WidePoint Reports Third Quarter 2020 Financial Results

November 16 2020 - 4:01PM

WidePoint Corporation

(NYSE American:

WYY), the leading provider of

Trusted Mobility Management (TM2) specializing in

Telecommunications Lifecycle Management, Identity Management (IdM)

and Digital Billing & Analytics solutions, today reported

results for the third quarter September 30, 2020.

Third Quarter

2020 and Recent Operational

Highlights:

- Secured more than $11 million in

contract wins, exercised option periods, and contract extensions

during the third quarter of 2020, approximately $10 million of

which is comprised of new business and new extensions

- Successfully onboarded Virginia

Alcoholic Beverage Control Authority (Virginia ABC) after being

awarded a new contract for TEM services

- Number of U.S. Department of Defense

digital certificates issued increased 14% sequentially from the

second quarter of 2020 and 15% year-over-year from the third

quarter of 2019, leading to an increase in high margin Identity

Management revenue

- Responded to the request for

proposal and provided oral presentation to the U.S. Department of

Homeland Security regarding the Cellular Wireless Managed Services

(CWMS) II contract re-compete

- Effectuated 1-for-10 reverse stock

split on November 6, 2020 to better position the Company for

long-term success

Third Quarter

2020 Financial Highlights

(results compared to the same year-ago

period):

- Revenues increased 94% to $57.5

million

- Managed Services revenue increased

38% to $12.5 million

- Gross profit increased 30% to $5.6

million

- Net income totaled $1.1 million

- EBITDA, a non-GAAP financial

measure, increased 102% to $1.6 million

- Adjusted EBITDA, a non-GAAP

financial measure, increased 82% to $1.7 million

Nine Month

2020 Financial Highlights (results

compared to the same year-ago period):

- Revenues increased 106% to $152.0

million

- Managed Services revenue increased

37% to $33.8 million

- Gross profit increased 24% to $15.6

million

- Net income totaled $2.0 million

- EBITDA, a non-GAAP financial

measure, increased 84% to $3.8 million

- Adjusted EBITDA, a non-GAAP

financial measure, increased 69% to $4.4 million

|

Third Quarter

2020 Financial Summary |

|

|

|

| |

|

|

|

|

|

|

|

|

|

(in millions, except per share amounts) |

September 30, 2020 |

|

September 30, 2019 |

|

|

(Unaudited) |

|

Revenues |

$ |

57.5 |

|

|

$ |

29.6 |

|

|

Gross Profit |

$ |

5.6 |

|

|

$ |

4.3 |

|

|

Gross Profit Margin |

|

9.8 |

% |

|

|

14.6 |

% |

|

Operating Expenses |

$ |

4.5 |

|

|

$ |

4.0 |

|

|

Income (Loss) from Operations |

$ |

1.1 |

|

|

$ |

0.3 |

|

|

Net Income (Loss) |

$ |

1.1 |

|

|

$ |

0.2 |

|

|

Basic and Diluted Earnings per Share (EPS) |

$ |

0.13 |

|

|

$ |

0.02 |

|

|

EBITDA |

$ |

1.6 |

|

|

$ |

0.8 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

Nine Month 2020

Financial Summary |

|

|

|

| |

|

|

|

|

|

|

|

|

|

(in millions, except per share amounts) |

September 30, 2020 |

|

September 30, 2019 |

|

|

(Unaudited) |

|

Revenues |

$ |

152.0 |

|

|

$ |

73.6 |

|

|

Gross Profit |

$ |

15.6 |

|

|

$ |

12.6 |

|

|

Gross Profit Margin |

|

10.3 |

% |

|

|

17.1 |

% |

|

Operating Expenses |

$ |

13.1 |

|

|

$ |

12.0 |

|

|

Income from Operations |

$ |

2.5 |

|

|

$ |

0.6 |

|

|

Net Income |

$ |

2.0 |

|

|

$ |

0.3 |

|

|

Basic and Diluted Earnings per Share (EPS) |

$ |

0.24 |

|

|

$ |

0.03 |

|

|

EBITDA |

$ |

3.8 |

|

|

$ |

2.0 |

|

| |

|

|

|

The following statements are forward-looking, and actual results

could differ materially depending on market conditions and the

factors set forth under the “Safe Harbor Statement” below.

Financial Outlook

For the fiscal year ending December 31, 2020, the Company is

reiterating its revenue guidance of $185 million to $195 million,

which at the midpoint of the range, would represent 87% growth

year-over-year. The Company is also reiterating the EBITDA guidance

it updated on October 26, 2020 of $4.7 million to $4.9 million,

which at the midpoint, is 50% above the Company’s previously issued

EBITDA guidance and represents a 69% year-over-year increase

compared to fiscal 2019. For fiscal 2020, the Company also

anticipates adjusted EBITDA, which excludes stock-based

compensation expense, to range between $5.5 million to $5.7

million, which, at the midpoint, represents a 57% year-over-year

increase compared to fiscal 2019. The EBITDA forecast takes into

consideration the Company’s planned strategic investments in sales

and marketing and product development. The Company’s financial

outlook is based on current expectations.

Management Commentary

“Thanks to the work of our dedicated personnel and the

flexibility we built into our organization, we continued to build

on the momentum established in the first half of the year and

produced record financial results for the third quarter of 2020,”

said WidePoint’s CEO, Jin Kang. “For the third quarter, our total

revenues increased to $57.5 million, largely driven by our

increased work on the U.S. Census 2020 as well as expansions with

other federal government customers, and perhaps more importantly,

our high margin managed services revenues increased 38%

year-over-year. That increase helped drive $1.1 million in net

income for the third quarter, which is almost five times greater

than our net income in all of fiscal 2019, and our adjusted EBITDA

for the quarter increased 82% to $1.7 million. We also strengthened

our balance sheet by increasing our cash position by $3.9 million

sequentially to $11.4 million.

“The financial success of the quarter is a clear indication of

the value WidePoint can generate because of our excellent staff,

our flexible organizational structure, and the market’s growing

demand for our products that function as a solution for many of the

problems faced by large government and commercial enterprises in

today’s environment. With 2020 lining up to be a banner year for

WidePoint, we believe our company has never been better positioned

than it is today, and we look forward to capitalizing on this

momentum as we close out the year and move into 2021.”

Conference Call

WidePoint management will hold a conference call today (November

16, 2020) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to

discuss these results.

WidePoint’s President and CEO Jin Kang, Executive Vice President

and Chief Sales and Marketing Officer Jason Holloway, and Executive

Vice President and CFO Kellie Kim will host the conference call,

followed by a question and answer period.

U.S. dial-in number: 844-407-9500International number:

862-298-0850

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at

949-574-3860.

The conference call will be broadcast live and available for

replay here and via the investor relations section of the Company’s

website.

A replay of the conference call will be available after 7:30

p.m. Eastern time on the same day through November 30, 2020.

Toll-free replay number: 877-481-4010International replay

number: 919-882-2331Replay ID: 38150

About WidePoint

WidePoint Corporation (NYSE American: WYY) is a leading provider

of trusted mobility management (TM2) solutions, including telecom

management, mobile management, identity management, and digital

billing and analytics. For more information,

visit widepoint.com.

Non-GAAP Financial Measures

WidePoint uses a variety of operational and financial metrics,

including non-GAAP financial measures such as EBITDA, to enable it

to analyze its performance and financial condition. The

presentation of non-GAAP financial information should not be

considered in isolation or as a substitute for, or superior to, the

financial information prepared and presented in accordance with

GAAP. A reconciliation of GAAP Net income to EBITDA is included on

the schedules attached hereto.

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

THREE MONTHS

ENDED |

|

NINE MONTHS

ENDED |

|

| |

|

|

|

SEPTEMBER 30, |

|

SEPTEMBER 30, |

|

| |

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

|

| |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

|

NET INCOME |

$ |

1,067,000 |

|

|

$ |

183,700 |

|

|

$ |

2,039,500 |

|

|

$ |

260,100 |

|

|

|

Adjustments to reconcile net (loss) income to EBITDA: |

|

|

|

|

|

|

|

|

| |

Depreciation and amortization |

|

415,700 |

|

|

|

479,300 |

|

|

|

1,247,100 |

|

|

|

1,429,100 |

|

|

| |

Amortization of deferred financing costs |

|

- |

|

|

|

1,300 |

|

|

|

1,700 |

|

|

|

3,800 |

|

|

| |

Income tax provision (benefit) |

|

12,500 |

|

|

|

32,300 |

|

|

|

242,800 |

|

|

|

126,800 |

|

|

| |

Interest income |

|

(100 |

) |

|

|

(100 |

) |

|

|

(3,100 |

) |

|

|

(4,800 |

) |

|

| |

Interest expense |

|

69,600 |

|

|

|

76,800 |

|

|

|

226,200 |

|

|

|

227,200 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

$ |

1,564,700 |

|

|

$ |

773,300 |

|

|

$ |

3,754,200 |

|

|

$ |

2,042,200 |

|

|

|

Other adjustments to reconcile net (loss) income to Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

| |

(Recovery) Provision for doubtful accounts |

|

|

|

12,300 |

|

|

|

600 |

|

|

|

23,500 |

|

|

| |

Gain on sale of assets held for sale |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| |

Loss on disposal of leasehold improvements |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| |

Lease account impact on EBITDA |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| |

Stock-based compensation expense |

|

160,000 |

|

|

|

163,400 |

|

|

|

650,900 |

|

|

|

536,800 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

1,724,700 |

|

|

$ |

949,000 |

|

|

$ |

4,405,700 |

|

|

$ |

2,602,500 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Safe Harbor Statement

The information contained in any materials that may be accessed

above was, to the best of WidePoint Corporations’ knowledge, timely

and accurate as of the date and/or dates indicated in such

materials. However, the passage of time can render information

stale, and you should not rely on the continued accuracy of any

such materials. WidePoint Corporation has no responsibility to

update any information contained in any such materials. In

addition, you should refer to periodic reports filed by WidePoint

Corporation with the Securities and Exchange Commission for

information regarding the risks and uncertainties to which

forward-looking statements made in such materials are subject. Such

risks and uncertainties may cause WidePoint Corporation’s actual

results to differ materially from those described in the

forward-looking statements.

Investor Relations:

Gateway Investor RelationsMatt Glover or Charlie

Schumacher949-574-3860WYY@gatewayir.com

WIDEPOINT CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS

| |

|

|

|

|

| |

SEPTEMBER

30, |

|

DECEMBER 31, |

|

| |

|

2020 |

|

|

|

2019 |

|

|

| |

(Unaudited) |

|

|

ASSETS |

|

| CURRENT

ASSETS |

|

|

|

|

|

Cash and cash equivalents |

$ |

11,372,902 |

|

|

$ |

6,879,627 |

|

|

|

Accounts receivable, net of allowance for doubtful accounts |

|

|

|

|

|

of $119,248 and $126,235 in 2020 and 2019, respectively |

|

31,469,534 |

|

|

|

14,580,928 |

|

|

|

Unbilled accounts receivable |

|

15,041,634 |

|

|

|

13,976,958 |

|

|

|

Other current assets |

|

1,099,773 |

|

|

|

1,094,847 |

|

|

| |

|

|

|

|

| Total

current assets |

|

58,983,843 |

|

|

|

36,532,360 |

|

|

| |

|

|

|

|

| NONCURRENT

ASSETS |

|

|

|

|

|

Property and equipment, net |

|

619,773 |

|

|

|

681,575 |

|

|

|

Operating lease right of use asset, net |

|

6,299,131 |

|

|

|

5,932,769 |

|

|

|

Intangibles, net |

|

2,076,320 |

|

|

|

2,450,770 |

|

|

|

Goodwill |

|

18,555,578 |

|

|

|

18,555,578 |

|

|

|

Other long-term assets |

|

874,906 |

|

|

|

140,403 |

|

|

| |

|

|

|

|

| Total

assets |

$ |

87,409,551 |

|

|

$ |

64,293,455 |

|

|

| |

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

|

| |

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

|

Accounts payable |

$ |

30,954,163 |

|

|

$ |

13,581,822 |

|

|

|

Accrued expenses |

|

17,348,047 |

|

|

|

14,947,981 |

|

|

|

Deferred revenue |

|

2,270,783 |

|

|

|

2,265,067 |

|

|

|

Current portion of operating lease liabilities |

|

580,483 |

|

|

|

599,619 |

|

|

|

Current portion of other term obligations |

|

- |

|

|

|

133,777 |

|

|

| |

|

|

|

|

| Total

current liabilities |

|

51,153,476 |

|

|

|

31,528,266 |

|

|

| |

|

|

|

|

| NONCURRENT

LIABILITIES |

|

|

|

|

|

Operating lease liabilities, net of current portion |

|

6,097,949 |

|

|

|

5,593,649 |

|

|

|

Deferred revenue, net of current portion |

|

382,814 |

|

|

|

363,560 |

|

|

|

Deferred tax liability |

|

2,100,446 |

|

|

|

1,868,562 |

|

|

| |

|

|

|

|

| Total

liabilities |

|

59,734,685 |

|

|

|

39,354,037 |

|

|

| |

|

|

|

|

| Commitments

and contingencies |

|

- |

|

|

|

- |

|

|

| |

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares |

|

|

|

|

|

authorized; 2,045,714 shares issued and none outstanding |

|

- |

|

|

|

- |

|

|

|

Common stock, $0.001 par value; 30,000,000 shares |

|

|

|

|

|

authorized; 8,458,734 and 8,386,145 shares |

|

|

|

|

|

issued and outstanding, respectively |

|

84,587 |

|

|

|

83,861 |

|

|

|

Additional paid-in capital |

|

95,919,199 |

|

|

|

95,279,114 |

|

|

|

Accumulated other comprehensive loss |

|

(187,435 |

) |

|

|

(242,594 |

) |

|

|

Accumulated deficit |

|

(68,141,485 |

) |

|

|

(70,180,963 |

) |

|

| |

|

|

|

|

| Total

stockholders’ equity |

|

27,674,866 |

|

|

|

24,939,418 |

|

|

| |

|

|

|

|

| Total

liabilities and stockholders’ equity |

$ |

87,409,551 |

|

|

$ |

64,293,455 |

|

|

| |

|

|

|

|

WIDEPOINT CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

THREE MONTHS

ENDED |

|

NINE MONTHS

ENDED |

|

| |

|

|

|

SEPTEMBER 30, |

|

SEPTEMBER 30, |

|

| |

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

|

| |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

|

REVENUES |

$ |

57,506,561 |

|

|

$ |

29,616,940 |

|

|

$ |

151,955,707 |

|

|

$ |

73,626,995 |

|

|

|

COST OF REVENUES (including amortization and depreciation of |

|

|

|

|

|

|

|

|

| |

$130,559, $233,033, $432,327, and $698,192, respectively) |

|

51,888,205 |

|

|

|

25,302,919 |

|

|

|

136,314,439 |

|

|

|

61,002,387 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

5,618,356 |

|

|

|

4,314,021 |

|

|

|

15,641,268 |

|

|

|

12,624,608 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

| |

Sales and marketing |

|

500,015 |

|

|

|

406,683 |

|

|

|

1,431,930 |

|

|

|

1,215,556 |

|

|

| |

General and administrative expenses (including share-based |

|

|

|

|

|

|

|

|

| |

|

compensation

of $160,056, $163,451, $650,924 and $536,828, respectively) |

|

|

3,684,344 |

|

|

|

3,372,269 |

|

|

|

10,887,952 |

|

|

|

10,070,383 |

|

|

| |

Depreciation and amortization |

|

285,181 |

|

|

|

246,293 |

|

|

|

814,813 |

|

|

|

730,905 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

operating expenses |

|

|

4,469,540 |

|

|

|

4,025,245 |

|

|

|

13,134,695 |

|

|

|

12,016,844 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS |

|

1,148,816 |

|

|

|

288,776 |

|

|

|

2,506,573 |

|

|

|

607,764 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER (EXPENSE) INCOME |

|

|

|

|

|

|

|

|

| |

Interest income |

|

94 |

|

|

|

40 |

|

|

|

3,119 |

|

|

|

4,761 |

|

|

| |

Interest expense |

|

(69,582 |

) |

|

|

(78,066 |

) |

|

|

(227,889 |

) |

|

|

(230,983 |

) |

|

| |

Other income |

|

118 |

|

|

|

5,324 |

|

|

|

458 |

|

|

|

5,324 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total other

expense |

|

|

(69,370 |

) |

|

|

(72,702 |

) |

|

|

(224,312 |

) |

|

|

(220,898 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAX PROVISION |

|

1,079,446 |

|

|

|

216,074 |

|

|

|

2,282,261 |

|

|

|

386,866 |

|

|

|

INCOME TAX PROVISION |

|

12,483 |

|

|

|

32,364 |

|

|

|

242,783 |

|

|

|

126,816 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

$ |

1,066,963 |

|

|

$ |

183,710 |

|

|

$ |

2,039,478 |

|

|

$ |

260,050 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

BASIC EARNINGS PER SHARE |

$ |

0.13 |

|

|

$ |

0.02 |

|

|

$ |

0.24 |

|

|

$ |

0.03 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

BASIC WEIGHTED-AVERAGE SHARES OUTSTANDING |

|

8,450,843 |

|

|

|

8,423,435 |

|

|

|

8,409,114 |

|

|

|

8,401,405 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

DILUTED EARNINGS PER SHARE |

$ |

0.13 |

|

|

$ |

0.02 |

|

|

$ |

0.24 |

|

|

$ |

0.03 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

DILUTED WEIGHTED-AVERAGE SHARES OUTSTANDING |

|

8,527,309 |

|

|

|

8,427,183 |

|

|

|

8,463,561 |

|

|

|

8,405,152 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

THREE MONTHS

ENDED |

|

NINE MONTHS

ENDED |

|

| |

|

|

|

SEPTEMBER 30, |

|

SEPTEMBER 30, |

|

| |

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

|

| |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

|

NET INCOME |

$ |

1,067,000 |

|

|

$ |

183,700 |

|

|

$ |

2,039,500 |

|

|

$ |

260,100 |

|

|

|

Adjustments to reconcile net (loss) income to EBITDA: |

|

|

|

|

|

|

|

|

| |

Depreciation and amortization |

|

415,700 |

|

|

|

479,300 |

|

|

|

1,247,100 |

|

|

|

1,429,100 |

|

|

| |

Amortization of deferred financing costs |

|

- |

|

|

|

1,300 |

|

|

|

1,700 |

|

|

|

3,800 |

|

|

| |

Income tax provision (benefit) |

|

12,500 |

|

|

|

32,300 |

|

|

|

242,800 |

|

|

|

126,800 |

|

|

| |

Interest income |

|

(100 |

) |

|

|

(100 |

) |

|

|

(3,100 |

) |

|

|

(4,800 |

) |

|

| |

Interest expense |

|

69,600 |

|

|

|

76,800 |

|

|

|

226,200 |

|

|

|

227,200 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

$ |

1,564,700 |

|

|

$ |

773,300 |

|

|

$ |

3,754,200 |

|

|

$ |

2,042,200 |

|

|

|

Other adjustments to reconcile net (loss) income to Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

| |

(Recovery) Provision for doubtful accounts |

|

|

|

12,300 |

|

|

|

600 |

|

|

|

23,500 |

|

|

| |

Gain on sale of assets held for sale |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| |

Loss on disposal of leasehold improvements |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| |

Severance and exit costs |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| |

Lease account impact on EBITDA |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| |

Stock-based compensation expense |

|

160,000 |

|

|

|

163,400 |

|

|

|

650,900 |

|

|

|

536,800 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

1,724,700 |

|

|

$ |

949,000 |

|

|

$ |

4,405,700 |

|

|

$ |

2,602,500 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

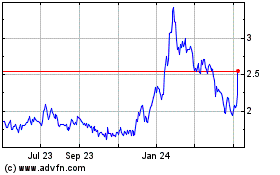

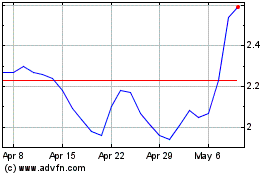

WidePoint (AMEX:WYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

WidePoint (AMEX:WYY)

Historical Stock Chart

From Apr 2023 to Apr 2024