ACI Worldwide & Western Union Announce Early Termination of HSR Waiting Period in Connection with Proposed Acquisition of Spe...

March 27 2019 - 8:00AM

Business Wire

ACI Worldwide (NASDAQ: ACIW), a leading global provider of

real-time electronic payment and banking solutions, and

The Western Union Company (NYSE: WU), a global leader in

cross-border, cross-currency money movement, today announced that

the Federal Trade Commission has granted early termination of the

waiting period under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976 with respect to ACI’s previously announced acquisition

of Speedpay, Western Union’s United States bill pay business. This

satisfies one of the closing conditions. The transaction is

expected to close as early as possible in the second quarter of

2019, subject to the satisfaction or waiver of other customary

closing conditions.

About ACI Worldwide

ACI Worldwide, the Universal Payments (UP) company, powers

electronic payments for more than 5,100 organizations around the

world. More than 1,000 of the largest financial institutions and

intermediaries, as well as thousands of global merchants, rely on

ACI to execute $14 trillion each day in payments and securities. In

addition, myriad organizations utilize our electronic bill

presentment and payment services. Through our comprehensive suite

of software solutions delivered on customers’ premises or through

ACI’s private cloud, we provide real-time, immediate payments

capabilities and enable the industry’s most complete omni-channel

payments experience. To learn more about ACI, please visit

www.aciworldwide.com. You can also

find us on Twitter @ACI_Worldwide.

About Western Union

The Western Union Company is a global leader in cross-border,

cross-currency money movement. Our omnichannel platform connects

the digital and physical worlds and makes it possible for consumers

and businesses to send and receive money and make payments with

speed, ease, and reliability. As of December 31, 2018, our network

included over 550,000 retail agent locations offering Western

Union, Vigo or Orlandi Valuta branded services in more than 200

countries and territories, with the capability to send money to

billions of accounts. Additionally, westernunion.com, our fastest

growing channel in 2018, is available in more than 60 countries,

plus additional territories, to move money around the world. In

2018, we moved over $300 billion in principal in nearly 130

currencies and processed 34 transactions every second across all

our services. With our global reach, Western Union moves money for

better, connecting family, friends and businesses to enable

financial inclusion and support economic growth. For more

information, visit www.westernunion.com.

Forward-Looking

Statements

This press release contains forward-looking statements based on

current expectations that involve a number of risks and

uncertainties. Generally, forward-looking statements do not relate

strictly to historical or current facts and may include words or

phrases such as “believes,” “will,” “expects,” “anticipates,”

“intends,” and words and phrases of similar impact. The

forward-looking statements are made pursuant to safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

The foregoing forward-looking statements are expressly qualified by

the risk factors discussed in the companies’ SEC filings. For a

detailed discussion of these risk factors, parties that are relying

on the forward-looking statements should review ACI’s or Western

Union’s filings, including their most recently filed Annual Reports

on Form 10-K.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190327005290/en/

ACI Media Relations:Dan Ring+1 (781)

370-3600dan.ring@aciworldwide.comACI Investor Relations:John

Kraft+1 (239) 403-4627John.kraft@aciworldwide.comWestern Union

Media Relations:Claire Treacy+1 (720)

332-0652claire.treacy@westernunion.comWestern Union Investor

Relations:Mike Salop+1(720)

332-8276mike.salop@westernunion.com

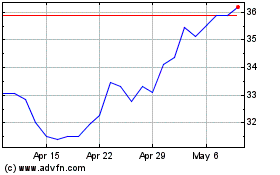

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Mar 2024 to Apr 2024

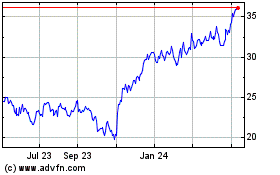

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Apr 2023 to Apr 2024