Senseonics Announces Equity Line of Credit Financing Agreement

November 09 2020 - 4:04PM

Business Wire

Energy Capital to Provide up to $12 Million of

Liquidity

Senseonics Holdings, Inc. (NYSE American: SENS), a medical

technology company focused on the development and commercialization

of long-term, implantable continuous glucose monitoring (CGM)

systems for people with diabetes, today announced entrance into an

equity line of credit financing agreement with current shareholder

Energy Capital, LLC for up to $12.0 million.

“This line of credit provides the opportunity to increase

liquidity as needed in 2021 or 2022 for flexibility to ramp

manufacturing operations for the potential 180-day product launch

in the U.S. and to support the continued development of our next

generation 365-day wear sensor,” said Tim Goodnow, PhD, President

and CEO of Senseonics. “The ability to strengthen the balance sheet

according to our needs allows us to be strategic in our value

creating initiatives as we transition commercial responsibilities

to Ascensia Diabetes Care. We appreciate the shared level of

commitment to Senseonics’ long-term success from a top

shareholder.”

Robert J. Smith, Managing Member of Energy Capital, LLC added,

“as a longtime shareholder and supporter of Senseonics, I am

pleased to continue and grow my commitment to the company. Having

watched my father’s experience with Eversense the past two years, I

am a firm believer in the promise of this unique CGM system to

improve the lives of people with diabetes and their families. I am

excited about the future of Senseonics and the potential for

Eversense to become a leader in CGM.”

Subject to the terms and conditions of agreement, the equity

line of credit is accessible at Senseonics’ discretion after

January 21, 2021 if Senseonics’ aggregate cash and cash equivalents

and other available credit are below $8 million and the price of

Senseonics’ common stock is at least $0.25 per share. Investments

of up to $12.0 million by Energy Capital would occur in draws of a

maximum of $4.0 million no more frequently than monthly, whereby

Senseonics would issue preferred stock which will be convertible

into common stock based on the closing price of $0.3951, which was

the volume-weighted average trading price of the common stock on

November 6, 2020. The agreement includes the issuance of warrants

to purchase 10 million shares of common stock to Energy Capital,

with an exercise price of $0.3951 per share. The agreement also

provides Energy Capital the right to buy any undrawn shares of

preferred stock beginning January 1, 2022 and through November 9,

2022 if the shares are not otherwise drawn by Senseonics, subject

to certain other conditions.

About Senseonics

Senseonics Holdings, Inc. is a medical technology company

focused on the design, development and commercialization of

transformational glucose monitoring products designed to help

people with diabetes confidently live their lives with ease.

Senseonics' CGM systems, Eversense® and Eversense® XL, include a

small sensor inserted completely under the skin that communicates

with a smart transmitter worn over the sensor. The glucose data are

automatically sent every 5 minutes to a mobile app on the user's

smartphone.

Forward Looking Statements

Any statements in this press release about future expectations,

plans and prospects for Senseonics, including statements about the

potential to ramp manufacturing for the potential 180-day product

launch in the U.S. in 2021, the continued development of the

365-day wear sensor, the potential investments by Energy Capital

pursuant to the terms of the equity line of credit financing

agreement, the potential for Eversense to improve the lives of

patients and their families, the potential for Eversense to become

a leader in CGM, and other statements containing the words

“believe,” “expect,” “intend,” “may,” “projects,” “will,”

“planned,” and similar expressions, constitute forward-looking

statements within the meaning of The Private Securities Litigation

Reform Act of 1995. Actual results may differ materially from those

indicated by such forward-looking statements as a result of various

important factors, including: Senseonics’ satisfaction of the

conditions for accessing the equity line under the terms of the

agreement with Energy Capital, uncertainties in the regulatory

approval process, uncertainties inherent in the commercial launch

and commercial expansion of the product, uncertainties in insurer,

regulatory and administrative processes and decisions,

uncertainties in the duration and severity of the COVID-19

pandemic, and such other factors as are set forth in the risk

factors detailed in Senseonics’ Annual Report on Form 10-K for the

year ended December 31, 2019, Senseonics’ Quarterly Report on Form

10-Q for the quarter ended September 30, 2020 and Senseonics’ other

filings with the SEC under the heading “Risk Factors.” In addition,

the forward-looking statements included in this press release

represent Senseonics’ views as of the date hereof. Senseonics

anticipates that subsequent events and developments will cause

Senseonics’ views to change. However, while Senseonics may elect to

update these forward-looking statements at some point in the

future, Senseonics specifically disclaims any obligation to do so

except as required by law. These forward-looking statements should

not be relied upon as representing Senseonics’ views as of any date

subsequent to the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201109006083/en/

Senseonics Investor Contact Lynn Lewis or Philip Taylor

Investor Relations 415-937-5406 investors@senseonics.com

Senseonics Media Contact: Mirasol Panlilio 301-556-1631

Mirasol.panlilio@senseonics.com

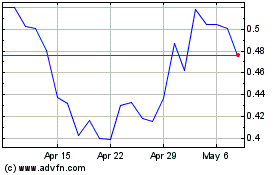

Senseonics (AMEX:SENS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Senseonics (AMEX:SENS)

Historical Stock Chart

From Apr 2023 to Apr 2024