Filed Pursuant to Rule 424(b)(5)

Registration No.: 333-249984

PROSPECTUS SUPPLEMENT

To Prospectus dated November 23, 2020

148,965,762

Shares

ACACIA

RESEARCH CORPORATION

Common

Stock

The selling stockholders named in this prospectus,

or the selling stockholders, may from time to time, in one or more offerings, offer and sell up to an aggregate of 148,965,762

shares of our common stock. The shares of common stock offered by the selling stockholders consist of:

|

|

·

|

up to 12,465,762 shares issuable upon the conversion of our Series A Convertible Preferred Stock;

|

|

|

·

|

up to 6,500,000 shares issuable upon the exercise of our Series A

Warrants; and

|

|

|

·

|

up to 130,000,000 shares issuable upon the exercise of our Series B Warrants.

|

As of the date hereof, the Series A Convertible

Preferred Stock are convertible into 9,589,045 shares of common stock, the Series A Warrants are exercisable for 5,000,000 shares

of common stock and the Series B Warrants are exercisable for 100,000,000 shares of common stock. Pursuant to a Registration Rights

Agreement with the selling stockholders, we are registering 130% of the shares of common stock underlying the Series A Convertible

Preferred Stock, Series A Warrants and Series B Warrants held by the selling stockholders, to cover such indeterminate number of

shares of common stock as may be issued upon the conversion or exercise of such Series A Convertible Preferred Stock, Series A

Warrants and Series B Warrants pursuant to their anti-dilution provisions. See “Prospectus Supplement Summary” beginning

on page S-3 for more information regarding the Registration Rights Agreement. We will not receive any of the proceeds from the

sale of our common stock offered by the selling stockholders.

The selling stockholders may offer the

shares of common stock directly, through agents, or to or through underwriters. See “Selling Stockholders”

beginning on page S-8 and “Plan of Distribution” beginning

on page S-10 for more information on this topic.

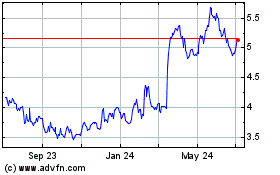

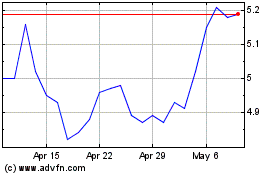

Our common stock is listed on the Nasdaq

Global Select Market, or NASDAQ, under the symbol “ACTG.” On November 24, 2020, the closing sale price of our

common stock on NASDAQ was $3.77 per share.

Investing

in OUR COMMON STOCK involves A HIGH DEGREE OF risk. before investing in our COMMON STOCK, You should carefully REVIEW the

SECTION ENTITLED “risk factors” beginning on page S-6 of this prospectus SUPPLEMENT, AS WELL AS THE RISKS AND UNCERTAINTIES

DESCRIBED in any documents incorporated by reference herein or therein.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of

this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is

November 24, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of a registration

statement that was filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process

and consists of two parts. The first part is this prospectus supplement, including the documents incorporated by reference herein,

which describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated

by reference therein, provides more general information about us and our securities. In general, when we refer only to the prospectus,

we are referring to both parts of this document combined. Before you invest, you should carefully read this prospectus supplement,

the accompanying prospectus, all information incorporated by reference herein and therein, as well as the additional information

described under the heading “Where You Can Find More Information.” You are encouraged to carefully consider

all of this information when deciding whether to invest in our common stock.

This prospectus supplement may add, update

or change information contained in the accompanying prospectus. To the extent there is a conflict between the information contained

in this prospectus supplement and the accompanying prospectus, you should rely on information contained in this prospectus supplement,

provided that if any statement in, or incorporated by reference into, one of these documents is inconsistent with a statement in

another document having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded

will be deemed not to constitute a part of this prospectus.

You should rely only on the

information contained in this prospectus supplement, the accompanying prospectus, and any document incorporated by reference

herein or therein. No dealer, salesperson or other person has been authorized to provide you with any different information.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may

provide to you. The information contained in this prospectus supplement, the accompanying prospectus, and any document

incorporated by reference herein or therein is accurate only as of the date such information is presented. Our business,

financial condition, results of operations, liquidity and future prospects may have changed since those respective dates.

This prospectus does not constitute an

offer to sell or the solicitation of an offer to buy any securities other than the shares of common stock to which it relates,

nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any

person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

This prospectus supplement and the

accompanying prospectus, and any documents incorporated by reference herein or therein, include statements that are based on

various assumptions and estimates that are subject to numerous known and unknown risks and uncertainties. Some of these risks

and uncertainties are described under the heading “Risk Factors” beginning on page S-6 of this prospectus

supplement, beginning on page 45 of our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020, or

the Q3 Quarterly Report, and beginning on page 5 of our Annual Report on Form 10-K for the year ended December 31, 2019,

or the Annual Report, each of which is incorporated by reference into the prospectus. These and other important factors could

cause our future results to be materially different from the results expected as a result of, or implied by, these

assumptions and estimates. You should read the information contained in this prospectus supplement, the accompanying

prospectus, and the documents incorporated by reference herein and therein, completely and with the understanding that future

results may be materially different from and worse than what we expect. See the information under the heading

“Special Note Regarding Forward-Looking Information.”

SPECIAL NOTE REGARDING FORWARD-LOOKING

INFORMATION

This prospectus supplement, the accompanying

prospectus, and the documents incorporated by reference herein and therein, contain forward-looking statements within the meaning

of the federal securities laws. These forward-looking statements are intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this

prospectus, any accompanying prospectus supplement, and any documents incorporated by reference herein or therein, are forward-looking

statements.

Our forward-looking statements are based

on our management’s current assumptions and expectations of future events and trends, which affect or may affect our business,

strategy, operations, financial performance, liquidity and future prospects. Although we believe that these forward-looking statements

are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties and are made in light

of information currently available to us. Many important factors, in addition to the factors described in this prospectus, may

materially and adversely affect our results as expressed or implied in our forward-looking statements. You should read this prospectus completely and with the

understanding that our actual future results may be materially different from and worse than what we expect.

Forward-looking statements involve risks

and uncertainties and are not guarantees of future performance. As a result of the risks and uncertainties described above, the

forward-looking statements discussed in this prospectus might not occur and our future results and performance may differ materially

from the information provided in these forward-looking statements due to, but not limited to, the factors mentioned above. Because

of these uncertainties, you should not place undue reliance on these forward-looking statements when making an investment decision.

Moreover, we operate in an evolving environment.

New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors

and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Forward-looking statements speak only

as of the date they were made, and, except to the extent required by law or the rules of the Nasdaq Stock Market, we undertake

no obligation to update or review any forward-looking statement because of new information, future events or other factors. You

should, however, review the risks and uncertainties we describe in the reports we will file with the SEC, including those reports

we file after the date of this prospectus. For additional information, see the section entitled “Where You Can Find More Information.”

We qualify all of our forward-looking

statements by these cautionary statements.

PROSPECTUS SUPPLEMENT SUMMARY

This prospectus supplement summary discusses

the key aspects of the offering and highlights certain information appearing elsewhere in this prospectus supplement and the accompanying

prospectus, and in the documents incorporated by reference herein and therein. However, as this is a summary, it does not contain

all of the information you should consider before deciding to invest in our common stock.

General

We invest in intellectual property, or IP,

and related absolute return assets and engage in the licensing and enforcement of patented technologies. We partner with inventors

and patent owners, applying our legal and technology expertise to patent assets to unlock the financial value in their patented

inventions. We generate revenues and related cash flows from the granting of patent rights for the use of patented technologies

that our operating subsidiaries control or own. We assist patent owners with the prosecution and development of their patent portfolios,

the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented

technologies and, where necessary, with the enforcement against unauthorized users of their patented technologies through the filing

of patent infringement litigation. We are principals in the licensing and enforcement effort, obtaining control of the rights in

the patent portfolio, or control of the patent portfolio outright.

We have a proven track record of licensing

and enforcement success with over 1,580 license agreements executed to date, across nearly 200 patent portfolio licensing and enforcement

programs. Currently, on a consolidated basis, our operating subsidiaries own or control the rights to multiple patent portfolios,

which include U.S. patents and certain foreign counterparts, covering technologies used in a variety of industries. To date, we

have generated gross licensing revenue of approximately $1.6 billion, and have returned more than $796 million to our patent partners.

Our principal executive, corporate and administrative

offices are located in Irvine, California, and we employed 20 full-time employees as of November 17, 2020.

Corporate Information

We were originally incorporated in California

in January 1993 and reincorporated in Delaware in December 1999. Our principal executive offices are located at 4 Park Plaza, Suite

550, Irvine, California 92614. The telephone number of our principal executive office is (949) 480-8300.

Our website address is www.acaciaresearch.com.

Reference in this prospectus to this website address does not constitute incorporation by reference of the information contained

on or accessed through our website and references to our website address in this prospectus are inactive textual references only.

Securities Purchase Agreement, Registration Rights Agreement

and Governance Agreement

Securities Purchase Agreement

On November 18, 2019, we entered into

a Securities Purchase Agreement, or the Purchase Agreement, with Starboard Value LP, or Starboard Value, and the Buyers (as

defined in the Purchase Agreement), pursuant to which we (i) issued and sold to the Buyers 350,000 shares of Series A

Convertible Preferred Stock, par value $0.001 per share, (ii) issued to the Buyers Series A Warrants to purchase up to

5,000,000 shares of common stock, (iii) agreed to issue, at Starboard Value’s election upon the identification and

approval by each of us and Starboard Value of a suitable investment or acquisition by us, or an Approved Investment, senior

secured non-convertible notes, or the Notes, to Starboard Value and/or its affiliates, in an aggregate principal amount not

to exceed $365 million, and (iv) agreed to issue to the Buyers Series B Warrants to purchase up to 100,000,000 shares of

common stock upon the satisfaction of certain conditions set forth in the Purchase Agreement. Upon the satisfaction of such

conditions, we issued the Series B Warrants to Buyers on February 25, 2020. Upon the identification of an Approved Investment

on June 4, 2020, we issued to Starboard Value and its affiliates $115 million principal amount of Notes, all of which were

subsequently exchanged by the noteholders on June 30, 2020 for senior notes issued by Merton Acquisition HoldCo LLC, our

wholly-owned subsidiary. The shares of Series A Convertible Preferred Stock are immediately convertible into, and the Series

A and Series B Warrants are immediately exercisable for, shares of our common stock.

The offer and sale of the foregoing shares

of Series A Convertible Preferred Stock, Series A Warrants, Series B Warrants and Notes, which we collectively refer to as the

Securities, were not registered under the Securities Act in reliance on the exemption afforded by Section 4(a)(2) of the Securities

Act and Rule 506(b) of Regulation D promulgated thereunder.

Registration Rights Agreement

On November 18, 2019, in connection with

the Purchase Agreement, we entered into a Registration Rights Agreement, or the Rights Agreement, with Starboard Value and the

Buyers, pursuant to which we agreed to, among other things, prepare and file with the SEC (i) an initial registration statement,

or the Initial Registration Statement, on Form S-3, covering the resale of 130% of the shares of common stock underlying the then-outstanding

Securities, or the Underlying Shares, and (ii) subsequent registration statements covering the resale of Underlying Shares to the

extent not included in previous registration statements. In addition, upon written notice to us by Starboard Value, or a Demand

Notice, we will prepare and file with the SEC a registration statement covering the resale of any Series A Convertible Preferred

Stock, Notes and/or Series B Warrants set forth in such Demand Notice.

The registration statement of which this

prospectus is a part has been filed by us in satisfaction of our obligations under the Purchase Agreement and the Rights Agreement

to file the Initial Registration Statement. We intend to maintain the effectiveness of the registration statement until the earlier

of (i) such time as the shares offered by the selling stockholders pursuant to this prospectus have been sold, or (iii) such time

as such shares offered by the selling stockholders pursuant to this prospectus can be freely resold without restriction or limitation

under Rule 144 and without the requirement to be in compliance with Rule 144(c)(1) or otherwise under applicable securities laws.

We have certain customary obligations under

the Rights Agreement to indemnify for losses incurred by the initial selling stockholders in connection with any untrue statements

of material fact or material omissions in the registration statement of which this prospectus is a part, and for certain violations

of securities and other similar laws.

Governance Agreement

On November 18, 2019, in connection with

the Purchase Agreement, we entered into a Governance Agreement, or the Governance Agreement, with Starboard Value and certain of

its affiliates, which we collectively refer to as Starboard. Pursuant to the Governance Agreement, we (i) appointed Jonathan Sagal

as a member of our Board of Directors, or the Starboard Appointee, (ii) granted Starboard the right to recommend two additional

directors for appointment to our Board of Directors, or the Additional Appointees and (iii) formed a Strategic Committee of the

Board of Directors, or the Strategic Committee, which was tasked with, among other things, sourcing and performing due diligence

on potential acquisition targets and intellectual property or other investment opportunities, with the goal of finding one or more

Approved Investments for recommendation to the Board of Directors. The Governance Agreement was subsequently amended on January

7, 2020.

THE OFFERING

|

Common Stock offered by the Selling Stockholders

|

Up to an aggregate of 148,965,762 shares of common stock, which includes (i) 12,465,762 shares issuable upon the conversion of Series A Convertible Preferred Stock, (ii) 6,500,000 shares issuable upon the exercise of Series A Warrants, and (iii) 130,000,000 shares issuable upon the exercise of Series B Warrants.

|

|

|

|

|

Use of Proceeds

|

We will not receive any of the proceeds from the sale of our common stock offered by the selling stockholders.

|

|

|

|

|

Risk Factors

|

Investing in our common stock involves a high degree of risk. You should carefully review the risks and uncertainties described under the heading “Risk Factors” beginning on page S-6 of this prospectus supplement, ”beginning on page 45 of the Q3 Quarterly Report, and beginning on page 5 of the Annual Report.

|

|

|

|

|

NASDAQ Global Select Market Symbol

|

ACTG

|

|

|

|

RISK FACTORS

Investing in our common stock

involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described

in (i) the sections entitled “Risk Factors” in the Annual Report and the Q3 Quarterly

Report, which are incorporated by reference in this prospectus,

(ii) the additional risks and uncertainties described below, and (iii) any amendments or updates to our risk factors

reflected in subsequent filings with the SEC. If any of these risks actually occur, our business, financial condition,

results of operations, liquidity and future prospects could be materially and adversely affected. For more information, see

the section entitled “Where You Can Find More Information.”

The risks and uncertainties we have described

are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial

may also affect our business, financial condition, results of operations, liquidity and future prospects.

This prospectus contains forward-looking statements that involve risks

and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result

of certain factors, including the risks and uncertainties mentioned elsewhere in this prospectus. For more information, see the

section entitled “Special Note Regarding Forward-Looking Information.”

Risks Related to Selling Stockholders’ Sales of Shares

Sales of a significant number of shares of our common

stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock,

impair our ability to raise capital, and weaken market confidence in our company.

Starboard Value and its affiliates currently

hold Securities convertible into, or exercisable for, an aggregate of 114,589,045 shares of our common stock. As of November 17,

2020, 49,279,453 shares of our common stock were issued and outstanding. A future decision by Starboard Value and/or its affiliates

to sell all or a large portion of its shares, or the perception in the market that such sales could occur, could weaken market

confidence in our company and our future prospects, which could have a material adverse effect on our financial condition or results

of operation, and result in a decline in the market price of our common stock. In addition, such sales may impair our ability to

raise additional capital in the future at a time and price that our management deems acceptable. Further, it is possible that the

selling stockholders may sell their shares to one of our competitors, to a potential acquirer of our company, or to another person

whose interests may differ, perhaps materially, from those of our other stockholders.

We may not be able to maintain effectiveness of the registration

statement of which this prospectus forms a part, which could impact the liquidity of our common stock.

Under the terms of the Rights Agreement,

we are obligated to file the Initial Registration Statement to cover 130% of the shares of common stock underlying the then-outstanding

Securities issued pursuant to the Purchase Agreement. The registration statement of which this prospectus forms a part is intended

to satisfy that obligation. We also agreed to use our reasonable efforts to maintain the continuous effectiveness of the Initial

Registration Statement, but we may not be able to do so. We cannot assure you that we will not be required to suspend or cease

sales under the Initial Registration Statement, that the SEC will not issue any stop order to suspend the effectiveness of the

Initial Registration Statement or that, if such a stop order is issued, we will be able to amend the Initial Registration Statement

to remove the stop order to permit sales to be made under the Initial Registration Statement in a timely manner or at all. To the

extent the Initial Registration Statement is not effective, the selling stockholders’ ability to sell the shares of common

stock issuable upon the conversion or exercise of the Securities may be limited, which could have a material adverse effect on

the liquidity of our common stock.

In addition, if (i) the Initial Registration

Statement is not declared effective by the time period required by the Rights Agreement, (ii) the Initial Registration Statement

fails to register all of the Underlying Shares or (iii) sales of all of the Underlying shares cannot be made pursuant to the Initial

Registration Statement or otherwise, we will be required to pay certain monetary penalties to the holders of the Underlying Shares,

as set forth in the Rights Agreement.

USE OF PROCEEDS

We will not receive any proceeds from the

sale of shares of our common stock by the selling stockholders (other than the net proceeds received upon the exercise of the Series

A Warrants and Series B Warrants held by the Buyers, assuming the exercise price for such warrants is paid in cash). All of the

shares of common stock offered by the selling stockholders pursuant to this prospectus will be sold by the selling stockholders

for their own account.

SELLING STOCKHOLDERS

The shares of common stock being offered

by the selling stockholders are those issuable to the selling stockholders upon conversion of the shares of Series A Convertible

Preferred Stock, and upon exercise of the Series A Warrants and Series B Warrants. The shares of Series A Convertible Preferred

Stock are immediately convertible into, and the Series A and Series B Warrants are immediately exercisable for, shares of our common

stock. For additional information regarding the issuances of the shares of Series A Convertible Preferred Stock, the Series A Warrants

and the Series B Warrants, see the section entitled “Prospectus Supplement Summary.”

We are registering such shares of common

stock in order to permit the selling stockholders to offer and sell the shares from time to time. Except for the transactions described

in the section entitled “Prospectus Supplement Summary,” the selling stockholders have not had any material relationship with us

within the past three years.

The table below lists the selling stockholders

and other information regarding the beneficial ownership of the shares of common stock held by the selling stockholders.

The second column lists the number of shares

of common stock beneficially owned by the selling stockholders, based on their ownership of the Series A Convertible Preferred

Stock, Series A Warrants and Series B Warrants, in each case as of September 30, 2020, assuming conversion of all shares of Series

A Convertible Preferred Stock, and exercise of all Series A Warrants and Series B Warrants, held by the selling stockholders on

that date, without regard to any limitations on the issuance of common stock pursuant to the terms of the Amended and Restated

Certificate of Designations, Preferences, and Rights of Series A Convertible Preferred Stock, or the Amended Certificate of Designations,

or upon exercise of the Series A Warrants or Series B Warrants.

The third column lists the shares of common

stock being offered by the selling stockholders pursuant to this prospectus. In accordance with the terms of the Rights Agreement,

this prospectus covers the resale of the sum of 130% of (i) the initial number of shares of common stock issued and issuable

pursuant to the Amended Certificate of Designations, and (ii) the maximum number of shares of common stock issued and issuable

upon exercise of the Series A Warrants and Series B Warrants, in each case, as of the date the registration statement is initially

filed with the SEC, all subject to adjustment as provided in the Rights Agreement, and without regard to any limitations on the

issuance of shares of common stock pursuant to the terms of the Amended Certificate of Designations or upon exercise of the Series

A Warrants and Series B Warrants. Because the conversion price of the Series A Convertible Preferred Stock may be adjusted, the

number of shares that will actually be issued upon conversion of the Series A Convertible Preferred Stock may be more or less than

the number of shares being offered by this prospectus.

The fourth column assumes the sale of all

of the shares of common stock offered by the selling stockholders pursuant to this prospectus.

Under the terms of the Series A

Convertible Preferred Stock, and the Series A Warrants and Series B Warrants, a selling stockholder may not convert the

shares of Series A Convertible Preferred Stock, or exercise the Series A Warrants or Series B Warrants, to the extent such

conversion or exercise would cause such selling stockholder, together with its affiliates, to beneficially own a number of

shares of our common stock which would exceed, except in limited circumstances with respect to the shares of Series A

Convertible Preferred Stock, 4.89% of our then outstanding shares of common stock following such conversion or exercise,

excluding for purposes of such determination shares of common stock issuable pursuant to the terms of the Amended Certificate

of Designations if such shares of Series A Convertible Preferred Stock have not been converted, and shares of common stock

issuable upon exercise of the Series A Warrants or Series B Warrants which have not been exercised. The number of shares

reflected in the second and third columns does not reflect this limitation.

The selling stockholders may sell all, some

or none of their shares in this offering. For additional information, see the section entitled “Plan of Distribution.”

|

Name of Selling Stockholder

|

|

Number of Shares of

Common Stock

Owned Prior to

Offering

|

|

|

Maximum Number of

Shares of

Common

Stock to be Sold

Pursuant to this

Prospectus

|

|

Number of Shares of

Common Stock

Owned After

Offering

|

|

|

Percentage of

Shares of

Common Stock

Owned After

Offering

|

|

Entities managed by Starboard Value(1)

|

|

|

114,589,045

|

(2)

|

|

148,965,762 (3)

|

|

|

0

|

|

|

*

|

* Denotes less than

one percent (1.0%).

|

|

(1)

|

These securities are held by various managed accounts and funds for which Starboard Value serves as the investment manager,

including, without limitation, Starboard Value and Opportunity Master Fund Ltd, Starboard X Master Fund Ltd, Starboard Value and

Opportunity S LLC, Starboard Value and Opportunity C LP and Starboard Value and Opportunity Master Fund L LP. Starboard Value also

serves as the manager of Starboard Value and Opportunity S LLC. Starboard Value R LP acts as the general partner of Starboard Value

and Opportunity C LP. Starboard Value L LP acts as the general partner of Starboard Value and Opportunity Master Fund L LP. Starboard

Value R GP LLC acts as the general partner of Starboard R LP and Starboard L GP. Starboard Value GP LLC ("Starboard Value

GP") acts as the general partner of Starboard Value. Starboard Principal Co LP ("Principal Co") acts as a member

of Starboard Value GP. Starboard Principal Co GP LLC ("Principal GP") acts as the general partner of Principal Co. Each

of Jeffrey C. Smith and Peter A. Feld acts as a member of Principal GP and as a member of each of the Management Committee of Starboard

Value GP and the Management Committee of Principal GP. Each of the foregoing disclaims beneficial ownership of these securities

except to the extent of its or his pecuniary interest therein.

|

|

|

(2)

|

Amount represents the sum of: (i) 9,589,045 shares of common stock issuable upon the conversion of 350,000 shares of Series

A Convertible Preferred Stock, (ii) 5,000,000 shares of common stock issuable upon the exercise of Series A Warrants, and (iii)

100,000,000 shares of common stock issuable upon the exercise of Series B Warrants.

|

|

|

(3)

|

Amount represents the sum of: (i) 12,465,762 shares of common stock issuable upon the conversion

of 350,000 shares of Series A Convertible Preferred Stock, (ii) 6,500,000 shares of common stock issuable upon the exercise of

Series A Warrants, and (iii) 130,000,000 shares of common stock issuable upon the exercise of Series B Warrants.

|

PLAN

OF DISTRIBUTION

We are registering the shares of common

stock issuable to the selling stockholders upon the conversion of the Series A Convertible Preferred Stock and upon the exercise

of the Series A Warrants and Series B Warrants, to permit the selling stockholders to offer and sell such shares from time to time

after the date of this prospectus. We will not receive any of the proceeds from the sale of common stock offered by the selling

stockholders. We will bear all fees and expenses incident to our obligation, pursuant to the Rights Agreement, to register the

shares of common stock offered by the selling stockholders.

The selling stockholders may sell all or

a portion of the securities offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents.

If shares of common stock are sold by the selling stockholders through underwriters or broker-dealers, the selling stockholders

will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common stock may be sold

in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined

at the time of sale, or at negotiated prices. These sales made pursuant to this prospectus may be effected in transactions, which

may involve crosses or block transactions.

|

|

·

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

|

|

·

|

in the over-the-counter market;

|

|

|

·

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

·

|

through the writing of options, whether such options are listed on an options exchange or otherwise;

|

|

|

·

|

in ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

in block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion

of the block as principal to facilitate the transaction;

|

|

|

·

|

through purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

through an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

through privately negotiated transactions;

|

|

|

·

|

through sales pursuant to Rule 144;

|

|

|

·

|

through block trades in which broker-dealers, underwriters or agents may agree with us and/or the selling stockholders to sell

a specified number of such securities at a stipulated price per share;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

In connection with sales of the shares of

common stock or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn

engage in short sales of the shares of common stock in the course of hedging in positions they assume. The selling stockholders

may also sell shares of common stock short and deliver shares of common stock covered by this prospectus to close out short positions

and to return borrowed shares in connection with such short sales. The selling stockholders may also loan or pledge shares of common

stock to broker-dealers that in turn may sell such shares.

The selling stockholders may pledge or grant

a security interest in some or all of the shares of Series A Convertible Preferred Stock, Series A Warrants, Series B Warrants

or shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured

parties may offer and sell the shares of common stock from time to time pursuant to this prospectus or any amendment to this prospectus

under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933, as amended, amending, if necessary, the list

of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

The selling stockholders also may transfer and donate the shares of common stock in other circumstances in which case the transferees,

donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The selling stockholders and any broker-dealer

participating in the distribution of the securities offered hereby may be deemed to be “underwriters” within the meaning

of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed

to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the securities is made,

a prospectus supplement, if required, will be distributed which will set forth the aggregate amount and type of securities being

offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions

and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions allowed or

reflowed or paid to broker-dealers.

Under the securities laws of some states,

the securities offered hereby may be sold in such states only through registered or licensed brokers or dealers. In addition, in

some states the securities offered hereby may not be sold unless such shares have been registered or qualified for sale in such

state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that we and/or

any selling stockholder will sell any or all of the securities registered pursuant to the registration statement, of which this

prospectus forms a part.

The selling stockholders and any other person

participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended,

and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the

timing of purchases and sales of any of the securities by the selling stockholders and any other participating person. Regulation

M may also restrict the ability of any person engaged in the distribution of the securities to engage in market-making activities

with respect to the securities. All of the foregoing may affect the marketability of the securities and the ability of any person

or entity to engage in market-making activities with respect to the securities.

We will pay all expenses of the registration

of the shares of common stock pursuant to the Rights Agreement, including, without limitation, SEC filing fees and expenses of

compliance with state securities or “blue sky” laws; provided, however, that the selling stockholders will pay all underwriting

discounts and selling commissions, if any. We will indemnify the selling stockholders against liabilities, including some liabilities

under the Securities Act, in accordance with the Rights Agreement, or the selling stockholders will be entitled to contribution.

We may be indemnified by the selling stockholders against civil liabilities, including liabilities under the Securities Act, that

may arise from any written information furnished to us by the selling stockholder specifically for use in this prospectus, in accordance

with the related Rights Agreement, or we may be entitled to contribution.

Once sold under the registration statement,

of which this prospectus forms a part, the securities will be freely tradable in the hands of persons other than our affiliates.

LEGAL MATTERS

Certain legal matters, including the validity

of the issuance of the shares of common stock offered by this prospectus, will be passed upon for us by Stradling Yocca Carlson

& Rauth, P.C., Newport Beach, California.

EXPERTS

The audited consolidated financial statements

and management’s assessment of the effectiveness of internal control over financial reporting incorporated by reference in

this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the reports

of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and

auditing.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate”

into this prospectus supplement and the accompanying prospectus information that we file with the SEC in other documents. This

means that we can disclose important information to you by referring to other documents that contain that information. Any information

that we incorporate by reference into this prospectus is considered part of this prospectus.

Information contained in this prospectus,

and information that we file with the SEC in the future and incorporate by reference in this prospectus, automatically modifies

and supersedes previously filed information, including information in previously filed documents or reports that have been incorporated

by reference in this prospectus, to the extent the new information differs from or is inconsistent with the previously filed information.

Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded

will be deemed not to constitute a part of this prospectus.

We incorporate by reference, as of their

respective dates of filing, the documents listed below that we have filed with the SEC and any future documents that we file with

the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including any documents filed after the date on which

the registration statement of which this prospectus is a part is initially filed until the offering of the shares of common stock

covered by this prospectus has been completed, other than, in each case, documents or information deemed to have been “furnished”

and not “filed” in accordance with SEC rules:

|

|

·

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, or the Annual Report, filed with the SEC on March 16,

2020;

|

|

|

|

|

|

|

·

|

our Quarterly Report on Form 10-Q for the fiscal quarter ended March

31, 2020, filed with the SEC on May 11, 2020, our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2020, filed

with the SEC on August 10, 2020, and our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2020, filed with

the SEC on November 9, 2020;

|

|

|

·

|

our Current Reports on Form 8-K as filed with the SEC on each of January

13, 2020, February 21, 2020, March 3, 2020, March 12, 2020, May 18, 2020, June 4, 2020, June 10, 2020, June 25, 2020, July 7, 2020,

July 20, 2020, August 3, 2020 and October 20, 2020; and

|

|

|

|

|

|

|

·

|

the description of our common stock contained in our registration statement on Form 8-A, filed with the SEC on December 19, 2002,

as amended by Form 8-A/A, filed with the SEC on August 14, 2008, including any amendment or report filed for the purpose of updating

such description.

|

Each of these filings is incorporated

by reference into this prospectus. We will provide to each person, including any beneficial owner to whom this

prospectus is delivered, a copy of any document that is incorporated by reference in this prospectus. You

may obtain a copy of these documents, at no cost, from our website (www.acaciaresearch.com) or by contacting

us using the following information:

Jennifer Graff

Secretary

Acacia Research Corporation

4 Park Plaza, Suite 550

Irvine, California 92614

Exhibits to the documents will not be sent,

however, unless those exhibits have specifically been incorporated by reference in this prospectus.

You should rely only on the information

contained in this prospectus supplement, the accompanying prospectus, and any document incorporated by reference herein or therein.

We have not authorized anyone to provide you with any different information. We take no responsibility for, and can provide no

assurance as to the reliability of, any other information that others may provide to you.

The information contained in this prospectus

supplement, the accompanying prospectus, and any document incorporated by reference herein or therein is accurate only as of the

date such information is presented. Our business, financial condition, results of operations, liquidity and future prospects may

have changed since those respective dates.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current

reports, as well as other information, with the SEC. Our filings with the SEC are available on the SEC’s website at www.sec.gov,

which contains reports, proxy and information statements, and other information regarding issuers that file electronically.

This prospectus is part of a registration

statement that we filed with the SEC. As permitted by SEC rules, this prospectus, which form a part of the registration statement,

does not contain all of the information that is included in the registration statement. The registration statement contains more

information regarding us, the selling stockholders, and the securities offered by us and the selling stockholders, including certain

exhibits. You can obtain a copy of the registration statement from the SEC at the website referenced above.

PROSPECTUS

$100,000,000

ACACIA

RESEARCH CORPORATION

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

and

Units

148,965,762

Shares of Common Stock Offered by the Selling Stockholders

We may, from time to time, offer, in one

or more series or classes, separately or together, and in amounts, at prices and on terms to be set forth in one or more supplements

to this prospectus, the following securities:

|

|

·

|

shares of our common stock, par value $0.001 per share;

|

|

|

·

|

shares of our preferred stock, par value $0.001 per share;

|

|

|

·

|

debt securities, which may be convertible into one or more other securities

or non-convertible;

|

|

|

·

|

warrants to purchase shares of common stock, shares of preferred stock,

debt securities and/or units;

|

|

|

·

|

rights to purchase shares of common stock, shares of preferred stock,

debt securities, warrants and/or units; and

|

|

|

·

|

units that may consist of any combination of the other securities described

in this prospectus, which may or may not be separable from one another.

|

In addition, the selling stockholders named

in this prospectus, or the selling stockholders, may from time to time, in one or more offerings, offer and sell up to an aggregate

of 148,965,762 shares of our common stock. The shares of common stock offered by the selling stockholders consist of:

|

|

·

|

up to 12,465,762 shares issuable upon the conversion

of our Series A Convertible Preferred Stock;

|

|

|

·

|

up

to 6,500,000 shares issuable upon the exercise of Series A Warrants; and

|

|

|

·

|

up to 130,000,000 shares issuable upon the exercise

of Series B Warrants.

|

As of the date hereof, the Series A

Convertible Preferred Stock are convertible into 9,589,045 shares of common stock, the Series A Warrants are exercisable for 5,000,000

shares of common stock and the Series B Warrants are exercisable for 100,000,000 shares of common stock. Pursuant to a Registration

Rights Agreement with the selling stockholders, we are registering 130% of the shares of common stock underlying the Series A

Convertible Preferred Stock, Series A Warrants and Series B Warrants held by the selling stockholders, to cover such indeterminate

number of shares of common stock as may be issued upon the conversion or exercise of such Series A Convertible Preferred Stock,

Series A Warrants and Series B Warrants pursuant to their anti-dilution provisions. See “About the Company” beginning

on page 3 for more information regarding the Registration Rights Agreement. We will not receive any of the proceeds from the

sale of our common stock offered by the selling stockholders.

We refer to the common stock,

preferred stock, debt securities, warrants, rights and units that may be offered and sold pursuant to this prospectus,

collectively, as the "securities". The securities to be offered by us will have an aggregate initial offering price

of up to $100,000,000.

The specific terms of the securities will

be set forth in the applicable prospectus supplement and will include, as applicable: (i) in the case of our common stock, any

public offering price; (ii) in the case of our preferred stock, the specific designation and any dividend, liquidation, redemption,

conversion, voting and other rights, and any public offering price; (iii) in the case of debt securities, the principal amount,

maturity date, interest rate, seniority, the type and terms of securities deliverable upon conversion (if any), and any public

offering price; (iv) in the case of warrants, the duration, offering price, exercise price, the type and terms of securities deliverable

upon exercise, and any public offering price; (v) in the case of rights, the number being issued, the exercise price, and the expiration

date, the transferability, and the type and terms of securities deliverable upon exercise; and (vi) in the case of units, the title

of the series of units, the type and terms of securities comprising the units, and any public offering price. The applicable prospectus

supplement will also contain information, where applicable, about certain U.S. federal income tax consequences relating to, and

any listing on a securities exchange of, the securities covered by such prospectus supplement. It is important that you read

both this prospectus and the applicable prospectus supplement before you invest.

We or the selling stockholders may

offer the securities directly, through agents, or to or through underwriters. The prospectus supplement will describe the

terms of the plan of distribution and set forth the names of any underwriters involved in the offer and sale of the

securities. See “Plan of Distribution” beginning on page 9 and “Selling

Stockholders” beginning on page 7 for more information on this topic. No securities may be sold without

delivery of this prospectus and a prospectus supplement describing the method and terms of the offering of the

securities.

Our common stock is listed on the Nasdaq

Global Select Market, or NASDAQ, under the symbol “ACTG.” On November 17, 2020, the closing sale price of our

common stock on NASDAQ was $3.79 per share.

Investing

in OUR securities involves A HIGH DEGREE OF risk. before investing in our securities, You should carefully REVIEW the

SECTION ENTITLED “risk factors” beginning on page 5 of this prospectus, AS WELL AS THE RISKS AND UNCERTAINTIES

DESCRIBED in any prospectus supplement, and in any documents incorporated by reference herein or therein.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of

this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is

November 23, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a

registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf”

registration process. Under this process, we may, from time to time, offer and sell any combination of the securities

described in this prospectus in one or more offerings. The aggregate offering price of the securities that we may offer

pursuant to this prospectus will not exceed $100,000,000. This prospectus also relates to the offer and sale of up to an

aggregate of 148,965,762 shares of our common stock held by the selling stockholders identified in this prospectus in the

section entitled “Selling Stockholders”.

This prospectus provides a general description

of the securities that we and the selling stockholders may offer and sell from time to time. Each time we offer and sell any of

our securities under this prospectus, we will, to the extent required by law, describe the specific terms of the offering in a

prospectus supplement. To the extent that any selling stockholder offers and sells any shares of our common stock, the selling

stockholders may be required to provide you with a prospectus supplement containing specific information about the selling stockholder

and the terms of the offering. Any prospectus supplement that we or the selling stockholders provide to you may add, update or

change information in this prospectus. To the extent there is a conflict between the information contained in this prospectus and

any accompanying prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement

in one of these documents is inconsistent with a statement in another document having a later date—for example, a document

incorporated by reference in this prospectus or any prospectus supplement—the statement in the document having the later

date automatically modifies or supersedes the earlier statement. Any statement so modified will be deemed to constitute a part

of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus.

This prospectus, together with any accompanying prospectus supplement, will include all material information relating to an offering

pursuant to this registration statement. You should read this prospectus and any prospectus supplement, as well as the documents

incorporated by reference herein and therein, carefully before you invest in any securities.

You should rely only on the information

contained in this prospectus, in any accompanying prospectus supplement, or in any document incorporated by reference herein or

therein. We have not authorized anyone to provide you with any different information. We take no responsibility for, and can provide

no assurance as to the reliability of, any other information that others may provide to you. The information contained in this

prospectus, in any applicable prospectus supplement, and in the documents incorporated by reference herein or therein, is accurate

only as of the date such information is presented. Our business, financial condition, results of operations, liquidity and future

prospects may have changed since those respective dates.

This prospectus and any accompanying prospectus

supplement does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered

securities to which they relate, nor does this prospectus and any accompanying prospectus supplement constitute an offer to sell

or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or

solicitation in such jurisdiction. This prospectus may not be used to offer or sell our securities unless accompanied by a prospectus

supplement relating to the offered securities.

Investing in our securities involves a

high degree of risk. Before investing in our securities, you should carefully review the section entitled “Risk Factors” beginning on page 5 of this prospectus, as well as the risks and uncertainties described in any applicable

prospectus supplement, and in any documents that we incorporate by reference herein or therein.

The registration statement containing this

prospectus, including the exhibits to the registration statement, provides additional information about us, the selling stockholders,

and the securities offered by us and the selling stockholders pursuant to this prospectus. For a more complete understanding of

the offering of the securities covered by the registration statement of which this prospectus is a part, you should refer to the

registration statement, including its exhibits. For additional information, see the section entitled “Where You Can Find More Information.”

SPECIAL NOTE REGARDING FORWARD-LOOKING

INFORMATION

This prospectus, any accompanying prospectus

supplement, and the documents incorporated by reference herein and therein, contain forward-looking statements within the meaning

of the federal securities laws. These forward-looking statements are intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this

prospectus, any accompanying prospectus supplement, and any documents incorporated by reference herein or therein, are forward-looking

statements.

Our forward-looking statements are based

on our management’s current assumptions and expectations of future events and trends, which affect or may affect our business,

strategy, operations, financial performance, liquidity and future prospects. Although we believe that these forward-looking statements

are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties and are made in light

of information currently available to us. Many important factors, in addition to the factors described in this prospectus, may

materially and adversely affect our results as expressed or implied in our forward-looking statements. You should read this prospectus,

any accompanying prospectus supplement, and the documents we incorporate by reference herein and therein, completely and with the

understanding that our actual future results may be materially different from and worse than what we expect.

Forward-looking statements involve risks

and uncertainties and are not guarantees of future performance. As a result of the risks and uncertainties described above, the

forward-looking statements discussed in this prospectus might not occur and our future results and performance may differ materially

from the information provided in these forward-looking statements due to, but not limited to, the factors mentioned above. Because

of these uncertainties, you should not place undue reliance on these forward-looking statements when making an investment decision.

Moreover, we operate in an evolving environment.

New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors

and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Forward-looking statements speak only

as of the date they were made, and, except to the extent required by law or the rules of the Nasdaq Stock Market, we undertake

no obligation to update or review any forward-looking statement because of new information, future events or other factors. You

should, however, review the risks and uncertainties we describe in the reports we will file with the SEC, including those reports

we file after the date of this prospectus. For additional information, see the section entitled “Where You Can Find More Information.”

We qualify all of our forward-looking

statements by these cautionary statements.

ABOUT THE COMPANY

General

We invest in intellectual property, or IP,

and related absolute return assets and engage in the licensing and enforcement of patented technologies. We partner with inventors

and patent owners, applying our legal and technology expertise to patent assets to unlock the financial value in their patented

inventions. We generate revenues and related cash flows from the granting of patent rights for the use of patented technologies

that our operating subsidiaries control or own. We assist patent owners with the prosecution and development of their patent portfolios,

the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented

technologies and, where necessary, with the enforcement against unauthorized users of their patented technologies through the filing

of patent infringement litigation. We are principals in the licensing and enforcement effort, obtaining control of the rights in

the patent portfolio, or control of the patent portfolio outright.

We have a proven track record of licensing

and enforcement success with over 1,580 license agreements executed to date, across nearly 200 patent portfolio licensing and enforcement

programs. Currently, on a consolidated basis, our operating subsidiaries own or control the rights to multiple patent portfolios,

which include U.S. patents and certain foreign counterparts, covering technologies used in a variety of industries. To date, we

have generated gross licensing revenue of approximately $1.6 billion, and have returned more than $796 million to our patent partners.

Our principal executive, corporate and

administrative offices are located in Irvine, California, and we employed 20 full-time employees as of November 17,

2020.

Corporate Information

We were originally incorporated in California

in January 1993 and reincorporated in Delaware in December 1999. Our principal executive offices are located at 4 Park Plaza, Suite

550, Irvine, California 92614. The telephone number of our principal executive office is (949) 480-8300.

Our website address is www.acaciaresearch.com.

Reference in this prospectus to this website address does not constitute incorporation by reference of the information contained

on or accessed through our website and references to our website address in this prospectus are inactive textual references only.

Securities Purchase Agreement, Registration Rights Agreement

and Governance Agreement

Securities Purchase Agreement

On November 18, 2019, we entered into a

Securities Purchase Agreement, or the Purchase Agreement, with Starboard Value LP, or Starboard Value, and the Buyers (as defined

in the Purchase Agreement), pursuant to which we (i) issued and sold to the Buyers 350,000 shares of Series A Convertible Preferred

Stock, par value $0.001 per share, (ii) issued to the Buyers Series A Warrants to purchase up to 5,000,000 shares of common stock,

(iii) agreed to issue, at Starboard Value’s election upon the identification and approval by each of us and Starboard Value

of a suitable investment or acquisition by us, or an Approved Investment, senior secured non-convertible notes, or the Notes, to

Starboard Value and/or its affiliates, in an aggregate principal amount not to exceed $365,000,000, and (iv) agreed to issue to

the Buyers Series B Warrants to purchase up to 100,000,000 shares of common stock upon the satisfaction of certain conditions set

forth in the Purchase Agreement. Upon the satisfaction of such conditions, we issued the Series B Warrants to Buyers on February

25, 2020. Upon the identification of an Approved Investment on June 4, 2020, we issued to Starboard Value and its affiliates $115

million principal amount of Notes, all of which were subsequently exchanged by the noteholders on June 30, 2020 for senior notes

issued by Merton Acquisition HoldCo LLC, our wholly-owned subsidiary. The shares of Series A Convertible Preferred Stock are immediately

convertible into, and the Series A and Series B Warrants are immediately exercisable for, shares of our common stock.

The offer and sale of the foregoing shares

of Series A Convertible Preferred Stock, Series A Warrants, Series B Warrants and Notes, which we collectively refer to as the

Securities, were not registered under the Securities Act in reliance on the exemption afforded by Section 4(a)(2) of the Securities

Act and Rule 506(b) of Regulation D promulgated thereunder.

Registration Rights Agreement

On November 18, 2019, in connection with

the Purchase Agreement, we entered into a Registration Rights Agreement, or the Rights Agreement, with Starboard Value and the

Buyers, pursuant to which we agreed to, among other things, prepare and file with the SEC (i) an initial registration statement,

or the Initial Registration Statement, on Form S-3, covering the resale of 130% of the shares of common stock underlying the then-outstanding

Securities, or the Underlying Shares, and (ii) subsequent registration statements covering the resale of Underlying Shares to the

extent not included in previous registration statements. In addition, upon written notice to us by Starboard Value, or a Demand

Notice, we will prepare and file with the SEC a registration statement covering the resale of any Series A Convertible Preferred

Stock, Notes and/or Series B Warrants set forth in such Demand Notice.

The registration statement of which this

prospectus is a part has been filed by us in satisfaction of our obligations under the Purchase Agreement and the Rights Agreement

to file the Initial Registration Statement. We intend to maintain the effectiveness of the registration statement until the earlier

of (i) such time as the shares offered by the selling stockholders pursuant to this prospectus have been sold, or (iii)

such time as such shares offered by the selling stockholders pursuant to this prospectus can be freely resold without restriction

or limitation under Rule 144 and without the requirement to be in compliance with Rule 144(c)(1) or otherwise under applicable

securities laws.

We have certain customary obligations under

the Rights Agreement to indemnify for losses incurred by the initial selling stockholders in connection with any untrue statements

of material fact or material omissions in the registration statement of which this prospectus is a part, and for certain violations

of securities and other similar laws.

See the section entitled “Description of Capital Stock – Registration Rights Agreement” for additional information.

Governance Agreement

On November 18, 2019, in connection with

the Purchase Agreement, we entered into a Governance Agreement, or the Governance Agreement, with Starboard Value and certain of

its affiliates, which we collectively refer to as Starboard. Pursuant to the Governance Agreement, we (i) appointed Jonathan Sagal

as a member of our Board of Directors, or the Starboard Appointee, (ii) granted Starboard the right to recommend two additional

directors for appointment to our Board of Directors, or the Additional Appointees and (iii) formed a Strategic Committee of the

Board of Directors, or the Strategic Committee, which was tasked with, among other things, sourcing and performing due diligence

on potential acquisition targets and intellectual property or other investment opportunities, with the goal of finding one or more

Approved Investments for recommendation to the Board of Directors. The Governance Agreement was subsequently amended on January

7, 2020.

See the section entitled “Description of Capital Stock – Governance Agreement” for additional information.

RISK FACTORS

Investing in our securities involves

a high degree of risk. Before making an investment decision, you should carefully consider the risks described in (i) the

sections entitled “Risk Factors” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports

on Form 10-Q, as filed with the SEC, which are incorporated by reference in this prospectus, (ii) the additional risks and

uncertainties described below, and (iii) any amendments or updates to our risk factors reflected in subsequent filings with

the SEC, including in any applicable prospectus supplement, or in any document incorporated by reference herein or therein.

If any of these risks actually occur, our business, financial condition, results of operations and future prospects could be

materially and adversely affected. For more information, see the section entitled “Where You Can Find More Information.”

The risks and uncertainties we have described

are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial

may also affect our business, financial condition or results of operations.

This prospectus, and the documents we

incorporate by reference in this prospectus, contain forward-looking statements that involve risks and uncertainties. Our actual

results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including

the risks and uncertainties mentioned elsewhere in this prospectus. For more information, see the section entitled “Special Note Regarding Forward-Looking Information.”

Risks Related to Selling Stockholders’ Sales of Shares

Sales of a significant number of shares of our common

stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock,

impair our ability to raise capital, and weaken market confidence in our company.

Starboard Value and its affiliates currently

hold Securities convertible into, or exercisable for, an aggregate of 114,589,045 shares of our common stock. As of November

17, 2020, 49,279,453 shares of our common stock were issued and outstanding. A future decision by Starboard Value and/or its

affiliates to sell all or a large portion of its shares, or the perception in the market that such sales could occur, could weaken

market confidence in our company and our future prospects, which could have a material adverse effect on our financial condition

or results of operation, and result in a decline in the market price of our common stock. In addition, such sales may impair our

ability to raise additional capital in the future at a time and price that our management deems acceptable. Further, it is possible

that the selling stockholders may sell their shares to one of our competitors, to a potential acquirer of our company, or to another

person whose interests may differ, perhaps materially, from those of our other stockholders.

We may not be able to maintain effectiveness of the registration

statement of which this prospectus forms a part, which could impact the liquidity of our common stock.

Under the terms of the Rights Agreement,

we are obligated to file the Initial Registration Statement to cover 130% of the shares of common stock underlying the then-outstanding

Securities issued pursuant to the Purchase Agreement. The registration statement of which this prospectus forms a part is intended

to satisfy that obligation. We also agreed to use our reasonable efforts to maintain the continuous effectiveness of the Initial

Registration Statement, but we may not be able to do so. We cannot assure you that we will not be required to suspend or cease

sales under the Initial Registration Statement, that the SEC will not issue any stop order to suspend the effectiveness of the

Initial Registration Statement or that, if such a stop order is issued, we will be able to amend the Initial Registration Statement

to remove the stop order to permit sales to be made under the Initial Registration Statement in a timely manner or at all. To the

extent the Initial Registration Statement is not effective, the selling stockholders’ ability to sell the shares of common

stock issuable upon the conversion or exercise of the Securities may be limited, which could have a material adverse effect on

the liquidity of our common stock.

In addition, if (i) the Initial Registration

Statement is not declared effective by the time period required by the Rights Agreement, (ii) the Initial Registration Statement

fails to register all of the Underlying Shares or (iii) sales of all of the Underlying shares cannot be made pursuant to the Initial

Registration Statement or otherwise, we will be required to pay certain monetary penalties to the holders of the Underlying Shares,

as set forth in the Rights Agreement.

USE OF PROCEEDS

We intend to use the net proceeds we receive

from the sale of our securities, and from the exercise of any warrants or rights issued pursuant hereto, for working capital and

other general corporate purposes.

We may set forth additional information

regarding the anticipated use of proceeds from the sale of securities we offer under this prospectus in a prospectus supplement

relating to the specific offering. We have not determined the amount of net proceeds to be used from any specific offering. As

a result, our management will have broad discretion in the allocation of the net proceeds received from the sale of the securities

offered pursuant to this prospectus.

Pending the use of the net proceeds, we

intend to invest the net proceeds in high-quality, short-term interest-bearing obligations, investment-grade instruments, certificates

of deposit or direct or guaranteed obligations of the U.S. government.

We will not receive any proceeds from the

sale of shares of our common stock by the selling stockholders (other than the net proceeds received upon the exercise of the

Series A Warrants and Series B Warrants held by the Buyers, assuming the exercise price for such warrants is paid in cash). All

of the shares of common stock offered by the selling stockholders pursuant to this prospectus will be sold by the selling stockholders

for their own account.

SELLING STOCKHOLDERS

The shares of common stock being offered

by the selling stockholders are those issuable to the selling stockholders upon conversion of the shares of Series A Convertible

Preferred Stock, and upon exercise of the Series A Warrants and Series B Warrants. The shares of Series A Convertible Preferred

Stock are immediately convertible into, and the Series A and Series B Warrants are immediately exercisable for, shares of our common

stock. For additional information regarding the issuances of the shares of Series A Convertible Preferred Stock, the Series A Warrants

and the Series B Warrants, see the section entitled “About the Company.”

We are registering such shares of common

stock in order to permit the selling stockholders to offer and sell the shares from time to time. Except for the transactions described

in the section entitled “About the Company,” the selling stockholders have not had any material relationship with us

within the past three years.

The table below lists the selling stockholders

and other information regarding the beneficial ownership of the shares of common stock held by the selling stockholders.

The second column lists the number of shares

of common stock beneficially owned by the selling stockholders, based on their ownership of the Series A Convertible Preferred

Stock, Series A Warrants and Series B Warrants, in each case as of September 30, 2020, assuming conversion of all shares of Series

A Convertible Preferred Stock, and exercise of all Series A Warrants and Series B Warrants, held by the selling stockholders on

that date, without regard to any limitations on the issuance of common stock pursuant to the terms of the Amended and Restated

Certificate of Designations, Preferences, and Rights of Series A Convertible Preferred Stock, or the Amended Certificate of Designations,

or upon exercise of the Series A Warrants or Series B Warrants.

The third column lists the shares of common