Indian Consumers Prefer Digital Payments Over Cash this Festival Season, Embracing UPI and Digital Wallets for Merchant Spend...

October 23 2019 - 12:00AM

Business Wire

Growing strength of digital payments in

merchant payments channel, increasing ubiquity driven by younger

consumers, according to new study by ACI Worldwide

Digital payments are the preferred payment option for 42 percent

of consumers in India, leading card payments (29%) and cash (27%),

according to a new online study conducted by YouGov and ACI

Worldwide (NASDAQ: ACIW), a leading global provider of real-time

electronic payment and banking solutions.

While preference for digital payments – including eWallet and

UPI payments – is more pronounced with younger consumers (42% for

Gen Z and 48% for Millennials), the survey revealed a more

consistent picture across age groups in terms of adoption. 77

percent of Millennials had used digital payments at least once

during the festival season, compared to 72 percent of Gen Z and 69

percent of Gen X. Nearly half (45%) of Baby Boomers also indicated

they had used digital payments within the survey period.

“Digital payments, including UPI and other eWallets, are

increasingly the payment method of choice across a wide spectrum of

consumers in India,” said Kaushik Roy, vice president & country

leader – South Asia, ACI Worldwide. “While there is still a

perception that UPI, for example, is primarily for the peer-to-peer

channel, this study shows that significant inroads are being made

in the merchant payments channel. With monthly transactions on the

UPI platform nearing one billion, and credit and debit card usage

at the POS experiencing double-digit annual growth, digital and

card payments will continue to make inroads into the cash

economy.”

44 percent of respondents used digital payment methods for

low-value payment (less than 1,000 INR) via a merchant website

(eCommerce) or app (P2M), indicative of the progress made by

digital payments in the merchant channel. However, banks, fintechs

and merchants should be aware that 40 percent of those surveyed

consider data privacy as a top area of concern when it comes to

digital payments.

Other key findings and trends:

Payment behaviors and spending patterns

- 43 percent of respondents used digital payment methods

regularly (at least 2-3 times per week) during the festival period,

with 15 percent purchasing this way once or more per day.

- 32 percent have not used cash for festival season purchases,

indicating that for some, festival season spending is becoming a

largely cashless affair.

- Only one in ten respondents (10%) claimed to have not made a

digital payment method at all in the period leading up to

Diwali.

- Peer-to-peer (P2P) payments were made by 36 percent of

respondents for low-value payments (less than 1,000 INR) and 37

percent for high-value payments (more than 1,000 INR) during the

festival season.

Consumer concerns and industry opportunities

- Internet connectivity (a prerequisite to most digital payment

methods) is a top concern for 44 percent, while failed transactions

(36%), problems processing refunds (32%) and fraud (29%) also

identified as major concerns.

- Only 21 percent of respondents cited lack of clarity about fees

as a top concern and 23 percent lack of acceptance infrastructure

at merchants, reflecting increasing ease of use for customers and

greater merchant acceptance.

- Queried about what would encourage more frequent usage of

digital payments, 42 percent said better rewards (discounts,

incentives or cashbacks); 24 percent cited faster and more

frictionless checkout.

As per data released by NPCI, UPI transactions hit an all-time

high of 955.02 million in September 2019 as compared to 918.35

million in August. There has been a 135 percent YoY increase in the

number of transactions and UPI is soon expected to cross one

billion monthly transactions.

Mandy Killam, EVP Growth Markets, ACI Worldwide, will be joined

by George Sam, co-founder, Mindgate Solutions, to deliver the

presentation “Addressing the APAC Opportunity and the Growth of UPI

Transactions” at 10:25am, Sunday, October 27 at Money20/20 USA.

Survey Methodology:

All figures, unless otherwise stated, are from YouGov Plc. Total

sample size was 1,025 adults. Fieldwork was undertaken between

October 9-15, 2019. The survey was carried out online. The figures

have been weighted and are representative of all Indian adults

(aged 18+). Generations were defined as follows: Gen Z (born after

1999, 201 total), Millennial (born 1982-1999, 488 total), Gen X

(born 1965-1981, 279 total), and Baby Boomer (born 1946-1964, 57

total).

About ACI Worldwide

ACI Worldwide, the Universal Payments (UP) company, powers

electronic payments for more than 5,100 organizations around the

world. More than 1,000 of the largest financial institutions and

intermediaries, as well as thousands of global merchants, rely on

ACI to execute $14 trillion each day in payments and securities. In

addition, myriad organizations utilize our electronic bill

presentment and payment services. Through our comprehensive suite

of software solutions delivered on customers’ premises or through

ACI’s private cloud, we provide real-time, immediate payments

capabilities and enable the industry’s most complete omni-channel

payments experience. To learn more about ACI, please visit

www.aciworldwide.com. You can also find us on Twitter

@ACI_Worldwide.

© Copyright ACI Worldwide, Inc. 2019

ACI, ACI Worldwide, the ACI logo, ACI Universal Payments, UP,

the UP logo and all ACI product/solution names are trademarks or

registered trademarks of ACI Worldwide, Inc., or one of its

subsidiaries, in the United States, other countries or both. Other

parties' trademarks referenced are the property of their respective

owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191022005786/en/

Shivani Joshi Archetype E-mail: shivani.joshi@archetype.co

Phone: +91-98709 08500

Christopher Taine ACI Worldwide E-mail:

christopher.taine@aciworldwide.com Phone: +49 (0) 89 45230 557

Dan Ring Email: dan.ring@aciworldwide.com Phone: +1 (781)

370-3600

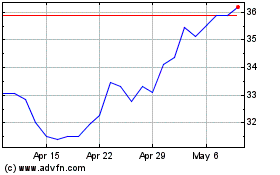

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Mar 2024 to Apr 2024

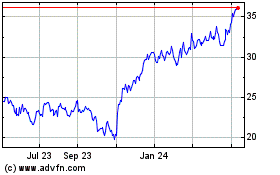

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Apr 2023 to Apr 2024