Statement of Changes in Beneficial Ownership (4)

January 26 2021 - 6:45PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Madden James C. |

2. Issuer Name and Ticker or Trading Symbol

Accolade, Inc.

[

ACCD

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

Fomer Director |

|

(Last)

(First)

(Middle)

610 NEWPORT CENTER DRIVE, SUITE 1220 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/22/2021 |

|

(Street)

NEWPORT BEACH, CA 92660

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 1/22/2021 | | J | | 341153 (1) | D | (1) | 3289843 | I | See footnotes (9)(10) |

| Common Stock | 1/22/2021 | | J | | 3401 (1) | A | (1) | 3293244 | I | See footnotes (9)(10) |

| Common Stock | 1/22/2021 | | J | | 6682 (2) | D | (2) | 3286562 | I | See footnotes (9)(10) |

| Common Stock | 1/22/2021 | | J | | 2075349 (3) | D | (3) | 1211213 | I | See footnotes (9)(10) |

| Common Stock | 1/22/2021 | | J | | 20491 (3) | A | (3) | 1231704 | I | See footnotes (9)(10) |

| Common Stock | 1/22/2021 | | J | | 487608 (4) | D | (4) | 744096 | I | See footnotes (9)(10) |

| Common Stock | 1/22/2021 | | J | | 487608 (5) | D | (5) | 256488 | I | See footnotes (9)(10) |

| Common Stock | 1/22/2021 | | J | | 1674 (6) | D | (6) | 254814 | I | See footnotes (9)(10) |

| Common Stock | 1/25/2021 | | J | | 109878 (7) | D | (7) | 144936 | I | See footnotes (9)(10) |

| Common Stock | 1/25/2021 | | J | | 54939 (7) | A | (7) | 199875 | I | See footnotes (9)(10) |

| Common Stock | 1/25/2021 | | J | | 22218 (8) | D | (8) | 177657 | I | See footnotes (9)(10) |

| Common Stock | 1/25/2021 | | J | | 11109 (8) | A | (8) | 188766 | I | See footnotes (9)(10) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | On January 22, 2021, 341,153 shares of the common stock of Accolade, Inc. (the "Common Stock") held of record by Carrick Capital Associates Fund, L.P. ("CCAF") were distributed to the fund's respective partners for no consideration. CCAF no longer holds any shares of Common Stock. On the same date, 3,401 of CCAF's shares of Common Stock were transferred to Carrick Management Partners, LLC ("CMP"), CCAF's general partner. |

| (2) | On January 22, 2021, 6,682 shares of the Common Stock held of record by Carrick Capital Founders Fund, L.P. ("CCFF") were distributed to the fund's respective partners for no consideration. CCFF continued to hold 109,878 shares of Common Stock. |

| (3) | On January 22, 2021, 2,075,349 shares of the Common Stock held of record by Carrick Capital Partners, L.P. ("CCP") were distributed to the fund's respective partners, on a pro rata basis, for no consideration. CCP no longer holds any shares of Common Stock. On the same date, 20,491 of CCP's shares of Common Stock were transferred to CMP, CCP's general partner. |

| (4) | On January 22, 2021, 487,608 shares of the Common Stock held of record by Carrick Capital Partners II Co-Investment Fund, L.P. ("CIF") were distributed to the fund's partner for no consideration. CIF no longer holds any shares of Common Stock. |

| (5) | On January 22 ,2021, 487,608 shares of the Common Stock held of record by Carrick Capital Partners II Co-Investment Fund II, L.P. ("CIFII") were distributed to the fund's partner for no consideration (the forgoing transactions discussed in footnotes (1)-(5) constituting the "Distribution"). CIFII no longer holds any shares of Common Stock. |

| (6) | On January 22, 2021 CMP further distributed 1,674 of the shares of the Common Stock that it received from the Distribution to its non-managing member for no consideration. CMP continued to hold 22,218 shares of Common Stock. |

| (7) | On January 25, 2021, 109,878 shares of the Common Stock held of record by CCFF were distributed to certain of the fund's partners, on a pro rata basis, for no consideration. CCFF no longer holds any shares of Common Stock. On the same date, 54,939 of CCFF's shares of Common Stock were transferred to the James C. Madden, V. Living Trust (the "Trust"), of which the reporting person is the trustee. |

| (8) | On January 25, 2021, 22,218 shares of the Common Stock held of record by CMP were distributed to certain of its members, on a pro rata basis, for no consideration. CMP no longer holds any shares of Common Stock. On the same date, 11,109 of CMP's shares of Common Stock were transferred to the Trust. |

| (9) | CMP is the general partner of each of CCAF, CCFF and CCP (the "CMP Group"). CMPII is the general partner of each of CIF and CIFII (the "CMPII Group"). CMP and CMPII may be deemed to have voting, investment and dispositive power with respect to the securities held by the CMP Group and the CMPII Group, respectively. The reporting person is a managing member of both CMP and CMPII. Thus, the reporting person may be deemed to share voting, investment and dispositive power with respect to the shares of Common Stock held by CMP and the CMP Group and CMPII and the CMPII Group. |

| (10) | Additionally, the reporting person, as the trustee of the Trust, has the sole voting and disposition power in connection with the Common Stock held of record by the Trust. The reporting person disclaims beneficial ownership of the securities discussed herein and this report shall not be deemed an admission that he is the beneficial owner of such securities for purposes of Section 16 or for any other purpose, except to the extent of his pecuniary interests therein. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Madden James C.

610 NEWPORT CENTER DRIVE, SUITE 1220

NEWPORT BEACH, CA 92660 |

|

|

| Fomer Director |

Signatures

|

| /s/ James C. Maddden, V. | | 1/26/2021 |

| **Signature of Reporting Person | Date |

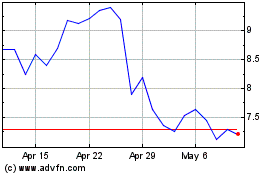

Accolade (NASDAQ:ACCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accolade (NASDAQ:ACCD)

Historical Stock Chart

From Apr 2023 to Apr 2024