lanes/kiosk options (39%) were tied for second

- More Millennials (43%) than Gen Xers

(39%) and Baby Boomers (37%) desire a fast checkout/payment

process

“As Gen Z continues to gain purchasing power, retailers and

merchants need to consider offering digital wallet payments as an

option or be left out,” Tadele continued. “By addressing security

through tokenization, point-to-point encryption and fraud

prevention and detection tools, merchants are increasing consumers’

confidence in using these convenient channels of payment.”

MethodologyAll figures, unless otherwise stated, are from

YouGov Plc. Total sample size was 1,270 adults. Fieldwork was

undertaken between March 12-13, 2019. The survey was carried out

online. The figures have been weighted and are representative of

all US adults (aged 18+). Generations were defined as follows:

Millennial (born 1982-1999, 343 total), Gen X (born 1965-1981, 350

total), and Baby Boomer (born 1946-1964, 439 total).

About ACI WorldwideACI Worldwide, the Universal

Payments (UP) company, powers electronic

payments for more than 5,100 organizations around the world.

More than 1,000 of the largest financial institutions and

intermediaries, as well as thousands of global

merchants, rely on ACI to execute $14 trillion each day in

payments and securities. In addition, myriad organizations utilize

our electronic bill presentment and payment services.

Through our comprehensive suite of software solutions delivered on

customers’ premises or through ACI’s private cloud, we provide

real-time, immediate payments capabilities and enable the

industry’s most complete omni-channel

payments experience. To learn more about ACI, please

visit www.aciworldwide.com. You can also find us on

Twitter @ACI_Worldwide.

© Copyright ACI Worldwide, Inc. 2019ACI, ACI Worldwide, the ACI

logo, ACI Universal Payments, UP, the UP logo and all ACI

product/solution names are trademarks or registered trademarks of

ACI Worldwide, Inc., or one of its subsidiaries, in the United

States, other countries or both. Other parties' trademarks

referenced are the property of their respective owners.

Product roadmaps are for informational purposes only and may not

be incorporated into a contract or agreement. The development

release and timing of future product releases remains at ACI’s sole

discretion. ACI is providing the following information in

accordance with ACI's standard product communication policies. Any

resulting features, functionality, and enhancements or timing of

release of such features, functionality, and enhancements are at

the sole discretion of ACI and may be modified without notice. All

product roadmap or other similar information does not represent a

commitment to deliver any material, code, or functionality, and

should not be relied upon in making a purchasing decision.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190415005418/en/

Dan RingE-mail: dan.ring@aciworldwide.comPhone:

781-370-3600Nidhi AlbertiE-mail:

nidhi.alberti@aciworldwide.comPhone: 781-370-3600

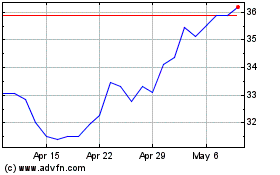

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Mar 2024 to Apr 2024

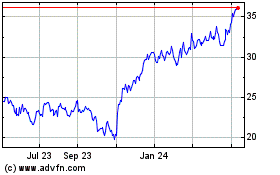

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Apr 2023 to Apr 2024