Current Report Filing (8-k)

September 18 2019 - 4:54PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

Date of

Report (Date of Earliest Event Reported): September 17, 2019

PEDEVCO CORP.

(Exact name of registrant as specified in its charter)

|

Texas

|

|

001-35922

|

|

22-3755993

|

|

(State or other jurisdiction of incorporation or

organization)

|

|

(Commission file number)

|

|

(IRS Employer Identification No.)

|

575 N. Dairy Ashford

Energy Center II, Suite 210

Houston, Texas 77079

(Address of principal executive offices)

(713) 221-1768

(Registrant’s telephone number, including area

code)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

|

[

]

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

|

|

|

[

]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

|

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the

Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

PED

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this

chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 1.01 Entry Into a Material Definitive

Agreement.

Common Stock Sales

On September 17, 2019, PEDEVCO Corp. (the

“Company”,

“PEDEVCO”,

“we” and “us”), raised $12 million through the sale of

8,400,000 shares of restricted Company common stock at a price of

$1.4285714 per share (the “Investor Purchase

Price”) to Mr. Viktor

Tkachev (the “Investor”),

a non-U.S. person unaffiliated with the Company, pursuant to a

Common Stock Subscription Agreement, dated September 17, 2019,

entered into by and between the Company and the Investor (the

“Investor Subscription

Agreement”). The Investor

Purchase Price represents a 6.6% discount to the closing price of

the Company’s common stock on the NYSE American Exchange as

of the closing date. The Investor Subscription Agreement includes

customary representations and warranties of the

parties.

In addition, on September 17, 2019, the

Company raised an additional $13 million through the sale of

8,204,481 shares of restricted Company common stock at a price of

$1.5845 per share (the “SK Purchase

Price”) to SK Energy LLC

(“SK

Energy”), a company

wholly-owned by our Chief Executive Officer and director, Dr. Simon

Kukes, pursuant to a Common Stock Subscription Agreement, dated

September 17, 2019, entered into by and between the Company and SK

Energy (the “SK Subscription

Agreement”). The SK

Purchase Price represents a premium to the closing price of the

Company’s common stock on the NYSE American Exchange as of

the closing date and was equal to the greater of the book/market

price of the Company’s common stock for the purposes of the

NYSE American Exchange rules and requirements.

As

a result of the purchase, SK Energy, which beneficially owned 80.6%

of our outstanding common stock prior to the Investor Subscription

Agreement and SK Subscription Agreement transactions, beneficially

owns 73.2% of our outstanding common stock following such

transactions.

The

Company intends to apply the funds raised from the sale of the

common stock to (i) fund the Company’s Permian Basin asset

development program and (ii) fund additional acquisition activities

in the Permian Basin.

* * * * * * * * *

The foregoing description of the Investor

Subscription Agreement and SK Subscription Agreement does not

purport to be complete and is qualified in its entirety by

reference to the Investor Subscription Agreement and SK

Subscription Agreement, copies of which are attached

as Exhibit 10.1 and

Exhibit

10.2, respectively, to this

Current Report on Form 8-K and incorporated herein by

reference.

Item 3.02 Unregistered Sales of Equity Securities.

On September 17, 2019, the Company sold an

aggregate of 8,400,000 shares of Company restricted common stock to

the Investor as described above in Item

1.01, which description is

incorporated by reference in this Item 3.02,

at a price a price of $1.4285714 per

share, pursuant to the Investor Subscription Agreement, and the

Company also sold an aggregate of 8,204,481 shares of Company

restricted common stock to SK Energy as described above in

Item

1.01, which description is

incorporated by reference in this Item 3.02,

at a price a price of $1.5845 per

share, pursuant to the SK Subscription

Agreement.

We claim an exemption from registration for the

issuance and sale of the Company’s restricted common stock to

the Investor and SK Energy described above pursuant to Section

4(a)(2), Rule 506 and/or Regulation S of the Securities Act of

1933, as amended (the “Securities

Act” and

“Regulation

S”) since the shares were

issued to “accredited

investors” and/or

non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of

Regulation S), pursuant to offshore transactions, and no directed

selling efforts were made in the United States by the Company, a

distributor, any of their respective affiliates, or any person

acting on behalf of any of the foregoing. The securities are

subject to transfer restrictions, and the certificates evidencing

the securities contain an appropriate legend stating that such

securities have not been registered under the Securities Act and

may not be offered or sold absent registration or pursuant to an

exemption therefrom. The securities were not registered under the

Securities Act and such securities may not be offered or sold in

the United States absent registration or an exemption from

registration under the Securities Act and any applicable state

securities laws.

Item 7.01. Regulation FD

Disclosure.

The Company issued a press release on September

18, 2019 regarding the matters discussed

in Items 1.01 and 3.02 above

and certain development updates. A copy of the

press release is furnished herewith as Exhibit

99.1 and is incorporated

by reference herein.

The information responsive to Item 7.01

of this Form 8-K and

Exhibit

99.1 attached hereto, shall not

be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange

Act”) or otherwise

subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as expressly set

forth by specific reference in such a filing. The furnishing of

this Report is not intended to constitute a determination by the

Company that the information is material or that the dissemination

of the information

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

$12,000,000

Common Stock Subscription Agreement between PEDEVCO Corp. and

Mr. Viktor Tkachev, dated

September 17, 2019

|

|

|

|

$13,000,000.14 Common Stock Subscription Agreement between

PEDEVCO Corp. and SK Energy LLC, dated September 17, 2019

|

|

|

|

Press Release dated September 18, 2019

|

* Filed herewith.

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused

this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

|

|

|

|

|

PEDEVCO CORP.

|

|

|

|

|

|

Date: September

18, 2019

|

By:

|

/s/ Dr. Simon Kukes

|

|

|

|

Dr. Simon Kukes

|

|

|

|

Chief

Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

$12,000,000

Common Stock Subscription Agreement between PEDEVCO Corp. and

Mr. Viktor Tkachev, dated

September 17, 2019

|

|

|

|

$13,000,000.14 Common Stock Subscription Agreement between

PEDEVCO Corp. and SK Energy LLC, dated September 17, 2019

|

|

|

|

Press Release dated September 18, 2019

|

* Filed herewith.

** Furnished herewith.

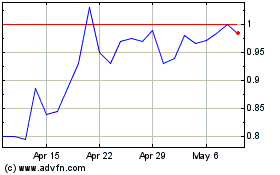

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

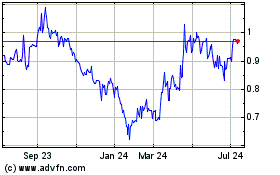

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024