Filed Pursuant to Rule 424(b)(3)

Registration No. 333-251138

PROSPECTUS

TIMBER PHARMACEUTICALS, INC.

11,383,389 Shares of Common Stock

This prospectus of

Timber Pharmaceuticals, Inc., a Delaware corporation (the “Company” or “Timber”), relates solely to the

resale by the investors listed in the section of this prospectus entitled “Selling Stockholders” (the “Selling

Stockholders”) of up to 11,383,389 shares of our common stock (“Common Stock”), par value $0.001 per share (“Common

Shares”). The 11,383,389 Common Shares consist solely of Common Shares issuable upon exercise of outstanding warrants to

purchase Common Shares (the “Series B Warrants”) issued by us on June 2, 2020, pursuant to that certain Securities

Purchase Agreement, dated as of March 27, 2020, by and among the Company, Timber Pharmaceuticals LLC, a Delaware limited liability

company) (“Timber Sub”), and the investors named therein (the “Investors”), as amended (the “Securities

Purchase Agreement”).

The Series B Warrants

have an exercise price of $0.001 per share, were exercisable upon issuance and will expire on the day following the later to occur

of (i) April 30, 2021 and (ii) the date on which the Series B Warrants have been exercised in full (without giving effect to any

limitation on exercise contained therein) and no shares remain issuable thereunder. We are registering the resale of 11,383,389

Common Shares underlying the Series B Warrants (the “Warrant Shares”) as required by the Waiver Agreements we entered

into with the Selling Stockholders on November 19, 2020 (the “Waiver Agreements”) and the Amended and Restated Registration

Rights Agreement, dated July 17, 2020, among the Company and the Selling Stockholders (the “RRA”). There are currently

22,766,776 Common Shares underlying the Series B Warrants. See “Description of Capital Stock—Warrants.”

Our registration of

the Warrant Shares covered by this prospectus does not mean that the Selling Stockholders will offer or sell any of the Warrant

Shares. The Selling Stockholders may sell the Warrant Shares covered by this prospectus in a number of different ways and at varying

prices. For additional information on the possible methods of sale that may be used by the Selling Stockholders, you should refer

to the section of this prospectus entitled “Plan of Distribution” of this prospectus. We will not receive any of the

proceeds from the Warrant Shares sold by the Selling Stockholders, other than any proceeds from any cash exercise of the Series

B Warrants.

No underwriter or other

person has been engaged to facilitate the sale of the Warrant Shares in this offering. The Selling Stockholders may, individually

but not severally, be deemed to be an “underwriter” within the meaning of the Securities Act, of the Warrant Shares

that they are offering pursuant to this prospectus. We will bear all costs, expenses and fees in connection with the registration

of the Warrant Shares. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their respective

sales of the Warrant Shares.

You should read this

prospectus, any applicable prospectus supplement and any related free writing prospectus carefully before you invest. Our Common

Stock is listed on the NYSE American under the symbol “TMBR”. On December 9, 2020, the last reported sale price of

our Common Stock on the NYSE American was $1.12 per share.

Investing in our securities involves

risk. You should carefully consider the risks that we have described under the section captioned “Risk Factors” in

this prospectus on page 8 before buying our Securities.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 10,

2020

TABLE OF CONTENTS

Timber Pharmaceuticals, Inc. and its consolidated

subsidiaries are referred to herein as “Timber,” “the Company,” “we,” “us” and

“our,” unless the context indicates otherwise.

You may only rely on the information contained

in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This

prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the securities offered

by this prospectus. This prospectus and any future prospectus supplement do not constitute an offer to sell or a solicitation of

an offer to buy any securities in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this

prospectus or any prospectus supplement nor any sale made hereunder shall, under any circumstances, create any implication that

there has been no change in our affairs since the date of this prospectus or such prospectus supplement or that the information

contained by reference to this prospectus or any prospectus supplement is correct as of any time after its date.

FORWARD-LOOKING STATEMENTS

Some of the statements

contained or incorporated by reference in this prospectus may include forward-looking statements that reflect our current views

with respect to our research and development activities, business strategy, business plan, financial performance and other future

events. These statements include forward-looking statements both with respect to us, specifically, and the biotechnology sector,

in general. We make these statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of

1995. Statements that include the words “expect,” “intend,” “plan,” “believe,”

“project,” “estimate,” “may,” “should,” “anticipate,” “will”

and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities

laws or otherwise.

All forward-looking

statements involve inherent risks and uncertainties, and there are or will be important factors that could cause actual results

to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, those

factors set forth under the caption “Risk Factors” in this prospectus supplement and in our most recent Annual Report

on Form 10-K and our Quarterly Reports on Form 10-Q, all of which you should review carefully. Please consider our forward-looking

statements in light of those risks as you read this prospectus supplement. We undertake no obligation to publicly update or review

any forward-looking statement, whether as a result of new information, future developments or otherwise.

If one or more of these

or other risks or uncertainties materializes, or if our underlying assumptions prove to be incorrect, actual results may vary materially

from what we anticipate. All subsequent written and oral forward-looking statements attributable to us or individuals acting on

our behalf are expressly qualified in their entirety by this Note. Before purchasing any of our securities, you should consider

carefully all of the factors set forth or referred to in this prospectus that could cause actual results to differ.

PROSPECTUS SUMMARY

The following summary

highlights some information from this prospectus. It is not complete and does not contain all of the information that you should

consider before making an investment decision. You should read this entire prospectus, including the “Risk Factors”

section on page 8, the consolidated financial statements and related notes and the other more detailed information appearing elsewhere

or incorporated by reference into this prospectus.

The Company

We are a clinical-stage

medical dermatology company with a focus on rare, orphan designated disorders. We believe we have a robust medical dermatology

pipeline with mid- and early-stage candidates in clinical development. Our pipeline targets rare dermatologic disorders where there

is a high unmet need and no United States Food and Drug Administration, or FDA, approved treatments.

We are currently developing

three product candidates to treat several rare and high unmet need dermatologic indications. The current state of our development

pipeline is illustrated below:

FAs—Facial Angiofibromas

TSC—Tuberous Sclerosis

TMB-001

We are developing TMB-001,

a topical ointment formulation (0.05% and 0.1%) of isotretinoin, utilizing Timber's proprietary IPEG™ delivery system, for

the treatment of Congenital Ichthyosis (“CI”), in subjects as young as nine years of age.

CI is a rare disorder

of keratinization (a scaling condition) that affects approximately 80,000 people in the U.S. and more than 1.5 million globally,

according to a 2012 research letter from the American Medical Association.

There are

currently no FDA approved treatments for CI; however, oral isotretinoin is commonly used off label. Isotretinoin was first

approved in the United States by the FDA as ACCUTANE® and was formulated as an oral product to treat severe recalcitrant

nodular acne. No topical forms of isotretinoin have ever been approved in the US. Although oral isotretinoin is used off

label for patients with CI, common and potentially serious systemic side effects limit its utility as a chronic treatment. We

believe a topical isotretinoin could potentially provide benefit to patients with CI without

the systemic side effects. These systemic side effects of oral isotretinoin can include teratogenicity, pancreatitis,

elevations of serum triglycerides, psychiatric disorders, and skeletal hyperostosis, among others. In 2018, the TMB-001

program, formerly known as PAT-001, was the recipient of the Orphan Products Clinical Trials Grant from the FDA and awarded

$1.5 million in non-dilutive funding to support the Phase 2a and 2b trials of TMB-001 for the treatment of this severe

dermatologic disorder.

In a proof of concept

Phase 2 clinical trial, TMB-001 was found to be well tolerated and demonstrated evidence of an efficacy signal supported by improvement

in IGA and CI signs/symptoms at the end of Parts 1 and 2 of the Phase 2 trial. A favorable efficacy signal was further supported

in Part 2 of the study where an overall IGA improvement was observable in about half of the subjects initially treated with vehicle

after receiving 4 weeks of treatment with TMB-001 ointment.

Given the positive

outcome from the Phase 2a study, a Phase 2b dose ranging study for TMB-001 was commenced in the fourth quarter of 2019.

TMB-002

In parallel with the

development of TMB-001, we are developing TMB-002, a topical rapamycin (0.5% and 1.0%) cream for the treatment of Facial Angiofibromas

(“FAs”) associated with Tuberous Sclerosis Complex (“TSC”). TSC is a rare, genetic, multi-system disorder

that causes tumors to form in many different organs, primarily in the brain, eyes, heart, kidney, skin and lungs. According to

the Tuberous Sclerosis Alliance, one in 6,000 babies are born with TSC and nearly one million people are estimated to have TSC

globally (50,000 in the U.S.). Common symptoms of TSC include skin lesions, cerebral pathology, seizures, renal pathology and retinal

hamartomas. We believe there is a need for a simple, non-invasive treatment option of FAs. Pharmacologic treatment options include

oral rapamycin (also known as sirolimus) for the treatment of renal and neurological manifestations of TSC and has been a treatment

option for FAs as well, although the systemic side effects of oral rapamycin have limited its utility in the treatment of FAs.

TMB-002's proprietary

lipid crystalline cream base protects molecules that are readily oxidized, such as rapamycin, and has favorable cosmetic properties,

natural antimicrobial effects and releases the active ingredient into the skin by melting at skin temperature (33-34°C).

Preclinical studies

of TMB-002 have demonstrated a positive toxicity profile. We have initiated a large Phase 2b dose response study, evaluating the

dose-dependent efficacy of TMB-002 in the treatment of FAs associated with TSC compared with vehicle.

TMB-003

The product in its

earliest stage in our pipeline is locally applied sitaxsentan, a highly selective endothelin-A (“ET-A”) receptor antagonist

being developed as a local agent for the treatment of Localized Scleroderma (“LS”).

Scleroderma is a chronic

connective tissue disease that is generally classified as one of the autoimmune rheumatic diseases. There are two major classifications

of scleroderma: Localized Scleroderma and Systemic Sclerosis. While both types of scleroderma will have cutaneous symptoms, systemic

sclerosis will affect other organ systems too. Localized Scleroderma manifests as an excess production of collagen resulting in

a thickening of the skin and connective tissue affecting approximately 90,000 people in the U.S. and an estimated two million globally,

according to the Scleroderma Foundation. One of the most commonly visible symptoms of the disease is hardening of the skin and

symptoms can vary from patient-to-patient, ranging from very mild to very severe and can affect mobility, impair growth of limbs,

and cause severe disfigurement. The severity will depend on which part, or parts, of the body is affected and to what extent. If

not treated timely and properly, a mild case can become more serious. Localized scleroderma is more common in children and can

be considered a pediatric condition. Currently, there are no approved treatments for the cutaneous symptoms of either type of scleroderma.

Sitaxsentan is a highly

selective ET-A receptor antagonist that was originally developed as an oral tablet for treating Pulmonary Arterial Hypertension

(“PAH”). Sitaxsentan gained regulatory approval in Europe, Canada, and Australia but was voluntarily withdrawn from

the market within five years based on emerging safety concerns, particularly those associated with liver toxicity. Consequently,

sitaxsentan never gained FDA approval in the U.S. We expect such safety concerns can be greatly mitigated through our approach

and formulation efforts of pursuing TMB-003 as a localized treatment.

In a series of preclinical

studies, sitaxsentan was shown to significantly reduce fibroblast migration, induce apoptosis, and reduce the amount of collagen

produced in TGF-b1 induced human dermal fibroblasts. Further, sitaxsentan was shown to be significantly better than bosentan, a

non-selective endothelin receptor antagonist, in all of the above measures. These results suggest that TMB-003 may have the potential

to effectively treat LS.

BPX-01 and BPX-04

In connection with

the Merger (as defined below), we acquired the BPX-01 and BPX-04 assets. BPX-01 is a Phase 3 ready topical minocycline for the

treatment of inflammatory lesions of acne vulgaris, and BPX-04 is a Phase 3 ready topical minocycline for the treatment of papulopustular

rosacea. We will seek to monetize these assets through a license, co-development, or sale.

The Merger, Reverse Stock Split and

Name Change

On

May 18, 2020, we completed our business combination with Timber Sub, in accordance with the terms of the Agreement and Plan of

Merger and Reorganization, dated as of January 28, 2020, as amended, by and among Timber, Timber Sub and BITI Merger Sub Inc.,

a wholly-owned subsidiary of Timber (“Merger Sub”) (the “Merger Agreement”), pursuant to which Merger Sub

merged with and into Timber Sub, with Timber Sub surviving as a wholly owned subsidiary of Timber (the “Merger”).

In

connection with, and immediately prior to the completion of, the Merger, we effected a reverse stock split of the Common Shares,

at a ratio of 1-for-12 (the “Reverse Stock Split”). Under the terms of the Merger Agreement, after taking into account

the Reverse Stock Split, we issued Common Shares to Timber Sub’s unitholders at an exchange rate of 629.57 Common Shares

for each Timber Sub common unit outstanding immediately prior to the Merger. In connection with the Merger, we changed our name

from “BioPharmX Corporation” to “Timber Pharmaceuticals, Inc.,” and the business conducted by the Company

became the business conducted by Timber Sub.

Private Placement

of Common Shares and Warrants

On

May 18, 2020, Timber and Timber Sub completed a private placement transaction (the “Pre-Merger Financing”) with the

Investors pursuant to the Securities Purchase Agreement for an aggregate purchase price of approximately $25.0 million (comprised

of (i) approximately $5 million credit with respect to the senior secured notes issued in connection with the bridge loan that

certain of the Investors made to Timber Sub at the time of the execution of the Merger Agreement and (ii) approximately $20 million

in cash from the Investors).

Pursuant

to the Pre-Merger Financing, (i) Timber Sub issued and sold to the Investors common units of Timber Sub which converted pursuant

to the exchange ratio in the Merger into an aggregate of approximately 4,137,509 shares (the “Converted Shares”) of

Common Stock; and (ii) the Company agreed to issue to each Investor, on the tenth trading day following the consummation of the

Merger, (A) Series A Warrants (the “Series A Warrants”) representing the right to acquire shares of Common Stock equal

to 75% of the sum of (a) the number of Converted Shares issued to the Investor, without giving effect to any limitation on delivery

contained in the Securities Purchase Agreement, and (b) the number of shares of Common Stock underlying the Series B Warrants issued

to the Investor and (B) the Series B Warrants. On June 2, 2020, pursuant to the terms of the Securities Purchase Agreement, the

Company issued the Series A Warrants and the Series B Warrants.

In

addition, pursuant to the terms of the Securities Purchase Agreement, dated as of January 28, 2020 between Timber Sub and

several of the Investors, the Company issued to such purchasers, on May 22, 2020, warrants to purchase 413,751 shares of Common

Stock (the “Bridge Warrants”) which have an exercise price of $2.2362 per share.

Pursuant

to the Waiver Agreements, (A) the exercise price of the Series A Warrants was definitively set at $1.16 per share, (B) the number

of shares underlying all of the Series A Warrants was definitively set at 20,178,214 and (C) the number of shares underlying all

of the Series B Warrants was definitively set at 22,766,776.

Corporate Information

Our principal offices

are located at 50 Tice Blvd, Suite A26, Woodcliff Lake, New Jersey 07677, and our telephone number is (973) 314-9570. Our website

address is www.timberpharma.com. Our website and the information contained on, or that can be accessed through, our website shall

not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on any such

information in making your decision whether to purchase our Common Stock.

This Offering

We are registering

for resale by the Selling Stockholders named herein the 11,383,389 Warrant Shares as described below.

|

Securities being offered:

|

|

11,383,389 shares of our Common Stock issuable under the Series B Warrants.

|

|

|

|

|

Use of proceeds:

|

|

We will not receive any of the proceeds from the sale or other disposition of shares of our Common Stock by the Selling Stockholders.

|

|

|

|

|

Market for Common Stock:

|

|

Our Common Stock is listed on the NYSE American under the

symbol “TMBR.” On December 9, 2020, the last reported sale price of our Common Stock on the NYSE American was

$1.12 per share.

|

|

|

|

|

Risk factors:

|

|

See “Risk Factors” beginning on page 8 for risks

you should consider before investing in our shares.

|

RISK FACTORS

Investing in our securities

involves risks. You should carefully consider the risks, uncertainties and other factors described in the Company’s Registration

Statement on Form S-4 (File No. 333-236526) filed with the Securities and Exchange Commission on February 20, 2020 (as amended by Form S-4/A on March 30, 2020

and supplemented by the First Supplement to the Proxy Statement/Prospectus on April 27, 2020), in our most recent Annual Report

on Form 10-K, as supplemented and updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we

have filed or will file with the SEC and in other documents which are incorporated

by reference into this prospectus, as well as the risk factors and other information contained in or incorporated by reference

into any accompanying prospectus supplement before investing in any of our securities. Our financial condition, results of operations

or cash flows could be materially adversely affected by any of these risks. The risks and uncertainties described in the documents

incorporated by reference herein are not the only risks and uncertainties that you may face.

For more information

about our SEC filings, please see “Where You Can Find More Information” and “Incorporation of Certain Information

by Reference.”

USE OF PROCEEDS

We will receive no

proceeds from the sale of shares of Common Stock by the Selling Stockholders.

SELLING STOCKHOLDERS

The shares of Common

Stock being offered by the Selling Stockholders are those issuable to the Selling Stockholders, upon exercise of the Series B Warrants.

For additional information regarding the issuances of those shares of Common Stock and the Series B Warrants, see “Private

Placement of Common Shares and Warrants” above. We are registering the Common Stock in order to permit the Selling Stockholders

to offer the shares for resale from time to time. Except for the ownership of the shares of Common Stock and warrants, the Selling

Stockholders have not had any material relationship with us within the past three years.

The table below lists

the Selling Stockholders and other information regarding the beneficial ownership of the shares of Common Stock by each of the

Selling Stockholders. The second column lists the number of shares of Common Stock owned by each Selling Stockholder as of November

20, 2020, without regard to any limitations on exercises. The third column lists the shares of Common Stock being offered by this

prospectus by the Selling Stockholders.

This prospectus covers

11,383,389 shares of our Common Stock underlying the Series B Warrants. The fifth column assumes the sale of all of the shares

offered by the Selling Stockholders pursuant to this prospectus, and is based on 12,032,391 shares of Common Stock outstanding

on November 20, 2020.

Under the terms of

the Series B Warrants, a Selling Stockholder may not exercise the warrants to the extent such exercise would cause such Selling

Stockholder, together with its affiliates, to beneficially own a number of shares of Common Stock which would exceed 4.99% or 9.99%,

as applicable, of our then outstanding Common Stock following such exercise, excluding for purposes of such determination Common

Stock issuable upon exercise of the warrants which have not been exercised. The numbers of shares in the second and fourth columns

do not reflect this limitation. The Selling Stockholders may sell all, some or none of their shares in this offering. See “Plan

of Distribution.”

|

Name of Selling Securityholder

|

|

Number of

Shares of Common

Stock

Owned

Prior to

Offering

|

|

|

Maximum

Number of

Shares of Common

Stock to be

Sold

Pursuant to

this

Prospectus

|

|

|

Number of

Shares of Common

Stock

Owned

After

Offering

|

|

|

Percentage

of Shares of

Common

Stock

Beneficially Owned

After

Offering

(1)(2)

|

|

|

Empery Asset Master, Ltd. (3)

|

|

|

755,833

|

|

|

|

200,348

|

|

|

|

555,485

|

|

|

|

2.32

|

%

|

|

Empery Tax Efficient, LP (4)

|

|

|

191,030

|

|

|

|

50,087

|

|

|

|

140,943

|

|

|

|

*

|

|

|

Empery Debt Opportunity Fund, LP (5)

|

|

|

18,147,534

|

|

|

|

4,758,256

|

|

|

|

13,389,278

|

|

|

|

9.99

|

%

|

|

Altium Growth Fund, LP (6)

|

|

|

19,102,671

|

|

|

|

5,008,691

|

|

|

|

14,093,980

|

|

|

|

9.99

|

%

|

|

Hudson Bay Master Fund Ltd.(7)

|

|

|

5,158,237

|

|

|

|

1,366,007

|

|

|

|

3,792,230

|

|

|

|

9.99

|

%

|

|

*

|

Represents less than 1%

|

|

(1)

|

Beneficial ownership includes shares of Common Stock as to which a person or group has sole or shared voting power or dispositive power. Shares of Common Stock registered hereunder, as well as shares of Common Stock subject to options, warrants or convertible preferred stock that are exercisable or convertible within 60 days of November 20, 2020, are deemed outstanding for purposes of computing the number of shares beneficially owned and percentage ownership of the person or group holding such shares of Common Stock, options, warrants or convertible securities, but are not deemed outstanding for computing the percentage of any other person.

|

|

|

|

|

(2)

|

Percentage gives effect to any limitations on exercises contained in the warrants.

|

|

(3)

|

The number of shares consists of 755,833

shares of Common Stock issuable upon exercise of warrants, without regard to any limitations on exercises. Empery Asset Management

LP, the authorized agent of Empery Asset Master Ltd (“EAM”), has discretionary authority to vote and dispose of the

shares held by EAM and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as

investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares

held by EAM. EAM, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

|

|

(4)

|

The number of shares consists of 191,030 shares of Common Stock

issuable upon exercise of warrants, without regard to any limitations on exercises. Empery Asset Management LP, the authorized

agent of Empery Tax Efficient, LP (“ETE”), has discretionary authority to vote and dispose of the shares held by ETE

and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers

of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE. ETE,

Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

|

|

|

|

|

(5)

|

The number of shares consists of 18,147,534 shares of Common

Stock issuable upon exercise of warrants, without regard to any limitations on exercises. Empery Asset Management LP, the authorized

agent of Empery Debt Opportunity Fund, LP (“EDOF”), has discretionary authority to vote and dispose of the shares held

by EDOF and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment

managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held

by EDOF. EDOF, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

|

|

|

|

|

(6)

|

The number of shares consists of 19,102,671 shares of Common

Stock issuable upon exercise of warrants, without regard to any limitations on exercises. Altium Capital Management, LP, the investment

manager of Altium Growth Fund, LP, has voting and investment power over these securities. Jacob Gottlieb is the managing member

of Altium Capital Growth GP, LLC, which is the general partner of Altium Growth Fund, LP. Each of Altium Growth Fund, LP and Jacob

Gottlieb disclaims beneficial ownership over these shares.

|

|

|

|

|

(7)

|

The number of shares consists of 5,158,237 shares of Common

Stock issuable upon exercise of warrants, without regard to any limitations on exercises. Hudson Bay Capital Management LP, the

Investment Manager of Hudson Bay Master Fund Ltd. has voting and dispositive power over the securities of the company held by such

entity. Sander Gerber is the Managing Member of Hudson Bay Capital GP LLC, which is the General Partner of Hudson Bay Capital Management

LP. Each of Hudson Bay Master Fund Ltd. and Sander Gerber disclaims beneficial ownership over these securities.

|

PLAN OF DISTRIBUTION

We are registering

the shares of Common Stock issued and issuable upon exercise of the Series B Warrants to permit the resale of these shares of Common

Stock by the holders of the Series B Warrants from time to time after the date of this prospectus. We will not receive any of the

proceeds from the sale by the Selling Stockholders of the shares of Common Stock. We will bear all fees and expenses incident to

our obligation to register the shares of Common Stock.

The Selling Stockholders

may sell all or a portion of the shares of Common Stock beneficially owned by them and offered hereby from time to time directly

or through one or more underwriters, broker-dealers or agents. If the shares of Common Stock are sold through underwriters or broker-dealers,

the Selling Stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares

of Common Stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at

varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may

involve crosses or block transactions,

|

|

●

|

on any national securities exchange or quotation service on which the securities may

|

|

|

|

|

|

|

●

|

be listed or quoted at the time of sale;

|

|

|

|

|

|

|

●

|

in the over-the-counter market;

|

|

|

|

|

|

|

●

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

|

|

|

|

●

|

through the writing of options, whether such options are listed on an options exchange or otherwise;

|

|

|

|

|

|

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

|

|

|

|

●

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

|

|

|

|

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

|

|

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

|

|

●

|

privately negotiated transactions;

|

|

|

|

|

|

|

●

|

short sales;

|

|

|

|

|

|

|

●

|

sales pursuant to Rule 144;

|

|

|

|

|

|

|

●

|

broker-dealers may agree with the selling securityholders to sell a specified number of

|

|

|

|

|

|

|

●

|

such shares at a stipulated price per share;

|

|

|

|

|

|

|

●

|

a combination of any such methods of sale; and

|

|

|

|

|

|

|

●

|

any other method permitted pursuant to applicable law.

|

If the Selling

Stockholders effect such transactions by selling shares of Common Stock to or through underwriters, broker-dealers or agents,

such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from

the Selling Stockholders or commissions from purchasers of the shares of Common Stock for whom they may act as agent or to

whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or

agents may be in excess of those customary in the types of transactions involved). In connection with sales of the shares of

Common Stock or otherwise, the Selling Stockholders may enter into hedging transactions with broker-dealers, which may in

turn engage in short sales of the shares of Common Stock in the course of hedging in positions they assume. The Selling

Stockholders may also sell shares of Common Stock short and deliver shares of Common Stock covered by this prospectus to

close out short positions and to return borrowed shares in connection with such short sales. The Selling Stockholders may

also loan or pledge shares of Common Stock to broker-dealers that in turn may sell such shares. The Selling Stockholders may

pledge or grant a security interest in some or all of the warrants or shares of Common Stock owned by them and, if they

default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of

Common Stock from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other

applicable provision of the Securities Act of 1933, as amended, amending, if necessary, the list of Selling Stockholders to

include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus. The Selling

Stockholders also may transfer and donate the shares of Common Stock in other circumstances in which case the transferees,

donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The Selling Stockholders

and any broker-dealer participating in the distribution of the shares of Common Stock may be deemed to be “underwriters”

within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer

may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares

of Common Stock is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of

shares of Common Stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents,

any discounts, commissions and other terms constituting compensation from the Selling Stockholders and any discounts, commissions

or concessions allowed or reallowed or paid to broker-dealers.

Under the securities

laws of some states, the shares of Common Stock may be sold in such states only through registered or licensed brokers or dealers.

In addition, in some states the shares of Common Stock may not be sold unless such shares have been registered or qualified for

sale in such state or an exemption from registration or qualification is available and is complied with. There can be no assurance

that any Selling Stockholder will sell any or all of the shares of Common Stock registered pursuant to the registration statement,

of which this prospectus form is a part.

The Selling Stockholders

and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act

of 1934, as amended, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act,

which may limit the timing of purchases and sales of any of the shares of Common Stock by the Selling Stockholders and any other

participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of Common

Stock to engage in market-making activities with respect to the shares of Common Stock. All of the foregoing may affect the marketability

of the shares of Common Stock and the ability of any person or entity to engage in market-making activities with respect to the

shares of Common Stock.

We will pay all expenses

of the registration of the shares of Common Stock pursuant to the registration rights agreement, estimated to be $50,000 in total,

including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state securities

or “blue sky” laws; provided, however, that a Selling Stockholder will pay all underwriting discounts and selling commissions,

if any. We will indemnify the Selling Stockholders against liabilities, including some liabilities under the Securities Act, in

accordance with the registration rights agreements, or the Selling Stockholders will be entitled to contribution. We may be indemnified

by the Selling Stockholders against civil liabilities, including liabilities under the Securities Act, that may arise from any

written information furnished to us by the Selling Stockholder specifically for use in this prospectus, in accordance with the

related registration rights agreement, or we may be entitled to contribution. Once sold under the registration statement, of which

this prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons other than our affiliates.

DETERMINATION OF

OFFERING PRICE

The prices at which

the shares of Common Stock covered by this prospectus may actually be sold will be determined by the prevailing public market price

for shares of Common Stock, by negotiations between the Selling Stockholders and buyers of our Common Stock in private transactions

or as otherwise described in “Plan of Distribution.”

DESCRIPTION OF CAPITAL STOCK

General

We are authorized to

issue up to 460,000,000 shares of capital stock, including 450,000,000 shares of Common Stock, par value $0.001 per share, and

10,000,000 shares of undesignated preferred stock, no par value. As of November 20, 2020, we had 12,032,391 shares of Common Stock

and 1,819 shares of preferred stock issued and outstanding.

The additional shares

of our authorized stock available for issuance may be issued at times and under circumstances so as to have a dilutive effect on

earnings per share and on the equity ownership of the holders of our Common Stock. The ability of our board of directors to issue

additional shares of stock could enhance the board’s ability to negotiate on behalf of the stockholders in a takeover situation

but could also be used by the board to make a change-in-control more difficult, thereby denying stockholders the potential to sell

their shares at a premium and entrenching current management. The following description is a summary of the material provisions

of our capital stock. You should refer to our certificate of incorporation, as amended and bylaws, both of which are on file with

the SEC as exhibits to previous SEC filings, for additional information. The summary below is qualified by provisions of applicable

law.

Common Stock

Subject to preferences

that may apply to any shares of preferred stock outstanding at the time, the holders of our Common Stock are entitled to receive

dividends out of funds legally available if our board of directors, in its discretion, determines to issue dividends and then only

at the times and in the amounts that our board of directors may determine. Holders of our Common Stock are entitled to one

vote for each share held on all matters submitted to a vote of stockholders. We have not provided for cumulative voting for any

matter in our certificate of incorporation. Accordingly, pursuant to our certificate of incorporation, holders of a majority of

the shares of our Common Stock will be able to elect all of our directors. Our Common Stock is not entitled to preemptive rights,

and is not subject to conversion, redemption or sinking fund provisions. Upon our liquidation, dissolution or winding-up, the assets

legally available for distribution to our stockholders would be distributable ratably among the holders of our Common Stock and

any participating preferred stock outstanding at that time, subject to prior satisfaction of all outstanding debt and liabilities

and the preferential rights of and the payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

As of November 20, 2020, we had outstanding options to purchase an aggregate of 184,456 shares of our Common Stock, with a weighted-average

exercise price of $ 2.87 per share. As of November 20, 2020, there were Value Appreciate Rights payable in 367,070 shares of Common

Stock. As of November 20, 2020, we had outstanding warrants to purchase an aggregate 43,579,040 shares of our Common Stock,

with a weighted-average exercise price of $1.04 per share.

In connection with

our September 2016 public offering of warrants, or the 2016 Warrants, to Roth Capital Partners and certain designees of Rodman

& Renshaw, a unit of H.C. Wainwright & Co., LLC, the holders of Common Stock underlying such warrants were entitled to

rights with respect to the registration of such shares under the Securities Act. In January 2017, we issued additional warrants,

or the 2017 Warrants, to Rodman & Renshaw pursuant to a letter agreement. In August 2017, a shelf registration statement with

respect to the 2016 Warrants and the 2017 Warrants was filed and declared effective by the SEC. We are required to use commercially

reasonable efforts to cause such registration statement to remain continuously effective for a period that will terminate upon

the earlier of (i) the date on which all such Common Stock has been disposed of pursuant to such registration statement, or (ii)

the date on which all such Common Stock is sold in a transaction that is exempt from registration pursuant to Rule 144 or a transaction

in which such selling stockholders’ rights under the registration rights agreement are not assigned; provided, however, that

such requirement shall not apply during any period in which all the shares of Common Stock then outstanding and held by selling

stockholders may be sold under Rule 144 without restriction, including volume limitations or manner of sale restrictions.

Preferred Stock

As of November 20,

2020, 1,819 shares of our preferred stock are issued and outstanding and no such shares were subject to outstanding options or

other rights to purchase or acquire. However, shares of preferred stock may be issued in one or more series from time to time by

our board of directors, and the board of directors is expressly authorized to fix by resolution or resolutions the designations

and the powers, preferences and rights, and the qualifications, limitations and restrictions thereof, of the shares of each series

of preferred stock. Subject to the determination of our board of directors, any shares of our preferred stock that may be issued

in the future would generally have preferences over our Common Stock with respect to the payment of dividends and the distribution

of assets in the event of our liquidation, dissolution or winding up.

The issuance of preferred

stock could decrease the amount of earnings and assets available for distribution to the holders of Common Stock or adversely affect

the rights and powers, including voting rights, of the holders of Common Stock. The issuance of preferred stock, while providing

flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of

delaying, deferring or preventing a change in control of Timber, which could depress the market price of our Common Stock.

Anti-Takeover Effects of Certain Provisions

of Delaware Law and Our Certificate of Incorporation and Bylaws

Our Certificate of

Incorporation, as amended, and Bylaws, as amended, contain provisions that could have the effect of discouraging potential acquisition

proposals or tender offers or delaying or preventing a change of control. These provisions are as follows:

|

|

●

|

they provide that special meetings of stockholders may be called only by a majority of our board of directors or an officer instructed by the directors to call a special meeting, thus prohibiting a stockholder from calling a special meeting;

|

|

|

|

|

|

|

●

|

they authorize our board of directors to fill vacant directorships, including newly created seats;

|

|

|

|

|

|

|

●

|

they can be amended or repealed by unanimous

written consent of our board of directors;

|

|

|

●

|

they do not include a provision for cumulative voting in the election of directors. Under cumulative voting, a minority stockholder holding a sufficient number of shares may be able to ensure the election of one or more directors. The absence of cumulative voting may have the effect of limiting the ability of minority stockholders to effect changes in our board of directors; and

|

|

|

|

|

|

|

●

|

they allow us to issue, without stockholder approval, up to 10,000,000 shares of preferred stock that could adversely affect the rights and powers of the holders of our Common Stock.

|

We are subject to

the provisions of Section 203 of the Delaware General Corporation Law, an anti-takeover law. Subject to certain exceptions, the

statute prohibits a publicly held Delaware corporation from engaging in a “business combination” with an “interested

stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder

unless:

|

|

●

|

prior to such date, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

|

|

|

|

|

|

|

●

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least eighty-five percent 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding those shares owned (1) by persons who are directors and also officers and (2) by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

|

|

|

|

●

|

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least sixty-six and two-thirds percent 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

Generally, for purposes

of Section 203, a “business combination” includes a merger, asset or stock sale, or other transaction resulting in

a financial benefit to the interested stockholder. An “interested stockholder” is a person who, together with affiliates

and associates, owns or, within three (3) years prior to the determination of interested stockholder status, owned fifteen percent

(15%) or more of a corporation’s outstanding voting securities.

Potential Effects of Authorized but

Unissued Stock

We have shares of Common

Stock and preferred stock available for future issuance without stockholder approval. We may utilize these additional shares for

a variety of corporate purposes, including future public offerings to raise additional capital, to facilitate corporate acquisitions

or payment as a dividend on the capital stock.

The existence of unissued

and unreserved Common Stock and preferred stock may enable our board of directors to issue shares to persons friendly to current

management or to issue preferred stock with terms that could render more difficult or discourage a third-party attempt to obtain

control of us by means of a merger, tender offer, proxy contest or otherwise, thereby protecting the continuity of our management.

In addition, the board of directors has the discretion to determine designations, rights, preferences, privileges and restrictions,

including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences of each series of

preferred stock, all to the fullest extent permissible under the DGCL and subject to any limitations set forth in our Certificate

of Incorporation. The purpose of authorizing the board of directors to issue preferred stock and to determine the rights and preferences

applicable to such preferred stock is to eliminate delays associated with a stockholder vote on specific issuances. The issuance

of preferred stock, while providing desirable flexibility in connection with possible financings, acquisitions and other corporate

purposes, could have the effect of making it more difficult for a third-party to acquire, or could discourage a third-party from

acquiring, a majority of our outstanding voting stock.

Warrants

Series B Warrants

The Series B Warrants

have an exercise price of $0.001 per share, were exercisable upon issuance and will expire on the day following the later to occur

of (i) April 30, 2021 and (ii) the date on which the Series B Warrants have been exercised in full (without giving effect to any

limitation on exercise contained therein) and no shares remain issuable thereunder. The Series B Warrants are exercisable for 22,766,776

shares of Common Stock in the aggregate.

Pursuant to the Series

B Warrants, the Company has agreed not to enter into, allow or be party to certain fundamental transactions, generally including

any merger with or into another entity, sale of all or substantially all of the Company’s assets, tender offer or exchange

offer, or reclassification of the Common Stock (a “Fundamental Transaction”) until May 1, 2021. Thereafter, upon any

exercise of a Series B Warrant, the holder shall have the right to receive, for each share of Common Stock that would have been

issuable upon such exercise immediately prior to the occurrence of a Fundamental Transaction, at the option of the holder (without

regard to any limitation on the exercise of the Series B Warrant), the number of shares of Common Stock of the successor or acquiring

corporation or of the Company, if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”)

receivable as a result of such Fundamental Transaction by a holder of the number of shares of Common Stock for which the Series

B Warrant is exercisable immediately prior to such Fundamental Transaction (without regard to any limitation on the exercise of

the Series B Warrant). For purposes of any such exercise, the determination of the exercise price shall be appropriately adjusted

to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common

Stock in such Fundamental Transaction, and the Company shall apportion the exercise price among the Alternate Consideration in

a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common

Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the holder

shall be given the same choice as to the Alternate Consideration it receives upon any exercise of the Series B Warrant following

such Fundamental Transaction. The Company shall cause any successor entity in a Fundamental Transaction in which the Company is

not the survivor (the “Successor Entity”) to assume in writing all of the obligations of the Company under the Series

B Warrants, upon which the Series B Warrants shall become exercisable for shares of Common Stock, shares of the Common Stock of

the Successor Entity or the consideration that would have been issuable to the holders had they exercised the Series B Warrants

prior to such Fundamental Transaction, at the holders’ election.

The Series B Warrants

also contain a “cashless exercise” feature that allows the holders to exercise the Series B Warrants without making

a cash payment. The Series B Warrants are subject to a blocker provision which restricts the exercise of the Series B Warrants

if, as a result of such exercise, the holder, together with its affiliates and any other person whose beneficial ownership of Common

Stock would be aggregated with the holder’s for purposes of Section 13(d) of the Exchange Act would beneficially own in excess

of 4.99% or 9.99% of the outstanding Common Stock (including the shares of Common Stock issuable upon such exercise), as such percentage

ownership is determined in accordance with the terms of the Series B Warrants.

If the Company fails

to issue to a holder of Series B Warrants the number of shares of Common Stock to which such holder is entitled upon such holder’s

exercise of the Series B Warrants, then the Company shall be obligated to pay the holder on each day while such failure is continuing

an amount equal to 1.5% of the market value of the undelivered shares determined using a trading price of Common Stock selected

by the holder while the failure is continuing and if the holder purchases shares of Common Stock in connection with such failure

(“Series B Buy-In Shares”), then Timber must, at the holder’s discretion, reimburse the holder for the cost of

such Series B Buy-In Shares or deliver the owed shares and reimburse the holder for the difference between the price such holder

paid for the Series B Buy-In Shares and the market price of such shares, measured at any time of the holder’s choosing while

the delivery failure was continuing.

Further, the Series

B Warrants provide that, in the event that the Company does not have sufficient authorized shares to deliver in satisfaction of

an exercise of a Series B Warrant, then unless the holder elects to void such attempted exercise, the holder may require the Company

to pay an amount equal to the product of (i) the number of shares that Timber is unable to deliver and (ii) the highest volume-weighted

average price of a share of Common Stock as quoted on the NYSE American during the period beginning on the date of such attempted

exercise and ending on the date that the Company makes the applicable payment.

Registration Rights

In connection with

the Pre-Merger Financing, Timber entered into a Registration Rights Agreement with the Investors (the “Registration Rights

Agreement”). Pursuant to the Registration Rights Agreement, as amended, Timber was required to file an initial resale registration

statement with respect to shares of Common Stock held by or issuable to the Investors pursuant to the Series A Warrants, Series

B Warrants and the Bridge Warrants (the “Registrable Securities”), within 15 trading days after the closing of the

Pre-Merger Financing, or June 16, 2020. On July 17, 2020, Timber and the Investors entered into an Amended and Restated Registration

Rights Agreement, pursuant to which the Investors were given certain demand registration rights. Pursuant to the Waiver Agreements,

the Investors exercised such demand registration rights, and Timber agreed to initially register 50% of the shares underlying the

Series B Warrants. Pursuant to the Waiver Agreements, the Inventors have been granted two additional demand registrations with

respect to any remaining Registrable Securities not yet registered.

Transfer Agent and Registrar

The transfer agent

and registrar for our Common Stock is Computershare. The transfer agent address is Computershare, 520 Pike Street Suite 1305, Seattle,

WA 98101, (206) 674-3050.

LEGAL MATTERS

Unless otherwise indicated

in the applicable prospectus supplement, the validity of the securities offered hereby will be passed upon for us by Lowenstein

Sandler LLP, Roseland, New Jersey. If the validity of the securities offered hereby in connection with offerings made pursuant

to this prospectus are passed upon by counsel for the underwriters, dealers or agents, if any, such counsel will be named in the

prospectus supplement relating to such offering.

EXPERTS

Timber Pharmaceuticals, Inc.

The consolidated financial

statements of Timber Pharmaceuticals, Inc. (formerly known as BioPharmX Corporation) as of January 31, 2020 and 2019 and for each

of the two years in the period ended January 31, 2020, incorporated by reference in this prospectus to its Annual Report on Form

10-K for the year ended January 31, 2020, have been so incorporated in reliance on the report (which contains an explanatory paragraph

relating to the Company’s ability to continue as a going concern as described in Note 2 to the consolidated financial statements)

of BPM LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

Timber Pharmaceuticals LLC

The

consolidated financial statements of Timber Pharmaceuticals LLC as of December 31, 2019, and for the period from February 26,

2019 (inception) through December 31, 2019, have been incorporated by reference herein and in the prospectus in reliance upon

the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority

of said firm as experts in accounting and auditing. The audit report covering the December 31, 2019 consolidated financial statements

contains an explanatory paragraph that states that the Timber Pharmaceuticals LLC loss from operations and net capital deficiency

raise substantial doubt about the entity's ability to continue as a going concern. The consolidated financial statements do not

include any adjustments that might result from the outcome of that uncertainty.

ADDITIONAL INFORMATION

This prospectus is

part of a registration statement on Form S-3 that we have filed with the SEC relating to the securities being offered hereby. This

prospectus does not contain all of the information in the registration statement and its exhibits. The registration statement,

its exhibits and the documents incorporated by reference in this prospectus and their exhibits, all contain information that is

material to the offering of the securities hereby. Whenever a reference is made in this prospectus to any of our contracts or other

documents, the reference may not be complete. You should refer to the exhibits that are a part of the registration statement in

order to review a copy of the contract or documents. The registration statement and the exhibits are available at the SEC’s

Public Reference Room or through its Website.

We file annual, quarterly

and current reports, proxy statements and other information with the SEC. You can read and copy any materials we file with the

SEC at its Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 and at its regional offices, a list of which is

available on the Internet at http://www.sec.gov/contact/addresses.htm. You may obtain information on the operation of the

Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site at http://www.sec.gov that

contains reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically

with the SEC. Additionally, you may access our filings with the SEC through our website at https://www.timberpharma.com/.

The information on our website is not part of this prospectus.

We will provide you

without charge, upon your oral or written request, with a copy of any or all reports, proxy statements and other documents we file

with the SEC, as well as any or all of the documents incorporated by reference in this prospectus or the registration statement

(other than exhibits to such documents unless such exhibits are specifically incorporated by reference into such documents). Requests

for such copies should be directed to:

Timber Pharmaceuticals, Inc.

Attn: John Koconis, Chief Executive Officer

50 Tice Blvd, Suite A26

Woodcliff Lake, NJ 07677

(973) 314-9570

You should rely

only on the information in this prospectus and the additional information described above and under the heading

“Incorporation of Certain Information by Reference” below. We have not authorized any other person to provide you

with different information. If anyone provides you with different or inconsistent information, you should not rely upon it.

We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should

assume that the information in this prospectus was accurate on the date of the front cover of this prospectus only. Our

business, financial condition, results of operations and prospects may have changed since that date.

INCORPORATION OF CERTAIN INFORMATION

BY REFERENCE

The SEC allows us to

“incorporate by reference” information that we file with it into this prospectus, which means that we can disclose

important information to you by referring you to those documents. The information incorporated by reference is an important part

of this prospectus. The information incorporated by reference is considered to be a part of this prospectus, and information that

we file later with the SEC will automatically update and supersede information contained in this prospectus and any accompanying

prospectus supplement.

We incorporate by reference the documents

listed below that we have previously filed with the SEC:

|

|

●

|

Our Annual Report on Form 10-K for the year ended January 31, 2020, filed with the SEC on March 23, 2020;

|

|

|

|

|

|

|

●

|

our Quarterly Reports on Form 10-Q for the quarters ended April 30, 2020, June 30, 2020 and September 30, 2020, filed with the SEC on June 12, 2020, August 18, 2020 and November 12, 2020, respectively;

|

|

|

|

|

|

|

●

|

our Current Reports on Form 8-K dated February 3, 2020, February 18, 2020, March 30, 2020, April 6, 2020, April 27, 2020, May 11, 2020, May 13, 2020, May 15, 2020, May 22, 2020, June 3, 2020, July 2, 2020, August 19, 2020 and November 20, 2020;

|

|

|

|

|

|

|

●

|

our Registration Statement on Form S-4 (File No. 333-236526) filed with the SEC on February 20, 2020 (as amended by Form S-4/A (File No. 333-236526) on March 30, 2020 and supplemented by the First Supplement to the Proxy Statement/Prospectus on April 27, 2020; and

|

|

|

|

|

|

|

●

|

the description of the Company’s Common Stock contained in the Company’s Registration Statement on Form 8-A filed with the SEC on June 1, 2015 under Section 12 of the Exchange Act, including any amendment or report filed for the purpose of updating such description.

|

All reports and other

documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the initial

registration statement and prior to effectiveness of the registration statement and after the date of this prospectus but before

the termination of the offering of the securities hereunder will also be considered to be incorporated by reference into this prospectus

from the date of the filing of these reports and documents, and will supersede the information herein; provided, however, that

all reports, exhibits and other information that we “furnish” to the SEC will not be considered incorporated by reference

into this prospectus. We undertake to provide without charge to each person (including any beneficial owner) who receives a copy

of this prospectus, upon written or oral request, a copy of all of the preceding documents that are incorporated by reference (other

than exhibits, unless the exhibits are specifically incorporated by reference into these documents). You may request a copy of

these materials in the manner set forth under the heading “Additional Information,” above.

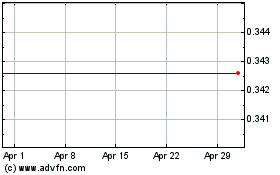

Timber Pharmaceuticals (AMEX:TMBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Timber Pharmaceuticals (AMEX:TMBR)

Historical Stock Chart

From Apr 2023 to Apr 2024