Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

July 24 2020 - 5:16PM

Edgar (US Regulatory)

Filed pursuant to

Rule 424(b)(3)

File No. 333-237290

UNITED STATES OIL FUND, LP

________________________________________

Supplement dated July 24, 2020

to

Prospectus dated June 12, 2020

________________________________________

This supplement contains information that amends, supplements or

modifies certain information contained in the prospectus of United States Oil Fund, LP (“USO”) dated June 12, 2020

(the “Prospectus”).

You should carefully read the Prospectus and this supplement before

investing. This supplement should be read in conjunction with the Prospectus. You should also carefully consider the “Risk

Factors” beginning on page 11 of the Prospectus before you decide to invest.

The subsection of the Prospectus titled “Litigation

and Claims” under the section of the Prospectus titled “Legal Matters” appearing on page 59 of the Prospectus

is deleted in its entirety and replaced with the following:

Litigation and Claims

On

June 19, 2020, USO was named as a defendant in a purported stockholder class action initiated by Robert Lucas, individually and

on behalf of others similarly situated, against defendants USO, USCF, John P. Love and Stuart P. Crumbaugh (the “Lucas Class

Action”). The Lucas Class Action is pending in the U.S. District of Southern District of New York as Civil Action No. 1:20-cv-04740.

The

Lucas Class Action alleges that, beginning in March 2020, in connection with USO’s registration and issuance of additional

USO shares, defendants failed to disclose to investors certain extraordinary market conditions and the attendant risks that caused

the demand for oil to fall precipitously, including the COVID-19 global pandemic and the Saudi Arabia-Russia oil price war. Plaintiff

alleges that defendants possessed inside knowledge about the consequences of these converging adverse events on USO and did not

sufficiently acknowledge them until late April and May 2020, after USO suffered losses and was allegedly forced to abandon its

investment strategy. The complaint seeks to certify a class and award the class compensatory damages at an amount to be determined

at trial.

The

defendants believe the claims in the Lucas Class Action are without merit and intend to vigorously contest such claims and move

for their dismissal.

On

July 10, 2020, USO was named as a defendant in a putative stockholder class action initiated by Momo Wang, individually and on

behalf of others similarly situated, against defendants USO, USCF, John P. Love, Stuart P. Crumbaugh, Nicholas D. Gerber, Andrew

F. Ngim, Robert L. Nguyen, Peter M. Robinson, Gordon L. Ellis, Malcolm R. Fobes III, ABN Amro, BNP Paribas Securities Corp., Citadel

Securities LLC, Citigroup Global Market Inc., Credit Suisse Securities USA LLC, Deutsche Bank Securities Inc., Goldman Sachs &

Company, JP Morgan Securities Inc., Merrill Lynch Professional Clearing Corp., Morgan Stanley & Company Inc., Nomura Securities

International Inc., RBC Capital Markets LLC, SG Americas Securities LLC, UBS Securities LLC, and Virtu Financial BD LLC (the “Wang

Class Action”). The Wang Class Action is pending in the U.S. District of Northern District of California as Case No. 3:20-cv-4596.

The

Wang Class Action alleges that, beginning in March 2020, in connection with USO’s registration and issuance of additional

USO shares, defendants failed to disclose to investors certain extraordinary market conditions and the attendant risks that caused

the demand for oil to fall precipitously, including the COVID-19 global pandemic and the Saudi Arabia-Russia oil price war. The

plaintiff alleges that defendants possessed inside knowledge about the consequences of these converging adverse events on USO and

did not sufficiently acknowledge them until late April and May 2020, after USO suffered losses and was allegedly forced to abandon

its investment strategy. The complaint seeks to certify a class and award the class compensatory damages at an amount to be determined

at trial.

The

defendants believe that the claims in the Wang Class Action are completely without merit and intend to vigorously contest such

claims and move for their dismissal.

USO may have additional actions filed against it based on similar

allegations as those that were made in the Lucas Class Action and Wang Class Action.

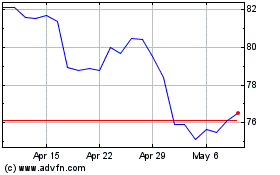

United States Oil (AMEX:USO)

Historical Stock Chart

From Mar 2024 to Apr 2024

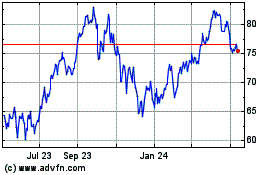

United States Oil (AMEX:USO)

Historical Stock Chart

From Apr 2023 to Apr 2024