Filed pursuant to

Rule 424(b)(3)

File No. 333-237290

UNITED STATES OIL FUND, LP

Supplement dated September 1, 2020

to

Prospectus dated June 12, 2020

This supplement contains information that amends, supplements or

modifies certain information contained in the prospectus of United States Oil Fund, LP (“USO”) dated June 12, 2020

(the “Prospectus”).

You should carefully read the Prospectus and this supplement before

investing. This supplement should be read in conjunction with the Prospectus. You should also carefully consider the “Risk

Factors” beginning on page 11 of the Prospectus before you decide to invest.

The following changes

are hereby made to the subsection of the Prospectus titled “Litigation and Claims” under the section of the Prospectus

titled “Legal Matters” appearing on page 59 of the Prospectus:

|

|

1.

|

The following is added at the beginning of the subsection, immediately

after the title:

|

SEC and CFTC Wells Notices

On August 17, 2020, USCF,

USO, and John Love received a “Wells Notice” from the staff of the SEC (the “SEC Wells Notice”). The SEC

Wells Notice relates to USO’s disclosures in late April and early May regarding constraints imposed on USO’s ability

to invest in Oil Futures Contracts. The SEC Wells Notice states that the SEC staff has made a preliminary determination to recommend

that the SEC file an enforcement action against USCF, USO, and Mr. Love alleging violations of Sections 17(a)(1) and 17(a)(3) of

the Securities Act of 1933, as amended, and Section 10(b) of the Securities Exchange Act of 1934, as amended, and Rule 10b-5 thereunder,

in each case with respect to its disclosures and USO’s actions during that period.

On

August 19, 2020, USCF, USO and John Love received a Wells Notice from the staff of the CFTC (the “CFTC Wells Notice”).

The CFTC Wells Notice states that the CFTC staff has made a preliminary determination to recommend that the CFTC file an enforcement

action against USCF, USO, and Mr. Love alleging violations of Sections 4o(1)(A) and (B) and 6(c)(1) of the Commodity Exchange Act,

7 U.S.C. §§ 6o(1)(A), (B), 9(1) (2018), and CFTC Regulations 4.26, 4.41, and 180.1(a), 17 C.F.R. §§ 4.26, 4.41,

180.1(a) (2019), in each case with respect to its disclosures and USO’s actions.

A

Wells Notice is neither a formal charge of wrongdoing nor a final determination that the recipient has violated any law. USCF,

USO, and Mr. Love maintain that USO’s disclosures and their actions were appropriate. They intend to vigorously contest

the allegations made by the SEC staff in the SEC Wells Notice and the CFTC staff in the CFTC Wells Notice and expect to engage

in a dialogue with the SEC staff and CFTC staff regarding these matters.

|

|

2.

|

The following is added, immediately prior to the heading “Wang

Class Action”:

|

On August 18, 2020, pursuant

to the Private Securities Litigation Reform Act (“PSLRA”), 15 U.S.C. § 78u-4, motions were filed seeking to consolidate

the Lucas Class Action with (i) a purported stockholder class action initiated on June 31, 2020 by Moshe Ephrati, individually

and on behalf of others similarly situated, that is currently pending in the U.S. District Court for the Southern District of New

York as Civil Action No. 1:20-cv-06010 and in which the same defendants named in the Lucas Class Action were also named as defendants

(the “Ephrati Class Action”), and (iii) a purported stockholder class action initiated on August 13, 2020 by Danny

Palacios, individually and on behalf of others similarly situated, that is currently pending in the U.S. District Court for the

Southern District of New York as Civil Action No. 1:20-cv-06442 and also named the same defendants as in the Lucas Class Action

and the Ephrati Class Action (the “Palacios Class Action” and, together with the Lucas Class Action and the Ephrati

Class Action, the “Class Actions”). Each of the complainants in the Ephrati Class Action and the Palacios Class Action

seeks to certify a class and award the class compensatory damages at an amount to be determined at trial.

The claims made in the Ephrati

Class Action and the Palacios Class Action are substantively identical to the Lucas Class Action, except that the putative class

period in each of the Ephrati Class Action and Lucas Class Action begins on March 19, 2020, whereas the putative class period in

the Palacios Class Action begins on February 25, 2020. The Class Actions have been designated as related, and have been assigned

to the same Judge. The actions are expected to be consolidated into a single case.

USCF, USO and the other

defendants in the Class Actions intend to vigorously contest the claims made therein and move for their dismissal.

|

|

3.

|

The heading “Ephrati Class Action,” and all of the paragraphs

that follow it, are deleted in their entirety.

|

|

|

4.

|

The following is added at the end of the “Litigation and Claims”

subsection of the Prospectus:

|

Mehan Complaint

USO was named as a defendant

in a complaint dated August 10, 2020 (docketed August 19, 2020), filed by purported shareholder Darshan Mehan, asserted derivatively

on behalf of USO, against defendants USCF, John P. Love, Stuart P. Crumbaugh, Nicholas D. Gerber, Andrew F Ngim, Robert L. Nguyen,

Peter M. Robinson, Gordon L. Ellis, Malcolm R. Fobes III, and USO as a nominal defendant (the “Mehan Complaint”). The

complaint is pending in the Superior Court of the State of California for the County of Alameda as Case No. RG20070732.

The

complaint alleges that the defendants breached their fiduciary duties to USO and that USCF failed to act in good faith in connection

with a March 19, 2020 offering and certain extraordinary market conditions that caused demand for oil to fall precipitously, including

the COVID-19 global pandemic and the Saudi Arabia-Russia oil price war. The plaintiff alleges that the defendants possessed inside

knowledge about the consequences of these converging adverse events on USO and did not sufficiently acknowledge them until after

USO suffered losses and was allegedly forced to abandon its investment strategy. The complaint seeks compensatory damages at an

amount be determined at trial, restitution, equitable relief, attorney’s fees and costs.

USCF,

USO and the other defendants intend to vigorously contest such claims and move for their dismissal.

Cantrell and AML

Pharm. Inc., Complaints

On August 27, 2020, USCF

was named as a defendant in two actions filed by purported shareholders Michael Cantrell (the “Cantrell Complaint”)

and AML Pharm. Inc. DBA Golden International (the “AML Complaint”). Both the Cantrell Complaint and the AML Complaint

are asserted derivatively on behalf of USO, against defendants USCF, John P. Love and Stuart P. Crumbaugh, as well as USO directors

Andrew F Ngim, Gordon L. Ellis, Malcolm R. Fobes III, Nicholas D. Gerber, Robert L. Nguyen, and Peter M. Robinson, as well as USO

as a nominal defendant. The Cantrell Complaint is pending in the U.S. District Court for the Southern District of New York as Civil

Action No. 1:20-cv-06974. The AML Complaint is pending in the U.S. District Court for the Southern District of New York as Civil

Action No. 1:20-cv-06981.

The

Cantrell Complaint and AML Complaint are nearly identical. They allege violations of Sections 10(b), 20(a) and 21D of the Exchange

Act, SEC Rule 10b-5 thereunder, and common law claims of breach of fiduciary duties, unjust enrichment, abuse of control, gross

mismanagement, and waste of corporate assets. These allegations stem from USO’s disclosures and performance, and defendants’

actions in respect thereof, in light of the extraordinary market conditions in 2020 that caused demand for oil to fall precipitously,

including the COVID-19 global pandemic and the Saudi Arabia-Russia oil price war. The complainants seek, on behalf of USO, compensatory

damages at an amount to be determined at trial, restitution, equitable relief, attorney’s fees and costs. The plaintiffs

in the Cantrell Complaint and AML Complaint have marked their actions as related to the Lucas Class Action.

USCF,

USO and the other defendants in the Cantrell Complaint and AML Complaint intend to vigorously contest such claims and move for

their dismissal.

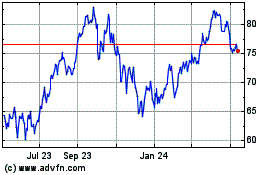

United States Oil (AMEX:USO)

Historical Stock Chart

From Mar 2024 to Apr 2024

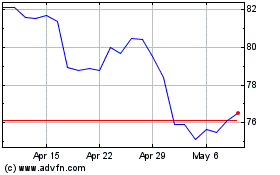

United States Oil (AMEX:USO)

Historical Stock Chart

From Apr 2023 to Apr 2024