Billions Of Dollars Tokenized Bitcoin Moved To Ethereum, BSC, And Solana

May 17 2023 - 9:20AM

NEWSBTC

More than 70% of all tokenized Bitcoin, worth over $4.3 billion,

have been transferred to Ethereum, according to data from

Cryptoflows. This migration highlights a growing trend of utilizing

Bitcoin within Ethereum’s decentralized finance (DeFi) ecosystem

and other interesting areas. Billions Of Bitcoin Being Tokenized

Out of the $5.75 billion worth of BTC exported from Bitcoin, over

$1.44 billion found its way to the BNB Smart Chain (BSC) with more

BTC tokens flowing to Avalanche, Fantom, and Solana. Just like

Ethereum, BSC, Avalanche, and other ecosystems where tokenized BTC

found its way to, support smart contracting. Therein, holders can

engage in DeFi, possibly earning income. Related Reading: Bitcoin

Whales Break A Pattern Held Throughout Halving Cycles: Glassnode

Bitcoin doesn’t support smart contracts; explaining why some

holders are tokenizing their assets. Still, while there appears to

be growing demand for DeFi, reading from this outflow of BTC to

smart contracting platforms, total value locked (TVL) and

decentralized exchange (DEX) volumes have been low and even

stagnant. Data from DefiLlama.com, a DeFi analytics platform, shows

that TVL is flat and below $50 billion. Meanwhile, DEX trading

volumes have been relatively low in recent months. This phase of

decreased activity could suggest a temporary slowdown in

decentralized trading, mirroring the general trend of crypto prices

in recent months. With less than $2 billion of registered DEX

trading volumes on May 17, there has been a notable slump in

activity over the last months, especially from early 2022. In

November 2021, at the peak of the last bull cycle, DEX trading

volumes, on average, stood at over $7 billion. BTC Prices

Suppressed But Coin Is A Safe Haven While users port their BTC to

smart contracting platforms, Bitcoin prices remain under pressure

partly due to regulatory decisions across the world, mainly in the

United States and Europe. On May 16, the European Union (EU)

approved comprehensive crypto regulations which aim to bring

transparency and oversight to the crypto industry, addressing

concerns such as money laundering and investor protection. Even in

this bearish environment, Geoff Kendrick, the head of digital

assets research at Standard Chartered, recently opined that Bitcoin

prices could rally by as much as 70%, adding $20,000, should the

United States default on its debt. Related Reading: Bitcoin Loses

Grip On $27,000 Handle Amid Debt Ceiling Concerns – Details

Although Kendrick said the probability of this default is a

“low-probability, high-impact event”, his prediction has generated

significant interest within the crypto and Bitcoin communities as

some begin to theorize the potential impact of the world’s

superpower defaulting on its debt obligations on the broader

financial landscape. Any such event would result in economic

turmoil and an inevitable loss of faith in traditional financial

systems that would most likely drive investors towards alternative

assets, mostly cryptocurrencies. Considering Bitcoin’s stature and

setup as a safe haven, the coin, in Kendrick’s view, could benefit,

subsequently posting significant gains. Feature From Canva, Chart

From TradingView

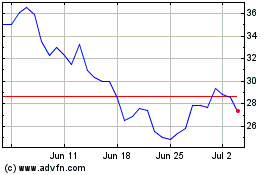

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024