As filed with the Securities and Exchange Commission on July 26, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

PARAMOUNT GOLD NEVADA CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Nevada

|

|

98-0138393

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

665 Anderson Street, Winnemucca, NV 89445

(775)

625-3600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Carlo Buffone

Chief

Financial Officer

Paramount Gold Nevada Corp.

665 Anderson Street

Winnemucca, NV 89445

(775)

625-3600

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

James

T. Seery

Duane Morris LLP

One Riverfront Plaza

1037 Raymond Boulevard, Suite 1800

Newark, NJ 07102-5429

(973)

424-2000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration

statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans,

please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed

or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D.

filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer or a smaller reporting company. See the definitions of “large accelerated filer,”

“non-accelerated

filer” and “smaller

reporting company” in Rule

12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐

|

|

Smaller reporting company

|

|

☒

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for not complying with any new or revised financial accounting provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

|

Amount

to be

registered(1)(2)

|

|

Proposed

maximum

offering price

per share(3)

|

|

Proposed

maximum

aggregate

offering price(3)

|

|

Amount of

registration fee

|

|

Common stock, par value $0.01 per share

|

|

2,400,000

|

|

$1.17

|

|

$2,808,000

|

|

$349.60

|

|

Common Stock underlying Warrants

|

|

1,200,000

|

|

$1.50

|

|

$1,800,000

|

|

$224.10

|

|

Total

|

|

3,600,000

|

|

|

|

$4,608,000

|

|

$573.70

|

|

|

|

|

|

(1)

|

Consists of an aggregate of 2,400,000 shares of common stock and 1,200,000 shares of common stock that may be issued upon exercise of warrants.

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares being registered hereunder include such indeterminate number of shares of the registrant’s common stock

as may be issuable with respect to the shares being registered hereunder to prevent dilution by reason of any stock dividend, stock split, recapitalization or other similar transaction.

|

|

(3)

|

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule

457(c) under the Securities Act. The proposed maximum offering price per share and proposed maximum aggregate offering price are based upon the average of the high and low sales prices of the registrant’s common stock on July 24, 2018, as

reported on the NYSE American LLC.

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall

thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may

determine.

The information in this preliminary prospectus is not complete and may be changed. The

Selling Stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell, and the Selling Stockholders are not soliciting offers to

buy, these securities in any state where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED JULY 26, 2018

PROSPECTUS

3,600,000 SHARES

PARAMOUNT GOLD NEVADA CORP.

Common Stock

This prospectus

covers the sale, transfer or other disposition of up to 3,600,000 shares of our common stock, including 1,200,000 shares issuable upon exercise of warrants, by certain selling stockholders, which as used herein includes donees, pledgees, transferees

and other

successors-in-interest

selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a Selling

Stockholder as a gift, pledge, partnership, distribution or other transfers, or the Selling Stockholders. The Selling Stockholders may, from time to time, sell, transfer, or otherwise dispose of any or all of their shares of common stock or

interests in shares of common stock on any stock exchange, market, or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices

related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

Paramount Gold Nevada

Corp. is not offering any shares of common stock for sale under this prospectus. We will not receive any of the proceeds from the sale or other disposition of the shares of common stock by the Selling Stockholders, other than any proceeds from the

cash exercise of the warrants to purchase shares of common stock.

All expenses of registration incurred in connection with this offering

are being borne by us. All selling and other expenses incurred by the Selling Stockholders will be borne by the Selling Stockholders.

Our

common stock is quoted on the NYSE American LLC under the symbol “PZG.” On July 24, 2018, the last reported sales price of our common stock, as reported on the NYSE American LLC, was $1.17 per share.

Investing in our common stock involves certain risks. See the “

Risk Factors

” section herein and in our

Annual Report on Form

10-K

for the year ended June 30, 2017 as well as our subsequently filed periodic and current reports, which we file with the Securities and Exchange Commission and are incorporated

by reference into this prospectus. You should read the entire prospectus carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of

this prospectus is , 2018

TABLE OF CONTENTS

- i -

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form

S-3

that we filed with the Securities and

Exchange Commission (the “SEC”) using a “shelf” registration or continuous offering process.

You should read this

prospectus and the information and documents incorporated by reference carefully. Such documents contain important information you should consider when making your investment decision. See “Where You Can Find More Information” and

“Incorporation of Certain Documents by Reference” in this prospectus.

You should rely only on the information provided in this

prospectus or documents incorporated by reference into this prospectus. We have not, and each of the Selling Stockholders has not, authorized anyone to provide you with different information. This prospectus covers offers and sales of common stock

only in jurisdictions in which such offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common

stock. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, or that the information contained in any document incorporated by reference is

accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

In this prospectus, we refer to Paramount Gold Nevada Corp. as “we,” “us,” “our,” the “Company” or

“Paramount.” References to “Selling Stockholders” refers to the stockholders listed herein under “Selling Stockholders” and their donees, pledgees, transferees, or other

successors-in-interest.

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING INFORMATION

Information in and incorporated by reference into this prospectus contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the safe harbor provided by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are not purely historical may be forward-looking. You can identify some forward-looking statements by the use of words such as “believes,”

“anticipates,” “expects,” “intends” and similar expressions. Forward looking statements involve inherent risks and uncertainties regarding events, conditions and financial trends that may affect our future plans of

operation, business strategy, results of operations, and financial position. These statements by their nature involve substantial risks and uncertainties, credit losses, dependence on management and key personnel, variability of quarterly results,

and our ability to continue growth. Statements in this annual report regarding planned drilling activities and any other statements about Paramount’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements.

For a discussion of these and other factors that could cause actual results to differ from those contemplated in the forward- looking

statements, please see the discussion under “Risk Factors” contained in our Annual Report on Form

10-K

for the fiscal year ended June 30, 2017 and in our subsequent filings with the SEC.

Forward-looking statements speak only as of the date made. Because actual results or outcomes could differ materially from those expressed in

any forward-looking statements made by us or on our behalf, you should not place undue reliance on any such forward-looking statements. We do not undertake any responsibility to update or revise any of these factors or to announce publicly any

revisions to forward-looking statements, whether as a result of new information, future events or otherwise.

- ii -

PROSPECTUS SUMMARY

The following is only a summary and therefore does not contain all of the information you should consider before investing in our common stock. We urge you to

read this entire prospectus, including the matters discussed under “Risk Factors” in this prospectus and the more detailed consolidated financial statements, notes to the consolidated financial statements and other information incorporated

by reference from our other filings with the SEC.

Our Company

We are an emerging growth company engaged in the business of acquiring, exploring and developing precious metal projects in the United States of America.

Paramount owns advanced stage exploration projects in the states of Nevada and Oregon. We enhance the value of our projects by implementing exploration and engineering programs that are likely to expand and upgrade known mineralized material to

reserves. Paramount believes there are several ways to realize the value of its projects: selling its projects to producers; joint venturing its projects with other companies; or building and operating small mines on its own.

The Company’s principal Nevada interest, the Sleeper Gold Project, is located in Humboldt County, Nevada, and was a producing mine until 1996.

Our project located in Oregon, known as the Grassy Mountain Project, is located in Malheur County, Oregon, and was acquired by way of statutory plan of

arrangement in the Province of British Columbia, Canada with Calico Resources Corp. in July 2016.

Inter-corporate Relationships

We currently have three active wholly owned direct subsidiaries:

New Sleeper Gold LLC and Sleeper Mining Company, LLC, which operate our mining interests in Nevada. Calico Resources USA Corp., which holds our interest in the

Grassy Mountain Project in Oregon.

Initial Public Offering and Organizational Transactions

Paramount Gold Nevada Corp. is a Nevada corporation formed on June 15, 1992 under the name

X-Cal

(USA), Inc.

On April 17, 2015, we entered into the previously disclosed separation and distribution agreement with Paramount Gold and Silver Corp. (“PGSC”), to

effect the separation (the “separation”) of the Company from PGSC, and to provide for the allocation between the Company and PGSC of the Company’s and PGSC’s assets, liabilities and obligations attributable to periods prior to,

at and after the separation.

We filed a registration statement on Form

S-1

in connection with the distribution

(the “distribution”) by PGSC to its stockholders of all the outstanding shares of common stock of the Company. The registration statement was declared effective by the Securities and Exchange Commission on April 9, 2015. The distribution,

which effected a

spin-off

of the Company from PGSC, was made on April 17, 2015. As a result of the distribution, the Company is now a publicly traded company independent from PGSC. On April 20, 2015, the

Company’s shares of common stock commenced trading on the NYSE MKT LLC under the symbol “PZG”.

On March 14, 2016, Paramount Gold Nevada

Corp. and Calico Resources Corp. (“Calico”) entered into an Arrangement Agreement providing for the acquisition of Calico by Paramount. On July 7, 2016, after having received the approval of the Supreme Court of British Columbia to

the transaction, Paramount and Calico completed the transaction contemplated by the Arrangement Agreement, pursuant to which Calico became a wholly-owned subsidiary of Paramount.

On November 14, 2016, Calico Resources Corp. was merged into Calico Resources USA Corp. As a result, Calico Resources USA Corp. became a wholly owned

subsidiary of Paramount.

Corporate Information

Our

principal business office is located at 665 Anderson Street, Winnemucca, Nevada 89445, and our telephone number is (775)

625-3600.

Our website address is www.paramountnevada.com. Information contained in our

website or any other website does not constitute part of this prospectus.

1

Private Placement

Effective June 25, 2018, the Company entered into definitive agreements and accepted subscriptions (the “Subscription Agreements”) with

accredited investors to issue common stock and warrants (the “Warrants”) in a

non-brokered

private transaction (the “Transaction”). Under the terms of the Transaction, Paramount agreed to

sell an aggregate of 2,400,000 units at $1.25 per unit for aggregate proceeds of $3,000,000. Each unit consists of one share of common stock and one warrant to purchase

one-half

of a share of common stock.

Each warrant has a

two-year

term and is exercisable at the following exercise prices: in the first year at $1.30 per share and in the second year at $1.50 per share. There were no commissions or underwriting

fees paid in connection with the Transaction.

Closing of the private placement pursuant to the definitive agreements occurred on July 11, 2018.

Copies of the forms of Subscription Agreement and Warrant are incorporated by reference as exhibits to the registration statement of which this prospectus

forms a part. The foregoing summaries of each of the transaction documents, including the warrants, are qualified in their entirety by reference to such documents.

2

The Offering

Common stock outstanding: 25,474,954 shares (1)

Common stock that may be sold or otherwise

disposed of by the

Selling Stockholders: 3,600,000 shares (2)

NYSE American symbol for common stock: PZG

Use of proceeds: We will not receive any of the proceeds from the sale or other disposition of the shares covered by this prospectus.

We will receive proceeds from the cash exercise of the warrants held by the Selling Stockholders, and we intend to use any such proceeds for working capital and general corporate purposes.

Risk factors: See “Risk Factors” in our Annual Report on Form

10-K

for the year ended

June 30, 2017 as well as our subsequently filed periodic and current reports, for a discussion of factors to consider before investing in shares of our common stock.

(1) The number of shares shown to be outstanding is based on the number of shares of our common stock

outstanding as of July 25, 2018, and does not include shares issuable upon exercise of warrants (including the shares of common stock being registered hereunder underlying the warrants held by the Selling Stockholders), or reserved for issuance upon

the exercise of options granted or available under our equity compensation plans.

(2) The number of

shares being registered hereunder includes 2,400,000 shares of our common stock outstanding, and 1,200,000 shares issuable upon exercise of the Warrants.

3

RISK FACTORS

An investment in our common stock involves risks. Prior to making a decision about investing in our common stock, you should consider carefully the risks

together with all of the other information contained or incorporated by reference in this prospectus, including any risks described in the section entitled “Risk Factors” contained in any supplements to this prospectus and in our Annual

Report on Form

10-K

for the fiscal year ended June 30, 2017 and in our subsequent filings with the SEC. Our business, financial condition or results of operations could be materially adversely affected by

any of these risks. The trading price of shares of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

USE OF PROCEEDS

We will not receive any of the proceeds from any sale or other disposition of the shares of common stock covered by this prospectus. We will receive proceeds

upon the cash exercise of the warrants for which underlying shares of common stock are being registered hereunder. Assuming full cash exercise of the Warrants in the first year at the exercise price of $1.30 per underlying share of common stock, we

will receive proceeds of $1,560,000. Assuming full cash exercise of the Warrants in the second year at the exercise price of $1.50 per underlying share of common stock, we will receive additional proceeds of $1,800,000. We currently intend to use

the cash proceeds from any warrant exercise for working capital and general corporate purposes. The amount and timing of our actual use of proceeds may vary significantly depending upon numerous factors, including the actual amount of proceeds we

receive and the timing of when we receive such proceeds. Our management will retain broad discretion in the allocation of the net proceeds from the exercise of the Warrants.

4

PLAN OF DISTRIBUTION

The Selling Stockholders, which as used herein includes donees, pledgees, transferees or other

successors-in-interest

selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership distribution

or other transfer, may from time to time sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in

private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. The

Selling Stockholders may use any one or more of the following methods when selling securities:

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

settlement of short sales;

|

|

|

•

|

|

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security;

|

|

|

•

|

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

•

|

|

a combination of any such methods of sale; or

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders may also sell

securities under Rule 144 or any other exemption from registration under the Securities, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive

commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case

of an agency transaction will not be in excess of a customary brokerage commission.

In connection with the sale of the securities or

interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The

Selling Stockholders may also, after the date of this Prospectus sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The

Selling Stockholders may also enter into options or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of

securities covered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be

“underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed

to be underwriting commissions or discounts under the Securities Act. The Selling Stockholders have informed us that they do not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the

securities.

We are required to pay certain fees and expenses incurred by us incident to the registration of the securities. We agreed to

indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

5

We agreed to keep this prospectus effective until the earlier of (i) the date that such

securities become eligible for resale without volume or

manner-of-sale

restrictions and without current public information pursuant to Rule 144 and certain other

conditions have been satisfied, or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not

simultaneously engage in market making activities with respect to our common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject

to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of common stock by the Selling Stockholders or any other person.

6

SELLING STOCKHOLDERS

The shares of common stock covered by this prospectus are those previously issued in the private placement described above and those issuable

upon exercise of the Warrants. For additional information regarding the issuances of those securities, see “Private Placement” above.

The shares of common stock to be offered by the Selling Stockholders are “restricted” securities under applicable federal and state

securities laws and are being registered under the Securities Act to give the Selling Stockholders the opportunity to sell these shares publicly. The registration of these shares does not require that any of the shares be offered or sold by the

Selling Stockholders. Subject to these resale restrictions, the Selling Stockholders may from time to time offer and sell all or a portion of their shares indicated below in privately negotiated transactions or on the NYSE American LLC or any other

market on which our common stock may subsequently be listed.

The registered shares may be sold directly or through brokers or dealers, or

in a distribution by one or more underwriters on a firm commitment or best effort basis. To the extent required, the names of any agent or broker-dealer and applicable commissions or discounts and any other required information with respect to any

particular offering will be set forth in a prospectus supplement. See the section of this prospectus entitled “Plan of Distribution”. The Selling Stockholders and any agents or broker-dealers that participate with the Selling Stockholders

in the distribution of registered shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions received by them and any profit on the resale of the registered shares may be deemed to be

underwriting commissions or discounts under the Securities Act.

The following table provides, as of July 25, 2018, information

regarding the beneficial ownership of our common stock held by each Selling Stockholder, the number of shares of common stock that may be sold be each Selling Stockholder under this prospectus and that each Selling Stockholder will beneficially own

after this offering.

Because each Selling Stockholder may dispose of all, none or some portion of their securities, no estimate can be

given as to the number of securities that will be beneficially owned by a Selling Stockholder upon termination of this offering. For purposes of the table below, however, we have assumed that after termination of this offering none of the securities

covered by this prospectus will be beneficially owned by the Selling Stockholders and further assumed that the Selling Stockholders will not acquire beneficial ownership of any additional securities during the offering. In addition, the Selling

Stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, our securities in transactions exempt from the registration requirements of the Securities Act after

the date on which the information in the table is presented.

Unless otherwise indicated in the footnotes below, no Selling Stockholder

has had any material relationship with us or any of our affiliates within the past three years other than as a security holder.

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

Shares of

Common Stock

Owned Prior

|

|

|

Maximum

Number of

Shares of

Common

Stock to be

Sold

Pursuant to

this

|

|

|

Number of Shares

of Common Stock

Owned

After

Offering

(1)

|

|

|

Name of Selling Stockholder

|

|

Offering

|

|

|

Prospectus

|

|

|

Numbers

|

|

|

Percentage

|

|

|

FCMI Parent Co.

|

|

|

4,727,910

|

|

|

|

570,000

|

|

|

|

4,157,910

|

|

|

|

15.6

|

%

|

|

Lakkanhald LLC

|

|

|

450,000

|

|

|

|

300,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Porter Partners, L.P.

|

|

|

641,287

|

|

|

|

255,000

|

|

|

|

386,287

|

|

|

|

1.5

|

%

|

|

EDJ Limited

|

|

|

122,013

|

|

|

|

45,000

|

|

|

|

77,013

|

|

|

|

*

|

|

|

Philippe Jordan

|

|

|

112,500

|

|

|

|

112,500

|

|

|

|

0

|

|

|

|

*

|

|

|

Seabridge Gold, Inc.

(2)

|

|

|

2,384,963

|

|

|

|

480,000

|

|

|

|

1,904,963

|

|

|

|

7.1

|

%

|

|

Ian MacKellar

|

|

|

320,000

|

|

|

|

60,000

|

|

|

|

260,000

|

|

|

|

1

|

%

|

|

Paul Huet

|

|

|

18,000

|

|

|

|

18,000

|

|

|

|

0

|

|

|

|

*

|

|

|

James McLean

|

|

|

149,500

|

|

|

|

45,000

|

|

|

|

104,500

|

|

|

|

*

|

|

|

VIG Holdings Inc.

|

|

|

30,000

|

|

|

|

30,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Wayne Wew

|

|

|

1,121,000

|

|

|

|

600,000

|

|

|

|

521,000

|

|

|

|

2

|

%

|

|

John Pelow

|

|

|

351,800

|

|

|

|

187,500

|

|

|

|

164,300

|

|

|

|

*

|

|

|

John McKeown

|

|

|

90,000

|

|

|

|

90,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Gregory Davies

|

|

|

248,097

|

|

|

|

150,000

|

|

|

|

98,097

|

|

|

|

*

|

|

|

Brookdale International Partners L.P.

|

|

|

150,750

|

|

|

|

150,750

|

|

|

|

0

|

|

|

|

*

|

|

|

Brookdale Global Opportunity Fund

|

|

|

74,250

|

|

|

|

74,250

|

|

|

|

0

|

|

|

|

*

|

|

|

MMCAP Fund

|

|

|

388,500

|

|

|

|

388,500

|

|

|

|

0

|

|

|

|

*

|

|

|

Anthony Corda

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Paul Dancer

|

|

|

22,500

|

|

|

|

22,500

|

|

|

|

0

|

|

|

|

*

|

|

|

Victoria Colizza

|

|

|

6,000

|

|

|

|

6,000

|

|

|

|

0

|

|

|

|

*

|

|

|

(1)

|

Assumes 26,674,954 shares of our common stock are outstanding after the offering, which reflects 25,474,954 shares presently outstanding and 1,200,000 shares issuable

upon exercise of the Warrants.

|

|

(2)

|

Mr. Rudi Fronk, the chairman and chief executive officer of Seabridge Gold Inc. (“Seabridge”), Mr. Christopher Reynolds, the chief financial

officer of Seabridge, and Eliseo Gonzalez-Urien, a director of Seabridge, are all members of our Board of Directors. All three are shareholders of the Company.

|

8

EXPERTS

The consolidated financial statements incorporated in this prospectus by reference from our Annual Report on Form

10-K

for the year ended June 30, 2017, and the effectiveness of our internal control over financial reporting, have been audited by MNP LLP, an independent registered public accounting firm as stated in their

reports, which are incorporated herein by reference, and have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

LEGAL MATTERS

The validity of the shares of our common stock covered hereby will be passed upon for us by Duane Morris LLP, Newark, New Jersey.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of the registration statement on Form

S-3

we filed with the SEC under the

Securities Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements, or other documents, the reference may not be complete and you

should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference in this prospectus supplement and the accompanying prospectus for a copy of such contract,

agreement, or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly, and current reports, proxy statements, and other information with the SEC. Our SEC filings are

available to the public over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330

for further information on the operation of the Public Reference Room. Our website address is www.paramountnevada.com.

Information contained in, or accessible through, our website is not a part of this prospectus.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we

file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information contained in any supplement to this

prospectus and information that we file with the SEC in the future and incorporate by reference in this prospectus will automatically update and supersede the information contained in this prospectus. We incorporate by reference the documents listed

below and any future filings (other than current reports on Form

8-K

furnished under Item 2.02 or Item 7.01 and exhibits filed on such form that are related to such items) we make with the SEC under Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the initial filing date of the registration statement of which this prospectus forms a part and prior to the termination of this offering covered by this prospectus:

|

|

•

|

|

Our Annual Report on Form

10-K

for the fiscal year ended June 30, 2017 filed on September 18, 2017, including certain information incorporated by reference therein from

our Definitive Proxy Statement for our 2017 annual meeting of stockholders;

|

|

|

•

|

|

Our Quarterly Reports on Form

10-Q

for the fiscal periods ended September 30, 2017 and December 31, 2017 and March 31, 2018 filed on November 7, 2017 and

February 8, 2018 and May 10, 2018 respectively;

|

|

|

•

|

|

Our Current Reports on Form

8-K

or Form

8-K/A

filed on October 5, 2017, December 13, 2017, June 26, 2018 and June 29,

2018; and

|

|

|

•

|

|

The description of our common stock included in our registration statement on Form

8-A

filed on April 6, 2015.

|

We will provide without charge upon written or oral request, to each person, including any beneficial owner, to whom a prospectus is

delivered, a copy of any or all of the documents incorporated by reference, including exhibits to these documents. You should direct any requests for documents to:

Paramount Gold Nevada Corp.

665

Anderson Street

Winnemucca, NV 89445

(775)

625-3600

9

3,600,000 Shares

Common Stock

PROSPECTUS

, 2018

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution

|

The following table lists the costs and

expenses payable by the registrant in connection with the sale of the securities covered by this prospectus other than any sales commissions or discounts, which expenses will be paid by the Selling Stockholders. All amounts shown are estimates

except for the SEC registration fee.

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

573.70

|

|

|

Legal fees and expenses

|

|

$

|

10,000.00

|

|

|

Accounting fees and expenses

|

|

$

|

1,500.00

|

|

|

Miscellaneous fees and expenses

|

|

$

|

3,000.00

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

15,073.70

|

|

|

|

|

|

|

|

|

Item 15.

|

Indemnification of Directors and Officers

|

Paramount Gold Nevada Corp. is incorporated

under the laws of the State of Nevada.

Nevada Revised Statutes Sections 78.7502 and 78.751 provide us with the power to indemnify any of

our directors and officers. The director or officer must have conducted himself/herself in good faith and reasonably believe that his/her conduct was in, or not opposed to, our best interests. In a criminal action, the director, officer, employee or

agent must not have had reasonable cause to believe his/her conduct was unlawful.

Under Revised Statutes Section 78.751, advances

for expenses may be made by agreement if the director or officer affirms in writing that he/she believes he/she has met the standards and will personally repay the expenses if it is determined such officer or director did not meet the standards.

Our amended and restated articles of incorporation provides that our officers and directors shall be indemnified and held harmless to the

fullest extent legally permissible under the laws of the State of Nevada against all expenses, liability and loss (including attorneys’ fees, judgments, fines and amounts paid or to be paid in settlement) reasonably incurred or suffered by them

in connection with any civil, criminal, administrative or investigative action, suit or proceeding related to their service as an officer or director. Such right of indemnification is a contract right which may be enforced in any manner desired by

such person. We must pay the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding as they are incurred and in advance of the final disposition of the action, suit or proceeding, upon receipt of an

undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he is not entitled to be indemnified by us. Such right of indemnification shall not be exclusive of

any other right which such directors or officers may have or hereafter acquire.

Our amended and restated articles of incorporation

provides that we may adopt bylaws to provide at all times the fullest indemnification permitted by the laws of the State of Nevada, and may purchase and maintain insurance on behalf of any of officers and directors. The indemnification provided in

our amended and restated articles of incorporation shall continue as to a person who has ceased to be a director, officer, employee or agent, and inures to the benefit of the heirs, executors and administrators of such person.

Our amended and restated bylaws provides that a director or officer shall have no personal liability to us or our stockholders for damages for

breach of fiduciary duty as a director or officer, except for damages for breach of fiduciary duty resulting from (a) acts or omissions which involve intentional misconduct, fraud, or a knowing violation of law, or (b) the payment of

dividends in violation of Nevada Revised Statutes Section 78.3900.

II-1

II-2

The undersigned registrant hereby undertakes:

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in

volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

|

Provided, however

, that paragraphs (i), (ii), and (iii) do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that

are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

That, for purposes of determining liability under the Securities Act of 1933 to any purchaser, each

prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of

and included in the registration statement as of the date it is first used after effectiveness.

Provided, however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a

document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify

any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the

registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended that is incorporated by reference in the registration statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities

Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-3

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form

S-3

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Winnemucca, State of

Nevada, on the 26

th

day of July, 2018.

|

|

|

|

|

PARAMOUNT GOLD NEVADA CORP.

|

|

|

|

|

By:

|

|

/s/ Glen Van Treek

|

|

|

|

Glen Van Treek

|

|

|

|

Director, Chief Executive Officer and President

|

II-4

POWER OF ATTORNEY

KNOW ALL BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Glen Van Treek and Carlo Buffone, and each

of them, as his true and lawful

attorney-in-fact

and agent, each with the full power of substitution and resubstitution, for him and in his name, place or stead, in any

and all capacities, to sign any and all amendments to this registration statement (including any and all post-effective amendments), and to sign any registration statement for the same offering covered by this registration statement that is to be

effective upon filing pursuant to Rule 462(b) promulgated under the Securities Act of 1933, and all post-effective amendments thereto, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and

Exchange Commission, granting unto said

attorneys-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite

and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said

attorneys-in-fact

and agents, or their or his or substitutes, may lawfully do or cause to be done by virtue hereof. This Power of Attorney may be signed in several

counterparts. Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title(s)

|

|

Date

|

|

|

|

|

|

/s/ Glen Van Treek

|

|

Director and President

|

|

July 26, 2018

|

|

Glen Van Treek

|

|

(

Principal Executive Officer

)

|

|

|

|

|

|

|

|

/s/ Carlo Buffone

|

|

Chief Financial Officer

|

|

July 26, 2018

|

|

Carlo Buffone

|

|

(

Principal Financial Officer and Principal Accounting Officer

)

|

|

|

|

|

|

|

|

/s/ John Seaberg

|

|

Executive Chairman

|

|

July 26, 2018

|

|

John Seaberg

|

|

|

|

|

|

|

|

|

|

/s/ Rudi Fronk

|

|

Director

|

|

July 26, 2018

|

|

Rudi Fronk

|

|

|

|

|

|

|

|

|

|

/s/ David Smith

|

|

Director

|

|

July 26, 2018

|

|

David Smith

|

|

|

|

|

|

|

|

|

|

/s/ John Carden

|

|

Director

|

|

July 26, 2018

|

|

John Carden

|

|

|

|

|

|

|

|

|

|

/s/ Eliseo Gonzalez-Urien

|

|

Director

|

|

July 26, 2018

|

|

Eliseo Gonzalez-Urien

|

|

|

|

|

|

|

|

|

|

/s/ Christopher Reynolds

|

|

Director

|

|

July 26, 2018

|

|

Christopher Reynolds

|

|

|

|

|

|

|

|

|

|

/s/ Pierre Pelletier

|

|

Director

|

|

July 26, 2018

|

|

Pierre Pelletier

|

|

|

|

|

II-5

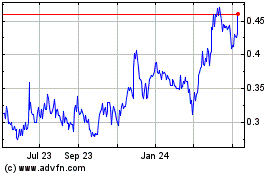

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Apr 2023 to Apr 2024