Current Report Filing (8-k)

February 20 2020 - 6:02AM

Edgar (US Regulatory)

false 0000935036 0000935036 2020-02-18 2020-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2020

ACI WORLDWIDE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

0-25346

|

|

47-0772104

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

3520 Kraft Rd, Suite 300

Naples, FL 34105

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (239) 403-4600

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.005 par value

|

|

ACIW

|

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On February 18, 2020, ACI Worldwide, Inc. (“ACIW”) announced the appointment of Odilon Almeida as its President and Chief Executive Officer effective March 9, 2020. Mr. Almeida will also be appointed to serve as a member of ACIW’s Board of Directors. A press release announcing this appointment is filed as Exhibit 99.1 to this report.

Mr. Almeida, age 58, has served as an Operating Partner at Advent International since October 2019. Prior to Advent International, Mr. Almeida served in increasingly significant general management and operational roles with The Western Union Company (“Western Union”) since joining that company in 2002. Most recently, from February 2017 to June 2019 (and as a senior advisor through September 2019), Mr. Almeida served as President, Western Union Global Money Transfer, where he headed Western Union’s $5 billion consumer business in over 200 countries and territories and Western Union’s digital offering in over 90 countries. From January 2014 to February 2017, Mr. Almeida served as Western Union’s President, Americas and European Union.

Mr. Almeida’s initial annual target total cash compensation will be $1,350,000, consisting of an annual base salary of $675,000 and an on-target bonus of 100% of base salary. The bonus opportunity will be granted pursuant to ACIW’s 2020 Management Incentive Compensation plan under which 0% to 200% of the on-target bonus opportunity can be earned based on the achievement of specified performance goals. Mr. Almeida’s 2020 bonus opportunity will be pro-rated based on his start date of March 9, 2020.

Mr. Almeida will receive initial equity awards with an aggregate grant date value of $6.2 million under the Company’s 2020 Long Term Incentive Plan. 35% of the aggregate award value will be provided in the form of restricted share units that vest ratably on an annual basis over three years. 65% of the aggregate award value will be provided in the form of performance share units that vest, if at all, at the end of the three-year performance period. Performance share units may pay out at 0% to 200% of the original number of granted shares based on the achievement of specified performance goals. The restricted share units and the performance share units will be issued under ACIW’s form equity award agreements.

ACIW and Mr. Almeida will enter into the Severance Agreement filed as Exhibit 10.1 to this report, the Change In Control Employment Agreement filed as Exhibit 10.2 to this report and ACIW’s standard form of indemnification agreement. Mr. Almeida will also be eligible to participate in ACIW’s welfare benefit plans that are generally available to employees.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ACI WORLDWIDE, INC.

|

|

|

|

|

|

By:

|

|

/s/ Dennis P. Byrnes

|

|

Name:

|

|

Dennis P. Byrnes

|

|

Title:

|

|

Executive Vice President and General Counsel

|

Date: February 20, 2020

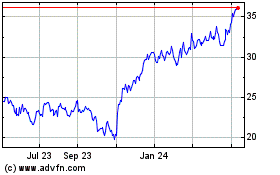

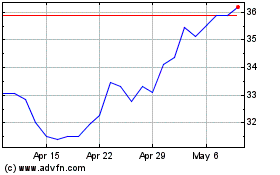

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Mar 2024 to Apr 2024

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Apr 2023 to Apr 2024