Stocks Climb, Extending Record-Setting Rally

December 29 2020 - 10:24AM

Dow Jones News

By Anna Hirtenstein

U.S. stocks notched gains Tuesday, extending a recent rally that

has sent major benchmarks to fresh records.

The S&P 500 added 0.4% shortly after the opening bell. The

Dow Jones Industrial Average advanced about 129 points, or 0.4%.

The Nasdaq Composite gained about 0.4%. All three indexes closed at

all-time highs Monday.

Stocks have been powering higher in the final days of the year,

and the latest leg of the rally has been driven in part by U.S.

lawmakers' efforts to pass a second stimulus package to help the

economy.

"Some people are getting carried away by the race for records.

The market momentum is pushing and exceeding these record highs,"

said Carsten Brzeski, global head of macro research at ING Groep.

"They are fictive thresholds, but benchmarks can live their own

lives and this is happening now."

Trading volumes are also typically thinner in the final days of

the year with many people on vacation, which can potentially

amplify market moves.

The House on Monday approved a bill proposing to increase the

size of stimulus checks to $2,000 from $600. The measure now heads

to the Senate where its fate is uncertain.

"Markets aren't necessarily taking the potential increase for

granted, but there is a cheerfulness about the possibility of

stepping it up. This is partly being priced in," said Mr.

Brzeski.

In bond markets, the yield on the benchmark 10-year Treasury

ticked up to 0.946%, from 0.932% Monday.

Overseas, the pan-continental Stoxx Europe 600 added 0.9%. In

the U.K., where markets reopened Tuesday, the main FTSE 100 stocks

benchmark rose about 2% as investors cheered the post-Brexit deal

struck on Christmas Eve. British and European Union officials

reached an agreement that includes a free-trade accord, bringing to

an end over four years of uncertainty.

"The Brexit deal will help risk sentiment. As investors come

back to the office for the first time since Christmas, people are

looking into the details of the deal," said James Athey, investment

manager at Aberdeen Standard Investments.

In Asia, most major benchmarks climbed. Japan's Nikkei 225 index

rose 2.7%, ending the day at a 30-year high. Hong Kong's Hang Seng

Index added 1%, while the Shanghai Composite Index edged down

0.5%.

"The momentum in Asian stocks shows that this whole

vaccine-motivated rally is getting global," Mr. Blokland said. "For

2021, we are quite bullish, we do think that the economic recovery

will recommence from [the first quarter] and the stimulus boost out

of the U.S. will help."

Gunjan Banerji contributed to this article.

Write to Anna Hirtenstein at anna.hirtenstein@wsj.com

(END) Dow Jones Newswires

December 29, 2020 10:09 ET (15:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

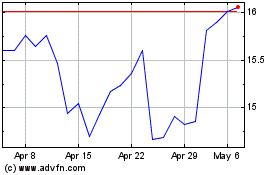

ING Groep NV (EU:INGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

ING Groep NV (EU:INGA)

Historical Stock Chart

From Apr 2023 to Apr 2024