As filed with the Securities and Exchange Commission on [•], 2020.

Registration No. 333-238704

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM F-10/A

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

SILVERCREST METALS INC.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Province or other jurisdiction of incorporation or organization)

1040

(Primary Standard Industrial Classification Code Number, if applicable)

N/A

(I.R.S. Employer Identification No., if applicable)

570 Granville Street, Suite 501

Vancouver, British Columbia

Canada V6C 3P1

(604) 694-1730

(Address and telephone number of Registrant's principal executive offices)

CT Corporation System

1015 15th Street N.W., Suite 1000

Washington, DC 20005

(202) 572-3100

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

|

Anne Yong

SilverCrest Metals Inc.

570 Granville Street Suite 501

Vancouver, British Columbia

Canada, V6C 3P1

Tel: (604) 694-1730

|

Bernard Poznanski

Koffman Kalef LLP

885 W Georgia St., 19th floor

Vancouver, British Columbia

Canada, V6C 3H4

Tel: (604) 891-3606

|

James Guttman

Kenneth Sam

Dorsey & Whitney LLP

TD Canada Trust Tower

Brookfield Place, 161 Bay Street, Suite 4310 Toronto, Ontario

Canada, M5J 2S1

Tel: (416) 367-7376

|

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this Registration Statement becomes effective.

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

|

A.

|

☐

|

upon filing with the Commission pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

|

|

B.

|

☒

|

at some future date (check the appropriate box below):

|

|

|

1.

|

☐

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing).

|

|

|

2.

|

☐

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ).

|

|

|

3.

|

☒

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

|

|

|

4.

|

☐

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. ☒

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective as provided in Rule 467 under the Securities Act or on such date as the Commission, acting pursuant to Section 8(a) of the Securities Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

SHORT FORM BASE SHELF PROSPECTUS

SILVERCREST METALS INC.

$200,000,000

Common Shares

Warrants

Subscription Receipts

Debt Securities

Units

SilverCrest Metals Inc. (the "Company" or "SilverCrest") may offer and issue from time to time common shares (the "Common Shares"), warrants (the "Warrants") to purchase Common Shares or other Securities (as defined below), subscription receipts ("Subscription Receipts") which entitle the holder to receive upon satisfaction of certain release conditions, and for no additional consideration, Common Shares or Warrants of the Company or any combination thereof, debt securities ("Debt Securities"), or units ("Units") consisting of two or more of the foregoing (all of the foregoing, collectively, the ''Securities'') or any combination thereof up to an aggregate initial offering price of $200,000,000 (or its equivalent in any other currency used to denominate the Securities at the time of the offering) during the 25-month period that this short form base shelf prospectus (the "Prospectus"), including any amendments thereto, remains effective. Securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of sale and set forth in an accompanying shelf prospectus supplement (a "Prospectus Supplement"). In addition, Securities may be offered and issued in consideration for the acquisition of other businesses, assets or securities by the Company or a subsidiary of the Company. The consideration for any such acquisition may consist of any of the Securities separately, a combination of Securities or any combination of, among other things, Securities, cash and assumption of liabilities.

Investing in securities of the Company involves a high degree of risk. You should carefully review the risks outlined in this Prospectus and in the documents incorporated by reference in this Prospectus and consider such risks in connection with an investment in such securities. See "Risk Factors".

This offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada ("MJDS"), to prepare this Prospectus in accordance with Canadian disclosure requirements. Prospective investors in the United States should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and may not be comparable to financial statements of United States companies. The audit of such financial statements is in accordance with the standards of the Public Company Accounting Oversight Board (United States) and the United States Securities and Exchange Commission ("SEC") independence standards.

Prospective investors should be aware that the acquisition of the securities described herein may have tax consequences both in the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein. Prospective investors should read the tax discussion contained in the applicable Prospectus Supplement with respect to a particular offering of Securities.

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the laws of British Columbia, Canada, that all of its officers and directors are residents of Canada, that all of the experts named in the registration statement are not residents of the United States, and that a substantial portion of the assets of the Company and said persons are located outside the United States.

NEITHER THE SEC NOR ANY STATE OR CANADIAN SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THE SECURITIES OFFERED HEREBY OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

The specific terms of the Securities with respect to a particular offering will be set out in the applicable Prospectus Supplement and may include, where applicable: (i) in the case of Common Shares, the number of Common Shares offered, the issue price, and any other terms specific to the Common Shares being offered; (ii) in the case of Warrants, the designation, number and terms of the Common Shares or other Securities issuable upon exercise of the Warrants, any procedures that will result in the adjustment of these numbers, the exercise price, dates and periods of exercise, the currency in which the Warrants are issued and any other specific terms; (iii) in the case of Subscription Receipts, the designation, number and terms of the Common Shares or Warrants receivable upon satisfaction of certain release conditions, any procedures that will result in the adjustment of those numbers, any additional payments to be made to holders of Subscription Receipts upon satisfaction of the release conditions, the terms of the release conditions, terms governing the escrow of all or a portion of the gross proceeds from the sale of the Subscription Receipts, terms for the refund of all or a portion of the purchase price for Subscription Receipts in the event the release conditions are not met and any other specific terms, (iv) in the case of Debt Securities, the specific designation, the aggregate principal amount, the currency or the currency unit for which the Debt Securities may be purchased, the maturity, the interest provisions, the authorized denominations, the offering price, whether the Debt Securities are being offered for cash, the covenants, the events of default, any terms for redemption or retraction, any exchange or conversion rights attached to the Debt Securities, whether the debt is senior or subordinated to the Company's other liabilities and obligations, whether the Debt Securities will be secured by any of the Company's assets or guaranteed by any other person and any other terms specific to the Debt Securities being offered; and (v) in the case of Units, the terms of the component Securities and any other specific terms. A Prospectus Supplement may include specific variable terms pertaining to the Securities that are not within the alternatives and parameters described in this Prospectus. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to such Securities will be included in the Prospectus Supplement describing such Securities.

Warrants will not be offered for sale separately to any member of the public in Canada unless the offering is in connection with, and forms part of, the consideration for an acquisition or merger transaction.

This Prospectus does not qualify for issuance Debt Securities in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to one or more underlying interests, including, for example, an equity or debt security, or a statistical measure of economic or financial performance (including, but not limited to, any currency, consumer price or mortgage index, or the price or value of one or more commodities, indices or other items, or any other item or formula, or any combination or basket of the foregoing items). For greater certainty, this Prospectus may qualify for issuance Debt Securities in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to published rates of a central banking authority or one or more financial institutions, such as a prime rate or bankers' acceptance rate, or to recognized market benchmark interest rates such as LIBOR, EURIBOR or a United States federal funds rate.

All information permitted under applicable laws to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus, such delivery to be effected in the case of United States purchasers through the filing of such Prospectus Supplement or Prospectus Supplements with the SEC. Each Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

This Prospectus constitutes a public offering of these Securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such Securities. The Company may offer and sell Securities to or through underwriters or dealers and also may offer and sell certain Securities directly to purchasers or through agents pursuant to exemptions from registration or qualification under applicable securities laws. A Prospectus Supplement relating to each issue of Securities offered thereby will set forth the names of any underwriters, dealers or agents involved in the offering and sale of such Securities and will set forth the terms of the offering of such Securities, the method of distribution of such Securities including, to the extent applicable, the proceeds to the Company and any fees, discounts or any other compensation payable to underwriters, dealers or agents and any other material terms of the plan of distribution.

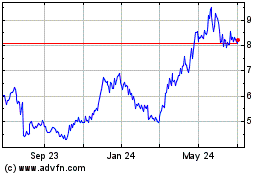

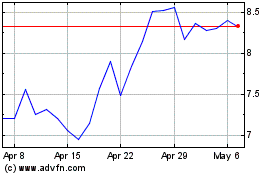

The outstanding Common Shares are listed for trading on the Toronto Stock Exchange ("TSX") under the symbol "SIL" and in the United States on the NYSE American LLC (the "NYSE American") under the symbol "SILV". Unless otherwise specified in the applicable Prospectus Supplement, Securities other than the Common Shares of the Company will not be listed on any securities exchange. On June 5, 2020, the closing price of the Common Shares on TSX was $11.70 per share and the closing price of the Common Shares on NYSE American was U.S.$8.77 per share. There is currently no market through which Securities, other than the Common Shares, may be sold and purchasers may not be able to resell such Securities purchased under this Prospectus. This may affect the pricing of the Securities, other than the Common Shares, in the secondary market, the transparency and availability of trading prices, the liquidity of these Securities and the extent of issuer regulation. See "Risk Factors".

The offering of Securities hereunder is subject to approval of certain legal matters on behalf of the Company by Koffman Kalef LLP, with respect to Canadian legal matters, and Dorsey & Whitney LLP, with respect to United States legal matters.

In connection with any offering of Securities (unless otherwise specified in a Prospectus Supplement), other than an "at-the-market distribution", the underwriters may over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at a level above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. See "Plan of Distribution".

The Company's head office is located at Suite 501 - 570 Granville Street, Vancouver, British Columbia, Canada V6C 3P1 and its registered office is located at 19th Floor, 885 West Georgia Street, Vancouver, British Columbia, Canada V6C 3H4.

No underwriter has been involved in the preparation of this Prospectus or performed any review of the contents of this Prospectus.

TABLE OF CONTENTS

_____________________________

You should rely only on the information contained in or incorporated by reference into this Prospectus or contained in any applicable Prospectus Supplement. The Company has not authorized anyone to provide you with different information. The Company is not making an offer of these Securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this Prospectus and any Prospectus Supplement is accurate as of any date other than the date on the front of those documents or that any information contained in any document incorporated by reference is accurate as of any date other than the date of that document.

Unless the context otherwise requires, references in this Prospectus and any Prospectus Supplement to "we", "our", "us", "SilverCrest" or the "Company" refer to SilverCrest Metals Inc. and each of its material subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of applicable Canadian securities laws and forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of its properties, planned expenditures and plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on expectations of future performance, including silver and gold production and planned work programs. In addition, these statements include, but are not limited to the future price of commodities, the estimation of mineral resources, the realization of mineral resource estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, timing of completion of exploration programs, technical reports and studies, success of exploration and development activities and mining operations, the timing of construction and mine operation activities, permitting timelines, currency fluctuations, requirements for additional capital, government regulation of exploration and production operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, completion of acquisitions and their potential impact on the Company and its operations, limitations on insurance coverage; maintenance of adequate internal control over financial reporting; and the timing and possible outcome of litigation.

Forward-looking statements are made based upon certain assumptions and other important factors that, while considered reasonable by the Company, are inherently subject to significant business economic, competitive, political and social uncertainties and contingencies. The Company has made assumptions based on many of these factors which include, without limitation, present and future business strategies, the environment in which the Company will operate in the future, including the price of silver and gold, anticipated cost and the ability to achieve goals. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, among others, volatility in the price of silver and gold, discrepancies between actual estimated production, mineral resources and metallurgical recovery, mining operational and development risks, regulatory restrictions, activities by governmental authorities and changes in legislation, community relations, the speculative nature of mineral exploration, the global economic climate, loss of key employees, additional funding requirements, defective title to mineral claims or property, and uncertainty as to duration and impact of the current novel coronavirus ("COVID-19") pandemic. While the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be factors that cause actions, events or results not to be as anticipated, estimated or intended.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation: the timing and content of work programs; results of exploration activities; the interpretation of drilling results and other geological data; reliability of mineral resource estimates; receipt, maintenance and security of permits and mineral property titles; enforceability of contractual interests in mineral properties; environmental and other regulatory risks; compliance with changing environmental regulations; dependence on local community relationships; risks of local violence; risks related to natural disasters, terrorism, civil unrest, public health concerns (including health epidemics or outbreaks of communicable diseases such as COVID-19) and other geopolitical uncertainties; reliability of costs estimates; project cost overruns or unanticipated costs and expenses; precious metals price fluctuations; fluctuations in the foreign exchange rate (particularly the Mexican peso, Canadian dollar and United States dollar); uncertainty in the Company's ability to fund the exploration and development of its mineral properties or the completion of further exploration programs; uncertainty as to whether the Company's exploration programs will result in the discovery, development or production of commercially viable ore bodies or yield reserves; risks related to mineral properties being subject to prior unregistered agreements, transfers, claims and other defects in title; uncertainty in the ability to obtain financing if required; maintaining adequate internal control over financial reporting; dependence on key personnel; and general market and industry conditions.

This above list is not exhaustive of the factors that may affect the Company's forward-looking statements. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this Prospectus and any Prospectus Supplement under "Risk Factors" and elsewhere in this Prospectus and any Prospectus Supplement and in the documents incorporated by reference herein. The Company's forward-looking statements are based on beliefs, expectations and opinions of management on the date the statements are made and the Company does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions change, except as required by applicable law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

CAUTIONARY NOTE TO U.S. INVESTORS

REGARDING THE USE OF MINERAL RESOURCE ESTIMATES

The Company is subject to the reporting requirements of the applicable Canadian securities laws and, as a result, reports the mineral resources of the projects it has an interest in according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and are different from U.S. reporting standards under Industry Guide 7. The definitions of NI 43-101 are adopted from those given by the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM"). U.S. reporting requirements are currently governed by Industry Guide 7. This Prospectus includes or incorporates by reference estimates of mineral resources reported in accordance with NI 43-101. These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody different approaches and definitions. The Company reports estimates of "mineral resources" in accordance with NI 43-101. While the terms "Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are recognized by NI 43-101, they are not defined terms under Industry Guide 7 and, generally, U.S. companies reporting pursuant to Industry Guide 7 have historically not been permitted to report estimates of mineral resources of any category in documents filed with the SEC. As such, certain information included or incorporated by reference in this Prospectus concerning descriptions of mineralization and estimates of mineral resources under Canadian standards is not comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of the SEC pursuant to Industry Guide 7. The quantity and grade or quality of Inferred Mineral Resources are estimated on the basis of limited geological evidence and sampling, and geological evidence is sufficient to imply but not verify geological and grade or quality continuity. Although it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration, readers are cautioned not to assume that all or any part of Indicated Mineral Resources will ever be converted into mineral reserves recognized under NI 43-101 or Industry Guide 7. Under Canadian rules, Inferred Mineral Resources must not be included in the economic analysis, production schedules, or estimated mine life in any publicly disclosed pre-feasibility or feasibility studies and can only be used in economic studies as provided under NI 43-101.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC. These amendments became effective February 25, 2019 (the "SEC Modernization Rules") and, following a two year transition period, the SEC Modernization Rules will replace the historical property disclosure requirements for mining registrants that are included in Industry Guide 7. Following the transition period, as a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM standards. If the Company ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the multi-jurisdictional disclosure system, then the Company will be subject to the SEC Modernization Rules which differ from the requirements of NI 43-101 and the CIM standards.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or as the context otherwise requires, all references to dollar amounts in this Prospectus and any Prospectus Supplement are references to Canadian dollars. References to "$" or "Cdn.$" are to Canadian dollars and references to "U.S. dollars" or "U.S.$" are to United States dollars.

The high, low, average and closing rates for the United States dollar in terms of Canadian dollars for each of the financial periods of the Company ended December 31, 2019, December 31, 2018 and December 31, 2017, as quoted by the Bank of Canada, were as follows:

|

|

Year ended

December 31, 2019

|

Year ended

December 31, 2018

|

Year ended

December 31, 2017

|

|

|

|

|

|

|

High

|

1.3600

|

1.3642

|

1.3743

|

|

Low

|

1.2988

|

1.2288

|

1.2128

|

|

Average

|

1.3269

|

1.2957

|

1.2986

|

|

Closing

|

1.2988

|

1.3642

|

1.2545

|

On June 5, 2020, the exchange rate for the United States dollar in terms of Canadian dollars, as quoted by the Bank of Canada, was U.S.$1.00 = Cdn.$1.3429 (Cdn.$1.00 = U.S.$0.7447).

THE COMPANY

SilverCrest is a Canadian precious metals exploration company headquartered in Vancouver, British Columbia, Canada that is focused on making new discoveries and value-added acquisitions and targeting production in Mexico's historic precious metal districts. The Company's ongoing initiative is to increase its asset base by acquiring and developing substantial precious metal resources and ultimately operating high grade silver and/or gold mines in Mexico. The Company's principal focus is currently its Las Chispas property ("Las Chispas"), which is located approximately 180 kilometres northeast of Hermosillo, Sonora, Mexico. Las Chispas is in a prolific mining area with nearby precious metal producers and consists of 28 concessions totalling approximately 1,401 hectares.

The Company has a portfolio of three other mineral exploration properties in Sonora Mexico: Cruz de Mayo, Angel de Plata, and Estacion Llano.

Further information regarding the business of the Company, its operations and its mineral properties can be found in the Company's AIF (as defined under "Documents Incorporated by Reference") and the materials incorporated by reference into this Prospectus. See "Documents Incorporated by Reference".

RECENT DEVELOPMENTS

Impact of COVID-19 on Operations

On March 30, 2020, the Company announced protocols to minimize exposure to COVID-19 in order to decrease risk to the Company's employees, contractors, families and communities near Las Chispas. In collaboration with government agencies, the Company had temporarily suspended its ongoing exploration and underground development work at Las Chispas to limit potential exposure of personnel and nearby communities to COVID-19. As of May 18, 2020, the Mexican government has allowed mines to reopen in the State of Sonora with strict COVID-19 protocols. The Company plans on slowly and cautiously restarting activities with an initial remote isolated camp to minimize physical contact with surrounding communities. Reintegration into the local communities will be based on success of the remote camp and local COVID-19 status. The Company plans to begin with seven surface exploration drills, focusing on Babi Vista Vein in-fill and expansion for inclusion in the ongoing resource estimation, reserve and front-end mine schedule. In addition, the Company will restart its construction work with the continuation of raise boring for a ventilation shaft on the Babicanora Vein and construction of administrative offices and warehouse. Underground development, with out-of-state contractors, may restart in early summer, depending on local COVID-19 status and implementation of the appropriate contractor health and safety protocols.

Due to the impact that COVID-19 has had on the Company, the resource estimate is continuing at a slower pace, resulting in a schedule shift into the fourth quarter of 2020 for feasibility study completion. With this extension in the feasibility schedule, the Company plans to allocate extra time to: (1) add further drill results beyond the March 1, 2020 assay cut-off date for resource estimation; (2) optimize resource estimation, mine design and schedule with emphasis on front-end high-grade production including the Babi Vista Vein; (3) finalize site power selection to potentially reduce operating costs; and (4) optimize the process gravity circuit for increased confidence in operations. Other ongoing feasibility work is expected to be completed in June 2020 for the process facility design, capital costs and operating costs. The Company also anticipates completing its basic engineering study as planned by the end of June 2020.

USE OF PROCEEDS

Unless otherwise specified in a Prospectus Supplement, the net proceeds from the sale of the Securities will be used for general corporate purposes, including, without limitation, the following anticipated purposes:

-

to fund Las Chispas exploration and development;

-

to fund prospective local property acquisitions and related exploration work; and

-

to fund continued exploration on the Company's various existing mineral properties.

Each Prospectus Supplement will contain specific information concerning the use of proceeds from that sale of Securities.

All expenses relating to an offering of Securities and any compensation paid to underwriters, dealers or agents, as the case may be, will be paid out of the Company's general funds, unless otherwise stated in the applicable Prospectus Supplement.

CONSOLIDATED CAPITALIZATION

There has been no material change in the share and loan capital of the Company, on a consolidated basis, since the date of the condensed consolidated interim financial statements of the Company for the three months ended March 31, 2020, which are incorporated by reference in this Prospectus, except for the Company's issuance of an aggregate of 17,062,292 Common Shares at $7.50 per share for gross proceeds of $127,967,190 pursuant to the completion of the "2020 Private Placement" and the "SSR April 2020 Private Placement" (each as defined under "Documents Incorporated by Reference") and the issuance of an aggregate of 1,747,450 Common Shares at prices ranging from $0.16 to $4.54 pursuant to stock option exercises for gross proceeds of $1,504,344. See "Prior Sales".

EARNINGS COVERAGE RATIOS

If the Company offers any Debt Securities having a term to maturity in excess of one year under a Prospectus Supplement, the Prospectus Supplement will include earnings coverage ratios giving effect to the issuance of such Debt Securities.

DIVIDEND POLICY

The Company has not declared or paid any dividends on its Common Shares since the date of its incorporation. The Company intends to retain its earnings, if any, to finance the growth and development of its business and does not expect to pay dividends or to make any other distributions in the near future. The Company's board of directors will review this policy from time to time having regard to the Company's financing requirements, financial condition and other factors considered to be relevant.

DESCRIPTION OF COMMON SHARES

The Company's authorized share capital includes an unlimited number of common shares without par value ("Common Shares"). As at the date of this Prospectus, the Company had 128,099,831 Common Shares issued and outstanding.

Each Common Share ranks equally with all other Common Shares with respect to distribution of assets upon dissolution, liquidation or winding up of the Company and payment of dividends. The holders of Common Shares are entitled to one vote for each share on all matters to be voted on by such holders and are entitled to receive pro rata such dividends as may be declared by the Board of Directors of the Company. The holders of Common Shares have no pre-emptive or conversion rights. The rights attached to the Common Shares can only be modified by the affirmative vote of at least two-thirds of the votes cast at a meeting of shareholders called for that purpose.

DESCRIPTION OF WARRANTS

The following description, together with the additional information the Company may include in any Prospectus Supplements, summarizes the material terms and provisions of the Warrants that the Company may offer under this Prospectus, which may consist of Warrants to purchase Common Shares or other Securities and may be issued in one or more series. Warrants may be offered independently or together with Common Shares or other Securities offered by any Prospectus Supplement, and may be attached to or separate from those Securities. Warrants will not, however, be offered for sale separately to any member of the public in Canada unless the offering is in connection with, and forms part of, the consideration for an acquisition or merger transaction. While the terms summarized below will apply generally to any Warrants that the Company may offer under this Prospectus, the Company will describe the particular terms of any series of Warrants that it may offer in more detail in the applicable Prospectus Supplement. The terms of any Warrants offered under a Prospectus Supplement may differ from the terms described below.

General

Warrants will be issued under and governed by the terms of one or more warrant indentures or agreement (each a "Warrant Indenture") between the Company and a warrant agent or warrant trustee (a "Warrant Agent") that the Company will name in the relevant Prospectus Supplement. Each Warrant Agent will be a financial institution organized under the laws of Canada or any province thereof and authorized to carry on business as a trustee. If applicable, the Company will file with the SEC as exhibits to the registration statement of which this Prospectus is a part, or will incorporate by reference from a Report of Foreign Private Issuer on Form 6-K that the Company files with the SEC, any Warrant Indenture describing the terms and conditions of such Warrants that the Company is offering before the issuance of such Warrants.

This summary of some of the provisions of the Warrants is not complete. The statements made in this Prospectus relating to any Warrant Indenture and Warrants to be issued under this Prospectus are summaries of certain anticipated provisions thereof and do not purport to be complete and are subject to, and are qualified in their entirety by reference to, all provisions of the applicable Warrant Indenture. Prospective investors should refer to the Warrant Indenture relating to the specific Warrants being offered for the complete terms of the Warrants. The applicable Prospectus Supplement relating to any Warrants offered by us will describe the particular terms of those Warrants and include specific terms relating to the offering.

The particular terms of each issue of Warrants will be described in the applicable Prospectus Supplement. This description will include, where applicable:

-

the designation and aggregate number of Warrants;

-

the price at which the Warrants will be offered;

-

the currency or currencies in which the Warrants will be offered;

-

the date on which the right to exercise the Warrants will commence and the date on which the right will expire;

-

the number of Common Shares or other Securities that may be purchased upon exercise of each Warrant and the price at which and currency or currencies in which the Common Shares or other Securities may be purchased upon exercise of each Warrant;

-

the designation and terms of any Securities with which the Warrants will be offered, if any, and the number of the Warrants that will be offered with each Security;

-

the date or dates, if any, on or after which the Warrants and the other Securities with which the Warrants will be offered will be transferable separately;

-

any minimum or maximum number of Warrants that may be exercised at any one time;

-

whether the Warrants will be subject to redemption and, if so, the terms of such redemption provisions;

-

whether the Company will issue the Warrants as global securities and, if so, the identity of the depositary of the global securities;

-

whether the Warrants will be listed on an exchange;

-

material Canadian federal income tax consequences and, if applicable, material United States federal income tax consequences of owning the Warrants; and

-

and any other material terms or conditions of the Warrants.

Rights of Holders Prior to Exercise

Prior to the exercise of Warrants, holders of Warrants will not have any of the rights of holders of the Common Shares or other Securities issuable upon exercise of the Warrants.

Exercise of Warrants

Each Warrant will entitle the holder to purchase the Securities that the Company specifies in the applicable Prospectus Supplement at the exercise price described therein. Unless the Company otherwise specifies in the applicable Prospectus Supplement, holders of the Warrants may exercise the Warrants at any time up to the specified time on the expiration date set forth in the applicable Prospectus Supplement. After the close of business on the expiration date, unexercised Warrants will become void.

Holders of the Warrants may exercise the Warrants by delivering the Warrant Certificate representing the Warrants to be exercised together with specified information, and paying the required amount to the Warrant Agent in immediately available funds, as provided in the applicable Prospectus Supplement. The Company will set forth on the Warrant Certificate and in the applicable Prospectus Supplement the information that the holder of the Warrant will be required to deliver to the Warrant Agent.

Upon receipt of the required payment and the Warrant Certificate properly completed and duly executed at the corporate trust office of the Warrant Agent or any other office indicated in the applicable Prospectus Supplement, the Company will issue and deliver the Securities purchasable upon such exercise. If fewer than all of the Warrants represented by the Warrant Certificate are exercised, then the Company will issue a new Warrant Certificate for the remaining amount of Warrants. If the Company so indicates in the applicable Prospectus Supplement, holders of the Warrants may surrender securities as all or part of the exercise price for Warrants.

Anti-Dilution

The Warrant Indenture will specify that, upon the subdivision, consolidation, reclassification or other material change of the Common Shares or any other reorganization, amalgamation, arrangement, merger or sale of all or substantially all of the Company's assets, Warrants exercisable for Common Shares will thereafter evidence the right of the holder to receive the securities, property or cash deliverable in exchange for or on the conversion of or in respect of the Common Shares to which the holder of a Common Share would have been entitled immediately after such event. Similarly, any distribution to all or substantially all of the holders of Common Shares of rights, options, warrants, evidences of indebtedness or assets will result in an adjustment in the number of Common Shares to be issued to holders of Warrants that are exercisable for Common Shares.

Rescission

The Warrant Indenture will also provide that, if Warrants are offered separately, any misrepresentation in this Prospectus, the Prospectus Supplement under which Warrants are offered separately, or any amendment hereto or thereto, will entitle each initial purchaser of Warrants to a contractual right of rescission following the issuance of the Common Shares or other Securities to such purchaser entitling such purchaser to receive the amount paid for the Warrants upon surrender of the Common Shares or other Securities, provided that such remedy for rescission is exercised in the time stipulated in the Warrant Indenture. This right of rescission does not extend to holders of such separately offered Warrants who acquire such Warrants from an initial purchaser, on the open market or otherwise, or to initial purchasers who acquire such Warrants in the United States.

Global Securities

The Company may issue Warrants in whole or in part in the form of one or more global securities, which will be registered in the name of and be deposited with a depositary, or its nominee, each of which will be identified in the applicable Prospectus Supplement. The global securities may be in temporary or permanent form. The applicable Prospectus Supplement will describe the terms of any depositary arrangement and the rights and limitations of owners of beneficial interests in any global security. The applicable Prospectus Supplement will describe the exchange, registration and transfer rights relating to any global security.

Modifications

The Warrant Indenture will provide for modifications and alterations to the Warrants issued thereunder by way of a resolution of holders of Warrants at a meeting of such holders or a consent in writing from such holders. The number of holders of Warrants required to pass such a resolution or execute such a written consent will be specified in the Warrant Indenture.

The Company may amend any Warrant Indenture and the Warrants, without the consent of the holders of the Warrants, to cure any ambiguity, to cure, correct or supplement any defective or inconsistent provision, or in any other manner that will not materially and adversely affect the interests of holders of outstanding Warrants.

DESCRIPTION OF SUBSCRIPTION RECEIPTS

The Company may issue Subscription Receipts, which will entitle holders to receive upon satisfaction of certain release conditions and for no additional consideration, Common Shares, Warrants or any combination thereof. Subscription Receipts will be issued pursuant to one or more subscription receipt agreements (each, a "Subscription Receipt Agreement"), each to be entered into between the Company and an escrow agent (the "Escrow Agent"), which will establish the terms and conditions of the Subscription Receipts. Each Escrow Agent will be a financial institution organized under the laws of Canada or a province thereof and authorized to carry on business as a trustee. A copy of the form of Subscription Receipt Agreement will be filed with Canadian securities regulatory authorities and, if applicable, the Company will file with the SEC as exhibits to the registration statement of which this Prospectus is a part, or will incorporate by reference from a Report of Foreign Private Issuer on Form 6-K that the Company files with the SEC, any Subscription Receipt Agreement describing the terms and conditions of such Subscription Receipts that the Company is offering before the issuance of such Subscription Receipts.

The following description sets forth certain general terms and provisions of Subscription Receipts and is not intended to be complete. The statements made in this Prospectus relating to any Subscription Receipt Agreement and Subscription Receipts to be issued thereunder are summaries of certain anticipated provisions thereof and are subject to, and are qualified in their entirety by reference to, all provisions of the applicable Subscription Receipt Agreement and the Prospectus Supplement describing such Subscription Receipt Agreement.

The Prospectus Supplement relating to any Subscription Receipts the Company offers will describe the Subscription Receipts and include specific terms relating to their offering. All such terms will comply with the requirements of the TSX and NYSE American relating to Subscription Receipts. If underwriters or agents are used in the sale of Subscription Receipts, one or more of such underwriters or agents may also be parties to the Subscription Receipt Agreement governing the Subscription Receipts sold to or through such underwriters or agents.

General

The Prospectus Supplement and the Subscription Receipt Agreement for any Subscription Receipts the Company offers will describe the specific terms of the Subscription Receipts and may include, but are not limited to, any of the following:

-

the designation and aggregate number of Subscription Receipts offered;

-

the price at which the Subscription Receipts will be offered;

-

the currency or currencies in which the Subscription Receipts will be offered;

-

the designation, number and terms of the Common Shares, Warrants or combination thereof to be received by holders of Subscription Receipts upon satisfaction of the release conditions, and the procedures that will result in the adjustment of those numbers;

-

the conditions (the "Release Conditions") that must be met in order for holders of Subscription Receipts to receive for no additional consideration Common Shares, Warrants or a combination thereof;

-

the procedures for the issuance and delivery of Common Shares, Warrants or a combination thereof to holders of Subscription Receipts upon satisfaction of the Release Conditions;

-

whether any payments will be made to holders of Subscription Receipts upon delivery of the Common Shares, Warrants or a combination thereof upon satisfaction of the Release Conditions (e.g. an amount equal to dividends declared on Common Shares by the Company to holders of record during the period from the date of issuance of the Subscription Receipts to the date of issuance of any Common Shares pursuant to the terms of the Subscription Receipt Agreement);

-

the identity of the Escrow Agent;

-

the terms and conditions under which the Escrow Agent will hold all or a portion of the gross proceeds from the sale of Subscription Receipts, together with interest and income earned thereon (collectively, the "Escrowed Funds"), pending satisfaction of the Release Conditions;

-

the terms and conditions pursuant to which the Escrow Agent will hold Common Shares, Warrants or a combination thereof pending satisfaction of the Release Conditions;

-

the terms and conditions under which the Escrow Agent will release all or a portion of the Escrowed Funds to the Company upon satisfaction of the Release Conditions;

-

if the Subscription Receipts are sold to or through underwriters or agents, the terms and conditions under which the Escrow Agent will release a portion of the Escrowed Funds to such underwriters or agents in payment of all or a portion of their fees or commission in connection with the sale of the Subscription Receipts;

-

procedures for the refund by the Escrow Agent to holders of Subscription Receipts of all or a portion of the subscription price for their Subscription Receipts, plus any pro rata entitlement to interest earned or income generated on such amount, if the Release Conditions are not satisfied;

-

any contractual right of rescission to be granted to initial purchasers of Subscription Receipts in the event this Prospectus, the Prospectus Supplement under which Subscription Receipts are issued or any amendment hereto or thereto contains a misrepresentation;

-

any entitlement of the Company to purchase the Subscription Receipts in the open market by private agreement or otherwise;

-

whether the Company will issue the Subscription Receipts as global securities and, if so, the identity of the depositary for the global securities;

-

whether the Company will issue the Subscription Receipts as bearer securities, registered securities or both;

-

provisions as to modification, amendment or variation of the Subscription Receipt Agreement or any rights or terms attaching to the Subscription Receipts;

-

whether the Subscription Receipts will be listed on an exchange;

-

material Canadian federal income tax consequences and, if applicable, material United States federal income tax consequences of owning the Subscription Receipts; and

-

any other terms of the Subscription Receipts.

The holders of Subscription Receipts will not be shareholders of the Company. Holders of Subscription Receipts are entitled only to receive Common Shares, Warrants or a combination thereof on exchange of their Subscription Receipts, plus any cash payments provided for under the Subscription Receipt Agreement, if the Release Conditions are satisfied. If the Release Conditions are not satisfied, Holders of Subscription Receipts shall be entitled to a refund of all or a portion of the subscription price therefor and all or a portion of the pro rata share of interest earned or income generated thereon, as provided in the Subscription Receipt Agreement.

Escrow

The Escrowed Funds will be held in escrow by the Escrow Agent, and such Escrowed Funds will be released to the Company (and, if the Subscription Receipts are sold to or through underwriters or agents, a portion of the Escrowed Funds may be released to such underwriters or agents in payment of all or a portion of their fees in connection with the sale of the Subscription Receipts) at the time and under the terms specified by the Subscription Receipt Agreement. If the Release Conditions are not satisfied, holders of Subscription Receipts will receive a refund of all or a portion of the subscription price for their Subscription Receipts plus their pro rata entitlement to interest earned or income generated on such amount, in accordance with the terms of the Subscription Receipt Agreement. Common Shares or Warrants may be held in escrow by the Escrow Agent and will be released to the holders of Subscription Receipts following satisfaction of the Release Conditions at the time and under the terms specified in the Subscription Receipt Agreement.

Anti-Dilution

The Subscription Receipt Agreement will specify that upon the subdivision, consolidation, reclassification or other material change of Common Shares or Warrants underlying the particular Subscription Receipts or any other reorganization, amalgamation, arrangement, merger or sale of all or substantially all of the Company's assets, the Subscription Receipts will thereafter evidence the right of the holder to receive the securities, property or cash deliverable in exchange for or on the conversion of or in respect of the Common Shares or Warrants to which the holder of a Common Share or identical Warrant would have been entitled immediately after such event. Similarly, any distribution to all or substantially all of the holders of Common Shares of rights, options, warrants, evidences of indebtedness or assets will result in an adjustment in the number of Common Shares to be issued to holders of Subscription Receipts whose Subscription Receipts entitle the holders thereof to receive Common Shares. Alternatively, such securities, evidences of indebtedness or assets may, at the option of the Company, be issued to the Escrow Agent and delivered to holders of Subscription Receipts on exercise thereof. The Subscription Receipt Agreement will also provide that if other actions of the Company affect the Common Shares or Warrants, which, in the reasonable opinion of the directors of the Company, would materially affect the rights of the holders of Subscription Receipts and/or the rights attached to the Subscription Receipts, the number of Common Shares or Warrants which are to be received pursuant to the Subscription Receipts shall be adjusted in such manner, if any, and at such time as the directors of the Company may in their discretion reasonably determine to be equitable to the holders of Subscription Receipts in such circumstances.

Rescission

The Subscription Receipt Agreement will also provide that any misrepresentation in this Prospectus, the Prospectus Supplement under which the Subscription Receipts are offered, or any amendment hereto or thereto, will entitle each initial purchaser of Subscription Receipts to a contractual right of rescission following the issuance of the Common Shares or Warrants to such purchaser entitling such purchaser to receive the amount paid for the Subscription Receipts upon surrender of the Common Shares or Warrants, provided that such remedy for rescission is exercised in the time stipulated in the Subscription Receipt Agreement. This right of rescission does not extend to holders of Subscription Receipts who acquire such Subscription Receipts from an initial purchaser, on the open market or otherwise, or to initial purchasers who acquire Subscription Receipts in the United States.

Global Securities

The Company may issue Subscription Receipts in whole or in part in the form of one or more global securities, which will be registered in the name of and be deposited with a depositary, or its nominee, each of which will be identified in the applicable Prospectus Supplement. The global securities may be in temporary or permanent form. The applicable Prospectus Supplement will describe the terms of any depositary arrangement and the rights and limitations of owners of beneficial interests in any global security. The applicable Prospectus Supplement also will describe the exchange, registration and transfer rights relating to any global security.

Modifications

The Subscription Receipt Agreement will provide for modifications and alterations to the Subscription Receipts issued thereunder by way of a resolution of holders of Subscription Receipts at a meeting of such holders or a consent in writing from such holders. The number of holders of Subscriptions Receipts required to pass such a resolution or execute such a written consent will be specified in the Subscription Receipt Agreement.

DESCRIPTION OF DEBT SECURITIES

In this section describing the Debt Securities, "the Company" refers only to SilverCrest Metals Inc. without any of its subsidiaries. This section describes the general terms that will apply to any Debt Securities issued pursuant to this Prospectus. The specific terms of the Debt Securities, and the extent to which the general terms described in this section apply to those Debt Securities, will be set forth in the applicable Prospectus Supplement. The Company may issue Debt Securities, separately or together, with Common Shares, Warrants, Subscription Receipts or Units or any combination thereof, as the case may be. The Debt Securities will be issued in one or more series under an indenture (the "Indenture") to be entered into between the Company and one or more trustees (the "Trustee") that will be named in a Prospectus Supplement for a series of Debt Securities. To the extent applicable, the Indenture will be subject to and governed by the United States Trust Indenture Act of 1939, as amended. A copy of the form of the Indenture to be entered into has been or will be filed with the SEC as an exhibit to the registration statement of which this Prospectus forms a part and will be filed with the securities commissions or similar authorities in Canada when it is entered into. The description of certain provisions of the Indenture in this section do not purport to be complete and are subject to, and are qualified in their entirety by reference to, the provisions of the Indenture. Terms used in this summary that are not otherwise defined herein have the meaning ascribed to them in the Indenture. The particular terms relating to Debt Securities offered by a Prospectus Supplement will be described in the related Prospectus Supplement. This description may include, but may not be limited to, any of the following, if applicable:

-

the specific designation of the Debt Securities; any limit on the aggregate principal amount of the Debt Securities; the date or dates, if any, on which the Debt Securities will mature and the portion (if less than all of the principal amount) of the Debt Securities to be payable upon declaration of acceleration of maturity;

-

the rate or rates (whether fixed or variable) at which the Debt Securities will bear interest, if any, the date or dates from which any such interest will accrue and on which any such interest will be payable and the record dates for any interest payable on the Debt Securities that are in registered form;

-

the terms and conditions under which the Company may be obligated to redeem, repay or purchase the Debt Securities pursuant to any sinking fund or analogous provisions or otherwise;

-

the terms and conditions upon which the Company may redeem the Debt Securities, in whole or in part, at the Company's option;

-

the covenants applicable to the Debt Securities;

-

the terms and conditions for any conversion or exchange of the Debt Securities for any other securities;

-

the extent and manner, if any, to which payment on or in respect of the Debt Securities of the series will be senior or will be subordinated to the prior payment of other liabilities and obligations of the Company;

-

whether the Debt Securities will be secured or unsecured;

-

whether the Debt Securities will be issuable in registered form or bearer form or both, and, if issuable in bearer form, the restrictions as to the offer, sale and delivery of the Debt Securities which are in bearer form and as to exchanges between registered form and bearer form;

-

whether the Debt Securities will be issuable in the form of registered global securities ("Global Securities"), and, if so, the identity of the depositary for such registered Global Securities;

-

the denominations in which registered Debt Securities will be issuable, if other than denominations of U.S.$1,000 and integral multiples of U.S.$1,000 and the denominations in which bearer Debt Securities will be issuable, if other than denominations of U.S.$5,000;

-

each office or agency where payments on the Debt Securities will be made and each office or agency where the Debt Securities may be presented for registration of transfer or exchange;

-

if other than United States dollars, the currency in which the Debt Securities are denominated or the currency in which we will make payments on the Debt Securities;

-

material Canadian federal income tax consequences and United States federal income tax consequences of owning the Debt Securities;

-

any index, formula or other method used to determine the amount of payments of principal of (and premium, if any) or interest, if any, on the Debt Securities; and

-

any other terms, conditions, rights or preferences of the Debt Securities which apply solely to the Debt Securities.

If the Company denominates the purchase price of any of the Debt Securities in a currency or currencies other than United States dollars, or if the principal of and any premium and interest on any Debt Securities is payable in a currency or currencies other than United States dollars, the Company will provide investors with information on the restrictions, elections, general tax considerations, specific terms and other information with respect to that issue of Debt Securities and such non-United States dollar currency or currencies in the applicable Prospectus Supplement.

Each series of Debt Securities may be issued at various times with different maturity dates, may bear interest at different rates and may otherwise vary.

The terms on which a series of Debt Securities may be convertible into or exchangeable for Common Shares or other securities of the Company will be described in the applicable Prospectus Supplement. These terms may include provisions as to whether conversion or exchange is mandatory, at the option of the holder or at the option of the Company, and may include provisions pursuant to which the number of Common Shares or other securities to be received by the holders of such series of Debt Securities would be subject to adjustment.

To the extent any Debt Securities are convertible into Common Shares or other securities of the Company, prior to such conversion the holders of such Debt Securities will not have any of the rights of holders of the securities into which the Debt Securities are convertible, including the right to receive payments of dividends or the right to vote such underlying securities.

DESCRIPTION OF UNITS

The following description, together with the additional information the Company may include in any applicable Prospectus Supplements, summarizes the material terms and provisions of the Units that the Company may offer under this Prospectus. While the terms summarized below will apply generally to any Units that the Company may offer under this Prospectus, the Company will describe the particular terms of any issue of Units in more detail in the applicable Prospectus Supplement. The terms of any Units offered under a Prospectus Supplement may differ from the terms described below.

The Company will also add to disclosure in any subsequent Prospectus Supplement whereby Units are offered the form of any unit agreement ("Unit Agreement") between the Company and a unit agent ("Unit Agent") that describes the terms and conditions of the issue of Units being offered, and any supplemental agreements. The following summaries of material terms and provisions of the Units are subject to, and qualified in their entirety by reference to, all the provisions of any Unit Agreement and any supplemental agreements applicable to a particular issue of Units. The Company urges you to read the applicable Prospectus Supplements relating to the particular issue of Units that the Company sells under this Prospectus, as well as any Unit Agreement and any supplemental agreements that contain the terms of the Units. If applicable, the Company will file with the SEC as exhibits to the registration statement of which this Prospectus is a part, or will incorporate by reference from a current report on Form 6-K that the Company files with the SEC, any Unit Agreement describing the terms and conditions of such Units that the Company is offering before the issuance of such Units.

General

The Company may issue Units comprising two or more of Common Shares, Warrants or Debt Securities, in any combination. Each Unit will be issued so that the holder of the Unit is also the holder of each Security included in the Unit. Therefore, the holder of a Unit will have the rights and obligations of a holder of each included Security. Any Unit Agreement under which a Unit is issued may provide that the Securities included in the Unit may not be held or transferred separately, at any time or at any time before a specified date. The Company will describe in the applicable Prospectus Supplement the terms of the issue of Units, including: the designation and terms of the Units and of the securities comprising the Units, including whether and under what circumstances those securities may be held or transferred separately; any provisions of any governing Unit Agreement that differ from those described below; and any provisions for the issuance, payment, settlement, transfer or exchange of the Units or of the securities comprising the Units. The provisions described in this section, as well as those described under "Description of Common Shares", "Description of Warrants" and "Description of Debt Securities" will apply to each Unit and to any Common Share, Warrant or Debt Security included in each Unit, respectively.

Issuance in Series

The Company may issue Units in such amounts and in numerous distinct series as the Company may determine.

Enforceability of Rights by Holders of Units

Each Unit Agent will act solely as the Company's agent under any applicable Unit Agreement and will not assume any obligation or relationship of agency or trust with any holder of any Unit. A single trust company may act as a Unit Agent for more than one series of Units. A Unit Agent will have no duty or responsibility in case of any default by us under any applicable Unit Agreement or Unit, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a Unit may, without the consent of any related Unit Agent or the holder of any other Unit, enforce by appropriate legal action its rights as holder under any security included in the Unit. The Company, any Unit Agents, and any of the Company's or their agents may treat the registered holder of any Unit certificate as an absolute owner of the Units evidenced by that certificate for any purpose and as the person entitled to exercise the rights attaching to the Units so requested, despite any notice to the contrary.

DENOMINATIONS, REGISTRATION AND TRANSFER

The Securities will be issued in fully registered form without coupons attached in either global or definitive form and in denominations and integral multiples as set out in the applicable Prospectus Supplement. Other than in the case of book-entry-only Securities, Securities may be presented for registration of transfer (with the form of transfer endorsed thereon duly executed) in the city specified for such purpose at the office of the registrar or transfer agent designated by the Company for such purpose with respect to any issue of Securities referred to in the Prospectus Supplement. No service charge will be made for any transfer, conversion or exchange of the Securities but the Company may require payment of a sum to cover any transfer tax or other governmental charge payable in connection therewith. Such transfer, conversion or exchange will be effected upon such registrar or transfer agent being satisfied with the documents of title and the identity of the person making the request. If a Prospectus Supplement refers to any registrar or transfer agent designated by the Company with respect to any issue of Securities, the Company may at any time rescind the designation of any such registrar or transfer agent and appoint another in its place or approve any change in the location through which such registrar or transfer agent acts.

In the case of book-entry-only Securities, a global certificate or certificates representing the Securities will be held by a designated depositary for its participants. The Securities must be purchased or transferred through such participants, which includes securities brokers and dealers, banks and trust companies. The depositary will establish and maintain book-entry accounts for its participants acting on behalf of holders of the Securities. The interests of such holders of Securities will be represented by entries in the records maintained by the participants. Holders of Securities issued in book-entry-only form will not be entitled to receive a certificate or other instrument evidencing their ownership thereof, except in limited circumstances. Each holder will receive a customer confirmation of purchase from the participants from which the Securities are purchased in accordance with the practices and procedures of that participant.

PLAN OF DISTRIBUTION

The Company may sell the Securities to or through underwriters or dealers, and also may sell Securities to one or more other purchasers directly or through agents, including sales pursuant to ordinary brokerage transactions and transactions in which a broker-dealer solicits purchasers. Underwriters may sell Securities to or through dealers. Each Prospectus Supplement will set forth the terms of the offering, including the name or names of any underwriters, dealers or agents and any fees or compensation payable to them in connection with the offering and sale of a particular series or issue of Securities, the public offering price or prices of the Securities and the proceeds to the Company from the sale of the Securities.

The Securities may be sold, from time to time in one or more transactions at a fixed price or prices which may be changed or at market prices prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices, including sales in transactions that are deemed to be "at-the-market distributions" as defined in National Instrument 44-102-Shelf Distributions, including sales made directly on the TSX, NYSE American or other existing trading markets for the Securities. The prices at which the Securities may be offered may vary as between purchasers and during the period of distribution. If, in connection with the offering of Securities at a fixed price or prices, the underwriters have made a bona fide effort to sell all of the Securities at the initial offering price fixed in the applicable Prospectus Supplement, the public offering price may be decreased and thereafter further changed, from time to time, to an amount not greater than the initial public offering price fixed in such Prospectus Supplement, in which case the compensation realized by the underwriters will be decreased by the amount that the aggregate price paid by purchasers for the Securities is less than the gross proceeds paid by the underwriters to the Company.

Underwriters, dealers and agents who participate in the distribution of the Securities may be entitled under agreements to be entered into with the Company to indemnification by the Company against certain liabilities, including liabilities under the United States Securities Act of 1933, as amended, and Canadian securities legislation, or to contribution with respect to payments which such underwriters, dealers or agents may be required to make in respect thereof. Such underwriters, dealers and agents may be customers of, engage in transactions with, or perform services for, the Company in the ordinary course of business.

In connection with any offering of Securities, other than an "at-the-market distribution", the underwriters may over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at a level above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time.

Unless otherwise specified in the applicable Prospectus Supplement, the Company does not intend to list any of the Securities other than the Common Shares on any securities exchange. Any underwriters, dealers or agents to or through which Securities other than the Common Shares are sold by the Company for public offering and sale may make a market in such Securities, but such underwriters, dealers or agents will not be obligated to do so and may discontinue any such market making at any time and without notice. No assurance can be given that a market for trading in Securities of any series or issue will develop or as to the liquidity of any such market, whether or not the Securities are listed on a securities exchange.

PRIOR SALES

The following table sets out details of all Common Shares issued by the Company during the 12 months prior to the date of this Prospectus

|

Date

|

Number of

Common Shares

|

Issue Price per

Common Share

|

Reason for issuance

|

|

June 6, 2019

|

3,440

|

$1.45

|

Warrant exercise

|

|

July 11, 2019

|

12,000

|

$1.45

|

Warrant exercise

|

|

July 24, 2019

|

75,000

|

$2.30

|

Stock option exercise

|

|

July 29, 2019

|

12,500

|

$1.94

|

Stock option exercise

|

|

July 29, 2019

|

7,500

|

$3.24

|

Stock option exercise

|

|

August 2, 2019

|

32,500

|

$1.88

|

Stock option exercise

|

|

August 2, 2019

|

12,500

|

$1.94

|

Stock option exercise

|

|

August 7, 2019

|

175,000

|

$0.16

|

Stock option exercise

|

|

August 7, 2019

|

24,000

|

$1.45

|

Warrant exercise

|

|

August 12, 2019

|

199,000

|

$1.45

|

Warrant exercise

|

|

August 14, 2019

|

132,700

|

$1.45

|

Warrant exercise

|

|

August 15, 2019

|

4,326,300

|

$5.85

|

Prospectus offering

|

|

August 16, 2019

|

780,000

|

$5.85

|

Private placement

|

|

August 16, 2019

|

75,000

|

$2.30

|

Stock option exercise

|

|

August 22, 2019

|

43,300

|

$1.45

|

Warrant exercise

|

|

September 5, 2019

|

13,000

|

$1.45

|

Warrant exercise

|

|

September 9, 2019

|

34,500

|

$1.45

|

Warrant exercise

|

|

September 12, 2019

|

95,000

|

$1.45

|

Warrant exercise

|

|

September 19, 2019

|

47,500

|

$1.45

|

Warrant exercise

|

|

Date

|

Number of

Common Shares

|

Issue Price per

Common Share

|

Reason for issuance

|

|

October 8, 2019

|

21,500

|

$1.45

|

Warrant exercise

|

|

October 8, 2019

|

10,000

|

$2.30

|

Stock option exercise

|

|

October 24, 2019

|

225,900

|

$2.29

|

Warrant exercise

|

|

November 1, 2019

|

12,000

|

$1.45

|

Warrant exercise

|

|

November 5, 2019

|

301,000

|

$1.45

|

Warrant exercise

|

|

November 6, 2019

|

24,000

|

$1.45

|

Warrant exercise

|

|

November 20, 2019

|

12,000

|

$1.45

|

Warrant exercise

|

|

November 22, 2019

|

187,000

|

$1.45

|

Warrant exercise

|

|

November 25, 2019

|

24,000

|

$1.45

|

Warrant exercise

|

|

November 26, 2019

|

20,000

|

$1.45

|

Warrant exercise

|

|

November 29, 2019

|

2,500

|

$1.45

|

Warrant exercise

|

|

December 2, 2019

|

12,000

|

$1.45

|

Warrant exercise

|

|

December 3, 2019

|

12,000

|

$1.45

|

Warrant exercise

|

|

December 5, 2019

|

527,500

|

$1.45

|

Warrant exercise

|

|

December 10, 2019

|

138,000

|

$1.45

|

Warrant exercise

|

|

December 11, 2019

|

310,000

|

$1.45

|

Warrant exercise

|

|

December 13, 2019

|

350,000

|

$1.45

|

Warrant exercise

|

|

December 18, 2019

|

12,650,000

|

$7.28

|

Prospectus offering

|

|

December 18, 2019

|

25,000

|

$1.45

|

Warrant exercise

|

|

December 19, 2019

|

711,000

|

$1.45

|

Warrant exercise

|

|

January 8, 2020

|

5,000

|

$3.24

|

Stock option exercise

|

|

January 10, 2020

|

50,000

|

$1.88

|

Stock option exercise

|

|

January 10, 2020

|

1,819,074

|

$7.28

|

SSR January 2020 Private Placement

|

|

January 27, 2020

|

12,500

|

$4.54

|

Stock option exercise

|

|

January 28, 2020

|

100,000

|

$2.69

|

Stock option exercise

|

|

February 3, 2020

|

175,000

|

$0.16

|

Stock option exercise

|

|

February 3, 2020

|