Tanzanian Gold Corporation (TSX:TNX) (NYSE American:TRX) (TanGold

or the Company) (operating through its wholly owned subsidiary in

Tanzania) and its joint venture partner, The State Mining Company

(STAMICO), announces that it has received initial and highly

favourable metallurgical test results from the sulphide component

of the Buckreef Gold Mine (Buckreef) mineral resource.

SGS Canada Inc. (SGS) was retained to complete

initial metallurgical test work at their Lakefield facility on the

sulphide component of the mineral resource. SGS flowsheets will be

a cornerstone of the feasibility study and help prove the viability

of the project to financiers and stakeholders as Buckreef

progresses towards full operation. SGS has reviewed the information

in the press release.

The initial metallurgical test work is now

concluding. SGS has now been commissioned to undertake the

metallurgical variability phase for Buckreef.

Highlights

- Three diamond

drill core samples were taken from the fresh rock (‘sulphide’

mineral resource) of the Buckreef deposit for the purposes of

metallurgical test work. The following intercepts and gold recovery

rates were observed (see figure on the subsequent page):

- MC01:

0.54 g/t over 78.88m – 94.1%

- MC02:

19.4 g/t over 27.99m – 95.4%

- MC03:

1.71 g/t over 52.53m – 85.3%

- SGS have advised

that a flowsheet consisting of crush/grind and flotation followed

by regrinding of the rougher concentrate and cyanidation at site,

along with cyanidation of the flotation tailing is currently the

metallurgically optimal mill circuit. Dore will be produced at

site.

- Test work is

ongoing on the MC03 sample, for the purpose of improving the gold

recovery rate. The same test work can be applied to the MC01 and

MC02 samples.

- SGS have now

been commissioned to complete feasibility level metallurgical

testing that will focus on the first 5-7 years of production at

Buckreef.

Mr. Stephen Mullowney, CEO (TanGold) commented,

“the initial metallurgical results from a reputable and prestigious

organization (SGS Lakefield) have indicated that a well-known and

simple flowsheet for our large high-grade deposit and plant is most

likely. The initial recoveries are excellent, and I look forward

with confidence to the results of the variability testing."

Mr. Andrew Cheatle, COO (TanGold) added, “the

initial metallurgical recovery results are excellent and typical of

Archean shear zone type hosted gold deposits. These results also

firmly underscore our overall plan to have two plants with two

different flowsheets; one plant to treat gold bearing oxides and a

second plant to treat gold bearing sulphide or primary materials.

We look forward to continuing to work with SGS on the metallurgical

study.”

Further Details of Test

Work

In 2020, three diamond drill holes were

completed for the purposes of initial, modern era metallurgical

test work. Diamond drill hole details are tabulated below:

The Buckreef Main Metallurgy samples table can

be found

at https://www.globenewswire.com/NewsRoom/AttachmentNg/a11a04ab-4961-43a1-a73b-0ec3d0d17727

The samples were extracted as fresh drill core

samples from areas/zones with known lithologies from within the

current projects open pit limit. The samples were selected by

TanGold and confirmed by the SGS geological services group that

worked together doing the metallurgical sample selection. The

investigation included ore characterization, comminution,

mineralogy, head analyses, and potential for gold preg robbing, and

evaluated the amenability of the three samples to two primary

processing flowsheet options, that incorporate comminution

(crushing and grinding), gravity separation, flotation and

cyanidation unit operations. A high-level summary of the test work

is provided below:

- Bond ball mill

work index values were 18.3 and 18.5 in MC01 and MC02 respectively.

MC03 was slightly softer at 17.1. The hanging wall (HW) comp was at

17.1 and the foot wall (FW) was 18. All of these comminution

samples are classified as “Hard” when compared to the SGS

comminution database. All of these samples are somewhat softer than

the values indicated for Buckreef ore as seen in the historical

documentation.

- Gravity

separation testwork completed to date by SGS has indicated poor

gold recoveries, averaging just under 5%. This seems to conflict

somewhat with indications in the historical testwork records which

indicated potential gold recoveries of >30%.

- Direct cyanide

leaching of the gravity separation tailing indicated that

composites MC01 and MC02 yielded ~80% gold extraction at a grind

size of ~150 μm (P80). The softer material, MC03, yielded 72% gold

extraction at the same approximate grind size. Grinding

significantly finer, to ~75 μm (P80), resulted in 8-9% additional

gold extraction (to 88-89%) from MC01 and MC02 material. MC03 gold

extraction increased to 79% with the same reduction in leach feed

size. Tests were run over 48 hours and gold extraction had

more-or-less ceased after 24 hours, with only minor additional gold

extraction up to 48 hours retention time.

- Rougher

flotation tests were conducted on gravity tailing at grind size

P80’s of ~150, ~120 and ~90 μm. Mass pulls of ~13-20% were

observed. Sulphide recovery was very stable (97-98%) and showed no

impact from coarser/finer grinding. Gold recoveries improved only

slightly, in MC01 and MC02 tests, with finer grinding, from

~87-90%. MC03 gold recovery remained rather stable at ~90% across

the feed size test series.

About Tanzanian Gold Corporation

Tanzanian Gold Corporation along with its joint

venture partner, STAMICO is building a significant gold project at

Buckreef in Tanzania that is based on an expanded Mineral Resource

base and the treatment of its mineable Mineral Reserves in two

standalone plants. Measured Mineral Resource now stands at 19.98MT

at 1.99g/t gold containing 1,281,161 ounces of gold and Indicated

Mineral Resource now stand at 15.89MT at 1.48g/t gold containing

755,119 ounces of gold for a combined tonnage of 35.88MT at 1.77g/t

gold containing 2,036,280 ounces of gold. The Buckreef Project also

contains an Inferred Mineral Resource of 17.8MT at 1.11g/t gold for

contained gold of 635,540 ounces of gold. The Company is actively

investigating and assessing multiple exploration targets on its

property. Please refer to the Company’s Updated Mineral Resources

Estimate for Buckreef Gold Project, dated May 15, 2020, for more

information.

Tanzanian Gold Corporation is advancing on three

value-creation tracks:

- Strengthening its balance sheet by

expanding near-term production to 15,000 - 20,000 oz. of gold per

year from the processing of oxide material from an expanded oxide

plant.

- Advancing the Final Feasibility

Study for a stand-alone sulphide treating plant that is

substantially larger than previously modelled and targeting

significant annual gold production.

- Continuing with a drilling program

to further test the potential of its property, Exploration Targets

and Mineral Resource base by: (i) identifying new prospects; (ii)

drilling new oxide/sulphide targets; (iii) infill drilling to

upgrade Mineral Resources currently in the Inferred category; and

(iv) a step-out drilling program in the Northeast Extension.

Andrew M. Cheatle, P.Geo. is the Company’s

Qualified Person as defined by the NI 43-101 who has verified the

data disclosed in this news release and has otherwise reviewed and

assumes responsibility for the technical content of this press

release.

About SGS

SGS is the world’s leading inspection,

verification, testing and certification company. They are

recognized as the global benchmark for quality and integrity. With

more than 89,000 employees, SGS operates a network of more than

2,600 offices and laboratories around the world. Bankable

flowsheets help prove the viability of a gold mining project to

financers and stakeholders. SGS has, in this regard, earned a

global reputation as a proven leader in the development of

transparent, bankable flowsheets for a wide range of mineral and

metal extraction operations.

For further information, please contact Michael Martin, Investor

Relations, m.martin@tangoldcorp.com, 860-248-0999, or visit the

Company website at www.tangoldcorp.com

The Toronto Stock Exchange and NYSE American

have not reviewed and do not accept responsibility for the adequacy

or accuracy of this release.

U.S. Investors are urged to consider closely the

disclosure in our SEC filings. You can review and obtain copies of

these filings from the SEC's website at

http://www.sec.gov/edgar.shtml

Forward-Looking StatementsThis

press release contains certain forward-looking statements as

defined in the applicable securities laws. All statements, other

than statements of historical facts, are forward-looking

statements. Forward-looking statements are frequently, but not

always, identified by words such as “expects”, “anticipates”,

“believes”, “hopes”, “intends”, “estimated”, “potential”,

“possible” and similar expressions, or statements that events,

conditions or results “will”, “may”, “could” or “should” occur or

be achieved. Forward-looking statements relate to future events or

future performance and reflect Tanzanian Gold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to the estimation of

mineral reserves and resources, recoveries, subsequent project

testing, success and viability of mining operations, the timing and

amount of estimated future production, and capital expenditure.

Although TanGold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TanGold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks,

uncertainties and factors include general business, legal,

economic, competitive, political, regulatory and social

uncertainties; actual results of exploration activities and

economic evaluations; fluctuations in currency exchange rates;

changes in costs; future prices of gold and other minerals; mining

method, production profile and mine plan; delays in exploration,

development and construction activities; changes in government

legislation and regulation; the ability to obtain financing on

acceptable terms and in a timely manner or at all; contests over

title to properties; employee relations and shortages of skilled

personnel and contractors; the speculative nature of, and the risks

involved in, the exploration, development and mining business.

These risks are set forth under Item 3.D in Tanzanian Gold’s Form

20-F for the year ended August 31, 2020, as amended, as filed with

the SEC.

The information contained in this press release

is as of the date of the press release and TanGold assumes not duty

to update such information.

Note to U.S. Investors

US investors are advised that the mineral

resource and mineral reserve estimated disclosed in this press

release have been calculated pursuant to Canadian standards which

use terminology consistent with the requirements CRIRSCO reporting

standards. For its fiscal year ending August 31, 2021, and

thereafter, the Company will follow new SEC regulations which uses

a CRIRSCO based template for mineral resources and mineral

reserves, that includes definitions for inferred, indicated, and

measured mineral resources.

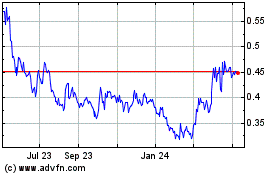

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Apr 2023 to Apr 2024