Silvercorp Metals Inc. ("Silvercorp" or the “Company”) (TSX/NYSE

American: SVM) is pleased to report the discovery of new gold zones

and high grade intercepts from its 2020 exploration program at the

LMW mine, Ying Mining District, Henan Province, China. Extensive

exploration drilling and tunnelling are ongoing at the LMW mine,

and all other mines at the Ying Mining District.

The 2020 exploration program from July 1, 2019

to October 30, 2020 at the LMW mine has used in-fill drilling to

target areas of known sub-vertical silver-lead-zinc veins that were

previously believed to be uneconomic. Since June 2020, drilling has

also targeted the gently-dipping zones believed to host gold

mineralization, as reported in the May 28, 2020 news release. These

gold zones were previously undiscovered and appear to have been

over-printed by the sub-vertical silver-lead-zinc veins which are

the focus of current mining operations. Currently, ten

rigs are drilling at the LMW mine and a total of 132 diamond drill

holes, including 108 underground holes and 24 surface holes

totaling 37,869 metres (“m”) have been completed. Assay results for

125 holes have been received with 72 holes intercepting many zones

of higher-grade silver-lead mineralization, including veins LM7,

LM7W1, LM8, LM8_1, LM12_1, LM13, LM14, LM16, LM22, LM25W, LM41E,

LM41E1, and LM41E2. Most of these higher-grade silver-lead

discoveries can be mined through existing tunnels which is expected

to substantially reduce tunnel development costs at the LMW mine

going forward.

Drilling to test the gold-bearing sub-horizontal

shear zone LM22 has intersected high gold grades, including 37.08

g/t Au over 1.89m. In addition, at least three new gently-dipping

(to the west at less than 15°), stacked gold mineralization zones,

namely LM50, LM51 and LM53, have been discovered in this drill

campaign. The gold mineralization is associated with

k-feldspar-ankerite-quartz-pyrite-galena veinlets and stockwork

alteration. The most-drilled LM50 vein has been defined by drilling

and underground tunnelling over 450m along strike to the northeast

and 350m down-dip in a 25m to 50m grid pattern and true thicknesses

ranging from 0.5m to over 5.4m. Three rigs are drilling LM50 which

is open in all directions.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9b26bc88-10c9-403e-a77f-76bdbb51a4ce

Highlights of selected drill hole

intersections:

-

Hole ZKX0535 intersected a 1.89m

interval (1.66m true width) of vein LM22 grading 37.08 grams per

tonne (“g/t”) gold (“Au”), 4 g/t silver (“Ag”), and 0.53% copper

(“Cu”), which includes a 1.25m interval (1.10m true width) grading

55.80 g/t Au, 5 g/t Ag, and 0.56% Cu.

-

Hole ZKX0723 intersected a 6.13m

interval (4.89m true width) of vein LM50 grading 5.23 g/t Au, 30

g/t Ag, 0.21% lead (“Pb”), and 0.12% zinc (“Zn”), which includes a

1.58m interval (1.34m true width) grading 12.70 g/t Au, 19 g/t Ag,

0.10% Pb, and 0.12% Zn.

- Hole

ZKX0527 intersected a 2.34m interval (2.22m true

width) of vein LM50 grading 8.51 g/t Au, and 16 g/t Ag, including a

1.22m interval (1.16m true width) grading 13.30 g/t Au, and 15 g/t

Ag.

- Hole

ZKX0725 intercepted a 2.45m interval grading 4.33 g/t Au

of an unknown vein, approximately 50m above the LM50 zone.

-

Hole ZKX0940 intersected a 1.63m

interval (1.46m true width) of vein LM8_1 grading 1,984 g/t Ag,

3.86% Pb, 0.60% Zn, 0.07 g/t Au, and 0.49% Cu, which includes a

1.08m interval (0.97m true width) grading 2,985 g/t Ag, 5.26% Pb,

0.87% Zn, 0.10 g/t Au, and 0.73% Cu.

-

Hole ZKX0934 intersected a 4.43m

interval (2.50m true width) of vein LM12_1 grading 343 g/t Ag,

6.21% Pb, 1.16% Zn, and 0.17 g/t Au, which includes two

intersections:

- A 1.24m

interval (0.70m true width) grading 339 g/t Ag, 7.72% Pb, 0.28% Zn,

and 0.17 g/t Au; and

- A 0.89m

interval (0.50m true width) grading 1,185 g/t Ag, 17.46% Pb, 4.84%

Zn, and 0.50 g/t Au.

- Hole

ZKX0118 intersected a 1.81m interval (1.29m true width) of

vein LM25W grading 1,715 g/t Ag, 1.53% Pb, 0.44% Zn, 0.44 g/t Au,

and 0.30% Cu.

In addition, a total of 8,684m of exploration

tunnels have been developed at the LMW mine during the period.

These exploration tunnels (including 4,750m of drifts) were driven

along and across major mineralized vein structures to upgrade the

drill defined mineral resources and test for new parallel and splay

structures, and are summarized in the following table:

|

Major Target Veins |

Total

Tunnelling

(m) |

Channel Samples Collected |

Drift

Included(m) |

Total Mineralization Exposed by Drifts

[1] |

|

Length (m) |

Average True Width

(m) |

Ag (g/t) |

Pb (%) |

Zn (%) |

Au (g/t) |

Cu (%) |

|

LM19W2, T27E, LM14, LM16_1, LM16,LM17W, LM12_1, LM12E, LM22,

LM8_4a, LM32, LM8, LM41E, LM17 |

8,684 |

3,320 |

4,750 |

775 |

0.53 |

397 |

4.34 |

0.42 |

0.09 |

0.18 |

[1] Mineralization is defined by silver

equivalent value (AgEq) greater than or equal to 155 g/t at the LMW

mine (Formula used for AgEq calculation: AgEq = Ag g/t + 35.06 *

(Pb% + Cu%) + 79.57 * Au g/t).

Highlights of selected mineralized zones exposed

in the drift tunnels:

- Drift

Tunnel XPDS-LM17-575-26SYM2 exposed

mineralization 25m long and 1.54m wide (true width) grading 894 g/t

Ag, 9.35% Pb, 0.53% Zn, 0.17 g/t Au, and 1.16% Cu within vein

structure LM17;

- Drift

Tunnel XPDS-LM16-675-115SYM exposed

mineralization 10m long and 0.59m wide (true width) grading 1,740

g/t Ag, 0.96% Pb and 0.36% Zn within vein structure LM16;

- Drift

Tunnel PD1080-LM41E-1080-11NYM exposed

mineralization 15m long and 0.74m wide (true width) grading 1,079

g/t Ag, 2.12% Pb, 0.15% Zn, 0.02 g/t Au, and 0.55% Cu within vein

structure LM41E; and

- Drift

Tunnel PD918-W6-880-128NYM exposed

mineralization 35m long and 0.68m wide (true width) grading 603 g/t

Ag, 4.91% Pb, 2.12% Zn, 0.02 g/t Au, and 0.13% Cu within vein

structure W6.

Table

1: Selected

results from the 2020 drill programs at the LMW

mine

|

Hole ID |

From(m) |

To (m) |

Interval(m) |

True Width (m) |

Ag(g/t) |

Pb(%) |

Zn(%) |

Au(g/t) |

Cu(%) |

Vein |

Ore Type |

| ZKX0015 |

307.53 |

308.73 |

1.20 |

1.07 |

331 |

1.10 |

2.78 |

0.05 |

0.14 |

LM10W |

Ag-Pb |

| ZKX0015 |

349.68 |

350.51 |

0.83 |

0.78 |

3 |

0.01 |

0.01 |

1.03 |

0.29 |

LM51 [1] |

Au |

|

ZKX0016 |

131.45 |

133.12 |

1.67 |

0.94 |

522 |

0.43 |

0.03 |

0.05 |

0.07 |

LM13 |

Ag-Pb |

|

ZKX0017 |

278.50 |

280.97 |

2.47 |

1.34 |

273 |

0.25 |

0.03 |

0.16 |

0.26 |

LM26 [1] |

Au |

|

ZKX0026 |

192.99 |

193.79 |

0.80 |

0.75 |

13 |

0.02 |

0.02 |

4.75 |

2.18 |

LM26 |

Au |

| ZKX0118 |

30.48 |

32.29 |

1.81 |

1.29 |

1,715 |

1.53 |

0.44 |

0.44 |

0.30 |

LM25W |

Ag-Pb |

|

ZKX0118 |

146.71 |

148.17 |

1.46 |

1.27 |

3 |

0.01 |

0.01 |

3.52 |

0.33 |

LM22 [1] |

Au |

|

ZKX0319 |

270.45 |

271.16 |

0.71 |

0.57 |

5 |

0.01 |

0.01 |

3.19 |

0.69 |

LM51 |

Au |

|

ZKX0334 |

84.70 |

86.08 |

1.38 |

1.30 |

1 |

0.00 |

0.00 |

5.43 |

0.09 |

LM22 |

Au |

| ZKX0517 |

46.70 |

47.23 |

0.53 |

0.50 |

6 |

0.01 |

0.02 |

2.49 |

0.00 |

LM22a [1] |

Au |

|

ZKX0527 |

162.82 |

165.16 |

2.34 |

2.22 |

16 |

0.64 |

0.07 |

8.51 |

0.01 |

LM50 [1] |

Au |

|

Including |

163.94 |

165.16 |

1.22 |

1.16 |

15 |

0.86 |

0.07 |

13.30 |

0.01 |

LM50 |

Au |

| ZKX0528 |

154.89 |

159.55 |

4.66 |

3.15 |

5 |

0.01 |

0.02 |

2.58 |

0.00 |

LM50 |

Au |

|

Including |

159.15 |

159.55 |

0.40 |

0.26 |

47 |

0.04 |

0.04 |

26.70 |

0.01 |

LM50 |

Au |

|

ZKX0529 |

113.56 |

114.16 |

0.60 |

0.36 |

780 |

1.23 |

0.33 |

0.04 |

0.46 |

LM7W1 |

Ag-Pb |

| ZKX0529 |

168.28 |

176.06 |

7.78 |

4.68 |

256 |

0.76 |

0.07 |

0.01 |

0.08 |

LM7 |

Ag-Pb |

|

Including |

168.28 |

169.97 |

1.69 |

1.02 |

587 |

0.25 |

0.02 |

0.01 |

0.03 |

LM7 |

Ag-Pb |

|

and |

174.68 |

176.06 |

1.38 |

0.83 |

609 |

2.93 |

0.24 |

0.01 |

0.39 |

LM7 |

Ag-Pb |

|

ZKX0531 |

105.26 |

105.97 |

0.71 |

0.61 |

5 |

0.02 |

0.01 |

21.10 |

1.14 |

LM22 |

Au |

| ZKX0535 |

92.91 |

94.80 |

1.89 |

1.66 |

4 |

0.00 |

0.01 |

37.08 |

0.53 |

LM22 |

Au |

|

Including |

92.91 |

94.16 |

1.25 |

1.10 |

5 |

0.00 |

0.01 |

55.80 |

0.56 |

LM22 |

Au |

|

ZKX0723 |

184.27 |

190.40 |

6.13 |

4.89 |

30 |

0.21 |

0.12 |

5.23 |

0.00 |

LM50 |

Au |

|

Including |

184.27 |

185.85 |

1.58 |

1.34 |

19 |

0.10 |

0.12 |

12.70 |

0.01 |

LM50 |

Au |

| ZKX0725 |

126.41 |

128.86 |

2.45 |

2.06 |

2 |

0.01 |

0.01 |

4.33 |

0.01 |

? [1], [2] |

Au |

|

Including |

126.41 |

127.36 |

0.95 |

0.80 |

3 |

0.02 |

0.01 |

10.03 |

0.01 |

? |

Au |

|

ZKX0725 |

166.07 |

167.37 |

1.30 |

1.18 |

1 |

0.02 |

0.06 |

1.87 |

0.01 |

LM50 |

Au |

| ZKX0726 |

165.59 |

166.44 |

0.85 |

0.65 |

15 |

0.59 |

0.33 |

9.74 |

0.01 |

LM50 |

Au |

| ZKX0726 |

207.06 |

208.56 |

1.50 |

0.92 |

370 |

0.59 |

0.08 |

0.01 |

0.04 |

LM8a |

Ag-Pb |

|

ZKX0934 |

135.46 |

136.56 |

1.10 |

0.98 |

39 |

0.09 |

0.46 |

3.25 |

0.01 |

LM13 |

Ag-Pb |

| ZKX0934 |

323.27 |

327.70 |

4.43 |

2.50 |

343 |

6.21 |

1.16 |

0.17 |

0.04 |

LM12_1 |

Ag-Pb |

|

Including |

323.27 |

324.51 |

1.24 |

0.70 |

339 |

7.72 |

0.28 |

0.17 |

0.05 |

LM12_1 |

Ag-Pb |

|

and |

326.81 |

327.70 |

0.89 |

0.50 |

1,185 |

17.64 |

4.84 |

0.50 |

0.08 |

LM12_1 |

Ag-Pb |

| ZKX0940 |

249.22 |

250.85 |

1.63 |

1.46 |

1,984 |

3.86 |

0.60 |

0.07 |

0.49 |

LM8_1 |

Ag-Pb |

|

Including |

249.77 |

250.85 |

1.08 |

0.97 |

2,985 |

5.26 |

0.87 |

0.10 |

0.73 |

LM8_1 |

Ag-Pb |

|

ZKX1103 |

56.48 |

57.34 |

0.86 |

0.72 |

156 |

0.91 |

0.05 |

0.03 |

0.01 |

LM7W1 |

Ag-Pb |

|

ZKX1103 |

116.00 |

116.29 |

0.29 |

0.27 |

618 |

0.08 |

0.03 |

0.03 |

0.04 |

LM7W |

Ag-Pb |

| ZKX1104 |

157.45 |

157.70 |

0.25 |

0.23 |

2,133 |

1.99 |

0.14 |

0.05 |

0.18 |

LM41E |

Ag-Pb |

|

ZKX1105 |

130.58 |

131.30 |

0.72 |

0.62 |

644 |

3.02 |

0.79 |

0.05 |

0.33 |

LM41E2 |

Ag-Pb |

|

Including |

130.58 |

130.82 |

0.24 |

0.21 |

1,842 |

8.37 |

2.25 |

0.05 |

0.94 |

LM41E2 |

Ag-Pb |

|

ZKX1105 |

133.32 |

133.69 |

0.37 |

0.32 |

582 |

3.69 |

1.07 |

0.05 |

0.22 |

LM41E1 |

Ag-Pb |

|

ZKX1108 |

130.04 |

131.52 |

1.48 |

0.85 |

330 |

0.63 |

0.02 |

0.01 |

0.02 |

LM12E |

Ag-Pb |

| ZKX1109 |

157.87 |

158.85 |

0.98 |

0.51 |

12 |

0.04 |

0.03 |

8.35 |

0.00 |

LM50 |

Au |

|

ZKX1501 |

270.21 |

273.89 |

3.68 |

2.83 |

135 |

0.35 |

0.04 |

0.01 |

0.02 |

T22 |

Ag-Pb |

|

Including |

270.21 |

270.46 |

0.25 |

0.16 |

1,579 |

3.70 |

0.40 |

0.03 |

0.20 |

T22 |

Ag-Pb |

| ZKX4007 |

284.81 |

287.36 |

2.55 |

1.81 |

423 |

0.26 |

0.22 |

0.01 |

0.07 |

LM17 |

Ag-Pb |

|

ZKX4008 |

296.43 |

297.54 |

1.11 |

0.80 |

29 |

13.52 |

0.04 |

0.01 |

0.00 |

LM17 |

Ag-Pb |

|

Including |

297.21 |

297.54 |

0.33 |

0.24 |

81 |

43.66 |

0.03 |

0.02 |

0.01 |

LM17 |

Ag-Pb |

| ZKX6801 |

121.67 |

122.94 |

1.27 |

1.22 |

2 |

0.25 |

0.02 |

1.99 |

0.02 |

LM53 [1] |

Au |

|

Including |

122.68 |

122.94 |

0.26 |

0.25 |

6 |

0.91 |

0.03 |

5.91 |

0.04 |

LM53 |

Au |

|

ZKX6803 |

182.76 |

184.49 |

1.73 |

0.89 |

454 |

1.37 |

0.18 |

0.01 |

0.28 |

? |

Ag-Pb |

| ZKX10105 |

336.91 |

337.16 |

0.25 |

0.20 |

20 |

9.13 |

1.00 |

0.03 |

0 |

LM8W |

Ag-Pb |

|

ZKX10509 |

254.09 |

254.52 |

0.43 |

0.40 |

743 |

0.32 |

0.30 |

0.31 |

0.05 |

LM8W3 |

Ag-Pb |

| ZKX10509 |

282.06 |

282.41 |

0.35 |

0.27 |

723 |

1.57 |

0.14 |

0.33 |

0.01 |

LM8W2 |

Ag-Pb |

| ZKX10509 |

385.00 |

385.51 |

0.51 |

0.39 |

168 |

11.57 |

1.77 |

0.22 |

0.03 |

LM8 |

Ag-Pb |

|

ZKX10708 |

247.43 |

249.99 |

2.56 |

2.15 |

394 |

2.96 |

0.22 |

0.03 |

0.07 |

LM8 |

Ag-Pb |

|

ZKX10814 |

232.25 |

233.17 |

0.92 |

0.65 |

9 |

0.02 |

0.01 |

2.21 |

0.00 |

LM51 |

Au |

|

ZKX10915 |

8.72 |

9.19 |

0.47 |

0.36 |

639 |

3.04 |

0.36 |

0.12 |

0.02 |

LM20 |

Ag-Pb |

|

ZKX11402 |

259.04 |

259.84 |

0.80 |

0.54 |

527 |

2.21 |

0.43 |

0.07 |

0.12 |

LM8 |

Ag-Pb |

|

ZKX11507 |

229.68 |

231.39 |

1.71 |

0.93 |

82 |

7.53 |

0.13 |

0.01 |

0.04 |

LM17W |

Ag-Pb |

|

ZKX12503 |

174.73 |

175.88 |

1.15 |

0.99 |

475 |

1.68 |

0.13 |

0.05 |

0.02 |

LM14 |

Ag-Pb |

|

ZKT4402 |

174.17 |

174.95 |

0.78 |

0.66 |

18 |

0.17 |

0.01 |

8.60 |

0.29 |

? |

Au |

|

ZKT4802 |

318.39 |

319.08 |

0.69 |

0.64 |

366 |

7.85 |

0.42 |

0.05 |

0.02 |

T11 |

Ag-Pb |

|

Including |

318.39 |

318.62 |

0.23 |

0.21 |

329 |

22.97 |

1.15 |

0.05 |

0.03 |

T11 |

Ag-Pb |

[1] Veins discovered between July 1, 2019 and October 30,

2020.

[2] New veins with no name assigned.

Table

2: Selected

mineralized zones exposed by drift

tunnelling

at the LMW

mine

|

Tunnel ID |

Vein |

Ore Length(m) |

True Width (m) |

Ag (g/t) |

Pb (%) |

Zn (%) |

Au (g/t) |

Cu (%) |

|

XPDN-LM8-600-111NYM |

LM8 |

25 |

0.33 |

229 |

2.57 |

0.29 |

0.04 |

0.07 |

|

XPDN-LM8_4a-500-143NYM |

LM8_4a |

35 |

0.42 |

301 |

1.07 |

1.39 |

0.00 |

0.00 |

|

PD969Shaft-LM12_1-600-12SYM |

LM12_1 |

45 |

0.77 |

344 |

3.37 |

0.19 |

0.00 |

0.00 |

|

PD924-LM12E-924-11NYM |

LM12E |

35 |

0.46 |

201 |

1.33 |

0.15 |

0.00 |

0.00 |

| XPDS-LM14-625-109SYM |

LM14 |

20 |

0.24 |

440 |

3.34 |

0.06 |

0.00 |

0.00 |

| XPDS-LM14-575-113NYM1 |

LM14 |

15 |

0.47 |

135 |

3.58 |

0.19 |

0.00 |

0.00 |

|

XPDS-LM14-575-113NYM2 |

LM14 |

15 |

0.30 |

304 |

2.96 |

0.25 |

0.00 |

0.00 |

| XPDS-LM16-675-115SYM |

LM16 |

10 |

0.59 |

1,740 |

0.96 |

0.36 |

0.00 |

0.00 |

| XPDS-LM16_1-725-111NYM |

LM16_1 |

20 |

0.29 |

616 |

1.64 |

0.25 |

0.00 |

0.00 |

|

XPDS-LM17-575-26SYM1 |

LM17 |

40 |

0.70 |

96 |

4.02 |

0.35 |

0.00 |

0.00 |

|

XPDS-LM17-575-26SYM2 |

LM17 |

25 |

1.54 |

894 |

9.35 |

0.53 |

0.17 |

1.16 |

| XPDS-LM17W-600-0NYM1 |

LM17W |

20 |

0.40 |

377 |

4.37 |

0.66 |

0.00 |

0.00 |

| XPDS-LM17W-600-0NYM2 |

LM17W |

40 |

0.72 |

249 |

2.98 |

1.16 |

0.00 |

0.00 |

|

XPDN-LM17W-800-9ECM |

LM17W1 |

15 |

0.27 |

719 |

5.07 |

0.59 |

0.00 |

0.00 |

| XPDN-LM19W2-700-122SYM |

LM19W2 |

70 |

0.63 |

499 |

2.72 |

0.45 |

0.00 |

0.00 |

|

PD969Shaft-LM19W2-600-114SYM |

LM19W2 |

12 |

0.52 |

195 |

1.22 |

0.18 |

0.00 |

0.00 |

|

PD969Shaft-LM19W2-600-114NYM |

LM19W2 |

15 |

0.56 |

381 |

1.63 |

0.15 |

0.00 |

0.00 |

| SJ969-LM19W2-550-110NYM |

LM19W2 |

15 |

0.97 |

26 |

8.58 |

0.26 |

0.00 |

0.00 |

|

PD924-LM22-834-3NYM |

LM22 |

40 |

0.18 |

11 |

0.04 |

0.01 |

2.72 |

1.55 |

|

PD969Shaft-LM30-550-114SYM |

LM30 |

30 |

0.41 |

136 |

4.40 |

0.31 |

0.00 |

0.00 |

|

PD969Shaft-LM12_2-500-14SYM |

LM32 |

25 |

0.28 |

303 |

4.87 |

0.85 |

0.33 |

0.11 |

| PD1080-LM41E-1080-11NYM |

LM41E |

15 |

0.74 |

1,079 |

2.12 |

0.15 |

0.02 |

0.55 |

|

PD924-T27E-900-110SYM |

T27E |

20 |

0.89 |

114 |

14.33 |

0.17 |

0.00 |

0.00 |

|

PD918-W6-880-128NYM |

W6 [1] |

35 |

0.68 |

603 |

4.91 |

2.12 |

0.02 |

0.13 |

[1] Veins discovered between July 1, 2019 and October 30,

2020.

Quality Control

Drill cores are NQ size. Drill core samples,

limited by apparent mineralization contacts or shear/alteration

contacts, were split into halves by saw cutting. The half cores are

stored in the Company's core shacks for future reference and

checks, and the other half core samples are shipped in securely

sealed bags to the Chengde Huakan 514 Geology and Minerals Test and

Research Institute in Chengde, Hebei Province, China, 226km

northeast of Beijing, the Zhengzhou Nonferrous Exploration

Institute Lab in Zhengzhou, Henan Province, China, and SGS-CSTC

Standards Technical Services (Tianjin) Co., Ltd., Tianjin, China.

All the three labs are ISO9000 certified analytical labs. For

analysis, the sample is dried and crushed to minus 1mm and then

split to a 200-300g subsample which is further pulverized to minus

200 mesh. Two subsamples are prepared from the pulverized sample.

One is digested with aqua regia for gold analysis with atomic

absorption spectroscopy (AAS), and the other is digested with

two-acids for analysis of silver, lead, zinc and copper with

AAS.

Channel samples are collected along sample lines

perpendicular to the mineralized vein structure in exploration

tunnels. Spacing between sampling lines is typically 5m along

strike. Both the mineralized vein and the altered wall rocks are

cut by continuous chisel chipping. Sample length ranges from 0.2m

to more than 1.0m, depending on the width of the mineralized vein

and the mineralization type. Channel samples are prepared and

assayed with AAS at Silvercorp’s mine laboratory (Ying Lab) located

at the mill complex in Luoning County, Henan Province, China. The

Ying lab is officially accredited by the Quality and Technology

Monitoring Bureau of Henan Province and is qualified to provide

analytical services. The channel samples are dried, crushed and

pulverized. A 200g sample of minus 160 mesh is prepared for assay.

A duplicate sample of minus 1mm is made and kept in the laboratory

archives. Gold is analysed by fire assay with AAS finish, and

silver, lead, zinc and copper are assayed by two-acid digestion

with AAS finish.

A routine quality assurance/quality control

(QA/QC) procedure is adopted to monitor the analytical quality at

each lab. Certified reference materials (CRMs), pulp duplicates and

blanks are inserted into each batch of lab samples. QA/QC data at

the lab are attached to the assay certificates for each batch of

samples.

The Company maintains its own comprehensive

QA/QC program to ensure best practices in sample preparation and

analysis of the exploration samples. Project geologists regularly

insert CRM, field duplicates and blanks to each batch of 30 core

samples to monitor the sample preparation and analysis procedures

at the labs. The analytical quality of the labs is further

evaluated with external checks by sending approximately 3-5% of the

pulp samples to higher level labs to check for lab bias. Data from

both the Company's and the labs' QA/QC programs are reviewed on a

timely basis by project geologists.

Guoliang Ma, P. Geo., Manager of Exploration and

Resource of the Company, is the Qualified Person for Silvercorp

under NI 43-101 and has reviewed and given consent to the technical

information contained in this news release.

About Silvercorp

Silvercorp is a profitable Canadian mining

company producing silver, lead and zinc metals in concentrates from

mines in China. The Company’s goal is to continuously create

healthy returns to shareholders through efficient management,

organic growth and the acquisition of profitable projects.

Silvercorp balances profitability, social and environmental

relationships, employees’ wellbeing, and sustainable development.

For more information, please visit our website at

www.silvercorp.ca.

For further information

Lon ShaverVice PresidentSilvercorp Metals

Inc.Phone: (604) 669-9397Toll Free: 1 (888) 224-1881Email:

investor@silvercorp.ca Website: www.silvercorp.ca

CAUTIONARY DISCLAIMER - FORWARD LOOKING

STATEMENTS

Certain of the statements and information in

this news release constitute “forward-looking statements” within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and “forward-looking information” within the

meaning of applicable Canadian provincial securities laws. Any

statements or information that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions or future events or performance (often, but

not always, using words or phrases such as “expects”, “is

expected”, “anticipates”, “believes”, “plans”, “projects”,

“estimates”, “assumes”, “intends”, “strategies”, “targets”,

“goals”, “forecasts”, “objectives”, “budgets”, “schedules”,

“potential” or variations thereof or stating that certain actions,

events or results “may”, “could”, “would”, “might” or “will” be

taken, occur or be achieved, or the negative of any of these terms

and similar expressions) are not statements of historical fact and

may be forward-looking statements or information. Forward-looking

statements or information relate to, among other things: the price

of silver and other metals; the accuracy of mineral resource and

mineral reserve estimates at the Company’s material properties; the

sufficiency of the Company’s capital to finance the Company’s

operations; estimates of the Company’s revenues and capital

expenditures; estimated production from the Company’s mines in the

Ying Mining District; timing of receipt of permits and regulatory

approvals; availability of funds from production to finance the

Company’s operations; and access to and availability of funding for

future construction, use of proceeds from any financing and

development of the Company’s properties.

Forward-looking statements or information are

subject to a variety of known and unknown risks, uncertainties and

other factors that could cause actual events or results to differ

from those reflected in the forward-looking statements or

information, including, without limitation, social and economic

impacts of COVID-19; risks relating to: fluctuating commodity

prices; calculation of resources, reserves and mineralization and

precious and base metal recovery; interpretations and assumptions

of mineral resource and mineral reserve estimates; exploration and

development programs; feasibility and engineering reports; permits

and licenses; title to properties; property interests; joint

venture partners; acquisition of commercially mineable mineral

rights; financing; recent market events and conditions; economic

factors affecting the Company; timing, estimated amount, capital

and operating expenditures and economic returns of future

production; integration of future acquisitions into the Company’s

existing operations; competition; operations and political

conditions; regulatory environment in China and Canada;

environmental risks; foreign exchange rate fluctuations; insurance;

risks and hazards of mining operations; key personnel; conflicts of

interest; dependence on management; internal control over financial

reporting as per the requirements of the Sarbanes-Oxley Act; and

bringing actions and enforcing judgments under U.S. securities

laws.

This list is not exhaustive of the factors that

may affect any of the Company’s forward-looking statements or

information. Forward-looking statements or information are

statements about the future and are inherently uncertain, and

actual achievements of the Company or other future events or

conditions may differ materially from those reflected in the

forward-looking statements or information due to a variety of

risks, uncertainties and other factors, including, without

limitation, those referred to in the Company’s Annual Information

Form under the heading “Risk Factors”. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated, described or intended.

Accordingly, readers should not place undue reliance on

forward-looking statements or information.

The Company’s forward-looking statements and

information are based on the assumptions, beliefs, expectations and

opinions of management as of the date of this news release, and

other than as required by applicable securities laws, the Company

does not assume any obligation to update forward-looking statements

and information if circumstances or management’s assumptions,

beliefs, expectations or opinions should change, or changes in any

other events affecting such statements or information. For the

reasons set forth above, investors should not place undue reliance

on forward-looking statements and information.

CAUTIONARY NOTE TO US

INVESTORS

This news release has been prepared in

accordance with the requirements of NI 43‐101 and the Canadian

Institute of Mining, Metallurgy and Petroleum Definition Standards,

which differ from the requirements of U.S. Securities laws. NI

43‐101 is a rule developed by the Canadian Securities

Administrators that establishes standards for all public disclosure

an issuer makes of scientific and technical information concerning

mineral projects.

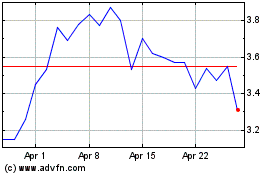

Silvercorp Metals (AMEX:SVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

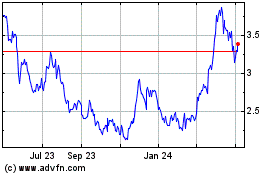

Silvercorp Metals (AMEX:SVM)

Historical Stock Chart

From Apr 2023 to Apr 2024