Current Report Filing (8-k)

December 09 2021 - 4:17PM

Edgar (US Regulatory)

0001617669FALSE00016176692021-12-092021-12-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 9, 2021

UNIQUE FABRICATING, INC.

(Exact name of registrant as specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-37480

|

46-1846791

|

(State or other jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

800 Standard Parkway

|

|

|

|

Auburn Hills,

|

Michigan

|

|

48326

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (248) 853-2333

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $.001 per share

|

UFAB

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01. Entry Into a Material Definitive Agreement.

On December 9, 2021, Unique Fabricating NA, Inc. (the “US Borrower”) and Unique-Intasco Canada, Inc. (the “CA Borrower” and together with the US Borrower, the “Borrowers” or the “Company”) and certain of their subsidiaries entered into the Third Amendment to Forbearance Agreement with respect to the Amended and Restated Credit Agreement, as amended, among the Borrowers, certain of their subsidiaries, with the financial institutions signatory thereto (the “Lenders”) and Citizens Bank, National Association, a national banking association, as Administrative Agent for the lenders (the “Agent”). As previously reported, the Company was in violation of the required Minimum Consolidated EBITDA Covenant (as amended by the Second Amendment to the Forbearance Agreement as of September 30, 2021). The Lenders in the Third Amendment to the Forbearance Agreement, among other things, agreed to forbear with respect to the Minimum Consolidated EBITDA covenant violation and to suspend the Minimum Consolidated EBITDA covenant during the remainder of the forbearance period, which ends on February 28, 2022.

The Third Amendment includes a new covenant which will be tested weekly on a rolling basis, beginning December 15, 2021, and requires that the Company’s actual cumulative total cash disbursements for the period being tested to not exceed total cash disbursements projected by the Company for the same period by more than 15% at any time during the forbearance period. The Third Amendment also reduces the maximum amount that may be borrowed under the revolving line of credit to $25 million from $27 million. As of December 7, 2021, the amount of borrowings under the revolving line of credit was $17.7 million and such borrowings have not exceeded $19 million outstanding at any time in 2021 to date.

The Third Amendment further modifies or establishes certain financial reporting requirements to the Lenders, including suspending the requirement for weekly cash flow projections for the remainder of the forbearance period and requiring on a weekly basis a comprehensive statement of actual cash flow for the preceding week and on a cumulative basis and comparing actual and projected cash flow for the period provided by the Company in connection with the Third Amendment. Except as specifically provided in the Third Amendment, the Loan Documents as defined remain in full force and effect.

This summary of the Third Amendment to Forbearance Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Third Amendment to Forbearance Agreement as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Exhibits.

(d) Exhibits. The following exhibits are filed herewith:

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (the Cover Page Interactive Data File is embedded with the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FABRICATING, INC.

|

|

Date: December 9, 2021

|

By:

|

/s/ Brian P. Loftus

|

|

|

|

Brian P. Loftus

|

|

|

|

Chief Financial Officer

|

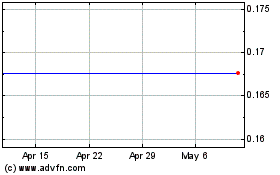

Unique Fabricating (AMEX:UFAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

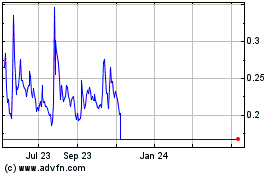

Unique Fabricating (AMEX:UFAB)

Historical Stock Chart

From Apr 2023 to Apr 2024