More Baby Boomers Prefer Digital Tax Refunds Compared to Millennials

March 04 2020 - 8:00AM

Business Wire

Majority of Americans prefer digital methods of

payment for taxes owed including debit, credit and electronic funds

withdrawal, according to a new ACI Worldwide study

Although a majority of U.S. adults (74%) opt for direct deposit

when receiving tax refunds, more Millennials (17%) and Gen Xers

(17%) prefer to receive a check in the mail compared with Baby

Boomers (14%), per new research from ACI Worldwide (NASDAQ: ACIW),

a leading global provider of real-time electronic payment and

banking solutions. When it comes to paying potential taxes owed,

digital methods such as debit, credit and electronic funds

withdrawal are most popular (50%), while only 32 percent prefer

non-digital methods (cash or check), based on the survey data from

1,215 taxpayers.

Other key findings and trends

include:

Preference for electronic payments continues to grow

- More U.S. adults filed or plan to file their taxes

electronically through self-service tools this year (45%), compared

to last year (40%)

- Only 8.5 percent filed or plan to file their taxes by

mail/paper without professional assistance this year, compared to

10.3 percent last year

- Preference for electronic methods of paying taxes (if owed)

versus mailing in a check increased in 2020, compared to last year:

- Electronic funds withdrawal – increased 13 percent (26% from

23%)

- Debit card – increased 17 percent (14% from 12%)

- Check – decreased 10 percent (26% from 29%)

- Although the percentage of U.S. adults who opted to pay their

taxes (if owed) with cash are low (below 10%), more Millennials

(8%) and Gen Xers (7%) than Baby Boomers (3%) opted for cash

payment of taxes

For some, the tax refund check exceeds their average

paycheck

- For 33 percent of U.S. adults who file taxes, the tax refund

check is typically larger than their average paycheck

- More Millennial tax filers (43%) found that their average tax

refund is typically larger than their average paycheck, compared to

Gen Xers (39%) and Baby Boomers (22%)

Tax scams continue to plague some, particularly by phone and

email

- Phone scams (21%) and email scams (12%) are the most common tax

scams experienced by taxpayers surveyed, while illegal tax

preparers (2%) and ghost preparers (2%) are less frequent

- More U.S. adults in 2020 (67%) have never experienced fraud or

tax scams, compared to last year (62%)

Millennials are less aware of tax scams compared to older

generations

- More U.S. adults are aware of phone scams (65%), email scams

(61%) and identity theft (65%) than they are of illegal tax

preparers (38%) or ghost preparers (20%)

- Close to 3 in 10 Millennials (27%) are unaware of tax scams,

compared to 17 percent of Gen Xers and 11 percent of Baby

Boomers

“During tax season, any consumer can be an easy target for

fraudsters as they share personal financial data with tax

preparers, or send and receive paper documents by mail,” said

Sanjay Gupta, executive vice president, ACI Worldwide. “Digital

methods of tax payment are convenient, faster and more secure. In

fact, the growing preference for digital payment methods aligns

with the growing number of taxpayers who have never experienced

fraud. However, awareness around tax scams is still necessary, even

for Millennials.”

ACI recommends the following top tips for

taxpayers this season:

- Digital payments: Digital payments are a safer (and

faster) choice for consumers, compared to checks, which can get

lost in the mail and typically include social security numbers that

can be easily stolen.

- Cash Payments: Paying taxes with cash can take

approximately 5-7 business days to process; consumers can avoid

late payment penalties by filing early.

- Tax Scams: Although phone and email scams are more

popular among fraudsters, consumers must be aware of other scams

such as “ghost preparers” and illegal tax preparers. Checking the

tax preparer’s PTIN will ensure they are legitimate.

For more than 20 years, ACI has been supporting the billing and

payment needs of federal, state and local government entities.

Learn more here.

Methodology All figures, unless otherwise stated, are

from YouGov Plc. Total sample size was 1,215 adults. Fieldwork was

undertaken between February 11-12, 2020. The survey was carried out

online. The figures have been weighted and are representative of

all U.S. adults (aged 18+). Generations were defined as follows:

Millennial (born 1982-1999, 390 total), Gen X (born 1965-1981, 311

total), and Baby Boomer (born 1946-1964, 399 total).

About ACI Worldwide ACI Worldwide, the Universal Payments

(UP) company, powers electronic payments for more than 5,100

organizations around the world. More than 1,000 of the largest

financial institutions and intermediaries, as well as thousands of

global merchants, rely on ACI to execute $14 trillion each day in

payments and securities. In addition, myriad organizations utilize

our electronic bill presentment and payment services. Through our

comprehensive suite of software solutions delivered on customers’

premises or through ACI’s private cloud, we provide real-time,

immediate payments capabilities and enable the industry’s most

complete omni-channel payments experience. To learn more about ACI,

please visit www.aciworldwide.com. You can also find us on Twitter

@ACI_Worldwide.

© Copyright ACI Worldwide, Inc. 2020 ACI, ACI Worldwide, the ACI

logo, ACI Universal Payments, UP, the UP logo and all ACI

product/solution names are trademarks or registered trademarks of

ACI Worldwide, Inc., or one of its subsidiaries, in the United

States, other countries or both. Other parties' trademarks

referenced are the property of their respective owners.

Product roadmaps are for informational purposes only and may not

be incorporated into a contract or agreement. The development

release and timing of future product releases remains at ACI’s sole

discretion. ACI is providing the following information in

accordance with ACI's standard product communication policies. Any

resulting features, functionality, and enhancements or timing of

release of such features, functionality, and enhancements are at

the sole discretion of ACI and may be modified without notice. All

product roadmap or other similar information does not represent a

commitment to deliver any material, code, or functionality, and

should not be relied upon in making a purchasing decision.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200304005041/en/

Dan Ring E-mail: dan.ring@aciworldwide.com Phone:

781-370-3600

Nidhi Alberti E-mail: nidhi.alberti@aciworldwide.com Phone:

781-370-3600

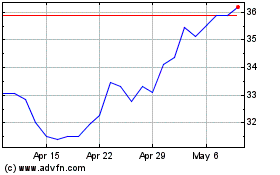

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Mar 2024 to Apr 2024

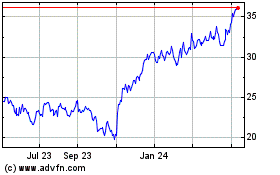

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Apr 2023 to Apr 2024