Current Report Filing (8-k)

June 13 2022 - 1:31PM

Edgar (US Regulatory)

false

0001334933

0001334933

2022-06-07

2022-06-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

June 7, 2022

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

1030 West Georgia Street, Suite 1830

Vancouver, British Columbia

|

V6E 2Y3

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(604) 682-9775

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UEC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

__________

Section 1 – Registrant’s Business and Operations

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Effective on April 19, 2022, Uranium Energy Corp. (the “Company”) entered into each of a Settlement Agreement (the “Settlement Agreement”), with Anfield Energy Inc. (“Anfield”), and a Property Swap Agreement (the “Property Swap Agreement”), with each of Anfield and its subsidiaries, ARH Wyoming Corp. and Highbury Resources Inc. (collectively, the “Anfield Parties”), representing a series of transactions wherein, in part, and subject to various conditions to closing, Anfield settled $18.34 million of indebtedness (the “Anfield Indebtedness”) owing to UEC (collectively, the “Anfield Settlement”). The Company received the Anfield Indebtedness through its $112 million acquisition of Uranium One Americas, Inc. (“U1 Americas”) on December 17, 2021.

In accordance with the terms and conditions of the Settlement Agreement, the Anfield Indebtedness to UEC was settled through the payment of $9.17 million in cash plus the issuance to UEC of 96,272,918 units of Anfield (each, an “Anfield Unit”), which were issued at a deemed price of $0.095 per Anfield Unit for an aggregate value of approximately $9.17 million. Each Anfield Unit is comprised of one common share of Anfield (each, an “Anfield Share”) plus one Anfield Share purchase warrant (each, an “Anfield Warrant”), with each Anfield Warrant entitling UEC to acquire one Anfield Share at a price of CAD$0.18 per Anfield Share until May 12, 2027. The securities underlying the Anfield Units are subject to certain resale restrictions pursuant to applicable securities laws and pursuant to the terms of the Settlement Agreement. As a result, UEC now owns approximately 15.4% of Anfield on an outstanding basis (including warrants, approximately 27% on a partially diluted basis). The Settlement Agreement closed on June 7, 2022.

In accordance with Property Swap Agreement, UEC completed a property swap (the “Property Swap”) with the Anfield Parties in which the Company will receive Anfield’s portfolio of 25 in-situ recovery uranium projects in Wyoming (the “Wyoming ISR Asset Portfolio”) in exchange for UEC’s Slick Rock and Long Park projects located in Colorado. The Property Swap Agreement closed on June 7, 2022.

The Wyoming ISR Asset Portfolio is comprised of the Charlie project, located immediately adjacent to UEC’s Christensen Ranch property, along with nine projects in the Powder River Basin, seven projects in the Great Divide Basin, four projects in the Wind River Basin, three projects in the Shirley Basin and one project in the Black Hills.

The foregoing descriptions of each of the Settlement Agreement and the Property Swap Agreement do not purport to be complete and are qualified in their entirety by each of the Settlement Agreement and the Property Swap Agreement, which are filed as Exhibits 10.1 and 10.2 hereto, respectively, and are incorporated by reference herein.

Section 2 – Financial Information

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

On June 7, 2022, UEC completed each of the Anfield Settlement and the related Property Swap, which were disclosed in the Company’s news release of June 8, 2022, which was attached as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on June 8, 2022. The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.01.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

(a)

|

Financial Statements of Business Acquired

|

Not applicable.

|

(b)

|

Pro forma Financial Information

|

Not applicable.

|

(c)

|

Shell Company Transaction

|

Not applicable.

|

Exhibit

|

|

Description

|

|

10.1*

|

|

|

| |

|

|

|

10.2

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document)

|

Note:

* portions of this exhibit have been omitted.

__________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

URANIUM ENERGY CORP. |

| |

|

| |

|

|

DATE: June 13, 2022.

|

By:

|

/s/ Pat Obara |

| |

|

Pat Obara, Secretary and

Chief Financial Officer

|

__________

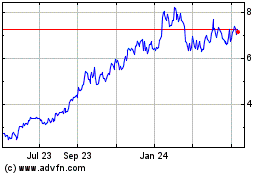

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

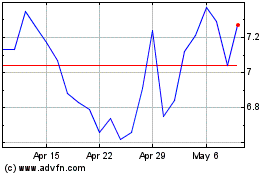

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Apr 2023 to Apr 2024