Current Report Filing (8-k)

April 22 2020 - 2:03PM

Edgar (US Regulatory)

0001327068

false

0001327068

2020-04-22

2020-04-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

April 22, 2020

UNITED STATES OIL FUND, LP

(Exact name of registrant as specified in its

charter)

|

Delaware

|

001-32834

|

20-2830691

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

1850 Mt. Diablo Boulevard, Suite 640

Walnut

Creek, California 94596

(Address of principal executive offices) (Zip

Code)

(510) 522-9600

Registrant’s telephone number, including area

code

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

☐ Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered:

|

|

Shares of United States Oil Fund, LP

|

|

USO

|

|

NYSE Arca, Inc.

|

Item 8.01. Other Events.

United States Oil Fund, LP (“USO”), a Delaware

limited partnership, announced previously in Forms 8-K filed on April 17, 2020 and April 21, 2020, respectively, that USO intended

to invest in other permitted investments, as described below and in its prospectus.

As of April 22, 2020, in response to ongoing

extraordinary market conditions in the crude oil markets, including “super contango” (a higher level of contango arising from the overabundance of oil being produced and the limited availability of storage for

such excess supply), USO may invest

approximately 20% of its portfolio in crude oil futures contracts on the NYMEX and ICE Futures in the June futures contract,

approximately 50% of its portfolio in crude oil futures contracts on the NYMEX and ICE Futures in the July contract,

approximately 20% of its portfolio in crude oil futures contracts on the NYMEX and ICE Futures in the August contract, and

approximately 10% of its portfolio in crude oil futures contracts on the NYMEX and ICE Futures in the September contract.

The foregoing announcement of USO’s intended investments is not meant to limit its ability to invest in other investments

as permitted in USO’s prospectus. Accordingly, in response to ongoing extraordinary market conditions in the crude oil markets, including super contango, USO may

invest in the above described crude oil futures contracts on the NYMEX and ICE Futures in any month available or in varying

percentages or invest in any other of the permitted investments described below and in its prospectus, without further

disclosure. USO intends to attempt to continue tracking USO’s benchmark as closely as possible, however significant

tracking deviations may occur above and beyond the differences described herein. USO’s portfolio holdings as of the end

of the prior business day are posted each day on the website: www.uscfinvestments.com/uso.

As stated in the prospectus for USO, USO seeks to achieve

its investment objective by investing primarily in futures contracts for light, sweet crude oil, other types of crude oil, diesel-heating

oil, gasoline, natural gas, and other petroleum-based fuels that are traded on the NYMEX, ICE Futures Europe and ICE Futures U.S.

(together, “ICE Futures”) or other U.S. and foreign exchanges (collectively, “Oil Futures Contracts”) and

to a lesser extent, in order to comply with regulatory requirements or in view of market conditions, other oil-related investments

such as cash-settled options on Oil Futures Contracts, forward contracts for oil, cleared swap contracts and non-exchange traded

(“over-the-counter” or “OTC”) transactions that are based on the price of oil, other petroleum-based fuels,

Oil Futures Contracts and indices based on the foregoing (collectively, “Other Oil Related Investments”). Market conditions

that USCF currently anticipates could cause USO to invest in Other Oil-Related Investments include those allowing USO to obtain

greater liquidity or to execute transactions with more favorable pricing. (For convenience and unless otherwise specified, Oil

Futures Contracts and Other Oil-Related Investments collectively are referred to as “Oil Interests” in the prospectus.)

The foregoing may impact the performance of USO. In addition,

as a result of these changes, USO may not be able to track the Benchmark Futures Contract or meet its investment objective, which

is for the daily percentage changes in the NAV per share to reflect the daily percentage changes of the spot price of light, sweet

crude oil, as measured by the daily percentage changes in the price of Benchmark Oil Futures Contract, plus interest earned on

USO’s collateral holdings, less USO’s expenses.

Forward-Looking Statements

This communication contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that

are subject to risks and uncertainties, including, without limitation, statements regarding USO’s expectations. Statements

containing words such as “may,” “will,” “expect,” “anticipate,” “believe,”

“intend,” “plan,” “project,” “should,” “estimate,” “seek”

or any negative or other variations on such expression constitute forward-looking statements. These forward-looking statements

are based on information currently available to USO and are subject to a number of risks, uncertainties and other factors, both

known and unknown, that could cause the actual results, performance, prospects or opportunities of USO to differ materially from

those expressed in, or implied by, these forward-looking statements.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

UNITED STATES OIL FUND, LP

|

|

|

By:

|

United States Commodity Funds LLC, its general partner

|

|

|

|

|

|

|

|

|

|

Date: April 22, 2020

|

By:

|

/s/ John P. Love

|

|

|

Name:

|

John P. Love

|

|

|

Title:

|

President and CEO

|

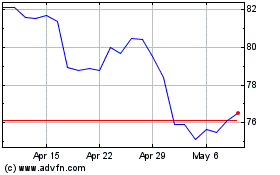

United States Oil (AMEX:USO)

Historical Stock Chart

From Mar 2024 to Apr 2024

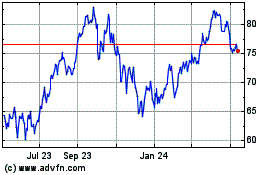

United States Oil (AMEX:USO)

Historical Stock Chart

From Apr 2023 to Apr 2024