CannabisNewsWire

Editorial Coverage: Last year was a year of maturation for the

cannabis market.

- California’s growing pains are a recipe for success for handful

of savvy operators

- Brands, consistency and scalability likely deciding factors for

many companies

- Projected global market size an open-and-shut case for scaling

up NA sector

The market growth resulted from retailers in nine legal

adult-use states being pushed beyond the sector’s historically core

demographics, targeting fast-growing new segments such as women,

with an emphasis on elements such as wellness and clearly

labeled/low-dose alternatives. That trend was reinforced with CBD

breaking out into the mainstream, as industrial hemp became legal

throughout the United States, and cannabis companies looked for

ways to stand out from the crowd. Some companies were more

successful at this than others, with TransCanna Holdings

Inc. (CSE: TCAN) (XETR: TH8) (TCAN

Profile) making huge strides recently to expand the

upper-end procurement part of the business, as well as flesh-out

its footprint of branded offerings. Other moves have been made by

comparable sector players such as Canopy Growth Corporation

(NYSE: CGC) (TSX: WEED), DionyMed Brands Inc.

(OTCQB: DYMEF) (CSE: DYME), Cresco Labs Inc.

(OTCQX: CRLBF) (CSE: CL) and CannaRoyalty Corp.

(OTCQX: ORHOF) (CSE: OH), which are pursuing similarly

comprehensive approaches to the sector that run the gamut from raw

inputs to changing branding, marketing and distribution

methods.

To view an infographic of this editorial, click here.

Diverse Markets Hold Big Potential

California’s administrative and tax regime may have cost the

state half a billion dollars or more in potential cannabis market

tax revenues through over regulation, with the

state being the first market in the world since transitioning in

2016 from medical to recreational that has actually witnessed a

subsequent decline in the size of the legal retail market. This is

in stark contrast to Massachusetts and Nevada, which both

dramatically outperformed expectations. And while the California

legal retail market may have come in around half a billion shy of

projected targets, the illicit market is doing just fine, with an

estimated value of $3.7 billion last year,

accounting for as much as 80% of all sales. This is a clear

indicator that the potential exists to have hit analyst-projected

targets for the legal market, had California regulators not

handicapped a growing industry just as things were really getting

started.

In fact, with thousands of cultivation and manufacturing

licenses set to expire in the next few months and only Senate Bill

67 on the horizon to address the problem, some analysts are

predicting that California may see supply shortages

in the near future. At any rate, the national and international

markets are shaping up quite nicely, with the most recent worldwide

consumer spending estimates from Arcview Market Research and BDS

Analytics showing a 39.1% year-over-year

jump to $17 billion in 2019 and beyond. This is a market which

is on track to run at an estimated 26% CAGR through 2022, hitting

upwards of $31.6 billion, making it an extremely lucrative export

market for sophisticated North American cannabis brands.

Self-Contained Ecosystem and Closed-Loop

Brands

Founded in 2017 with the goal of genuine seed-to-sale capability

and rapidly acquiring a bevy of premium cannabis brands,

Vancouver-based TransCanna Holdings Inc. (CSE: TCAN) (XETR:

TH8) is pursuing a true “self-contained

ecosystem” approach to the sector via its California-based,

wholly owned subsidiaries. TransCanna is intent on ensuring maximum

brand consistency by handling every aspect of the production

process — from procurement and branding and design through to

distribution, transportation, marketing and sales.

The company’s latest acquisition announcement will see

TransCanna picking up such well-performing Goodfellas Group LLC

brands as Daily Cannabis Goods, which saw more than 2,100 units

shipped during its first month in August of last year before

breaking the 10,000 mark just four months

later. TransCanna anticipates adding at least three more items to

the Daily Cannabis Goods product mix and also managed to pick up

the proprietary, in‐house Simple brand of user-friendly Simple Kit™

products in the Goodfellas Group deal, which are specially crafted

to give new users a positive first cannabis experience.

Forged in the Crucible of a Nascent

Industry

The company cut its teeth amid the growing pains of California’s

burgeoning — but still very young — recreational market. Today

TransCanna appears well poised to successfully deliver on a

closed-loop cannabis model that can cost effectively bring goods to

market while still dealing with prevailing regulations.

CEO TransCanna Jim Pakulis spoke in

mid-April of the company’s tremendous efforts to complete the

acquisition of what is arguably the largest vertically-integrated

cannabis focused facility in California. The $15 million

acquisition consists of a 196,000-square-foot, turnkey

manufacturing facility on a 5.5-acre piece of land in Modesto,

estimated to be able to support expansion of the site with an

additional 400,000 to 600,000 square feet of facilities for

cultivation.

Total revenues from the acquisition, including manufacturing,

extraction, distribution and cannabis sales, are currently

projected to be from $220 million to $363 million a year. A recent

independent third‐party business valuation firm’s conclusion put

the enterprise value of the proposed business, at around $50 to $75

million. That estimate

includes things such as the value of the recently renovated

manufacturing facility’s institutional-grade packaging and

extraction equipment. This appears to be a sweetheart deal, placing

the company in a solid position to take advantage of a potential

supply shortfall in California. Similarly, the move sets up

TransCanna for success on the rapidly developing national and

international stages.

Growth Financing Gone Well

In addition, the company originally announced a CD$10 million

broker-syndicated private placement but within short order was

oversubscribed to CD$16 million. The funds were used to assist in

the aforementioned acquisition and has already executed a sublease

agreement for an additional 10,000 square feet of multipurpose

floorspace in Adelanto, California.

This satellite facility is the first of five anticipated

satellite distribution network facilities that will be

strategically located throughout the state to support TransCanna’s

goal of quickly having 15 reliable, consistent, branded products on

offer at the scale necessary to keep the business growing alongside

demand. The completely fenced Adelanto complex is reportedly of

superior quality and already has existing round-the-clock armed

security, making it a solid deal at a negotiated price of $2 per

square foot per month for four years, which is roughly 30% below

current market rates.

Furthermore, TransCanna recently applied for a permanent

manufacturing, distribution and transportation license for

Adelanto, proving that the company’s immediate focus is on ensuring

city and state licenses are in hand as soon as possible. The

company anticipates applying for licenses with the local regulatory

body in Modesto by the first of June. The company anticipates being

able to prepare and package the Daily Cannabis Brand half gram

pre-rolls at the facility, then transport them straight to

dispensaries without the need to involve a third party or incur any

additional expenses.

Cannabis Companies Making Big Moves

Canopy Growth Corporation (NYSE: CGC) (TSX:

WEED), one of the largest players in the space, has made

big moves lately to expand its footprint in both North American and

Europe. In April, Canopy announced a definitive agreement to

acquire leading multistate operator Acreage Holdings Inc. outright

in a deal valued at around $3.4 billion. This massive deal could

make Canopy a real juggernaut, with a leading position in every

major international market for legal cannabis. The move will give

the company a sizeable presence in the United States as Canopy

rolls out its U.S. hemp operations in parallel, which will span

cultivation, extraction, processing, and packaging.

DionyMed Brands Inc. (OTCQB: DYMEF) (CSE:

DYME), while still a relatively small company compared to

others in this area, has nevertheless put together a compelling

model. The company’s approach spans multistate cannabis brands as

well as a distribution and direct-to-consumer delivery platform.

The company recently managed to secure a roughly $7.34 million

agreement with a syndicate of agents co-led by Canaccord Genuity

Corp. and leading Canadian independent investment dealer Cormark

Securities.

Cresco Labs Inc. (OTCQX: CRLBF) (CSE: CL) has

also been making big moves in the sector, recently prequalifying

for a cultivation and processing license in Michigan and signing a

letter to acquire VidaCann, one of the biggest and most advanced

medical cannabis providers in Florida. The VidaCann deal would put

Cresco in operation in six of the country’s most populous states,

granting access to some 140 million potential customers (roughly 65

percent of the total addressable U.S. cannabis market).

Cresco also signed a definitive agreement in April to acquire

California-based CannaRoyalty Corp. (OTCQX: ORHOF) (CSE:

OH), which does business under the well-known Origin House

moniker as a leading cannabis products distributor, as well as a

provider of brand support services. CannaRoyalty has built a

serious operation with more than 50 brands under the Origin House

name. The Cresco Labs acquisition would harness the branded product

development and distribution expertise of two of the industry’s top

players.

TransCanna is banking on the future of intelligently executed

cannabis brand offerings, not just in California and North America

but around the world as well. With longer-term projections of

$57 billion by 2027 for the global market, the

company could be setting the cornerstones today of a self-contained

ecosystem weed empire that may one day see its premium brands in

dispensaries all over the globe. Investors may want to keep tabs on

TransCanna as the company’s growing brand portfolio and physical

presence in California begin to bear fruits.

For more information on TransCanna Holdings, visit TransCanna

Holdings Inc. (CSE: TCAN) (XETR: TH8)

About CannabisNewsWire

CannabisNewsWire (CNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

CannabisNewsBreaks that summarize

corporate news and information, (3) enhanced press release

services, (4) social media distribution and optimization services,

and (5) a full array of corporate communication solutions. As a

multifaceted financial news and content distribution company with

an extensive team of contributing journalists and writers, CNW is

uniquely positioned to best serve private and public companies that

desire to reach a wide audience of investors, consumers,

journalists and the general public. CNW has an ever-growing

distribution network of more than 5,000 key syndication outlets

across the country. By cutting through the overload of information

in today’s market, CNW brings its clients unparalleled visibility,

recognition and brand awareness. CNW is where news, content and

information converge.

Receive Text Alerts

from CannabisNewsWire: Text "Cannabis" to

21000

For more information please visit https://www.CannabisNewsWire.com and

or https://CannabisNewsWire.News

Please see full terms of use and disclaimers on the

CannabisNewsWire website applicable to all content provided by CNW,

wherever published or re-published: http://CNW.fm/Disclaimer

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

DISCLAIMER: CannabisNewsWire (CNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by CNW are

solely those of CNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable CNW for any investment

decisions by their readers or subscribers. CNW is a news

dissemination and financial marketing solutions provider and is NOT

registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, CNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

CNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and CNW undertakes no

obligation to update such statements.

Source:

CannabisNewsWire

Contact:

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.net

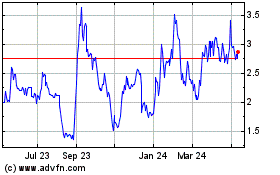

Cresco Labs (CSE:CL)

Historical Stock Chart

From Mar 2024 to Apr 2024

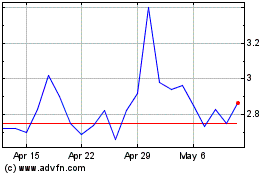

Cresco Labs (CSE:CL)

Historical Stock Chart

From Apr 2023 to Apr 2024