Casino Soars as Rallye Shares Plummet Following Bankruptcy Protection

May 24 2019 - 6:02AM

Dow Jones News

By Cristina Roca and Max Bernhard

--Shares in Casino shot up after Rallye, its majority

shareholder, enters bankruptcy-protection proceedings

--Rallye shares plummet after it enters court-supervised

proceedings

--Rallye depends on the free cash that the French retailer

generates in order to service its debt, though payments will be

suspended during the proceedings

--Casino said the proceedings don't relate to its operations and

backed its guidance

Shares in Casino Guichard-Perrachon SA (CO.FR) traded sharply

higher Friday after the company said late Thursday that it isn't

part of safeguard proceedings relating to its majority-shareholder

Rallye SA (RAL.FR).

Rallye said late Thursday that it and its subsidiaries Cobivia,

HMB, as well as their owners Fonciere Euris, Finatis and Euris,

have entered into bankruptcy protection in France. The so-called

safeguard proceedings allow debtors that are still solvent but face

insurmountable difficulties to be restructured under a court's

supervision. Shares in Rallye sank following the announcement.

"These procedures do no relate to Casino group, nor its

operations, nor its employees, and do not impact the ongoing

execution of its strategic plan," Casino said. The French

supermarket said it has no operational ties with Rallye.

Casino on Friday backed its 2019 guidance.

At 0814 GMT, shares in Casino traded 16% higher at EUR32.40.

Shares in Rallye were down 54% at EUR3.50.

Bryan Garnier analyst Clement Genelot said he saw a short

squeeze on Casino's shares as likely, noting that 20% of Casino's

total capital used to be shorted. Rallye's move to start safeguard

proceedings is an effort to short-circuit short sellers, Deutsche

Bank analyst Maxime Mallet said.

Rallye said Thursday that "following the persistent and massive

speculative attacks against the group's securities," the opening of

these proceedings will improve the companies' debt profile in a

stable environment.

Speaking to investors on Friday morning, Casino's Chief

Financial Officer David Lubek "was keen to rebuff the link between

[Casino's] (very generous) dividend policy and the Rallye liquidity

needs, but at the same time seemed to suggest that this policy may

now be reviewed," Jefferies analyst James Grzinic said. Casino

almost single-handedly generates the cash that supports the debt of

the constellation of companies owning it, Jefferies noted.

Bryan Garnier's Mr. Genelot believes Casino may lower its

dividend payout ratio, at least while its parent company is under

safeguard proceedings. Rallye is temporarily protected from

repaying its liabilities, Mr. Genelot noted.

Rallye said that as of December 31, 2018 it had racked up net

financial debt of 2.9 billion euros ($3.2 billion), while its

owners Fonciere Euris, Finatis and Euris had combined debt of

nearly EUR400 million. Part of this debt is subject to pledge over

Casino, Rallye, Fonciere Euris, or Finatis shares. Rallye holds

51.7% of Casino shares and 61% of voting rights.

"Rallye and its subsidiaries have...pledged nearly all of their

shares," it said.

The holding's shares were suspended from the Euronext Paris

exchange Thursdau after hitting an all-time low on Wednesday.

Shares in Casino were also halted during the course of the morning

Thursday following a sharp fall.

Casino has been beset by a string of bad news in recent months,

including rating downgrades by Standard & Poor's and Moody's.

On Wednesday the retailer confirmed that its headquarters were

investigated by European Commission officials as part of a probe

into suspected violations of antitrust rules.

Casino is currently undertaking an asset-disposal plan, and HSBC

analysts say both the shrinking of Casino's business and its

margin-maximization strategy could undermine the French group's

long-term strategic position.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca, Max Bernhard at max.bernhard@dowjones.com;

@mxbernhard

(END) Dow Jones Newswires

May 24, 2019 05:47 ET (09:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

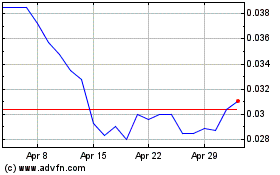

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Apr 2023 to Apr 2024