Protalix BioTherapeutics Reports 2018 Second Quarter Results and Provides Corporate Update

August 09 2018 - 7:00AM

Protalix BioTherapeutics, Inc. (NYSE American:PLX, TASE:PLX), a

biopharmaceutical company focused on the development and

commercialization of recombinant therapeutic proteins expressed

through its proprietary plant cell-based expression system,

ProCellEx®, today announced its financial results for the six-month

period ended June 30, 2018 and provided a corporate update.

"This has been a fantastic quarter for the company highlighted

by the expansion of our partnership with Chiesi that resulted from

the strong relationship developed over the past months,” commented

Moshe Manor, Protalix’s President and Chief Executive

Officer. “Additionally, we believe that the recent draft

guidelines from the U.S. Food and Drug Administration, or the FDA,

released in July regarding enzyme replacement therapies could

significantly benefit the regulatory path forward for PRX-102.”

2018 Second Quarter and Recent Clinical

Highlights

- Expanded partnership with Chiesi Farmaceutici S.p.A., or

Chiesi, to include exclusive U.S. rights for the development and

commercialization of PRX-102. Terms of the agreement include

an up-front payment of $25 million, up to $20 million in

development costs, up to $760 million, in the aggregate, in

regulatory and commercial milestone payments and tiered royalties

ranging from 15 to 40%.

- In July, the FDA issued a draft guideline “Slowly Progressive,

Low-Prevalence Rare Diseases with Substrate Deposition that Results

from Single Enzyme Defects: Providing Evidence of Effectiveness for

Replacement or Corrective Therapies”. The draft guideline

recognizes the challenges in achieving clinical evidence in rare,

slow progressing diseases and provides additional preclinical and

clinical results that may be acceptable to the FDA in its

consideration for accelerated approval. The Company is

reviewing the draft guidelines to determine how they might apply to

the Company’s Fabry clinical development program.

- With the additional cash from Chiesi, the Company is funded

through read-outs of all clinical trials of PRX-102.

- Presented data at the Digestive Disease Week® (DDW) 2018 Annual

Meeting on OPRX-106, which showed mucosal improvement in 61% of

patients, mucosal healing in 33% of patients and clinical responses

in 67% of patients.

- Exchanged 4.50% convertible notes for a combination of shares

and cash, and effectively discharged the remainder of the 4.50%

notes.

Financial Results for the Six Months ended June 30,

2018

- The Company reported a net loss of $20.7 million, or $0.14

per share, basic and diluted for the six-month period ended

June 30, 2018 compared to a net loss of $20.6 million, or

$0.16 per share, basic and diluted, excluding a one-time, non-cash

net charge of $38.1 million in connection with the remeasurement of

a derivative, for the same period of 2017.

- The Company recorded total revenues of $6.6 million for

the six-month period ended June 30, 2018, compared to

$9.2 million for the same period of 2017. The decrease

is attributed mainly to lower sales of drug substance to Pfizer

Inc. and of alfataliglicerase in Brazil.

- Research and development expenses were $14.8 million for

the six-month period ended June 30, 2018, compared to

$15.3 million for the same period of 2017. Chiesi’s

participation in the clinical trials of PRX-102 for the treatment

of Fabry disease in the amount of $5.0 million was recorded as

deferred revenues and not as a deduction from the research and

development expenses.

- Selling, general and administrative expenses were

$4.7 million for the six-month period ended June 30, 2018

compared to $5.4 million for the same period of 2017.

- As of June 30, 2018, the Company had $28.3 million of

cash and cash equivalents.

- Pro forma cash balance for June 30, 2018 to include the upfront

from the exclusive license signed with Chiesi for the rights to

PRX-102 in the United States is $53.3 million.

Conference Call and Webcast Information

The Company will host a conference call on Thursday, August

9, 2018, at 8:30 am ET to review the clinical, corporate

and financial highlights.

To participate in the conference call, please dial the following

numbers prior to the start of the call: United States:

+1-844-358-6760; International: +1-478-219-0004. Conference

ID number 9488046.

The conference call will also be broadcast live and available

for replay for two weeks on the Company's website,

www.protalix.com, in the Events Calendar of the Investors

section. Please access the Company's website at least 15

minutes ahead of the conference to register, download, and install

any necessary audio software.

About Protalix BioTherapeutics,

Inc.

Protalix is a biopharmaceutical company focused on the

development and commercialization of recombinant therapeutic

proteins expressed through its proprietary plant cell-based

expression system, ProCellEx®. Protalix’s unique expression

system presents a proprietary method for developing recombinant

proteins in a cost-effective, industrial-scale manner.

Protalix’s first product manufactured by ProCellEx,

taliglucerase alfa, was approved for marketing by the

U.S. Food and Drug Administration (FDA) in May 2012 and,

subsequently, by the regulatory authorities of other countries.

Protalix has licensed to Pfizer Inc. the worldwide

development and commercialization rights for taliglucerase alfa,

excluding Brazil, where Protalix retains full rights.

Protalix’s development pipeline includes the following

product candidates: pegunigalsidase alfa, a modified version of the

recombinant human alpha-GAL-A protein for the treatment of Fabry

disease; OPRX-106, an orally-delivered anti-inflammatory treatment;

alidornase alfa for the treatment of Cystic Fibrosis; and others.

Protalix has partnered with Chiesi Farmaceutici S.p.A., both

in the United States and outside the United States, for the

development and commercialization of pegunigalsidase alfa.

Forward-Looking Statements

To the extent that statements in this press release are not

strictly historical, all such statements are forward-looking, and

are made pursuant to the safe-harbor provisions of the Private

Securities Litigation Reform Act of 1995. The terms “expect,”

“anticipate, “believe,” “estimate,” “project,” “plan,” “should” and

“intend” and other words or phrases of similar import are intended

to identify forward-looking statements. These forward-looking

statements are subject to known and unknown risks and uncertainties

that may cause actual future experience and results to differ

materially from the statements made. These statements are

based on our current beliefs and expectations as to such future

outcomes. Drug discovery and development involve a high

degree of risk. Factors that might cause material differences

include, among others: failure or delay in the commencement or

completion of our preclinical and clinical trials which may be

caused by several factors, including: slower than expected rates of

patient recruitment; unforeseen safety issues; determination of

dosing issues; lack of effectiveness during clinical trials;

inability to monitor patients adequately during or after treatment;

inability or unwillingness of medical investigators and

institutional review boards to follow our clinical protocols; and

lack of sufficient funding to finance clinical trials; the risk

that the results of the clinical trials of our product candidates

will not support our claims of superiority, safety or efficacy,

that our product candidates will not have the desired effects or

will be associated with undesirable side effects or other

unexpected characteristics; risks related to our ability to

maintain and manage our relationship with Chiesi Farmaceutici and

any other collaborator, distributor or partner; risks related to

the amount and sufficiency of our cash and cash equivalents; risks

related to the ultimate purchase by Fundação Oswaldo

Cruz of alfataliglicerase pursuant to the stated purchase

intentions of the Brazilian Ministry of Health of the

stated amounts, if at all; risks related to the successful

conclusion of our negotiations with the Brazilian Ministry of

Health regarding the purchase of alfataliglicerase generally;

risks related to our commercialization efforts for

alfataliglicerase in Brazil; risks relating to the compliance

by Fundação Oswaldo Cruz with its purchase obligations

and related milestones under our supply and technology transfer

agreement; risks related to the amount and sufficiency of our cash

and cash equivalents; risks related to the amount of our future

revenues, operations and expenditures; the risk that despite the

FDA’s grant of fast track designation for pegunigalsidase alfa for

the treatment of Fabry disease, we may not experience a faster

development process, review or approval compared to applications

considered for approval under conventional FDA procedures; risks

related to the FDA’s ability to withdraw the fast track designation

at any time; risks relating to our ability to make scheduled

payments of the principal of, to pay interest on or to refinance

our outstanding notes or any other indebtedness; our dependence on

performance by third party providers of services and supplies,

including without limitation, clinical trial services; delays in

our preparation and filing of applications for regulatory approval;

delays in the approval or potential rejection of any applications

we file with the FDA or other health regulatory

authorities, and other risks relating to the review process; our

ability to identify suitable product candidates and to complete

preclinical studies of such product candidates; the inherent risks

and uncertainties in developing drug platforms and products of the

type we are developing; the impact of development of competing

therapies and/or technologies by other companies and institutions;

potential product liability risks, and risks of securing adequate

levels of product liability and other necessary insurance coverage;

and other factors described in our filings with the U.S.

Securities and Exchange Commission. The statements in this

press release are valid only as of the date hereof and we disclaim

any obligation to update this information, except as may be

required by law.

Investor Contact

Marcy NanusSolebury Trout Group646-378-2927

mnanus@troutgroup.com

PROTALIX BIOTHERAPEUTICS, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS(U.S. dollars in thousands)

(Unaudited)

|

|

|

June 30, 2018 |

|

|

December 31, 2017 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

$ |

28,327 |

|

|

|

$ |

51,163 |

|

| Accounts

receivable – Trade |

|

|

5,248 |

|

|

|

|

1,721 |

|

| Other

assets |

|

|

2,499 |

|

|

|

|

1,934 |

|

|

Inventories |

|

|

6,978 |

|

|

|

|

7,833 |

|

| Total

current assets |

|

$ |

43,052 |

|

|

|

$ |

62,651 |

|

|

|

|

|

|

|

|

|

|

|

| FUNDS IN

RESPECT OF EMPLOYEE RIGHTS UPON RETIREMENT |

|

|

1,729 |

|

|

|

|

1,887 |

|

| PROPERTY AND

EQUIPMENT, NET |

|

|

6,940 |

|

|

|

|

7,676 |

|

| Total

assets |

|

$ |

51,721 |

|

|

|

$ |

72,214 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES NET

OF CAPITAL DEFICIENCY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts

payable and accruals: |

|

|

|

|

|

|

|

|

|

Trade |

|

$ |

6,001 |

|

|

|

$ |

7,521 |

|

|

Other |

|

|

9,071 |

|

|

|

|

9,310 |

|

| Convertible

notes |

|

|

|

|

|

|

5,921 |

|

| Total current

liabilities |

|

$ |

15,072 |

|

|

|

$ |

22,752 |

|

| |

|

|

|

|

|

|

|

|

| LONG TERM

LIABILITIES: |

|

|

|

|

|

|

|

|

|

Convertible notes |

|

|

46,742 |

|

|

|

|

46,267 |

|

| Deferred

revenues |

|

|

31,885 |

|

|

|

|

26,851 |

|

| Liability

for employee rights upon retirement |

|

|

2,335 |

|

|

|

|

2,586 |

|

| Other long

term liabilities |

|

|

5,258 |

|

|

|

|

5,051 |

|

| Total long term

liabilities |

|

$ |

86,220 |

|

|

|

$ |

80,755 |

|

| Total liabilities |

|

$ |

101,292 |

|

|

|

$ |

103,507 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CAPITAL

DEFICIENCY |

|

|

(49,571 |

) |

|

|

|

(31,293 |

) |

| Total liabilities net

of capital deficiency |

|

$ |

51,721 |

|

|

|

$ |

72,214 |

|

PROTALIX BIOTHERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (U.S. dollars in thousands, except share and

per share data) (Unaudited)

|

|

Six Months Ended |

Three Months

Ended |

|

|

June 30, 2018 |

June 30, 2017 |

June 30, 2018 |

June 30, 2017 |

|

REVENUES. |

$ |

6,559 |

|

$ |

9,247 |

|

$ |

2,006 |

|

$ |

6,358 |

|

| COST OF

REVENUES |

|

(5,107 |

) |

|

(7,611 |

) |

|

(2,183 |

) |

|

(5,523 |

) |

| GROSS PROFIT

(LOSS) |

|

1,452 |

|

|

1,636 |

|

|

(177 |

) |

|

835 |

|

| RESEARCH AND

DEVELOPMENT EXPENSES (1) |

|

(14,762 |

) |

|

(15,271 |

) |

|

(7,476 |

) |

|

(9,304 |

) |

|

Less – grants |

|

1,078 |

|

|

1,816 |

|

|

235 |

|

|

478 |

|

| RESEARCH AND

DEVELOPMENT EXPENSES,

NET |

|

(13,684 |

) |

|

(13,455 |

) |

|

(7,241 |

) |

|

(8,826 |

) |

| SELLING,

GENERAL AND ADMINISTRATIVE

EXPENSES (2) |

|

(4,656 |

) |

|

(5,351 |

) |

|

(2,158 |

) |

|

(2,814 |

) |

| OPERATING

LOSS |

|

(16,888 |

) |

|

(17,170 |

) |

|

(9,576 |

) |

|

(10,805 |

) |

| FINANCIAL

EXPENSES |

|

(4,013 |

) |

|

(5,132 |

) |

|

(1,793 |

) |

|

(3,045 |

) |

| FINANCIAL

INCOME |

|

207 |

|

|

1,665 |

|

|

75 |

|

|

40 |

|

| (LOSS)

INCOME FROM CHANGE IN FAIR VALUE OF CONVERTIBLE NOTES

EMBEDDED DERIVATIVE |

|

|

(38,061 |

) |

|

|

14,260 |

|

| FINANCIAL

(EXPENSES) INCOME, NET |

|

(3,806 |

) |

|

(41,528 |

) |

|

(1,718 |

) |

|

11,255 |

|

| NET (LOSS)

INCOME FOR THE PERIOD |

$ |

(20,694 |

) |

$ |

(58,698 |

) |

$ |

(11,294 |

) |

$ |

450 |

|

| NET (LOSS)

EARNINGS PER SHARE OF COMMON STOCK: |

|

|

|

|

|

BASIC |

|

|

|

|

|

Net (loss) earnings per share

of common stock |

$ |

(0.14 |

) |

$ |

(0.47 |

) |

$ |

(0.08 |

) |

$ |

0.00 |

|

|

DILUTED |

|

|

|

|

|

Net loss per share of common

stock |

$ |

(0.14 |

) |

$ |

(0.47 |

) |

$ |

(0.08 |

) |

$ |

(0.06 |

) |

| WEIGHTED

AVERAGE NUMBER OF SHARES OF

COMMON STOCK USED IN COMPUTING (LOSS)

EARNINGS PER SHARE |

|

|

|

|

|

BASIC |

|

145,985,445 |

|

|

126,000,782 |

|

|

146,644,450 |

|

|

127,523,706 |

|

|

DILUTED |

|

145,985,445 |

|

|

126,000,782 |

|

|

146,644,450 |

|

|

192,598,389 |

|

| (1)

Includes share-based compensation |

$ |

40 |

|

$ |

120 |

|

$ |

(2 |

) |

$ |

55 |

|

| (2)

Includes share-based compensation |

$ |

34 |

|

$ |

96 |

|

$ |

14 |

|

$ |

43 |

|

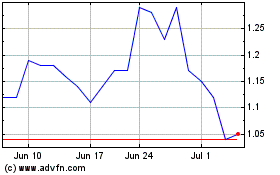

Protalix BioTherapeutics (AMEX:PLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

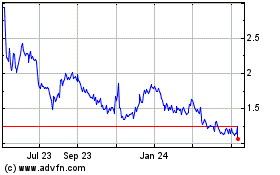

Protalix BioTherapeutics (AMEX:PLX)

Historical Stock Chart

From Apr 2023 to Apr 2024