Current Report Filing (8-k)

April 20 2022 - 4:17PM

Edgar (US Regulatory)

false

0001334933

0001334933

2022-04-20

2022-04-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

April 20, 2022

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

1030 West Georgia Street, Suite 1830

Vancouver, British Columbia

|

V6E 2Y3

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(604) 682-9775

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UEC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure

|

On April 20, 2022, Uranium Energy Corp. (the “Company” or “UEC”) issued a news release to report that it has now secured an additional 400,000 pounds of U.S. warehoused uranium, expanding its physical uranium program to 5 million pounds U3O8, with delivery dates out to December 2025 at a volume weighted average price of ~$38 per pound. UEC’s physical uranium program represents an unrealized gain of over $125 million based on the current spot price published by TradeTech on April 19, 2022, at $63.25 per pound U3O8.

Amir Adnani, President and CEO stated: “A year ago, UEC launched a physical uranium portfolio with 500,000 pounds purchased at a uranium cost basis of less than $30 per pound. The Company has grown the size of our inventory over ten-fold to 5 million pounds by making well-timed purchases near cycle lows that allow us to maintain a low-cost portfolio of ~$38/lb with spot uranium now trading at over $63/lb. At a time of heightened geopolitical uncertainty, UEC has the benefit of secure U.S. warehoused physical inventories. We have also staged our deliveries to receive uranium as far out as December 2025, providing a low-cost stream of physical uranium as we enter this uranium bull market that shows a major structural supply deficit exceeding 215 million pounds by 2026.”

UEC’s U.S. warehoused physical uranium program is currently the largest inventory position for a U.S. based uranium company and as previously disclosed, will support three key objectives: 1) strengthens the Company’s balance sheet as uranium prices appreciate; 2) provides strategic inventory to support future sales and marketing efforts with utilities in order to complement U.S. production and accelerate near term cashflows; and 3) increases the availability of UEC’s Texas and Wyoming production capacity to pursue specific opportunities for uranium of U.S. origin; including potential sales to the U.S. Government as part of the mandate to establish a National Uranium Reserve.

Due to the scarcity of domestic uranium production and the potential U.S. ban on Russian uranium imports, U.S. uranium may ultimately command significant premium pricing in the future.

A copy of the news release is attached as Exhibit 99.1 hereto.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

(a)

|

Financial Statements of Business Acquired

|

Not applicable.

|

(b)

|

Pro forma Financial Information

|

Not applicable.

|

(c)

|

Shell Company Transaction

|

Not applicable.

|

Exhibit

|

|

Description

|

|

99.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

URANIUM ENERGY CORP.

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE: April 20, 2022.

|

By:

|

/s/ Pat Obara

|

|

|

|

|

Pat Obara, Secretary and

|

|

|

|

|

Chief Financial Officer

|

|

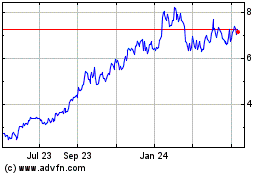

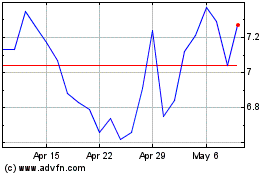

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Apr 2023 to Apr 2024